The good news is, there are recent signals that more resolute measures on this front may be taken to break the spiral.

In brief

- China’s official November PMI showed softening demand and output, leading to weak growth in industrial profits and prices.

- There has been a more resolute policy response to the economic weakness. For example, the central government introduced two bond schemes in the past few months to support fiscal spending. Banking regulators also issued guidelines to support the property sector, with shanty town redevelopment likely to come later in the year. Meanwhile, further easing of monetary policy is also expected.

- Although stimulus so far are not sufficient in terms of scale, it represents an important shift to a more growth-friendly policy stance.

Continued weakness in the data

COVID outbreaks and lockdowns in the past three years created a volatile base effect, thereby making it quite challenging to properly interpret newly released Chinese economic data. Helped by the low base in 4Q 2022, October consumption and industrial production grew strongly on a year-over-year (y/y) basis and weak base effects means this should be sustained in the upcoming months. However, on a month-over-month (m/m) basis, growth momentum is slowing down, and consumer sentiment may remain subdued.

In comparison with y/y growth figures, PMI is a better measure of short-term trends. In November 2023, official manufacturing PMI declined to 49.4, marking the second consecutive month with contracting activity. Meanwhile, official service PMI dipped to 49.3, which is the first time below 50 since January 2023. Moreover, PMI sub-indices for new orders remained weak at 49.4 for manufacturing sector and 46.3 for service sector, pointing to softening demand and outputs in the future months.

As a result of weakening demand and overcapacity, aggregate profits of industrial sectors grew by a very modest 2.7% y/y in October, compared to the growth of 17.2% and 11.9% in August and September respectively. On a m/m basis, the industrial profits decreased by 7.0%. Given intense competition, output prices of industrial products remained flat in October (0.0% m/m), after a transitory increase in August (0.2% m/m) and September (0.4% m/m), reflecting sustained deflationary pressure.

Underpinning a lot of the weakness in this cycle is the depressed confidence among consumers and businesses. According to the National Bureau of Statistics, consumer confidence in employment and future income is close to its historical low in October. Fixed asset investment data also reflected weak sentiment among private businesses.

… But potential policy inflection points ahead

With the downward spiral of shaky confidence in the past few months, monetary easing alone may not be effective in boosting aggregate demand, fiscal stimulus should take a more important role to jump start the economy. While China’s policy response in 1H23 has been slower and weaker-than-expected, the good news is, there are recent signals that more resolute measures on this front may be taken to break the spiral.

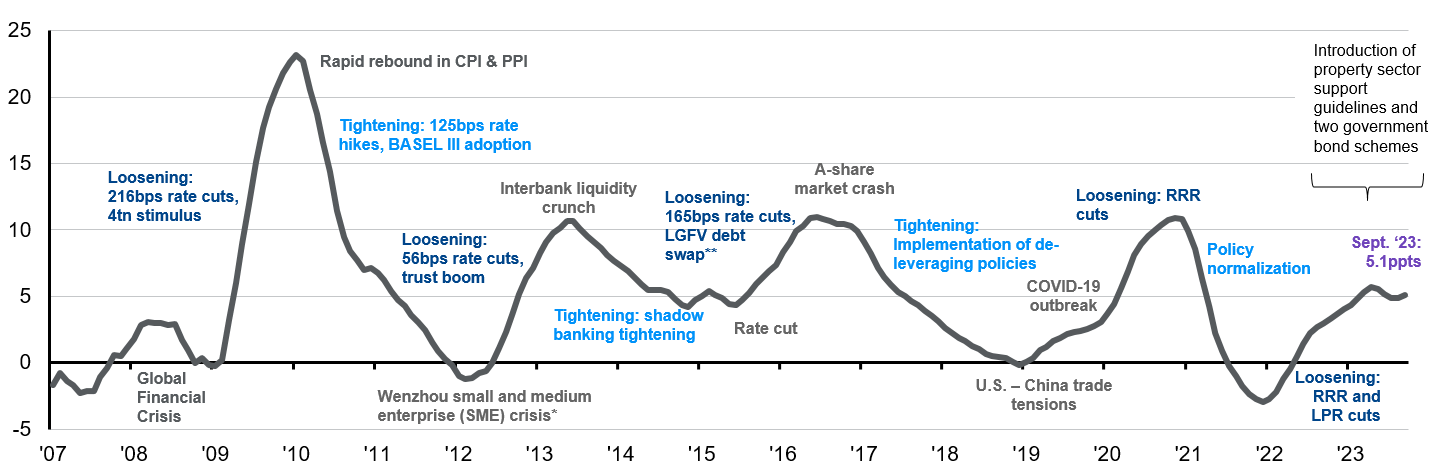

Exhibit 1: Credit cycles

Percentage points, credit growth – nominal GDP growth, 3-month moving average

Source: CEIC, People’s Bank of China, J.P. Morgan Asset Management. Credit growth measures the year-over-year growth of outstanding total social financing. *Wenzhou SME crisis refers to the wave of bankruptcies and funding problems faced by a large number of SMEs in Wenzhou in 2011. **LGFV refers to local government financing vehicle. “RRR” = Reserve requirement ratio. “LPR” = Loan Prime Rate. Guide to China. Data are as of December 5, 2023.

An advantage for China is its much lower central government debt ratio, which stayed at around 21% of nominal GDP as of 2022, versus U.S. at 116% of GDP (as of 2022) and Japan at 218% of GDP (as of 2021). This suggests large room for the central government to expand fiscal spending. On the other hand, Chinese local governments are heavily indebted, pointing to greater efforts in debt restructuring. Therefore, Chinese central government, rather than local governments, should play the key role in stimulus. Since late August, the Ministry of Finance has launched two bond schemes to support fiscal spending and relieve debt burdens on local governments.

In August, China launched a CNY 1.5 trillion local government refinancing bond plan to support debt restructuring and refinancing by local government financing vehicles (LGFVs). The refinancing allows local governments to replace their exiting debts with new debts at lower costs and longer maturities. However, the impact on growth may be minimal as refinancing existing debt is not likely to drive incremental investment.

In late October, a plan for CNY 1 trillion in special treasury bonds was announced. This increase in the official fiscal deficit during the fiscal year is unusual, even more so given it breaks the 3% budget deficit ratio. Following this move, the Chinese central government deficit ratio will reach 3.8% of GDP in 2023. Funds raised from these special bonds could be allocated to local infrastructure projects as equity capital, and the total investment might reach CNY 3 trillion. This might contribute to 0.5 percentage point in real GDP growth.

The property market is another priority requiring further support from both fiscal and monetary sides. In late November, Chinese banking regulators issued 16 guidelines to support the real estate sector, particularly funding to private developers. This might help reverse the steady decline in funding for developers. That said, there remains a major challenge in terms of incremental demand as households’ expectation for future property prices keep declining. As a result, it is widely expected that a new round of shanty town redevelopment will be started, with the initial investment scale of CNY 1 trillion.

The above fiscal and property policies will likely be accompanied by additional monetary easing. In upcoming months, it is expected that People’s Bank of China may cut required reserve ratio by 25 bps, so as to inject more liquidity to support government bond financing. The central bank will also expand its liquidity tools including medium-term liquidity facilities (MLF) and pledged supplemental lending (PSL) to support commercial banks’ loan issuance. Further cuts to deposit rates are also expected to maintain stable net interest margin for banks.

Taking China’s nominal GDP of CNY 121 trillion (2022) into consideration, the stimulus schemes that have been announced so far may not be sufficient to boost growth meaningfully. However, the recent acceleration in stimulus measures may symbolize a transition to a more growth-friendly policy stance. Later this month, the annual Central Economic Work Conference (CEWC) discussing and deciding the economic policy mix for 2024 will be held in Beijing. Having said that, explicit economic targets and fiscal budget will only be officially unveiled at the National People’s Congress in early March 2024. Nonetheless, the tone and discussion of economic support during CEWC will likely provide strong clues of the potential policy mix in 2024.

Investment implications

Uncertainties in growth and policy have weighed on the equity market and valuations have fallen throughout this year, but we continue to see some opportunities in the Chinese equity market. Corporate earnings, based on analysts’ earnings per share forecast for MSCI China, are expected to grow by 14.5% in 2024, after a projected 5.9% growth for 2023. Communication services and consumer discretionary, which include a number of leading tech names, are projected to deliver consistent earnings growth in 2023 and 2024, despite their price-to-earnings ratio currently trading below their 15-year averages. Hence, there are sectors with good earnings outlooks at reasonable valuations. Moreover, emerging sectors, such as renewable energy, electric vehicles and advanced manufacturing, are still enjoying ample policy support and the potential to be a new export engine for China.

Chinese equities remain an essential part of Asian investors’ portfolios. However, with an economy in transition, amid ongoing challenges in the property market, active management, coupled with sector and stock selection remains critical.