Tariffs impact markets and companies differently depending on their input sources, business model and revenue exposures, so active management will be key to protecting investors’ downsides from any tail risks.

In brief

- Following years of uncertainties surrounding global goods trade, there has been a re-configuration of trade flows originating from China within the Asian region.

- The next few months could see uncertainties rise as recent adjustments and imposition of tariffs on Chinese goods have varying impact across economies.

- Investors should stay regionally diversified, leaning into markets that can potentially benefit from a reorganization of supply chains or are more domestically oriented.

Global trade ties fraught with uncertainties

In recent weeks, the Biden administration announced increases in the tariff rates on select Chinese goods imports. This was followed by the imposition of tariffs by the European Commission on imports by some Chinese carmakers. The next few months could see uncertainties escalate ahead of the U.S. presidential elections, which could manifest in some volatility in financial markets, so investors should stay diversified and lean into markets that are less exposed to trade tensions.

Goods trade winds shifting

China’s admission to the World Trade Organization two decades ago had reshaped global goods trade linkages with China’s explosive growth in foreign trade, aided by the adoption of more trade-friendly policies including significant reductions in tariffs. China’s trade with the rest of the world expanded, particularly with major trading partners such as the U.S. However, 2018 marked a turning point as protectionist policies by the Trump administration splintered global trade flows. At the outset, the expectation was that China’s global goods export share would decline. Interestingly, China’s share of world goods exports remained stable through the 2018-19 period. Trade tensions have not caused as much disruption to China as many would have expected, given how Chinese companies have coped by reorganizing supply chains and diversifying export markets.

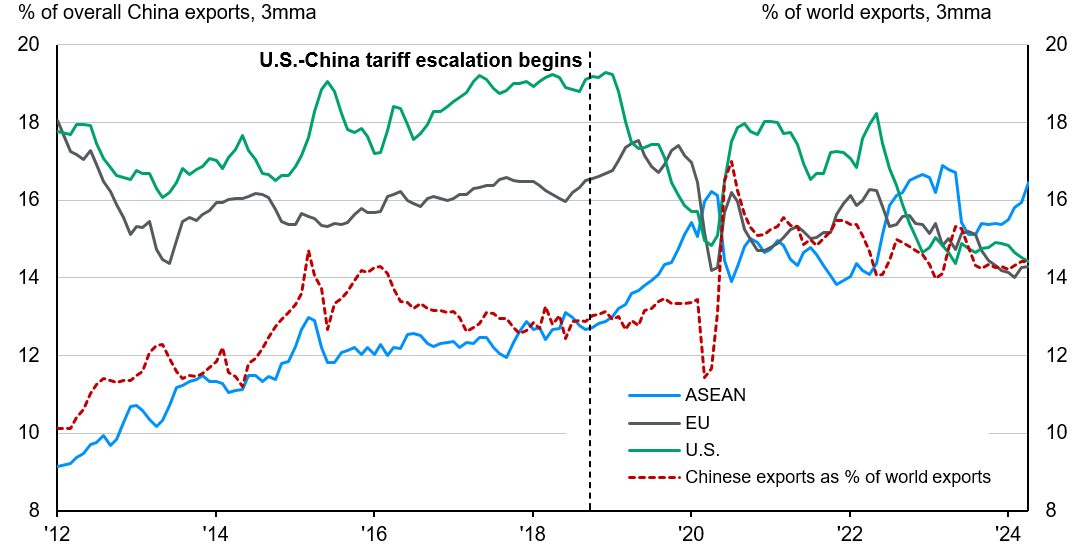

In fact, China’s share of goods exports to the U.S. had steadily declined from 19% in mid-2018 to 14% in April this year. This was almost completely offset by a pickup in exports to ASEAN markets, particularly for downstream products (Exhibit 1). This comes as China’s exports as a share of global exports had in fact increased since the beginning of the trade tensions. Contrary to early expectations, China has expanded foreign trade since the onset of the trade war, underscoring the re-configuration of global goods trade linkages. This is evident in the pickup of ASEAN exports to the U.S., while those originating from China declined.

Exhibit 1: China goods exports by destination and share of global goods exports

Source: CEIC, J.P. Morgan Asset Management. Data reflect most recently available as of 19/06/24.

2024 Biden’s tariffs - not too much pain

Investors might recall, in March 2018, owing to the ballooning US trade deficit with China, then-U.S. President Trump released the Section 301 report with a proposed tariff list on specific Chinese products including aluminum & steel, critical inputs to the U.S. manufacturing sector. This was met instantly with retaliatory tariffs by China on U.S. imports including soybeans, auto and aircrafts, culminating in the ongoing U.S.-China trade tensions.

Fast forward, the Biden administration’s May 14 announcement of additional tariffs on Chinese imports might evoke a sense of déjà vu. However, the tariff hikes are applied on only USD 18billion worth of goods, a fraction of the existing 301 tariffs that cover over USD 300billion of Chinese goods imports. This represents 4% of U.S. imports from China and 0.5% of China’s total exports, with some only effective from 2026. Moreover, tariffs on several categories are only effective starting 2025 or 2026, softening the immediate impact by allowing time for U.S. companies to adjust their supply chains.

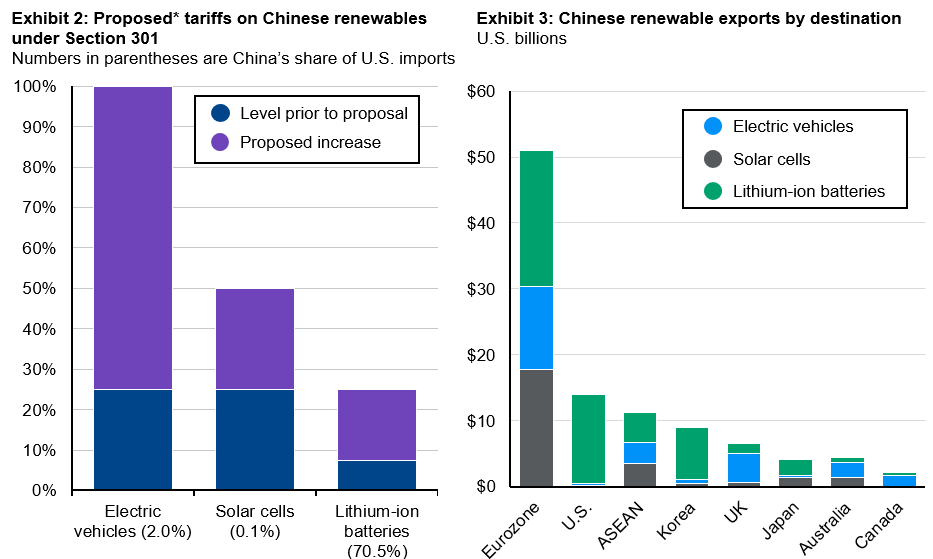

Targeted sectors range from China’s medical equipment to semiconductors. If we take China’s renewable exports as an example, a sector of strategic importance to China, tariffs on lithium-ion batteries were raised from 7.5% to 25%, electric vehicles (EV) from 25% to 100%, and solar cells from 25% to 50% (Exhibit 2). The impact on electric vehicles and solar panels are relatively minimal despite the remarkable tariff magnitude. In 2023, China’s share in U.S. imports for these categories are only at 2% and 0.1% respectively, a result of already high tariffs previously placed to pre-emptively bar entry for Chinese producers, as opposed to placing painful tariffs on Chinese products with already-large market shares in the U.S. The low import intensity also reflects Chinese companies exporting to the U.S. through intermediate locations to avoid tariffs. Thus, it can be argued that Biden’s move aims to show support for U.S. domestic industries during campaign season, without inflicting material economic pain on China.

On the other hand, tariffs on lithium-ion batteries are potentially more disruptive, given China's dominant 70% share in U.S. imports. This level of reliance possibly explains why the increase in tariffs for batteries is much softer than categories like EV. In fact, given China’s cost leadership and resource access, China plays a critical role in the battery supply chain from mining, mineral processing and cell components, making it challenging for other countries to be entirely independent of China as they progress towards net zero emissions.

Source: J.P. Morgan Asset Management; (Left) United States Trade Representative (USTR). (Right) United Nations Comtrade Database; *On May 14, 2024, following an in-depth review by the USTR, President Biden proposed to implement new tariffs on select items from China under Section 301, covering US$18 billion imports from China. The three categories on the chart are part of a broader basket of tariffed items. New tariffs on electric vehicles (EV), solar cells and lithium-ion EV batteries will be effective on August 1, 2024, but new tariffs on lithium-ion non-EV batteries will only be effective on January 1, 2026. Data reflect most recently available as of 19/06/24.

EU tariffs hit differently

As seen in Exhibit 3, the European Union (EU) is a much bigger market for China’s renewable exports, where tariffs could be more concerning. The European Commission's investigation into Chinese state subsidies allegedly distorting the EV market has led to increased tariffs on Chinese battery electric vehicles (BEVs), effective July 4. The tariff increase averaged 21%, including varied rates for specific Chinese carmakers, depending on the perceived level of Chinese subsidies.

Chinese EVs market share in Europe is growing, increasing from 1.1% in 2020 to 6.9% in 2023, with the EU being the top destination for China’s BEV exports (37% of total BEV exports). Despite these tariffs, Chinese carmakers are expected to manage well and unlikely to deter exports materially.

On one hand, even with the latest tariffs, Chinese carmakers’ cost advantage allow them to continue enjoying respectable profit margins exporting to Europe, with typical retail prices 2-3 times that of BEVs sold in China for the same model. On the other hand, Europe is a strategically important market for Chinese EVs given its size and aggressive energy transition plans. In addition, Chinese carmakers face intense competition domestically from a large number of carmakers, which could potentially further erode profitability. Chinese carmakers are also expanding manufacturing capabilities within the EU to mitigate tariff impacts.

The situation remains dynamic, with potential adjustments to the tariffs following industry feedback and ongoing diplomatic engagements. While the immediate impact is contained, the risk lies in the escalation into a tit-for-tat trade dispute. For now, China’s reaction has been targeted and proportional, with similar anti-dumping investigations announced into European brandy and pork. Chinese and EU authorities have also recently agreed to start talks regarding the EV tariffs. Though frictions remain, this gesture signals willingness for open dialogue and negotiations, which is an important first step towards easing tensions.

Investment implications

While the impact of the latest tariffs is so far manageable, investors continue to be concerned over potential changes in trade policy after the upcoming elections in Europe and the U.S., such as Presidential Candidate Trump’s proposal of a 60% tariff on Chinese goods (and 10% elsewhere). Such uncertainties will continue to be a source of volatility in the next few months, especially heading into the U.S. elections.

From an economic point of view, trade tensions may impact commodity prices, capital flows and the Chinese yuan, with indirect implications on inflation and growth. From an investment perspective, investors should stay regionally diversified, or lean into markets that can potentially benefit from a reorganization of supply chains such as ASEAN and India.

Apart from regional diversification, investors can also potentially hedge against trade disputes through seeking opportunities in service sectors which are less exposed directly. While manufacturing remains a key source of growth engine for many markets, in the event of heightened trade tensions, companies that are less reliant on imported inputs (i.e. source inputs domestically) and have stronger pricing power could weather the storm relatively better.

Tariffs impact markets and companies differently depending on their input sources, business model and revenue exposures, so active management will be key to protecting investors’ downsides from any tail risks.