Weakness in recent economic data necessitates more decisive and stronger policy reactions to restore confidence.

In brief

- Latest data release from China shows that consumer demand remained weak despite the holiday season.

- Investment confidence remained depressed, which hampered monetary policy transmission via credit expansion.

- Weakness in real estate sector was the major challenge, given its widespread impacts to local government financing, developers’ balance sheet and consumer demand for durable goods.

- To buoy confidence, further stimulus measures are expected, focusing on supports to private sectors and real estate market.

Latest data releases continued to show weakness in the health of the Chinese economy. Markets initially expected the holiday season to lift consumption, but retail sales data missed expectations by a large margin. Meanwhile, low confidence among private sectors and the property market continued to weigh on investment activities. The Politburo of the China Communist Party, the country’s top policy making group, has announced a series of guidelines to stabilize the economy, while policy implementations still fell short of expectation. As growth pressure continues to increase, further policy actions are expected to restore confidence.

Consumer confidence subdued despite the holiday season

According to the Chinese National Bureau of Statistics (NBS), retail sales growth disappointed at 2.5% year-over-year (yoy) in July, from 3.1% in June, against expectations of a pickup of 4.5%. Due to the holiday season, catering growth remained in the double digits, but sharp declines were observed in luxury goods such as jewelry, and building materials due to the headwinds in the real estate sector.

When even the holiday season was unable to drive strong momentum in retail sales, we expect data to further weaken after this summer. Surveys from the People’s Bank of China reflected weakening household confidence on future income (2Q2023: 48.5 vs. 1Q2023: 49.9), which might suggest shrinkage in consumer demand after the one-off tourism spendings.

Investment and real estate remained under pressure

Investment data also flashed warning signs in corporate confidence. Based on NBS data, our calculation showed that fixed asset investment only grew by 1.2% yoy in July, in which a larger decrease of 2.3% was recorded in private sectors.

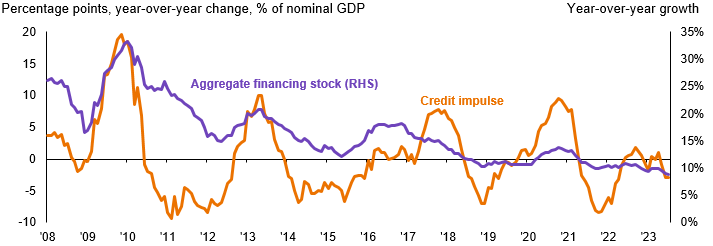

When confidence is low, obstacles become high in the transmission of monetary policy. Despite the 10-bps cut to 5-year LPR in June, incremental social financing declined to 528.2 billion Yuan in July (vs. June: 4.22 trillion), in which new bank loans were merely at 36.4 billion Yuan (vs. June: 3.24 trillion). The weak credit demand caused the credit impulse to continue falling, after only a brief period of expansion last year. This drag in liquidity suggests that previous marginal monetary easing may not be sufficient to boost confidence and support an investment recovery.

Exhibit 1: Credit impulse and aggregate credit growth

Source: CEIC, National Bureau of Statistics, The People's Bank of China, J.P. Morgan Asset Management. Credit impulse measures the year-over-year change in credit flow (net flow of total social financing) as a percentage of nominal GDP. Guide to the Markets – China. Data reflect most recently available as of 15/08/23.

Among all the sectors, real estate remained the weakest, with an 8.5% yoy decrease in investment during the past seven months. With people no longer expecting higher housing prices in the future, home purchases and property construction declined. In the past seven months, new construction starts in floor area shrank by 24.5% yoy.

With home purchases slowing down, related consumer spendings on durable goods are also under pressure. Furniture, electrical appliances and decoration materials accounted for about 10% of total consumption. These expenditures dropped by 11% yoy in July (vs. June: -3.6%), adding further uncertainties to consumption recovery.

Even more fundamental challenges came from the balance sheets of developers and local governments. Land is the major collateral backing the debts owed by developers and local government financing vehicles (LGFVs). When housing sales declined and land prices dropped, these entities not only face difficulties in fund-raising, but also the risks of severe impairment to assets, which might spread to banking sector.

Stronger policy reactions are needed to buoy confidence

Weakness in recent economic data necessitates more decisive and stronger policy reactions to restore confidence. In late July, the Politburo of the China Communist Party announced policy guidelines covering a wide range of the economy. However, the implementation of detailed measures is slower than market expectation.

Beijing has emphasized the importance of private sector companies and its desire to facilitate growth. The private sector, especially small and medium enterprises, are key to boosting the job market and investment. Following several years of regulatory changes facing the technology sector, more predictable policy and greater support to start-ups would be welcome. We believe the latest guidelines by the State Council is in the right direction, while more substantiative measures are required, such as tax cuts, from various government agencies.

In the real estate sector, allowing property prices more room to rise could help to boost sales and address a number of issues at the same time. The dilemma facing the authorities would be how to relax price restrictions while maintaining their credibility in ensuring housing affordability. Many local governments have already relaxed restrictions on home purchases and mortgage lending, but tier-one cities maintained restrictive measures. The deteriorating expectation on property prices should justify stronger reactions in a wider range, such as lower mortgage rates and tax cuts for home purchase.

The Peoples’ Bank of China cut its rate of 1-year mid-term lending facilities by 15 basis points on August 15, which suggest that accommodative policies may be escalated in upcoming months. However, recent market reaction suggests that investors remain patient for further policy catalysts against the backdrop of attractive valuation of China stocks.