To balance the short-term valuation challenges and long-term positive prospects, investors can opt to invest in India in phases, or via dollar cost averaging.

In brief

- India’s incumbent ruling party and Prime Minister Narendra Modi won a record equaling third term in power, but results fell short of the landslide victory predicted by the exit polls.

- The reduced number of seats held means a weaker mandate and less political capital for the Bharatiya Janata Party (BJP) and their allies.

- The focus on economic reform and industrialization is likely to remain, but more difficult changes, such as land laws and subsidy programs, are now harder to proceed.

- Longer term, the factors that have supported market returns remain, as strong economic performance should translate to sustained earnings growth.

Prime Minister Modi to remain in power for a third term

The BJP, led by incumbent Prime Minister Narendra Modi, has won India’s latest general election. Taking place over six weeks in seven different phases, the BJP and their allies that make up the National Democratic Alliance (NDA) coalition were returned to power for a third term, in a victory that fell short of initial expectations. While the NDA win was predicted, the opposition Indian National Developmental Inclusive Alliance (INDIA), led by the Indian National Congress party, had a stronger showing than expected. After dominating the political landscape in India for the past 10 years, the BJP is set to lose its majority in India’s lower house of parliament, the Lok Sabha, and needs to form a coalition government with its allies in the NDA.

Immediate market reactions after the initial exit poll results forecasted a landslide victory for the NDA were strongly positive. The BJP retaining or even improving from its 2019 result would have been seen as a strong signal of policy continuity and stability. A super majority without its allies raised hopes Modi would have enough political capital to tackle structural issues needed to improve India's economic fundamentals and support ambitious growth targets.

The actual vote count has instead revealed a narrower win than expected. Indian markets have reacted negatively to news after the initial euphoria and reversed their gains. The main concern for markets will be the BJP needing a greater number of allies in a bigger coalition, which could make the government more fragmented and constrain reforms, an issue India faced for several years before the NDA gained power in 2014. Coalition deals, political concessions and demands may come into play when the cabinet is formed.

With the short-term uncertainty of the elections out of the way, this initial volatility should now calm down, but this result does add an element of uncertainty to policy.

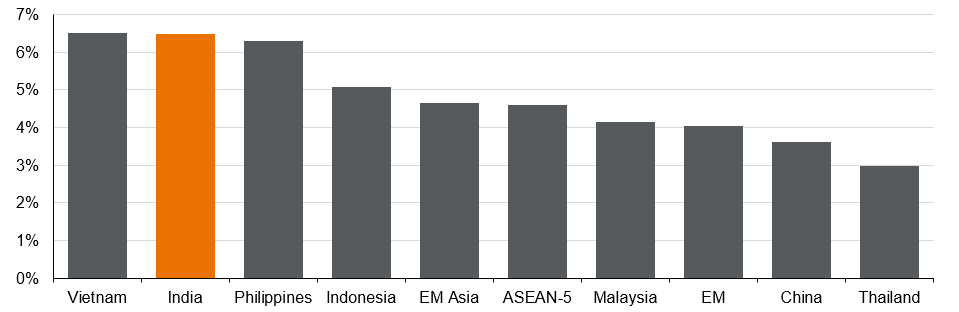

India’s growth prospects still amongst the highest in the region

IMF World Economic Outlook forecast, GDP at constant price, % change, average of 2025-2029

Source: FactSet, IMF, J.P. Morgan Asset Management. ASEAN-5 includes Indonesia, Malaysia, Philippines, Singapore and Thailand. EM stands for emerging markets. Data are as of June 4, 2024.

What the election results mean for India

Over the past 10 years in power, the government has pushed through a multitude of reforms aimed at improving efficiency and productivity across the country. Some of these key moves include the goods and services tax rollout—which brought taxpayers under a more unified indirect taxation scheme; various measures to deal with bad banks and bank loans through bankruptcy code reforms and public sector bank mergers; cutting the base corporate tax rate to 22% from 30%; demonetization to tackle corruption and money laundering, and introducing a real estate regulation authority are just a few of the initiatives from a rather impressive list. While not all of these have seen the level of success or impact that was hoped for, it can be argued that the strong gross domestic product (GDP) growth that we have seen recently, amongst the highest in emerging markets, reflects these reform efforts.

The BJP’s plans for its third term include pushing to be the third largest country by GDP, from its current fifth position, over the next five years. We expect the overall tone of the government and general policy outlook will not change.

Given the election results, the government will most likely move forward in areas that are less controversial. Ongoing attention on infrastructure spending, boosts to manufacturing capability as part of the “Make in India” program, and inserting itself as a more important participant in supply chains, will continue. Areas where India can see quick improvements such as ongoing urbanization, formalization and digitization should unlock further growth potential. Where India has an advantage in competitiveness such as labor costs, information technology services and business support are likely to see more promotion.

However, more divisive issues are now likely to require more political maneuvers to achieve, if at all possible. Constitutional changes are out of reach without a two-thirds majority in the Lok Sabha. Others will require more political capital—land and labor reforms, rationalization of subsidies on food and fuel now look more difficult to pass. The government’s next budget will be key to understanding the focus of developments.

Investment implications

Many investors see the Indian equity market to be strategically positive, but tactically challenging.

The long-term supporting factors for the Indian economy remain. Even with a weaker mandate, government efforts will be focused on delivering stronger growth through improvements in infrastructure and becoming a manufacturing base. India’s demographic and growth potential is immense, and it could be unlocked by ongoing economic reform and industrialization. With the shifts in global supply chains, some investors believe that India could develop into another global manufacturing hub, rivaling China and Southeast Asia. Strong economic performance should translate to strong earnings growth.

However, in the near term, Indian equity market valuation is expensive, reflecting strong earnings expectations. This needs time to be digested and sustained expansion in profitability to justify this optimism.

Our outlook remains positive. To balance the short-term valuation challenges and long-term positive prospects, investors can opt to invest in India in phases, or via dollar cost averaging. This strategy works well to smoothen out short-term volatility while building a position in an asset that should generate strong long-term returns.