Macroeconomic data still point toward the soft landing of the U.S. economy, but we should keep in mind the risks that could challenge investors.

The fundamental outlook of the global economy is benign. Economies have survived the sharp rise in interest rates and inflation is decreasing. This enables central banks to ease restrictive monetary policy to safeguard growth. An extension of the U.S. economic cycle is still our core scenario because triggers for a severe recession, such as over-leveraged households or corporations, are not evident. We believe the current momentum from personal consumption and business investment should keep the U.S. economy expanding at trend growth going into 2025.

While there are good reasons to be optimistic, it is important to take note of the ifs and buts, or risk scenarios, when we think about portfolio construction for the new year. We use “IF” and “BUT” to label five risk factors, each with different probabilities of appearing and varying effects on the market.

I - Inflation resurging. High interest rates have achieved the goal of bringing down inflationary pressures. However, as we experienced in 2022, a resurgence of inflation could reignite the positive correlation between stocks and bonds, especially if central banks are compelled to reverse their policies. This could be driven by supply-side factors, such as a surge in commodity prices, or the direct impact of higher tariffs and other protectionist measures. Strict immigration policies that result in a tighter labor market could also increase inflationary pressure.

F - Fiscal discipline. We saw in September 2022 what poor fiscal discipline did to the UK government bond market in terms of impaired investor confidence. With the incoming Republican administration in the U.S. looking to extend the 2017 tax cuts, and possibly pushing corporate tax rates even lower, investors should pay greater attention to the long-term debt sustainability of the federal government. Elsewhere, achieving net-zero carbon emissions and the changing geopolitical landscape could force developed market (DM) governments to raise deficits.

B - Borders and geopolitics. Conflicts over the past three years have disrupted commodity supply chains and shipping routes. Still, these key economic pipelines remain vulnerable to unexpected conflicts. Furthermore, how the new Trump administration collaborates with North Atlantic Treaty Organization and Asian allies could lead many governments to prioritize defense spending more highly. Borders also represent immigration policy in the U.S. and Europe. We view immigration as crucial for sustaining long-term economic growth, but voters prefer more restrictive policies.

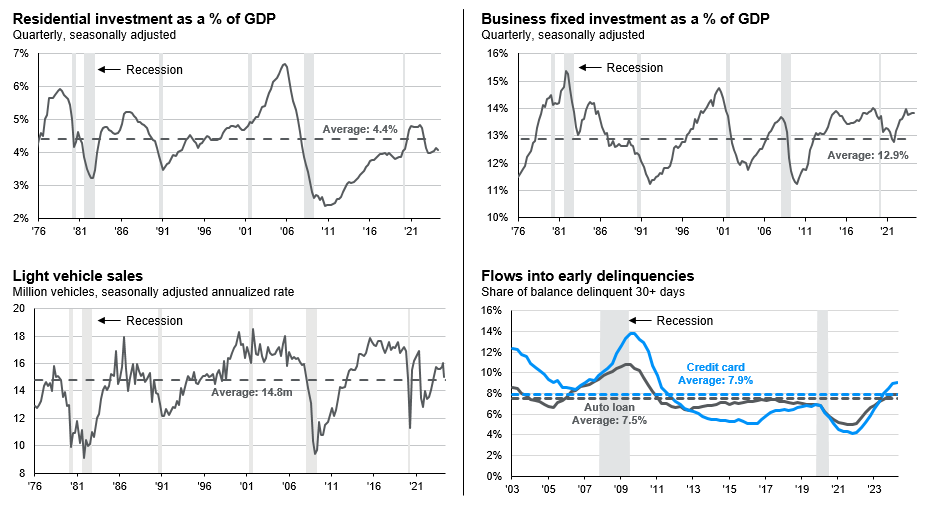

U - Unemployment and recessions. Economic growth typically does not just stop abruptly. Recessions are usually triggered by an economic shock. The key is to find the right strategy to safeguard our portfolio against this risk, especially when risk assets, such as equities and high-yield corporate bonds, are pricing in little risk of a recession.

T - Trade and industrial policy. Tariffs are likely the most well known risk in this category. This could trigger a resurgence of inflation and ignite trade tensions, both of which are destructive to global growth.

Yet, we have also seen an increase in industrial policies supporting the domestic development of strategically important sectors, such as technology, artificial intelligence (AI) and renewable energy. A less globalized world is arguably less productive and more expensive.

Macroeconomic data still point toward the soft landing of the U.S. economy, but we should keep in mind the risks that could challenge investors.

Exhibit 1: United States cyclical sectors