A view of the hawkish journey ahead

The Fed is aggressively increasing interest rates in order to tame persistently high inflation to a more normalized level of around 2%. This restrictive monetary policy is expected to continue into 2023.

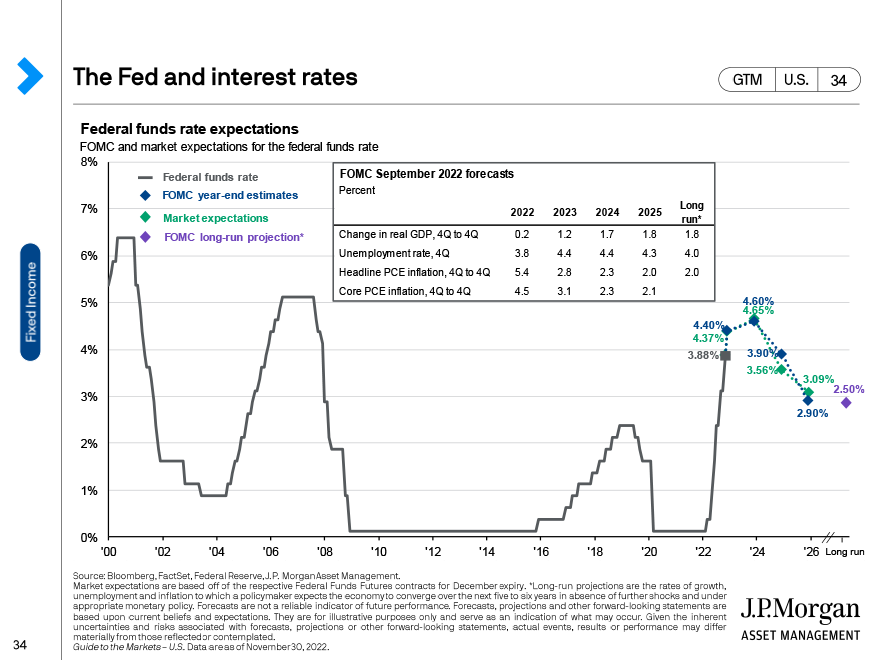

Exhibit 1: Further rate hikes are expected to move the federal funds target range to 3.25%-3.50% by year end and peak in 2023

Aggressive tightening

The Fed launched its aggressive tightening policy with three substantial 75 bps hikes in June, July and September 2022. As the largest single increase since 1994, this brought the federal funds target range to 3.00%-3.25%.

Fighting persistent inflation

Inflation spiked to a 40-year high of 9.1% in June 2022. With the July 2022 reading at 8.5%, persistent inflation is driving a hawkish rate policy. Committed to bringing down inflation, the Fed is moving expeditiously with foreceful, rapid rate hikes.

More rate hikes expected

The federal funds target range is expected to rise by another 100 bps this year with the Fed's June Summary of Economic projects (SEP) suggesting 2022 year-end rates of 3.25%-3.50%.

Riding the interest rate waves with money market strategies

In this rate-hiking climate, liquidity portfolios can benefit from yield pick-up while maintaining liquidity and reducing volatility.

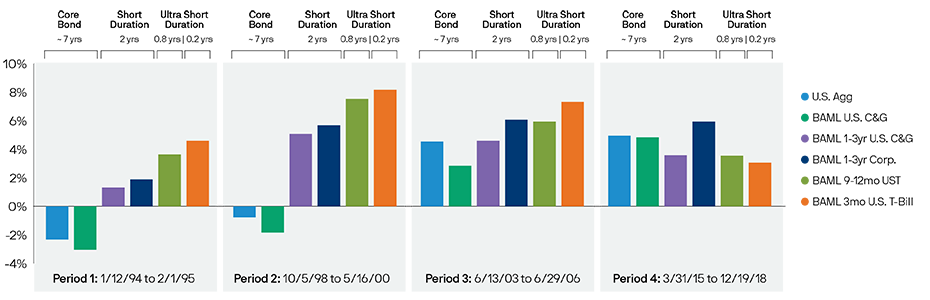

Exhibit 2: The BAML 3-month Treasury Bills index provided higher returns for three out of the last four tightening periods. This outperformance was accompanied by lower volatility.

Source: Bloomberg, J.P. Morgan Asset Management; data as of 12/31/21. Indexes depicted: Bloomberg U.S. Aggregate Bond Index (U.S. Agg), BAML U.S. Corporate & Government (C&G) Master Index (BAML U.S. C&G), BAML 1-3 year U.S. Corporate & Government (C&G) Index (BAML 1-3yr U.S. C&G), BAML 1-3 year U.S. Corporate Only Index (BAML 1-3yr Corp), BAML 9-12 month U.S. Treasury Index (BAML 9-12mo UST), BAML 3-month U.S. Treasury Bill Index (BAML 3mo U.S. T-Bill). Indexes do not include fees or operating expenses and are not available for actual investment. Past performance is not necessarily a reliable indicator for current and future performance.

![]()

Optimizing yield opportunities

Investors can optimize yield opportunities while maintaining liquidity through money market strategies which have short maturity investments designed to capture Fed rate increases. Money market strategies can also be redeemed quickly for funding needs.

![]()

Capturing yield uplift from rate hikes

Shorter-duration strategies have commonly outperformend longer-duration strategies during periods of rising rates, especially during rapid rate increases, similar to this rate cycle.

![]()

Reducing volatility in choppy conditions

Liquidity investments with shorter maturity are less sensitive to interest rate changes. Thus, these asset prices are less volatile in a rising rate environmnet.

Beacons of liquidity expertise

Among a sea of options, an investment partner with proven expertise, strong risk management and commitment to innovate can light the way to shore.

![]()

Global expertise with proven track record across market cycles

Consider the number of dedicated liquidity experts and experience managing short-duration liquidity portfolios across market cycles.

A global team with proven track record can steer you towards managing downside risks, liquidity and yield opportunities.

![]()

Rigorous credit and risk management process

Evaluate the indepedence and rigor of the credit and risk management team as an integral part of the investment process.

An independent credit team can rigorously evaluate investment opportunities.

![]()

Committment to innovate

Assess the ability to innovate its technology platform, expand its product line and faciliate sustainable investing.

A strong partner will bring best-in-class investment solutions across the liquidity spectrum and leverage technology to provide a trading and analytics platform that enables operational efficiency for your long-term success.

A snapshot of our liquidity insights

Embark on a journey to explore the range of solutions for your liquidity needs

Risk Management does not imply elimination of risks. This content is generic in nature and does not take into account any investor's specific objectives or circumstances. Investments involve risks and are not similar or comparable to deposits, not all investments are suitable for all investors. Investors should make independent evaluation before investing.