Emerging Markets: From Beta to Value

11-06-2020

Giles Bedford

Back in March, the bullish camp in emerging markets had shrunk to a ghost town. With coronavirus ravaging developed market economies into recession, consensus reasoned for a far worse impact on the emerging world. The result was departure, first from EM currencies and then EM bonds. The scale and pace of this outflow blew valuations out, leaving managers reeling in its wake. Since those late spring fireworks, markets have found firmer foundation in central bank anchoring, and risk has rallied. Absent from material second waves, recovery from COVID-19 lockdowns contributed to gradually improving economic data, and with that flows turned gently positive, with new issuance well received and supported. Emerging market hard currency debt tightened off the wides, with EM local currency bonds recovering to flat since 4 March 2020. As ever, emerging markets are staging a recovery from a volatile period. The tourists have begun to return.

While it is encouraging to see EM’s resilient performances, the economic damage from the pandemic is real. In China, we are expecting the lowest GDP growth number in a generation, at 1.5% - down from 6% last year. EM central bankers and finance ministers have been busy with responses, the scale of which have challenged policy buffers. The disease itself has extracted a fearsome human cost, both in the developed and emerging worlds; in places, the worst of this may not yet be seen. With many emerging market economies still in recession, weaker fundamentals reflect in discounted valuations and fears of default. So what happens next?

At our most recent strategy meeting, we gathered the team’s views and debated our findings. Our subsequent base case view looks for a “gradual normalisation”, where global growth exits recession gradually in 2020. The alternative – our stressed scenario – looks for a longer recession if re-openings prove more challenging. For 2020, we think EM growth should contract to -1.4% versus +3.7%, a level achieved in 2019. It appears that the bulk of this slowdown has already occurred, with Asia now leading the recovery and Latin America lagging, in our view. Even in recession, EM’s performances compare favourably with the developed market alternative: our base case scenario looks for growth alpha of 3.9% for the space versus developed markets, a near term high; we expect this to regress to a more normal +2.0% in 2021. Against this, we think the vast majority of emerging markets’ public and external financing should be able to weather the COVID shock.

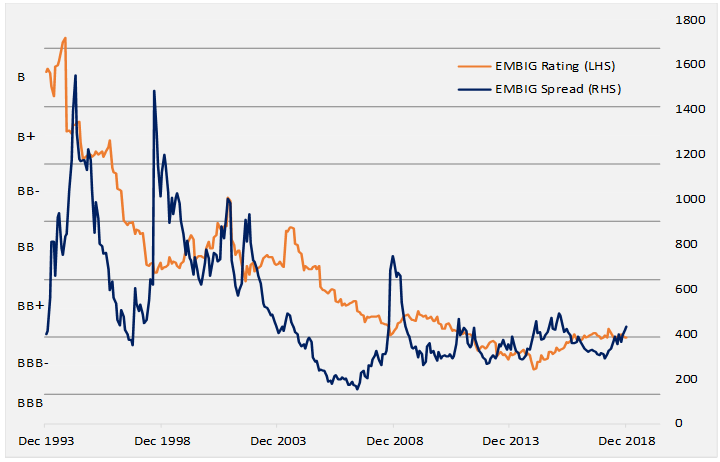

Quality underpins our defence of emerging market hard currency sovereign valuation.

Hard Currency Sovereign: Rating & Spread History

Source: J.P. Morgan Asset Management, June 2020

We note that external emerging market debt has rarely been rated this strongly at current valuations. While the market looks for a 1 or 2 notch downgrades, it discounts a more severe ratings event than we saw during the Global Financial Crisis – an event which ultimately resulted in a half notch quality downgrade to the space. This sets up a singular question: just how bad do we think the coronavirus impairment will become? A reversion to the mean could surprise expectations to the upside.

Sustaining our argument is the observation that just over 70% of EM Countries have successfully accessed the market since the beginning of the COVID crisis. In addition, many EM countries entered the crisis period in a strong position, having brought their funding schedules forward before the pandemic hit. We think this supports the belief that we have seen the majority of the year’s sovereign fallen angels, though current valuations discount ratings downgrades in countries like Mexico, Colombia, and Indonesia. When taken together, we see valuations discounting a more severe scenario than is likely to unfold in our base case scenario, and hence remain constructive.

We are not blindly constructive, we see a challenging quarter ahead for emerging market corporate fundamentals, however we still think the space offers some value. The present reality in the corporate space is one of fundamental headwinds testing corporate credit quality, a paradigm we describe as “no winners, only survivors.” We expect all sectors to suffer an earnings hit because of the pandemic’s impact to activity, but add that the sectors and countries most directly impacted are not a highly significant component of our benchmark. In our view, successful outcomes in the emerging market corporate space can be achieved through careful selection, as issuer fundamentals - and responses - differ within sector and region.

As ever for emerging market local currency, the Dollar presents both a key call and a unique challenge. The Fed’s policy response to the COVID crisis has led investors to query the impact on Dollar strength. We see evidence that the Fed’s asset purchasing has impacted the trade weighted dollar, but not every EM currency automatically benefits because of local policy choices. Hence we see selected opportunities to play Dollar beta in the currency space, though varied policy space sometimes reduces the appeal of some potential choices. A sustained rally in EMFX might require a pickup in both trade volumes and commodity prices, though EMFX’s “kerb appeal” is currently reduced by a low Sharpe measure versus historic averages.

As a result, our base case looks for more flat returns for emerging market debt in 2020, but over 12 months we are more positive and think that returns could exceed 10%. Were a longer recession to play out, we think returns would likely remain negative. Gradual recoveries and easy policy support EM carry, but do not immunize the space from bouts of volatility. The emerging market calendar includes a number of potential catalysts to potentially elevate volatility, including the upcoming US Presidential elections, and the possibility of increasing trade tension with China. For this reason, we think attention to differentiation and liquidity remain warranted. We continue to prefer EM hard currency, with a bias toward quality high yield issuers. In local currency, we continue our long duration bias in local rates, while selectively adding EMFX to play a softer dollar. Just enough, we think, to keep the tourists gradually coming back to that bullish camp.

We plan to publish a more detailed report on our Quarterly meeting’s findings in the near future.