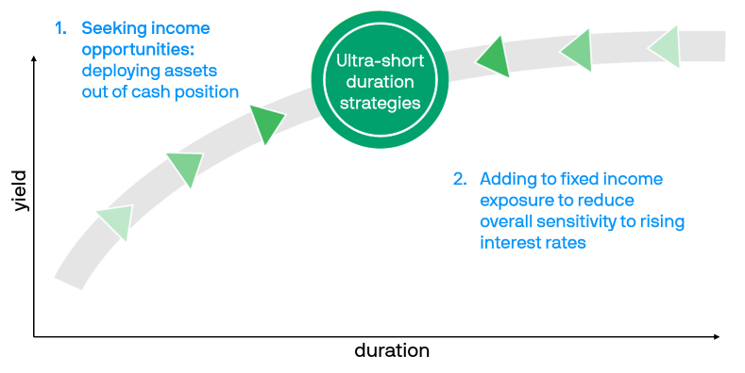

Optimally positioned for liquidity, yield and duration

Central banks around the world are picking up the pace of interest rate hikes to combat inflation, sparking recession fears and market turmoil. Investors are looking to reduce duration in a rising rate environment.

In these challenging markets, Ultra-Short Duration strategies provide opportunities for liquid source of yield as well as managing downside risks, and a low overall sensitivity to changes in interest rates, thanks to their focus on very short duration debt securities (typically less than one year).

Ultra-Short Duration ETF strategies seek to optimize income opportunities while managing interest rate risk

J.P. Morgan Ultra-Short Income ETF strategies: Liquidity that’s actively managed and easily traded

J.P. Morgan’s Ultra-Short Income ETF strategies provide access to the active security selection and credit research expertise of one of the world’s largest liquidity managers, combined with the trading, cost and transparency features of ETF strategies.

The strategies aim to generate incremental returns above money market strategies, while maintaining a high level of liquidity, by investing across a diversified basket of high quality, short maturity bonds and debt instruments chosen by our expert team of credit analysts and liquidity managers.

The strategies can help short-term investors to target a higher income on their strategic cash balances, and fixed income investors to manage credit risk and interest rate risk in their bond portfolios.

Features of ETF strategies

- Intra-day pricing allows for timely and efficient changes to cash allocations

- Low-cost daily liquidity provides the defensive qualities needed for reserve cash even in challenging markets

- Full portfolio transparency means holdings and positioning are visible daily

Benefit from active management

- Proprietary credit research and conservative philosophy targets diversified portfolio of high quality issuers

- Dynamic risk management focuses relentlessly on maintaining liquidity through the nimble deployment of risk

- Backed by the extensive resources of J.P. Morgan’s Global Liquidity platform (over 133 liquidity professionals and nearly USD 911 billion AUM as of 31 December 2021)

Diversification does not guarantee positive returns and eliminates risks of loss.