Read the latest publication from our Strategic Investment Advisory Group, exploring strategic asset allocation and active portfolio management in today’s credit markets.

Who we are

Dedicated private credit professionals with extensive experience and specialized expertise.

Source: J.P. Morgan Asset Management; as of December 31, 2023.

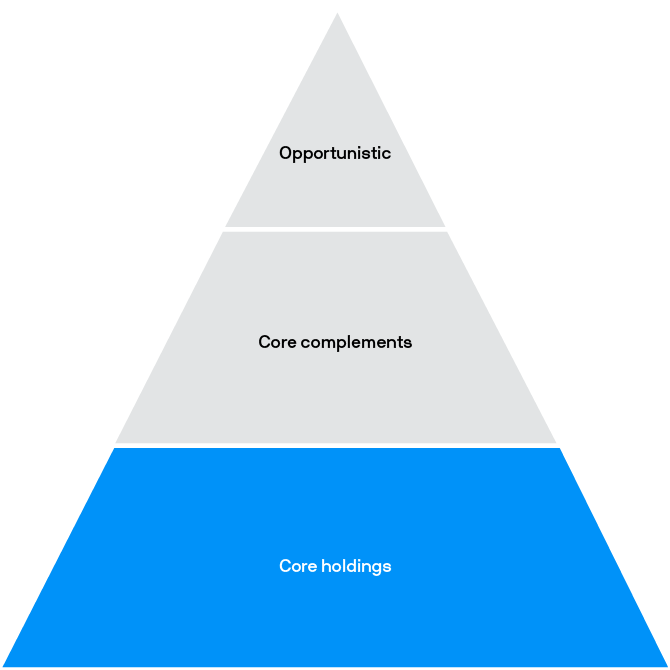

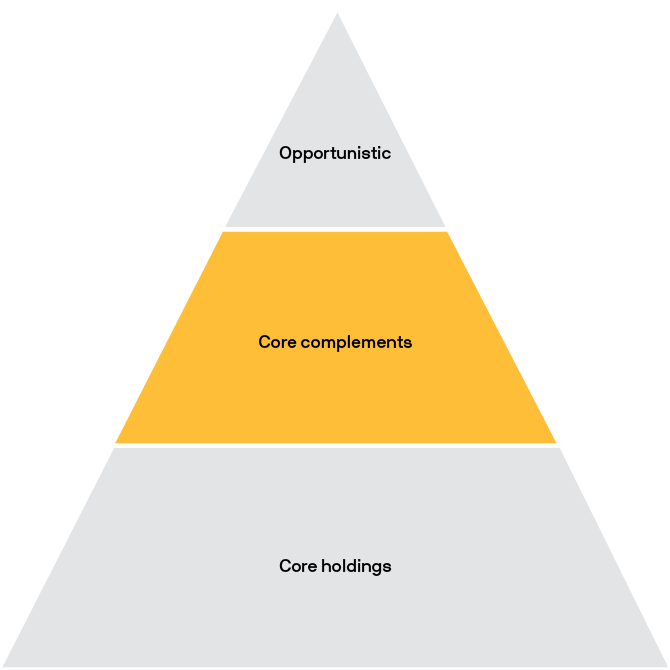

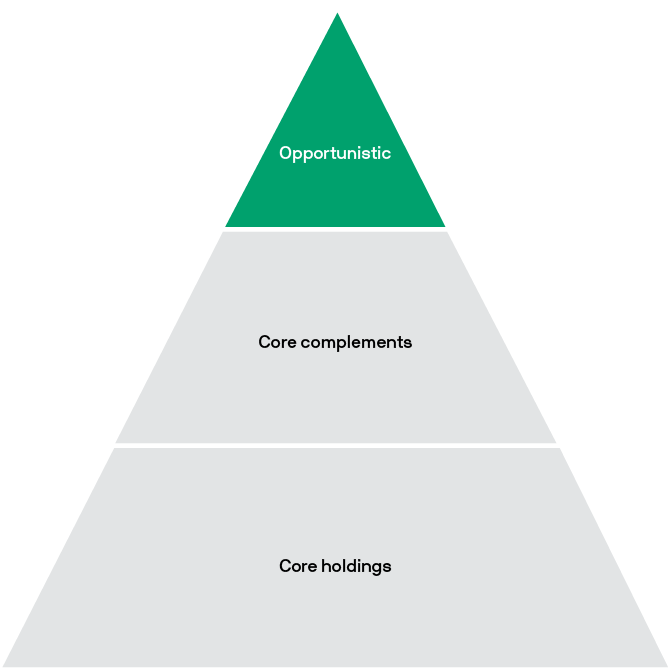

Our strategic framework

Diversifying portfolios and capturing opportunities across the credit spectrum

Seek to generate stable, consistent income from high-quality assets with low volatility

Characteristics:

- Low volatility

- Capital preservation

- High income

Examples:

- Senior direct lending

- Senior commercial real estate lending

- Senior real asset lending

- Senior residential real estate lending

Seek to increase total returns and portfolio diversification

Characteristics:

- Asset class diversification

- Moderate return enhancement potential

- Downside protection

Examples:

- Direct lending mezzanine

- Commercial real estate mezzanine

- Private credit secondaries

- Multisector

- Real asset mezzanine

- Levered lending

Seek to generate high total returns focusing on distressed, niche or opportunistic lending

Characteristics:

- Specialized markets

- High total return potential

- Risk mitigation

Examples:

- Specialty finance

- Esoteric credit

- Distressed lending

- Special situations

- Market inefficiencies

Our capabilities

Broad array of private credit solutions for clients seeking diversification, income, return and/or capital preservation.

Insights

Drawing on the experience of more than 800 global alternatives professionals, access our latest insights in private credit and beyond.*

*Source: J.P. Morgan Asset Management; as of December 31, 2023.

Let's Solve It

For more information, please email us or contact your J.P. Morgan client advisor.