When investing in the U.S., it should be stressed that the uncontrolled trajectory of the federal debt remains a long-term danger and may have little impact on investments in the next few months or even the next few years.

In brief

- We project that the U.S. government will run a deficit of 6% of gross domestic product (GDP), with the debt-to-GDP ratio of 99.5% in 2024, climbing to 7% and 102%, respectively, in 2025.

- In the short run, this widening deficit has limited effects on stimulating the economy, but will limit any rally in yields on the longer end.

- The current Congressional Budget Office (CBO) 10-year forecasts likely understated the deterioration in public finances, but in the medium run, we don’t think this implies a debt crisis.

- In the long run, the inability of the U.S. government to make tough decisions to address this issue remains a key risk. Thus, long-term investors should diversify globally and into real assets.

April numbers and the 2024 fiscal deficit

On May 10th, the U.S. Monthly Treasury Statement for April 2024 was released. As is usually the case in April, the Federal Government ran a surplus for the month. However, within the fiscal year, April stands out as an island of green in a deep sea of red. In February, the CBO forecast a deficit of USD 1.507trillion for this fiscal year. However, they1 noted that, with extra costs from student and disaster loans and smaller-than-expected annual payments on individual and corporate taxes, they now expect this year’s federal budget deficit to exceed last year’s total of USD 1.695trillion.

We concur and now project that the government will run a deficit of USD 1.708trillion in fiscal 2024, or 6.0% of GDP. The primary deficit, that is the difference between revenues and outlays excluding net interest, should actually fall to USD 806billion from USD 1.036trillion last year. However, net interest costs could climb to USD 902billion from USD 659billion last year, mostly reflecting the increasing impact of higher interest rates, as the government refinances old debt and finances new borrowing.

Deficits and debt in the short run

In the short run, the deficit has more important implications for financial markets than the economy.

On the economy, we do not expect larger deficits to stimulate demand. This is because the primary deficit is actually relatively stable at close to 3% of GDP, and has fallen since the pandemic and its immediate aftermath. It is growth in this primary deficit that really injects extra demand into the broader U.S. economy. Higher government interest payments, by contrast, largely end up in the hands of institutional investors, foreign governments and wealthy U.S. families, and have a very limited impact on consumer spending or aggregate demand in general.

However, growing government borrowing does have some implications for financial markets.

In the 50 years before the Great Financial Crisis, 10-year treasury yields averaged 2.7% above the year-over-year core consumer price index (CPI) inflation rate. By that yardstick, even if core CPI inflation gradually falls along with other inflation measures to 2%, today’s 4.50% 10-year treasury yield does not seem unreasonably high.

Moreover, the need to finance annual deficits that are heading above USD 2trillion, combined with having to offset an annual USD 300billion reduction in the Federal Reserve’s (Fed’s) treasury holdings, should limit any rally in the longer-end of the bond market, barring a major recession. These higher-for-longer long-term interest rates could also impede any decline in the U.S. dollar.

Deficits and debt in the medium term

The financial position of the federal government is likely to worsen further over the next decade. In February2, the CBO projected that under current law, the federal government would run annual deficits of between 5% and 6.5% of GDP over the next decade, with the debt-to-GDP ratio rising to a record 116% by 2034.

This understates the likely deterioration in the public finances for two reasons.

First, as the CBO noted last week, their starting point, in terms of the deficit for fiscal 2024, appears to be too low. They will be publishing new 10-year projections in June, which should show a higher baseline track for both deficits and debt.

Second, and more importantly, by convention, CBO forecasts assume a continuation of current law, which implies the expiration of many of the provisions of the 2017 tax cut in 2025. Regardless of who wins the presidency in November, we expect most of those tax cuts to be extended. CBO estimates of the cost of such a decision3, added to its baseline forecast, imply that the debt-to-GDP ratio would rise to a record 127% of GDP by 2034.

While this track for federal debt is alarming, it probably doesn’t imply a debt crisis over the next few years for two reasons. First, as we have pointed out before, calendar 2023 represented almost the ultimate stress test for the U.S. Treasury market. In particular, the Treasury Department managed to raise enough money to finance a deficit of close to USD 1.8trillion, add USD 364billion to its short-term cash balances, and offset a more than USD 700billion reduction in Fed Treasury holdings. This was all achieved with the 10-year treasury yield ending the year in exactly the same place as it started the year. This suggests a very strong underlying global demand for U.S. treasuries.

Second, it needs to be recognized how much of the increase in annual interest payments on the debt merely reflects higher interest rates rather than the growth in the debt itself. If the economy were to go into recession, or if, due to some crisis, the Fed decided to slash short-term interest rates and resume quantitative easing, this interest cost could fall very sharply.

Deficits and debt in the long run

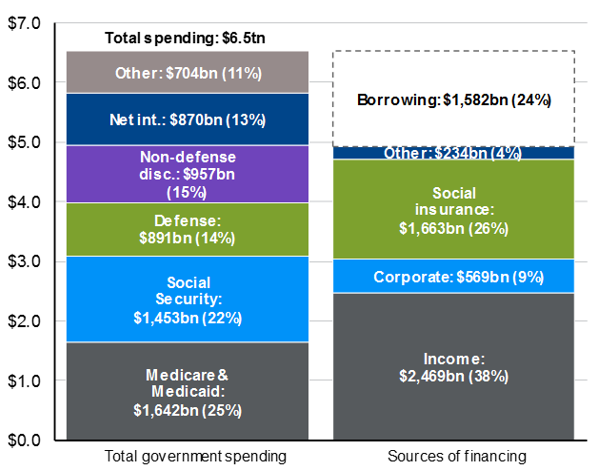

The rise in debt is important for long-term investors precisely because they are long-term investors. The biggest risk associated with federal debt is not excessive spending growth, insufficient tax revenues or even rising interest costs. It is that the political system is incapable of addressing the issue in a mature way. Even a cursory glance at this year’s federal budget, as shown in Exhibit 1, makes it clear that no real progress on the deficit can be achieved without either cutting spending on defense, social security, Medicare, Medicaid, raising taxes or a mixture of all these measures.

However, this has never been adequately explained to voters by either politicians or the news media, and consequently, voters have shown zero interest in electing politicians willing to make any of these tough choices. There is no sign that this will change, hence the situation will likely continue to deteriorate until some day, in five or ten or fifteen years when the debt can no longer be serviced within an environment of normal growth, normal inflation and normal interest rates.

At that point, there will only be two maneuvers available to a government still unwilling to make tough choices, which could perhaps be labeled “The Argentinian Tailspin” and “The Japanese Coma”.

Under the first of these, the federal government and the Fed could conspire to raise inflation to a level that significantly reduces the value of the debt relative to nominal GDP. The obvious problem with this is that interest rates would soar, worsening the debt financing problem while simultaneously crashing the economy and the currency.

Under the second strategy, the debt could still be financed if economic growth were suppressed to a point that held inflation and interest rates at very low levels as, for example, has been the case in Japan for much of the past 30 years. However, this would also have negative implications for economic growth and the U.S. dollar. Needless to say, both scenarios would also be very negative for returns on U.S. stocks and bonds.

Exhibit 1: The 2024 federal budget

USD trillions

Source: U.S. Congressionnel Budget Office, J.P. Morgan Asset Management. Guide to the Markets – U.S. Data are as of May 16, 2024.

Investment implications

The most obvious of these is global diversification. For all its problems, Europe has actually been more responsible in dealing with its government finances than the U.S. Last year, the European Union collectively ran a budget deficit of 3.5% of GDP, with government debt falling from 90% of GDP in 2020 to 82% of GDP last year. Both European bonds and equities could be a port in a storm if there was eventually a U.S. debt crisis, and the returns on these assets could be amplified by a rising euro relative to the U.S. dollar.

Other diversification could also be helpful if it was directed towards countries with enough real economic growth to grow out of their debts. Real assets, such as investments in real estate and infrastructure, could also hold their value better in a debt crisis.

When investing in the U.S., it should be stressed that the uncontrolled trajectory of the federal debt remains a long-term danger and may have little impact on investments in the next few months or even the next few years. However, the first step to successful long-term investing is to recognize that you are trying to maximize long-term returns while minimizing the impact of long-term risks, and in the U.S., there are few long-term risks more ominous than the U.S. government’s inability to limit the growth in federal debt.