According to Governor Ueda, further rate hikes will depend on economic data and that higher rates will have limited impact on the economy, in part, because real rates remain very low despite the hike and should stay significantly low.

In brief

- The Bank of Japan announced on July 31 that it will hike 15bps to 0.25% and reduce the pace of Japanese Government Bond (JGB) purchases by Japanese yen (JPY) 400billion per quarter starting August.

- Looking ahead, the USD/JPY exchange rate will likely be influenced more by the U.S. monetary policy than the BoJ’s decisions.

- Japan’s earnings growth is set to outpace the U.S. and Europe in 2024. Corporate governance improvements support long term investment.

The Bank of Japan (BoJ) announced on July 31 that it will hike 15 basis points (bps) to 0.25% (from the 0-0.1% range) and reduce the pace of Japanese Government Bond (JGB) purchases by JPY 400billion per quarter starting August in order to gradually reduce the size of its balance sheet. The reduction plan was broadly in line with market expectations. The BoJ says it will conduct an interim assessment of the plan at the June 2025 monetary policy meeting. In case of a rapid rise in long term interest rates, it will make nimble responses by, for example, increasing the amount of JGB purchases accordingly.

The market had originally expected no rate hike, but market expectation changed once Japan’s NHK and Nikkei reported very late on Tuesday night that the BoJ was considering the 15bps hike. USD/JPY fell after the BoJ announcement, hitting 151.64, before rebounding to trade at +0.3% on the day.

According to Governor Ueda, further rate hikes will depend on economic data and that higher rates will have limited impact on the economy, in part, because real rates remain very low despite the hike and should stay significantly low.

Improved economic data, including rising inflation and better growth, gave the BoJ confidence to hike

Rising inflation expectations – Even though the BoJ lowered the consumer price index (CPI) (all items less fresh food) forecast for 2024 (2.5% vs. 2.8%, forecast made in April 2024), they revised up the forecasts for 2025 (to 2.1% from 1.9% back in April 2024) as they see upside risks to inflation when the inflation relief measures expire. Meanwhile, the BoJ sees rising inflation expectations, with continued improvement in the output gap and changes in firms’ wage and price-setting behavior. This suggests that the BoJ is confident that the recent strong spring wage results will slowly translate into real income and consumer spending.

Better economic growth due to tight labor market – The BoJ revised down its 2024 gross domestic product (GDP) projections by 20bps to 0.6% from 0.8% back in April, while expecting growth to reach 1.0% in 2025, supported by the resilient labor market and improvement in exports and industrial production, as global demand for information technology-related goods picks up further. Recent economic data has shown some cyclical improvement following weak GDP numbers and depressed domestic consumption. Retail sales is considered a key gauge of private consumer spending and June retail sales rose 3.7% year-over-year, beating market expectations, with department stores seeing wealthier shoppers spending more despite ongoing price hikes.

Reducing JGB purchases

Since launching its massive quantitative easing program in 2013, the BoJ has accumulated 53% of all outstanding JGBs on its balance sheet, effectively giving it control over long-term interest rates. While the bank kept buying at the same pace even after the change in monetary policy direction in March, it now looks to pivot to tightening to put the private sector back in control of the JGB market. By slowly leaving the market, the BoJ allows enough time for investors to absorb the bonds it will no longer purchase.

During July’s policy meeting, the BoJ is to reduce JGB purchases by about JPY 400billion every quarter, with monthly JGB buying to be JPY 3trillion in January-March 2026. This suggests that going forward, instead of buying JPY 5.7trillion every month, starting in August, they will trim by about JPY 400billion for August and September and will be buying JPY 5.3trillion. In 4Q24, the BoJ will reduce its purchase by another JPY 400billion and will be buying JPY 4.9trillion. The longer-term view projects the BoJ to be buying around JPY 3trillion in Jan-March 2026.

According to Governor Ueda, the BoJ wants to be explicit by disclosing bond purchase plans for each quarter so as to provide greater predictability for the market. The BoJ estimated that its JGB holdings will decrease by about 7-8% as a result of the announced reduction plan, but also highlighted that even with this reduction, the level will likely still be higher than the long-term desirable level.

Investment implications

Japanese yen and Carry trade

The JPY’s recent appreciation has been driven by narrowing interest rate differentials between the U.S. and Japan. JPY short positions peaked earlier this year, but have since been unwound, particularly after weaker-than-expected U.S. June CPI data and Japan's Ministry of Finance intervention. The USD/JPY has fallen by approximately 4.2% since mid-July.

Looking ahead, the USD/JPY exchange rate will likely be influenced more by U.S. monetary policy than BoJ decisions. The JPY carry trade remains attractive as Japan's rate hikes are expected to be gradual. Significant JPY appreciation, which would make carry trades unattractive, seems unlikely unless the Federal Reserve undertakes substantial rate cuts.

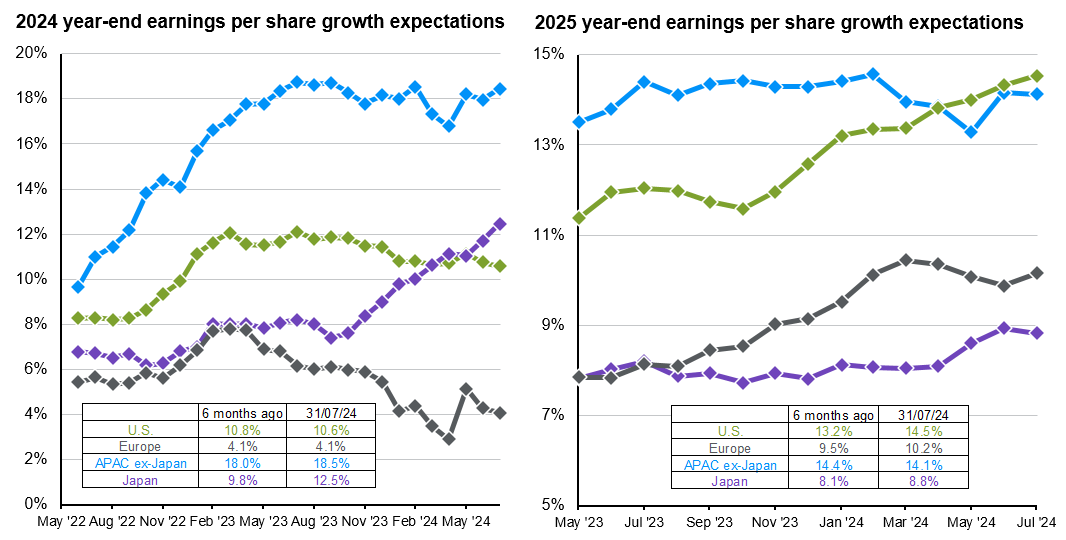

Source: FactSet, MSCI, J.P. Morgan Asset Management. APAC ex-Japan, Japan, Europe and U.S. equity indices used are the MSCI AC Asia Pacific ex-Japan, MSCI Japan, MSCI Europe and S&P 500, respectively. Data reflects most recently available as of 31/07/24.

Source: FactSet, MSCI, J.P. Morgan Asset Management. APAC ex-Japan, Japan, Europe and U.S. equity indices used are the MSCI AC Asia Pacific ex-Japan, MSCI Japan, MSCI Europe and S&P 500, respectively. Data reflects most recently available as of 31/07/24.

Japanese yen and equity market

Japanese equities have corrected after early July gains, with the MSCI Japan index up 18.7% year-to-date in JPY terms. Despite currency risk and hedging costs, earnings upgrades for Japanese companies are expected to continue into 2024 and 2025. MSCI Japan’s earnings per share growth is projected at nearly 13% for 2024 and 9% for 2025, outpacing the U.S. and Europe.

Earnings growth is not solely dependent on a weaker JPY. Financials and utilities have also seen upgrades, benefiting from higher interest rates and increased domestic spending. Japan's corporate governance improvements further support the long-term investment case for Japanese equities. Companies can boost profits by improving products and operations, unwinding cross-holdings and engaging in share buybacks.