As global and regional conditions increasingly point towards rate cuts by Asian central banks, domestic circumstances will play a large role in determining the timing of these rate cuts.

In brief

- The start of lower rates in the U.S. and a rebound in Asian currencies are giving Asian central banks more flexibility to cut rates, if needed.

- Domestic circumstances are expected to determine the timing and magnitude of rate cuts in Asia. We could see most Asian central banks wait until 4Q 2024 or early 2025 to take action.

- This policy flexibility is good news for both Asian fixed income and equities. The rebound in Asian currency also provides a favorable backdrop for these financial assets.

Asian central banks have more flexibility to cut rates over the next 12-24 months. The U.S. Federal Reserve (Fed) is set to start its own rate cut cycle in the September 17-18 meeting. This has led to a robust recovery in Asian currencies. Moreover, inflation in the Asia region has eased. However, domestic circumstances and decent growth momentum may persuade Asian central banks to be patient for now. Nonetheless, we see this policy flexibility as a positive for both Asian equities and fixed income.

The Fed and the dollar

While Asian central banks set their policies according to domestic conditions, the Fed still has a strong influence over their decisions. High rates in the U.S. and strong economic performance in the past two years drove the U.S. dollar (USD) stronger against Asian currencies. In some cases, such as Indonesia, higher domestic interest rates are needed to maintain currency stability. The prospects of rate cuts by the Fed has reversed this trend in recent weeks.

A growing number of senior Fed officials are open to the idea of bringing monetary policy back to neutral. Fed Chair Jerome Powell said in his Jackson Hole speech last week that the time has come to adjust policy rates as the downside risks to the labor market have increased.

The USD index has fallen by 4.5% since late June. Except for the Indian rupee, Asian currencies have strengthened to varying degrees during this period, especially ASEAN currencies such as the Malaysian ringgit (+7.6%), Thai baht (+6.9%) and Indonesian rupiah (+5.5%). A rebound in currencies provides Asian central banks with more room to cut rates, if they choose to.

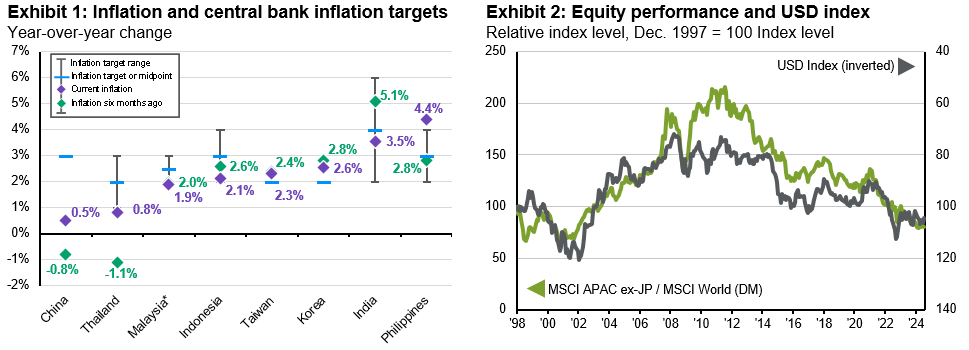

The luxury of falling inflation and steady growth

Most Asian central banks are also in a sweet spot at this point. Inflation has been falling toward their targets or desired ranges (Exhibit 1). Real policy rates (policy rates minus inflation) are also positive in most economies in Asia, indicating a monetary policy stance that is at least neutral, if not slightly tight. Meanwhile, economic growth momentum is generally steady around the region, partly driven by export recovery. This implies central banks have the choice, but not the urgency, to cut rates.

China is probably one exception here, in need of more aggressive monetary easing. Its economic momentum is still hampered by weakness in the housing market and business confidence. Bank lending contracted in July 2024 on the back of mortgages. With very low inflation, this calls for more monetary stimulus. The central bank did cut its one-year policy loan rate by 20 basis points (bps) in July, but more is likely to be needed to boost activities.

Source: FactSet, J.P. Morgan Asset Management; (Right) MSCI. *The inflation figure used for Malaysia is based on core CPI, which is the preferred metric used by the Bank Negara Malaysia (The Central Bank of Malaysia) for its inflation target. Inflation figures for other listed economies are based on headline CPI, in accordance with their preferred inflation target metric. Past performance is not a reliable indicator of current and future results. Data reflect most recently available as of 26/08/24.

Local conditions to dictate timing of cuts

As global and regional conditions increasingly point towards rate cuts by Asian central banks, domestic circumstances will play a large role in determining the timing of these rate cuts.

For example, the Philippines’ central bank (BSP) cut its standing overnight deposit facility rate by 25 bps in its August meeting, while keeping the main policy rate unchanged. It could cut rates further in October.

Bank Indonesia wants to see further currency reinforcement in 3Q 2024 before starting to cut rates. The economy's credit growth is also relatively healthy, allowing for some patience.

The Bank of Thailand noted sluggish investment as well as credit quality deterioration, which might require more policy support. However, given the recent change in the government, with a new prime minister in place, it wants to observe potential changes in fiscal policy before taking action.

For South Korea, inflation is grinding lower. This allowed for a more dovish tone from its most recent monetary policy committee meeting. However, the central bank has shown concerns over rising housing prices as well as rising household debt. A strong job market could also prevent the central bank from cutting rates in the short term. Of course, interest rates are not the only policy tools to cool down the property sector. The Bank of Korea is assessing the impact of macroprudential measures and the government’s plan to increase housing supply.

Overall, the easing bias is setting in across the region, but domestic conditions could mean most Asian central banks might choose to start their rate cut cycles in 4Q 2024 or early 2025.

Investment Implications

Asian government bond yields have already dropped in the past three months, reflecting expectations of lower policy rates over the medium term. While the level of government bond yields remains attractive for selected markets, such as India and Indonesia, investors may also look at local currency bonds given the prospects of a weaker U.S. dollar and higher local currency bond yields. Another option is to consider corporate debt issued by Asian companies.

Beyond fixed income, we remain constructive on the outlook for Asian equities. The structural drivers of rising consumerism and the ongoing reshuffling of global supply chains benefiting ASEAN and south Asia is well recognized. Export growth in the region is still enjoying steady momentum, reinforced by strong manufacturing purchasing manager indices in India, South Korea, Taiwan and Thailand. As we discussed earlier, more flexibility for central banks to cut rates to support growth is also a positive from a macroeconomic perspective. This would be important to provide additional protection to Asia’s corporate revenue performance.

Stronger Asian currencies may be considered a double-edged sword for Asian equities. They could put pressure on Asian exports’ competitiveness, but this should be less of an issue for semiconductors and electronics considering the region’s technological advantage. Meanwhile, outperformance in Asian currencies has historically coincided with periods of outperformance of Asian equities relative to developed market equities (Exhibit 2).