Student loan moratorium: A lot of moving parts

27-06-2023

Danial Qureshi

Tanay Trivedi

For the past three years, the US student loan moratorium has impacted 43 million federal student loan borrowers, who have not had to make a payment since March 2020. This September, payments will resume for the ~20 million borrowers that are not in an active deferment plan. For these borrowers, renewed payments will represent a meaningful shock to their monthly cashflows. Given the potential impacts to consumer health and the broader macro-economic picture, it is imperative to understand who these borrowers are and to quantify what the impact to their financial position will be. Doing so will help assess any meaningful effects on consumer credit investments.

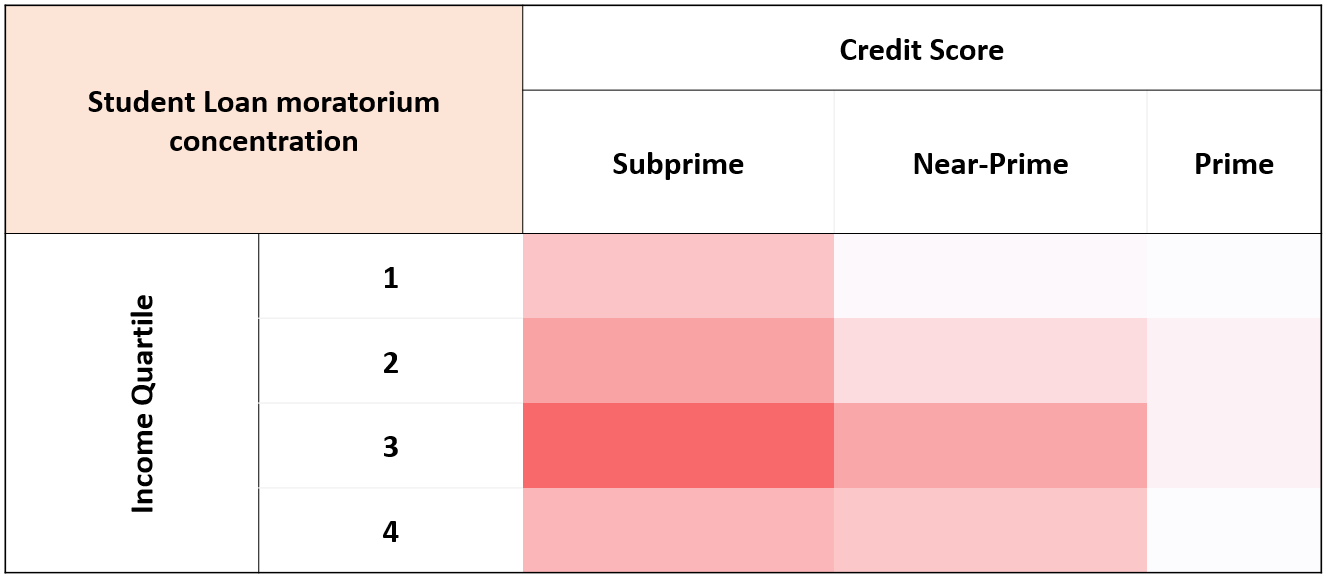

GFICC (Global Fixed Income Currency and Commodities) partnered with AM (Asset Management) Data Science to use our consumer datasets to identify borrowers with a student loan currently in moratorium which was actively in repayment pre-pandemic. Doing so revealed a population of ~20 million consumers who will face a collective payment shock of $5 billion/month when moratorium ends. Stratifying this “moratorium population” of ~20mm consumers by income and credit score, we found that the moratorium population skews lower in credit score and higher in income, with most borrowers concentrated in the millennial generation (Fig 1).

To assess how the financial situation of the moratorium population evolved during the payment pause, we compared their current debt-to-income ratios to pre-moratorium values and found that debt burdens relative to income grew more for the moratorium population than the broader population. This implies that the moratorium population increased leverage in the absence of their student loan payments. In fact, there is outsized exposure to first time home buyers in the moratorium population; millennials getting a break from student loan payments finally had a chance to save up for a mortgage down payment.

Figure 1: Heatmap

Source: Experian Ascend Data Services. As of 4/30/2023

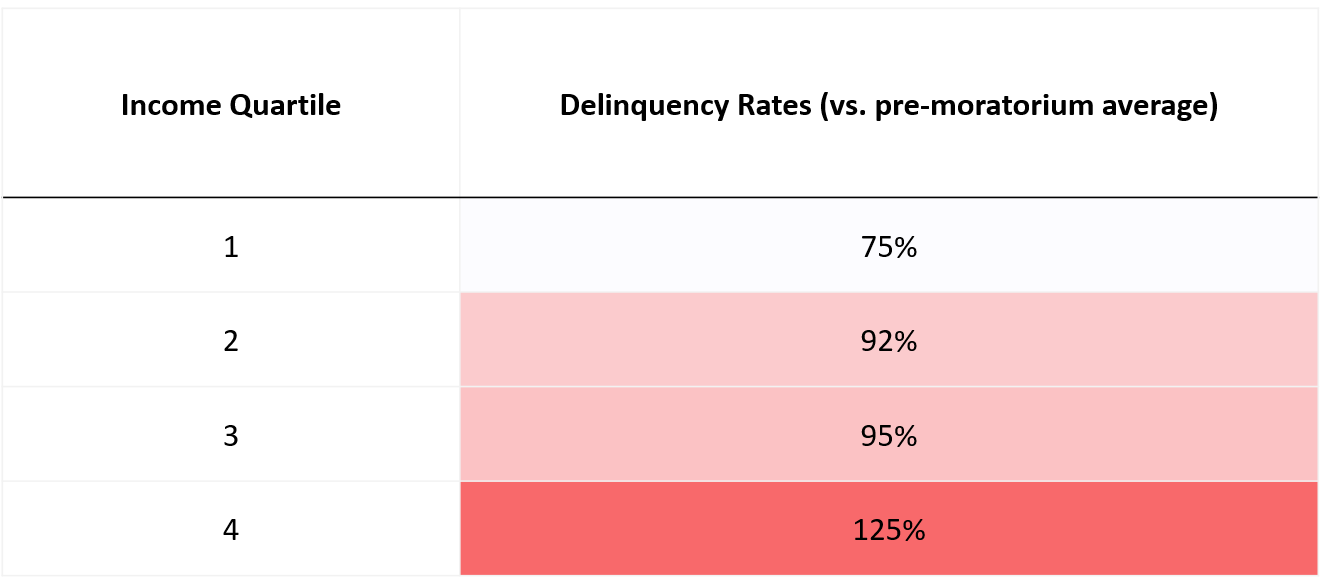

Further, when we stratified the moratorium population by income, we found that lower-income borrowers’ delinquency rates (on non-student loan debts) exhibited greater resiliency versus their higher-income counterparts (Fig 2), whose delinquency rates have already surpassed pre-pandemic levels. Thanks to a partnership with Chase’s consumer bank, we also found that cash buffers grew more for lower-income customers, in moratorium, relative to higher-income customers, whose cash buffers show minimal growth versus early 2020. While lower-income borrowers have seen the most deterioration in the broad population, those with a student loan in moratorium appear to be on relatively stronger footing.

Figure 2:

Source: Experian Ascend Data Services. Pre-moratorium defined as average delinquency rate 12 months preceding 3/2020.

Taken together, these points indicate that higher-income borrowers in moratorium are the ones most at risk once payments resume. Identifying consumer credit investments with outsized exposures to these borrower cohorts can reveal where risk of a potential negative performance shock is highest. Marketplace consumer lenders are an example of a sector that is particularly exposed as their target market (younger/higher-income/lower-credit score) has the highest overlap with the population in moratorium. However, the Department of Education is actively considering potential reforms that would alleviate this risk through two primary approaches:

(1) student loan debt forgiveness,

(2) new Income-Based Repayment (IBR) programs.

While (1) is currently being contested in the Supreme Court, (2) has faced no outright opposition by Congress at the time of this writing. The proposed IBR plans primarily decrease the payment size as a % of income by half while also increasing the deduction that borrowers can take against their incomes.

The practical impact of this reform may be substantial: We estimate that payments could be roughly reduced by 70+% for lower-income borrowers but even borrowers with incomes ~$100k could see their payment burdens cut in half versus current amounts. Current estimates peg the earliest start date for IBR reform to be Q1 2024. It is important to recognize that legislative pushback could derail IBR reform’s implementation, like the current situation with debt forgiveness. However, as of this writing, IBR reform has not faced any explicit legislation from Congress seeking to overturn its implementation.

The student loan situation is complex with many moving parts that range from multiple borrower payment plan options to government legislation that could significantly alter the situation at hand. As top-down fixed income investors with consumer credit investments, it is important to understand its potential macro impacts along with its micro level ramifications in sectors with consumer credit exposure.

09ay232306175430