Inside the minds of professional ETF investors

Investor appetite for exchange-traded funds (ETFs) has shown no sign of slowing down in the past year despite the uncertainty caused by the global pandemic, with ETF assets surging to USD 7.6 trillion (TrackInsight Global ETF Survey 2021). To find out what is driving this growth, we’ve partnered with leading ETF analysis platform TrackInsight to survey some of the key players in the global ETF market.

The result is the Global ETF Survey 2021, a study of the investment behaviour of 373 professional investors from across 18 countries, with responsibility for USD 347 billion of ETF investments. As one of the most comprehensive reports of its kind, the survey provides a detailed snapshot of the latest ETF allocations and investment trends, helping ETF investors to benchmark themselves against their peers, position themselves for future growth and validate their existing investment decisions.

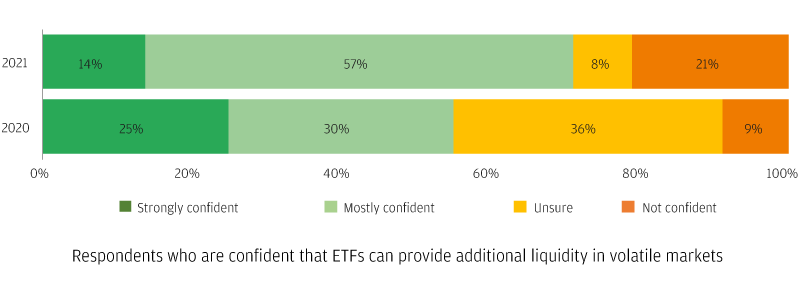

Liquidity is increasingly seen as an advantage of ETFs

While liquidity remains the top concern when selecting an ETF, the strong liquidity provided by ETFs in the Covid-related volatility of 2020, combined with education from providers on the mechanics of ETF pricing, has resulted in a sharp increase in the proportion of respondents who now see liquidity as an ETF advantage.

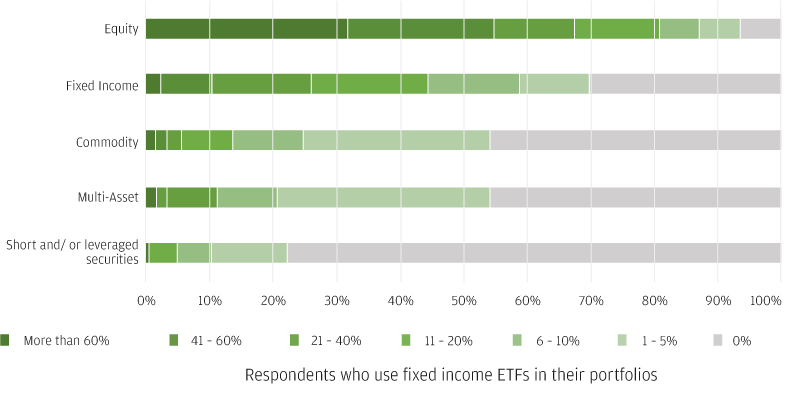

Fixed income allocations are growing fast

The ability of ETFs to provide liquid and cost-effective access to diversified bond portfolios is increasingly recognised by the survey’s respondents, with fixed income ETFs growing to become the second largest asset class in the ETF space.

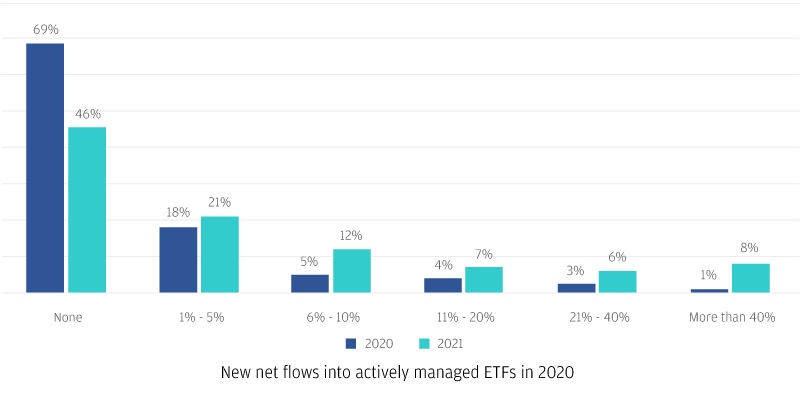

More respondents are turning to active ETFs

Although active ETFs remain a relatively small segment of the overall ETF market, the percentage of respondents with active ETF exposure has risen to 54%, up from 31% in 2020. This increase reflects rising demand for active strategies, both to boost portfolio diversification and alpha potential, and to reduce the cost of active investing.

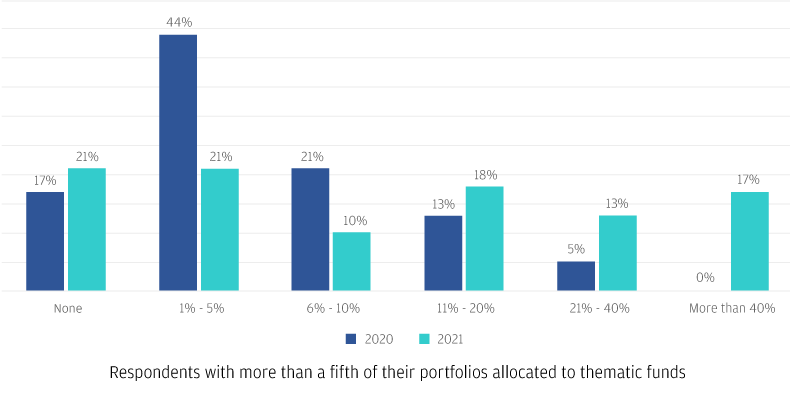

Thematic funds are going mainstream

Positions in thematic funds have increased significantly since 2020 and are set to increase further over the next two to three years, as respondents move more assets into the technology and environmental themes in particular.

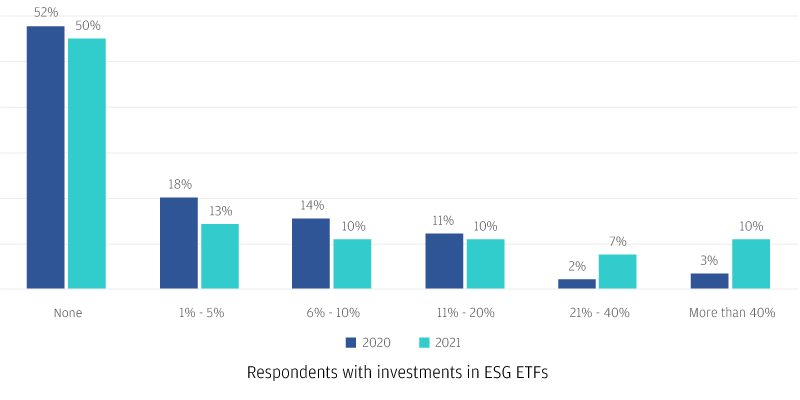

ESG is the key game in town

ESG assets more than tripled in 2020 to $174 billion from previous year, boosted by record inflows of $87 billion, and are set to rise further, with 48% of respondents saying they expect to increase their exposure to ESG ETFs by at least 5%. However, a lack of consistency in ESG metrics continues to make comparisons between funds difficult.