We continue to focus on quality stocks in U.S. and Europe, as the global economy sees slower growth and lower inflation.

In brief

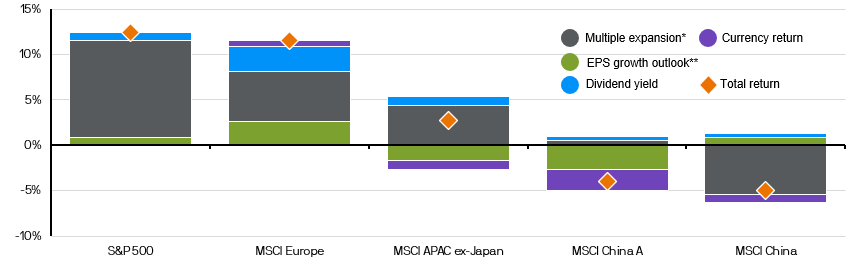

- Year-to-date (YTD) equity performances have been overwhelmingly driven by changes in valuation multiples.

- U.S. and European earnings have surprised to the upside, driven by resilient margins. Asia earnings have been mixed given its reliance on export growth.

- Most recently, U.S. and Asia earnings growth expectations continue to be downgraded, while European earnings growth expectations are picking up given the improving economic backdrop.

It’s all been about multiples so far

Global equities have performed positively YTD, but returns have primarily been driven by the re-rating of valuation multiples as shown in Exhibit 1. With valuations already making sizeable gains this year, it begs the question: will earnings growth provide the next leg up for equity returns?

Exhibit 1: Contribution to year-to-date equity returns

Total return, U.S. dollars (USD)

Source: FactSet, Standard and Poor’s, J.P. Morgan Asset Management. *Multiple expansion is based on the forward price-to-earnings ratio. **Earnings per share (EPS) growth outlook is based on next 12-month aggregate earnings estimates. Past performance is not a reliable indicator of current and future results. Data reflects most recently available as of 06/06/23.

How will U.S. earnings fare in an economic slowdown?

In the U.S., first quarter results were stronger than consensus estimate. As highlighted in our previous OTMOI, a major contributor to the upside surprise in earnings has been the resiliency of profit margins. Over 50% of MSCI U.S. in terms of market capitalization (market cap) delivered margins above their 10-year average levels. This, in part, reflects the ability of companies to pass on the rising costs readily towards consumers as well as the effectiveness of the cost reduction measures which has helped to preserve company bottom lines.

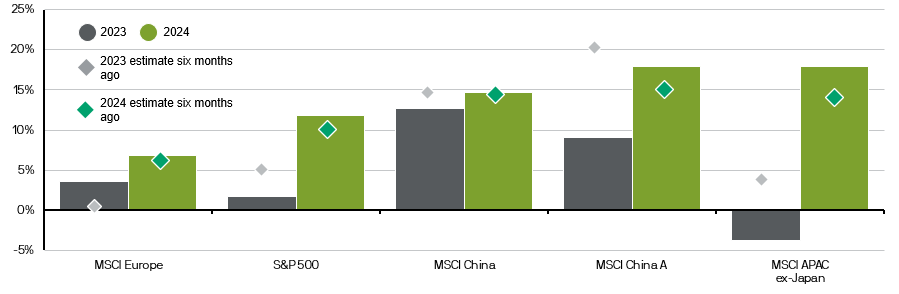

Despite the earnings surprises over the past couple of quarters, U.S. 2023 earnings per share (EPS) growth expectations has been steadily downgraded over the past couple of months. Analysts were expecting 4.7% EPS growth for 2023 at the beginning of the year, but that has been revised down to 0.9% most recently.

Given the high base effect and declining commodity prices, energy and materials sector may see a double-digit decline in EPS growth in 2023, but this should have a limited impact on the overall U.S. market given their small weightings within the MSCI U.S. index. Sectors such as financials and information technology (together accounting for 43% of the index) are also expected to see negative EPS growth of -0.9% and -0.4% respectively. Bank earnings fared relatively well so far due to robust net interest margins (NIMs) from higher interest rates, however 2023 earnings estimates have been downgraded over concerns about banking sector stress, as well as exposures to the commercial real estate sector given the potential rise in delinquency rates.

Tech stocks also surpassed earnings expectations in the first quarter, helped by the excitement over artificial intelligence and more resilient earnings. Companies’ focus on controlling costs have led to better efficiency and margins. However, EPS growth estimates for semiconductors have been revised downwards amid potential weaker global demand for semiconductors within autos and industrials going forward. On the other hand, software has seen earnings upgrades on the back of improvement in operating margins.

Further, sectors such as consumer discretionary and communication services are expected to deliver positive double-digit earnings growth in 2023. While consumer discretionary EPS growth is being revised downwards, it is still expected to grow by a solid 19.7% in 2023. As retailing and consumer services make up 72% of the consumer discretionary subindex, continued strength in the consumer markets and the rotation from goods to services spending has helped to prop up earnings expectations for the sector this year.

Going forward, earnings expectations may continue to moderate. With headline inflation easing off, but continued concerns about a recession lingering on, the headwind on earnings may be shifting from higher input costs to a slowdown in economic growth. This may mean pressures on both profit margins and top line revenues. Resilience can be found in by positioning in quality and defensive sectors. Sectors such as health care and consumer staples have typically delivered stable earnings even in recessionary periods, while tech and communication services – which hold many of the quality mega caps names – should also hold up during an economic downturn.

Where are the bright spots for Europe?

European equities have benefited from an improvement in economic backdrop supported by a fall in gas prices as well as optimism around China’s reopening. As a result, there were upside surprises in 1Q23 earnings in Europe.

Margins have been stronger than in the U.S., as 97% of MSCI Europe ex-UK index in terms of market cap delivered operating margins above 10-year average levels. In fact, margins were more than 2% higher than historical averages in sectors such as industrials, consumer discretionary, tech and financials, which make up around 55% of the MSCI Europe ex-UK index. Strong pricing power plus resilience in demands have allowed companies to raise price and improve their margins to protect their bottom line.

Although stubbornly high core inflation may put pressure on margins, we think there remains some bright spots in terms of the earnings backdrop in Europe given the benign economic environment. While U.S. equities EPS growth for 2023 has been downgraded over the past few months, on the contrary, European EPS growth estimates have been steadily upgraded. Currently, EPS growth expectations for Europe ex-UK is at 6% for 2023 and at 8% for 2024. The benefits of China’s reopening and prominence of bank stocks within European indices as rates continue to stay high should help European earnings in the coming months and quarters.

At a closer look, European industries such as consumer durables and household and personal products are highly geared towards Asia, with 10% and 17% revenue exposure to China, and 32% and 12% to the rest of Asia. Asia exposed sectors within Europe such as consumer discretionary and consumer staples are therefore fetching decent EPS growth expectations for 2023. Even if China’s consumption recovery story falls short of expectations, exposure to the rest of Asia will certainly be a tailwind for consumer related European sectors.

Financials will also benefit from a ‘rates higher for longer' scenario in Europe. With the European Central Bank likely to continue tightening in the coming months, banks should benefit from a higher NIMs. In addition, the European banking sector is less subject to the stresses experienced by U.S. banks with stickier deposits, comparatively limited exposure to CRE loans and regional banking issues. Moreover, the regulatory loopholes that led to insufficient oversight of regional banks do not appear present in Euro area, where liquidity and mark-to-market rules apply to all banks without exceptions.

Asia ex-Japan: Looking through the near-term pain

Asian earnings were more mixed and mainly dragged down by Taiwan (17% of MSCI Asia ex-Japan (AxJ) index) and Korea (14% of MSCI AxJ index). Surprisingly, despite their negative earnings growth estimates for 2023, at -40% and -26% respectively (vs. 2024 earnings growth estimates at +68% for Korea and +23% for Taiwan), both Korea and Taiwan markets have performed strongly year-to-date.

Earnings are unlikely to turn around this year and may stay at subdued levels in the near term as demand for semiconductor chips is stagnant given the decline in CAPEX. However, the market may be looking through this year’s earnings weakness. Markets are forward looking by nature and therefore may by pricing in a profit recovery in 2024 amid potential improvement in semiconductor demand/supply balance, which should lead to firmer pricing.

Strong price performance coupled with earnings downgrades has led to higher valuations for both markets. Korea, for example, is trading at 15.2x 12M forward price-to-earnings (P/E), which is way above its 15-year average at 9.9x. This suggests that earnings delivery along with improving, or at least stable earnings forecasts will be key to make further sustained gains in market performance.

China earnings too good to be true?

MSCI China has returned negatively YTD. While valuation multiples contributed negatively, earnings growth expectations for offshore equities has been mildly positive.

The de-rating of valuation multiples is mainly driven by subdued business and consumer confidence, as it is sensitive to investor sentiment and global flows. However, as MSCI China is heavily geared towards consumer and technology related stocks, it benefits from the reopening and loosening stance on gaming and tech regulations. Consumer discretionary and media and entertainment – which includes e-commerce platforms – make up 43% of the MSCI China index. As such, the earnings outlook has been positive.

Earnings growth estimates for 2023 and 2024 are still upbeat at 12.6% and 14.8% respectively but these estimates are being revised down as concerns over the sustainability of consumption rebound has grown. While the valuation for MSCI China remains below historical average,

an improvement in consumer confidence is needed to attract further flows into the market.

Financial sector (17% of the MSCI China index) EPS growth has benefited from the State-owned enterprise (SOE) reform which aims to boost SOE’s financial performance to generate more shareholder value.

On the other hand, structural challenges within the property sector and muted investment sentiment continue to weigh on sectors such as industrials, real estate and materials. Construction activity will likely stay subdued, dragging down demand for building materials as well as appliances. Rebuilding trust and credibility will likely be more crucial than just local property easing for property sales to get back on track.

Earnings expectation for China continues to be elevated despite the downgrades over the past months. Unless there is material positive shift in confidence as well as upbeat guidance from management, there may be further scope for earnings growth expectations to decline.

Exhibit 2: Global earnings growth estimates

Earnings per share, year-over-year change, consensus estimates

Source: FactSet, Standard and Poor’s, J.P. Morgan Asset Management. Past performance is not a reliable indicator of current and future results. Data reflects most recently available as of 06/06/23.

Investment implications

For developed economies like U.S. and Europe, varying phases of economic cycle as well as monetary policies, coupled with the different severity level of banking sector stress suggest investors should look to diversify geographically. Even though the market has lowered its overall U.S. recession probabilities on limited sign of a credit-induced contraction within the economy against still resilient labor market as well as housing data, we continue to focus on quality stocks in U.S. and Europe, as the global economy sees slower growth and lower inflation.

In Asia, Chinese equities have been disappointing so far. International investors remain on a wait-and-see mode until they see more clarity on the economic and geopolitical developments. Yet, we remain optimistic about sectors of strategic importance to the government, such as renewable energy, electric vehicles, technology development, including artificial intelligence and cloud computing.

For the rest of Asia, export is likely to remain weak for much of this year given softening global demand. However, the divergence in growth performance between developed economies versus Asia, coupled with a more favorable policy backdrop should imply a stronger return for Chinese companies and Asian equities with exposure to domestic demand. USD weakness would also benefit emerging market and Asian financial assets as the Fed comes to the end of its hiking cycle, but this tailwind may kick-in later as the pricing out of rate cuts in the U.S. and the liquidity impacts of the Treasury General Account rebuild might limit the downside to the USD in the near-term.

09af231306034929