As a result of the Chinese government's efforts to promote high-quality development, advanced manufacturing has become the key growth driver this year.

In brief

- The latest data release from China highlights subdued economic momentum and persistent growth imbalance.

- Advanced manufacturing has emerged as the key growth driver on the supply side, while weak consumer confidence has hampered recovery on the demand side. Exports play a crucial role in bridging the gap between domestic supply and demand.

- Despite the challenges, we still see some structural opportunities based on attractive valuations and resilience in certain sectors. Continuous intervention from national funds has also been helpful in stabilizing investor sentiment.

Imbalanced growth trend continued

The Chinese National Bureau of Statistics (NBS) reported a year-over-year (y/y) real gross domestic product (GDP) growth of 4.7% in 2Q 2024, lower than the market expectation. Compared to the previous quarter, real GDP was up 0.7% (vs 1.6% quarter-over-quarter in 1Q 2024), indicating subdued momentum in economic activities. Sector data pointed to a growth model increasingly biased toward the supply side, with a strong growth rate of 6.2% y/y reported for the manufacturing sector in 2Q 2024. Conversely, service activities continued to slow down, and growth rate of the tertiary industry slid to 4.2% y/y in 2Q 2024 (vs. 5.0% y/y in 1Q 2024).

In line with the GDP readings, monthly data also reflected the imbalance in the economic structure. On the supply side, industrial sectors remained resilient, while on the demand side, consumption growth slid to a new low since January 2023 when pandemic control measures were fully removed.

On the supply side, NBS reported a 9.5% y/y growth of fixed asset investment in manufacturing sectors during 1H 2024. This helped partially offset the negative impacts of a 10.1% y/y drop in real estate development investment. Infrastructure investment remained to be a supportive factor (1H 2024: 5.4% y/y), but the momentum was slowing down as local governments faced fiscal pressures.

As a result of the government's efforts to promote high-quality development, advanced manufacturing has become the key growth driver this year. Monthly activity data for June highlighted the strong momentum of 8.8% y/y value-added growth in advanced manufacturing, led by electrical vehicles, integrated circuits and industrial robotics.

On the demand side, the growth rate of retail sales declined to a new low of 2% y/y. Consumers remained cautious on spending due to uncertainties in employment and income. Although property sales rebounded in large cities after regulators loosened downpayment requirements and cut mortgage rates, the downward trend in housing prices persisted, exacerbating pressures on households through wealth effects.

Under these circumstances, exports played a crucial role in bridging the gap between domestic supply and demand. Technological progress has greatly enhanced the efficiency of Chinese manufacturers, and policy support along with a weak Chinese yuan (CNY) further improved their competitiveness. Meanwhile, intense competition in the domestic market pushed Chinese enterprises to seek opportunities overseas, supporting the exports of capital goods. As a result, in June 2024, Chinese exports increased by 8.6% y/y. However, geopolitical headwinds might become more severe, emphasizing an increasing urgency to bolster domestic demand.

Stronger policy measures are crucial to boost confidence

On the monetary policy front, the People’s Bank of China (PBoC) announced on July 22nd to 1) lower 1-year and 5-year loan prime rate (LPR) by 10 basis points (bps) to 3.35% and 3.85% respectively; and 2) reduce 7-day reverse repo rate by 10bps to 1.7% from 1.8%, adopting a lower rate for auctions of this liquidity-injecting operation. Timing of the cuts was earlier than anticipated, pointing to a positive gesture to showcase PBoC’s care for not just exchange rate stability but also the economic weaknesses laid out above. However, the small rate decline may be insufficient to boost credit demand substantially. Further monetary easing is still needed to support the economy. This LPR cut took place without prior medium-term lending facility MLF rate cut and aligned with the 7-day reverse repo rate, in line with the PBoC’s effort to reform LPR quotation mechanism to better reflect the interest rate within the loan market.

Meanwhile, on the fiscal policy front, the pace of fiscal expansion has fallen short of expectations this year. According to the government budget plan passed at the National People's Congress, net government bond financing should reach CNY 11.2trillion this year. However, by the end of June, only 30% of this quota has been filled, the lowest ratio compared to the same period in the previous three years. Slow bond issuance, high leverage ratio and continued decline in land sales revenue have restricted the room for fiscal stimulus.

We continue to expect further policy easing in the second half of this year. The key issue is better coordination among different policy goals. The Party’s third plenum, which convened during July 15 to 18, emphasized the importance to improve macro-control system and enhance policy consistency. It was reiterated that this year’s economic and social development goals should be achieved. In particular, policies should be implemented to boost domestic demand, promote new-quality productive forces, and develop new drivers of foreign trade. Meanwhile, risk prevention in the real estate sector, local government debt and small and mid-sized financial institutions was also highlighted. These policy proposals might point to an escalation in stimulus measures for the rest of this year.

Besides the near-term policy priorities, a broad range of long-term goals were listed. The overall target is to achieve Chinese-style modernization. By 2035, China aims to establish a high-level socialist market economy, laying a solid foundation for building a socialist modern power. The most relevant parts for investors include initiatives to promote innovation and high-quality development, develop a universal domestic market, reform the fiscal and tax system, and improve urban-rural integration.

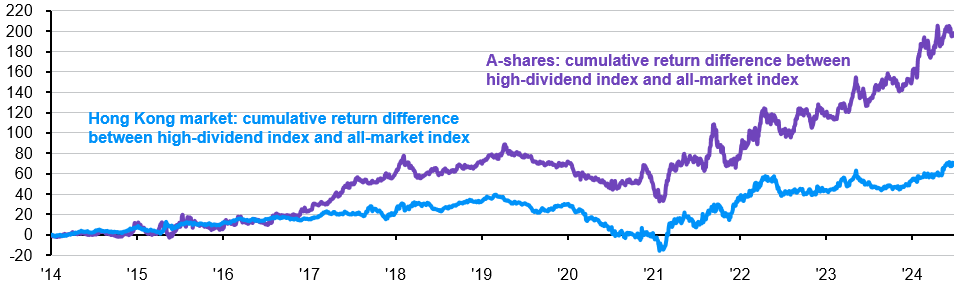

Exhibit 1: Relative performance of high-dividend indices against all-market benchmarks

Percentage points, December 31, 2013 as base date

Source: Wind, China Securities Index Co., Ltd., Hang Seng Indexes Co., Ltd., J.P. Morgan Asset Management.

A-share high-yield stocks are represented by CSI high-dividend total return Index, and A-share all-market index is represented by CSI all-share total return Index. Hong Kong high-dividend stocks are represented by Hang Seng high dividend total return index, and Hong Kong all-market index is represented by Hang Seng composite total return index.

Past performance is not a reliable indicator of current or future results.

Global Market Overview - China. Data are based on availability as of 30/06/24..

Investment implications

Investors stayed cautious about the Chinese market amid the imbalance in economic readings and weak confidence. However, we still see some structural opportunities based on attractive valuations and resilience in certain sectors. Continuous intervention from national funds has also helped stabilize investor sentiment.

As domestic investors become more risk averse, large cap, high-dividend and value stocks are attracting continuous inflows. These stocks are concentrated in sectors such as finance, materials, telecom services and utilities, which have stable cash flow and dividend returns during a weak economic environment. Based on historical data (Exhibit 1), high dividend stocks have significantly outperformed the all-market benchmark in recent years. Until there are substantial policy shifts, dividend stocks might remain a useful strategy in the Chinese market.

In addition, the valuation of some advanced manufacturing sectors dipped in the recent market correction, while earnings expectations is stabilizing after several years of price wars and overcapacity reduction. Long-term opportunities might be emerging for leaders in some of these sectors such as consumer electronics, lithium battery and solar power.