October 2024

This is a marketing communication.

Optimism on the UK is paying off

Positioning for an economic recovery in the UK and a stronger consumer has been a winning strategy.

The Mercantile Investment Trust’s portfolio manager, Guy Anderson, has been more optimistic about the UK economy and consumers than valuations of UK equities seemed to reflect. Over the course of the year, the UK economy has indeed been more resilient than anticipated and UK data is continuing to beat expectations in 2024. Real average weekly wage growth in the UK has been positive for about 15 months now and inflation has come down to normal levels. Those factors have helped boost consumer confidence close to the long-term average.

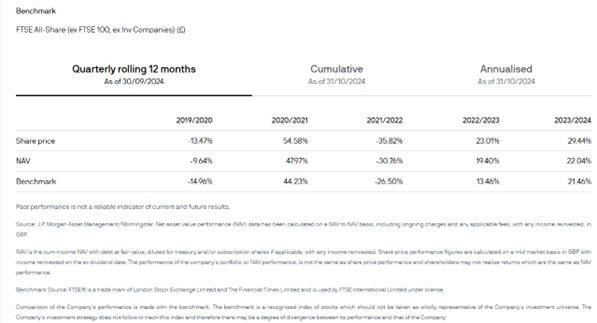

The Mercantile’s positioning for this recovery has helped the trust generate returns above its benchmark over the last few months and maintain its strong relative performance track record over one, five and 10 years..1

Homebuilders and financials benefit from improving outlook

One way this more optimistic view on the economy is expressed in The Mercantile is through holdings in housebuilders Bellway and Barratt Redrow, both of which posted strong returns in the last few months following the depressed valuations of 12-15 months ago. Anderson recently met with Bellway and noted that the management team sees evidence, such as improving demand and sales rates picking up, suggesting that the nadir of cycle has passed and recovery has begun. An additional position in Vistry makes housebuilders the biggest subsector overweight vs. the benchmark.

The portfolio also has substantial exposure to financials, particularly companies in the investment banking and brokerage subsector. The Mercantile’s largest active positions are in private equity firms Intermediate Capital Group and 3i Group, which both generated strong returns over the past year. The trust increased positions in brokerage company Plus 500 and alternative investment manager Pollen St.

Software and computer services remains a key position and The Mercantile’s holding in Softcat performed well following a strong earnings report that defied weakness in corporate tech spending.

Other changes to the portfolio at the sector level include reducing exposure to industrial companies with short-cycle end markets, such as autos, which have been weaker. The Mercantile’s positioning in the industrials sector is now tilted towards companies with exposure to long-cycle end markets, such as aerospace and energy. While the portfolio remains underweight real estate, it is less so than in previous years.

The consumer comes through

A key view reflected in the portfolio’s positioning is that the average UK consumer has more money to spend and is becoming more confident, both of which should drive consumption. Savings rates of around 10% are well above historical averages signalling potential for an increase in consumer spending.2 As a result, Anderson has been adding stocks that will benefit from this trend, which has bumped up The Mercantile’s active exposure to the consumer discretionary sector to a substantial overweight vs. the benchmark—a big change from a modest overweight a year ago. However, the increase is not across the board. The Mercantile reduced positions in retailers Pets at Home and Howdens Joinery while remaining more exposed to travel-related companies such as Jet 2 and Trainline, which is benefitting from increasing e-ticket penetration in the UK.

Another consumer-related company, food producer Cranswick, is a large holding in the portfolio and contributed significantly to returns. The company has strong operational momentum that is continuing to drive growth and could gain market share from its competitors, many of which are private and highly levered, limiting their ability to invest in their business.

Valuations make UK equities even more compelling

UK equities have looked inexpensive for some time and the broader UK market is still trading at 11.5 times 12-month forward earnings, which is roughly a 45% discount to US stocks—the widest gap ever. Small and mid-cap stocks look particularly attractive, trading with only a modest premium of 0% - 5% over large caps, well below the long-term average of 10%.3

Anderson’s outlook for small and mid-cap UK equities remains optimistic, given the combination of an improving economic outlook and company fundamentals, both of which are not fully reflected in low stock valuations. Backing up this view, The Mercantile is 15% geared, which is the top end of the 10-year range.

As The Mercantile turns 140 years old, this UK investment trust appears to be as strong as ever.

The portfolio is actively managed. Holdings, sector weights, allocations and leverage, as applicable, are subject to change at the discretion of the investment manager without notice.

1

2 Office for National Statistics. UK Household savings ratio to 30 June 2024 is 10%. The ratio is household savings as proportion of household disposable income.

3 Bloomberg, J.P. Morgan Asset Management. Data from January 2007 to July 2024. Past performance is not a reliable indicator of current and future results.

Summary Risk Indicator

The risk indicator assumes you keep the product for 5 year(s). The risk of the product may be significantly higher if held for less than the recommended holding period.

Investment objective: Aims to achieve capital growth through investing in a diversified portfolio of UK medium and smaller companies. It pays quarterly dividends and aims to grow its dividend at least in line with inflation. The Company’s gearing policy is to operate within a range of 10% net cash to 20% geared.

Key Risks: External factors may cause an entire asset class to decline in value. Prices and values of all shares or all bonds and income could decline at the same time, or fluctuate in response to the performance of individual companies and general market conditions. This Company may utilise gearing (borrowing) which will exaggerate market movements both up and down. This Company may also invest in smaller companies which may increase its risk profile. The share price may trade at a discount to the Net Asset Value of the Company. The single market in which the Company primarily invests, in this case the UK, may be subject to particular political and economic risks and, as a result, the Company may be more volatile than more broadly diversified companies. Companies listed on AIM tend to be smaller and early stage companies and may carry greater risks than an investment in a Company with a full listing on the London Stock Exchange.

This is a marketing communication and as such the views contained herein do not form part of an offer, nor are they to be taken as advice or a recommendation, to buy or sell any investment or interest thereto. Reliance upon information in this material is at the sole discretion of the reader. Any research in this document has been obtained and may have been acted upon by J.P. Morgan Asset Management for its own purpose. The results of such research are being made available as additional information and do not necessarily reflect the views of J.P. Morgan Asset Management. Any forecasts, figures, opinions, statements of financial market trends or investment techniques and strategies expressed are unless otherwise stated, J.P. Morgan Asset Management’s own at the date of this document. They are considered to be reliable at the time of writing, may not necessarily be all inclusive and are not guaranteed as to accuracy. They may be subject to change without reference or notification to you. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Changes in exchange rates may have an adverse effect on the value, price or income of the products or underlying overseas investments. Past performance and yield are not reliable indicators of current and future results. There is no guarantee that any forecast made will come to pass. Furthermore, whilst it is the intention to achieve the investment objective of the investment products, there can be no assurance that those objectives will be met. J.P. Morgan Asset Management is the brand name for the asset management business of JPMorgan Chase & Co. and its affiliates worldwide. To the extent permitted by applicable law, we may record telephone calls and monitor electronic communications to comply with our legal and regulatory obligations and internal policies. Personal data will be collected, stored and processed by J.P. Morgan Asset Management in accordance with our EMEA Privacy Policy www.jpmorgan.com/emea-privacy-policy. Investment is subject to documentation. The Annual Reports and Financial Statements, AIFMD art. 23 Investor Disclosure Document and PRIIPs Key Information Document can be obtained free of charge in English from JPMorgan Funds Limited or at www.jpmam.co.uk/investmenttrust. This communication is issued by JPMorgan Asset Management (UK) Limited, which is authorised and regulated in the UK by the Financial Conduct Authority. Registered in England No: 01161446. Registered address: 25 Bank Street, Canary Wharf, London E14 5JP.

ecfbfcb3-b266-11ef-bcb7-1f4f43dde9c5