While the near-term outlook is clouded by a slowing global economy and geopolitical uncertainty, we are constructive on the Korean equity market due to several factors, including valuations and improving earnings growth.

In brief

- Korea has underperformed against most major equity markets this year, despite having several supportive factors.

- The macroeconomic outlook remains steady, and the earnings outlook is still strong. Corporate reform remains a highlight.

- Poor performance in technology hardware and sensitivity to higher interest rates have dragged on index performance.

- While the near-term outlook is clouded by a slowing global economy and geopolitical uncertainty, we remain constructive on outlook for Korean equities.

Underperformance despite a lot of positives on paper

The South Korean equity market has oddly been one of the poorer performing markets this year. As of 19 August 2024, the MSCI Korea index is down 1.2% year-to date (total returns in U.S. dollar) and means that Korea has underperformed most other markets in the Asia region and significantly underperformed the S&P 500.

As of writing, even the CSI 300 index has fared better despite China dealing with a number of far more attention-grabbing issues in the form of relatively slow growth and a struggling real estate sector. The Korean market was not immune to the recent bout of market volatility triggered by new recession worries in the U.S., but like other markets, has regained most of the loss.

Despite the poor market performance, there are number of supportive aspects to the outlook for Korean equities:

- The economic picture is soft, but not alarming. The economy contracted by 0.2% quarter-over-quarter (q/q) in 2Q24, but this was expected and a technical payback on 1Q24’s strong 1.3% q/q. The economy is on track to meet the Bank of Korea’s 2.5% growth forecast for this year.

- Korea plays a significant role in the global technology manufacturing cycle and export growth is robust. July’s export growth was at a six-month high of 13.4% year-over-year (y/y) and chip sales were up over 50% y/y for the fourth consecutive month. The technology cycle appears to be in an upswing, with semiconductor and memory chip demand still very robust and also fueled by excitement for developments in artificial intelligence (AI).

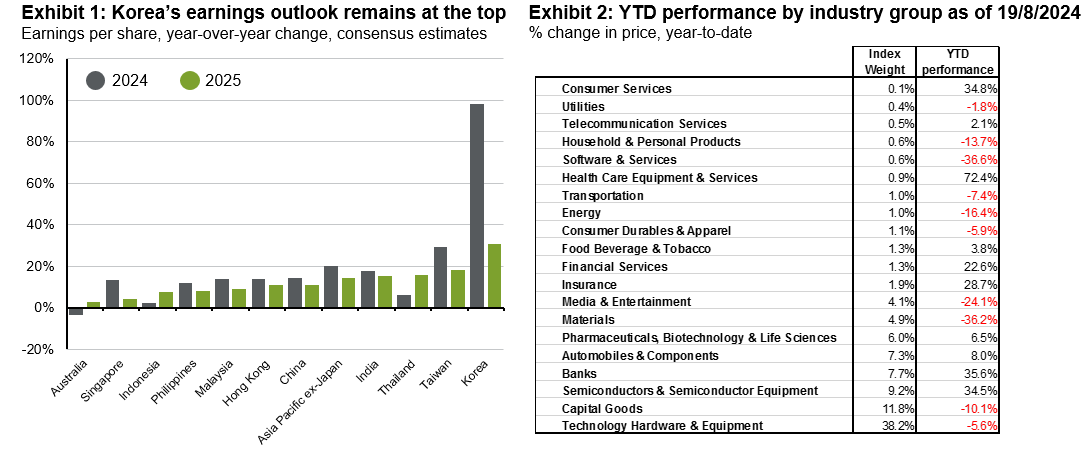

- Earnings growth expectations for 2024 and 2025 are being revised higher. Korea ranks amongst the highest earnings growth market in the Asia region (see Exhibit 1). The country’s exposure and contribution to secular AI themes and technology supply chains is leading to strong earnings per share expansion.

- Valuations are not stretched. The MSCI Korea index is currently trading at a forward earnings multiple of 9.0x, below the long run average of 9.9x. This compares favorably to the relatively high valuations in other regional markets such as Taiwan or India.

- A valuation re-rating is also possible through its “corporate value-up program” (see our previous piece on this). Korea’s program lacks the “name and shame” peer pressure enforcement of Japan’s corporate governance changes but is designed to achieve similar goals in increasing shareholder value. However, this is likely to be a long-term supportive story for Korean equities as the process unfolds.

Source: FactSet, MSCI, J.P. Morgan Asset Management. (Left) Consensus estimates used are calendar year estimates from FactSet. Equity indices used are the respective MSCI indices. Data reflect most recently available as of 19/08/24.

Specific issues have held back performance

Technology hardware dominates the Korean equity market, accounting for almost 40% of the index (see Exhibit 2). This industry has underperformed largely due to electric vehicle (EV) battery production, which has also negatively impacted the materials sector.

Batteries for EV production are one of Korea’s major exports and is facing increasing competition, particularly from Chinese producers (see our previous piece on this). In addition, EV demand and subsequently EV battery demand faces downward pressure from geopolitical trade tension as Europe and the U.S. have placed tariffs on Chinese EVs.

The Korean economy is also more sensitive to interest rates given the relatively high levels of household debt (94.9% of nominal gross domestic product as of 1Q24) and private non-financial sector debt servicing ratios (at 23.6% as of 4Q23). The Bank of Korea has held rates steady at 3.5% for the past twelve straight policy meetings, the highest level since 2008, with little expectation for a change in policy direction soon given inflation remains above target.

A global economic slowdown may lead to a looser monetary policy by the Bank of Korea but is also seen as detrimental due to Korea’s reliance on trade and global demand.

The depreciation in the Korean won versus the U.S. dollar (down almost 7% year-to-date at its worst in April) this year has not benefited an exporting nation like Korea, as historically, Korean equity performance is inversely correlated to the direction of the U.S. currency. However, expectations for policy easing in the U.S. and narrowing rate differentials between the U.S. and Korea may see the Korean won gain some ground against the greenback.

Investment Implications

While the near-term outlook is clouded by a slowing global economy and geopolitical uncertainty, we are constructive on the Korean equity market due to several factors, including valuations and improving earnings growth. Our base case remains for a slowing but not contracting global economy which should support Korean exports. We expect demand for semiconductors to remain robust and a pick-up in the memory chip cycle supported by secular AI themes.

There is also the continued global competitiveness in most of Korea’s manufactured goods, with Korea a crucial part of the manufacturing supply chain outside of technology, such as motor vehicles and heavy machinery. Finally, there is the ongoing improvement on corporate governance and regulatory reform. This is an ongoing long-term process but should lead to improvements in shareholder value.