As early as 2015, China introduced the “Made in China 2025” strategy to pursue a more innovative manufacturing industry. This emphasized “quality over quantity” and the nurturing of talents in the tech sector, marking a turning point from being the “world factory” for cheap goods.

In brief

- China’s real estate and consumption growth remains weak, reinforcing the transition toward self-sufficiency in high-end manufacturing and renewables.

- Dividend income is integral for investing in China. However, investors should capture emerging long-term opportunities in these new sectors.

- A high degree of dispersion in earnings expectations across market leaders and other players means active management is key in identifying quality growth companies.

Made in China 2025

In our previous note detailing the rise in trade tensions, we highlighted how China has reorganized its supply chains and diversified export markets to reduce potential disruptions. As a follow-up, this article takes a deeper dive into how China has strengthened self-sufficiency in two key industries – automobile and tech.

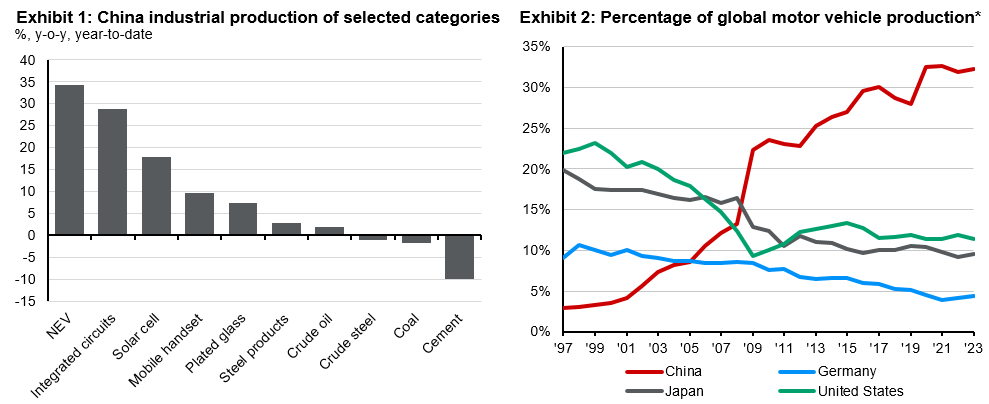

As early as 2015, China introduced the “Made in China 2025” strategy to pursue a more innovative manufacturing industry. This emphasized “quality over quantity” and the nurturing of talents in the tech sector, marking a turning point from being the “world factory” for cheap goods. This new driver of growth has been highlighted in subsequent policy meetings, with the recent Third Plenum being no exception. Indeed, while real estate and consumption growth remains tepid, manufacturing, especially advanced manufacturing, is a clear bright spot in high frequency economic data. This is demonstrated by the strong industrial production outturn in New Energy Vehicles (NEV) and advanced manufacturing sectors recently (Exhibit 1).

We recognize that the housing market is a major contributor to overall gross domestic growth in China, about three times that of the combined contribution from emerging sectors. This means the direction of the housing market remains pivotal to the Chinese economy in the absence of a rapid and sustainable pickup in growth momentum of the advanced manufacturing sectors. However, it is worth examining the progress so far and the future potential of China’s key manufacturing sectors.

Spotlight: Automobile industry

China’s automobile industry has come a long way toward self-sufficiency. Historically, it relied on foreign technology and expertise gained through joint ventures and imported components for domestic assembling. Even in the early days of NEV production, China leveraged foreign-developed batteries and electronic control technology to bridge the technology gap.

Source: NBS, J.P. Morgan Asset management; (Right) CEIC, J.P. Morgan Asset Management; *Shares are calculated by units produced or sold. Data are based on availability as of 30/06/24.

Throughout the years of government support and subsidies, localizing supply chains and developing domestic production capabilities, China surpassed Japan as the world’s largest motor vehicle producer in 2009, and accounts for 32% of the global car production (Exhibit 2). China is also the world’s top automobile exporter, with dramatic growth, from annual exports of merely 1 million units pre-pandemic, soaring to 4.9 million in 2023, and surpassing Japan’s 4.4 million. Momentum has continued, with automobile export growth at 31% year-over-year (y/y) in 1H24.

NEVs comprise for an increasing share of both production and exports. In 2023, NEVs accounted for 25% and 32% of total Chinese automobile exports and domestic production, respectively, from 15% and 14% two years ago. The current share is sizeable, but far from accounting for the majority. While NEVs are in the spotlight, the stellar production and export growth in China’s car industry is not confined to only NEVs, with internal combustion engine (ICE) cars also deserving of investor attention.

The Biden administration and the European Union have recently raised tariffs on several Chinese renewable exports, as detailed in our earlier note. Although those tariffs mainly targeted NEVs, this nonetheless raised concerns over the headwinds for China’s manufacturing and exports. However, two points are worth considering. Firstly, Chinese brands have gained increased market share in the domestic market, from 39% in 2020 to 56% in 2023, while the market share of brands from Germany, Japan and Korea have declined. This represents a growing appetite for domestic demand for Chinese cars, hence reducing the need for carmakers to turn to markets abroad. Secondly, China has a diversified mix of export markets. In 2023, the top ten country destinations (accounting for 54.5% of total) for China’s motor vehicles were Australia, Belgium, Mexico, Philippines, Russia, Saudi Arabia, Spain, Thailand, UAE and the UK.

Spotlight: Advanced manufacturing

The Third Plenum emphasized the “high-quality development” and the need to enhance the resilience and security of industrial and supply chains. While regulatory measures have dented confidence in the private sector, which accounts for 60% of total investment, the Chinese government has shifted its focus (and investment spending) toward supporting public sector-led technology innovation and high-end manufacturing. This shift is a response to the risk of further export controls and restrictions on technology transfer to China, and the pursuit of productivity gains amid a structural slowdown in growth.

Areas of policy focus include semi-conductors, artificial intelligence (AI) and green technologies. The advantages that China possesses includes a comparatively large domestic market, a larger pool of STEM1 graduates, and an expansive manufacturing sector. The heavy investment in domestic innovation is clear; China’s fixed asset investment in manufacturing grew 9.5% y/y in 1H24, as real estate investment contracted 10.1% over the same period.

Notably, industrial production of integrated circuits and solar cells in 1H 24 have recorded levels of 28.9% and 17.8%, respectively (Exhibit 1). The surge in production in part could also reflect strong domestic demand from downstream sectors such as NEV.

However, distinctions should be made on the scope of China’s self-sufficiency based on the type of technology products. For example, advanced wafer fabrication has a high technology entry barrier compared to cloud infrastructure (Infrastructure as a Service). These trends are likely to continue as the Chinese government prioritizes its transition toward higher-end manufacturing and establishes technological self-sufficiency.

Investment Implications

China’s emerging technology sectors provide an investment opportunity; however, it is worth noting that their still relatively small size means they are unlikely to change the country’s near-term growth trajectory. That said, while traditional growth drivers in China such as the housing market have slowed considerably, the push toward upgrading the manufacturing sector offers pockets of alpha opportunities for investors. Dividend income is an integral strategy for investing in China, however, long-term growth opportunities are emerging in China in sectors such as NEV, solar power and lithium battery. While valuations are on the higher side, investors should not shy away from a sector that has significant growth traction, strengthening self sufficiency and strong policy tailwinds.

However, the potential profitability of the companies should remain on the top of the mind for investors, particularly in the face of slowing demand and geopolitical headwinds. Within the focused sectors highlighted in this note, earnings expectations are quite dispersed between the market leaders and other players. This calls for active management during the process of stock selection to identify quality growth companies across the supply chain that could emerge as long-term winners of China’s move toward self-sufficiency.