Investing early for your child through a Junior ISA lets the power of compounding work its magic. Starting young, saving regularly, and choosing solid, long-term investments are key to building a nest egg for the future.

Many parents are familiar with the idea that investing for their young family, if it’s manageable, is a good idea from as early in the child’s life as possible.

But what they may not realise is that it’s not simply about having a longer time to tuck away monthly contributions that can generate returns.

A powerful process known as compounding – “the eighth wonder of the world,” according to Albert Einstein – starts to work on the investment as it grows, and over the years the impact of compounding increases exponentially.

So what is it, how can you make best use of it, and what kind of difference could it make to your child’s financial prospects in reality?

Returns from returns

When you start investing into a Junior ISA (JISA) on a child’s behalf, that cash is inaccessible either to you or to the youngster for whom it’s intended until they reach the age of 18.

At that point the JISA ‘rolls over’ into an adult ISA in the same name, where the money can continue to grow indefinitely until its owner decides to make use of it.

So, assuming you begin contributing when the child is still young, this is truly a long-term proposition.

Crucially, because no one can make withdrawals for up to 18 years, both capital growth (as the shares increase in value) and any dividend payouts received will automatically be reinvested back into the JISA portfolio.

The reinvested returns are used to buy more shares; compounding occurs as those additional shares themselves generate returns that in turn are reinvested to buy more shares, and so on through the years.

How does compounding work?

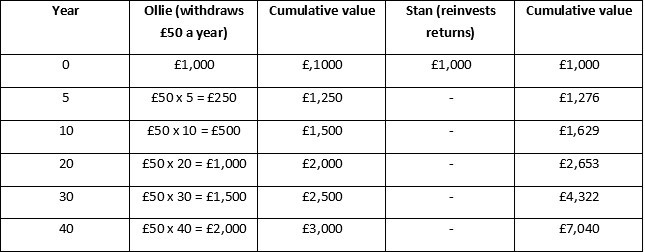

To get a clearer idea of how this process works, let’s compare outcomes for two investors, both of whom (for simplicity’s sake) invest £1,000 into funds returning a hypothetical average rate of return of 5% a year (note that in practice it could be more or less than this).

Ollie, the first investor, has plans for his profits, so he withdraws them each year and spends them.

Each year, Ollie receives £50 in payouts, so after five years the total value of his £1,000 investment is £1,250. After 10 years it is worth £1,500; after 20 years, £2,000, after 30 years £2,500 and after 40 years £3,000.

His friend Stan opts for his returns to be reinvested each year. After five years the additional units have made only a modest difference to his gains relative to Ollie’s, and his £1,000 investment is worth £1,276 (disregarding inflation)¹.

After 10 years, his lump sum has grown to £1,629, but after 20 years it’s valued at £2,653 and the gap over Ollie’s £2,000 total is becoming more significant. After 30 years, it’s worth £4,322 - 63% ahead of Ollie – and after 40 years, that initial £1,000 has grown into a meaty £7,040 nest egg, more than twice the value of Ollie’s investment².

So reinvesting returns, even on a single lump sum, can be transformative if you have a timescale of decades.

Of course, many JISAs are needed much sooner than the example above. But most people investing for a child will be regular contributors from the start, and that regular savings habit in itself can make a massive difference.

Let’s say that when Stan grows up he sets up a JISA for his baby Lucy, investing an initial £1,000 at her birth and then contributing £50 a month until she is 18. His total contributions are worth £1,000 + (£50 x 12) x 18 = £11,800.

Assuming a hypothetical growth rate of 5% again (note that in practice it could be more or less than this), Lucy will have a fund worth £19,740 when she turns 18³. If no one makes any further contributions but Lucy leaves the money fully invested at 5% a year, by the time she’s 30 and is perhaps thinking about a deposit for a flat, it will have almost doubled to a handy £35,450⁴.

Effective compounding

There are several takeaways to keep in mind if you’re looking to make the best use of compounding for a child’s nest egg.

Key, as we’ve seen, is the importance of a long timeframe: late-starting investors have to work much harder, or take more risks with their money, to catch up.

For example, when his daughter Harriet is nine, Ollie might have a chat with Stan, realise that he is missing a trick on the JISA front and start investing. But to build a comparable investment by the time Harriet is 18 he will have to put away £134 a month⁵.

Not only does he have to find more than twice as much as Stan each month, but in total he’s investing £14,472 (£1,000 + (£134 x 12) x 9), against Stan’s £11,800.

An alternative is to choose a slightly riskier investment capable of delivering higher returns. That might be a rewarding strategy if you’re comfortable with a greater chance of short-term ups and downs. But be warned – big risks could mean you sustain large losses that are difficult to recover from.

Similarly, taking too little risk – for instance, using a cash JISA paying a couple of per cent in interest each year – gives little growth on which compounding can work its magic.

To create the optimal conditions for effective compounding, then, it’s best to start investing regularly when your child is young even if the sums you save are small – you can always increase them in years to come – and avoid investments promising to shoot the lights out that could let you down in a big way.

Instead, choose a well-run and broadly diversified investment trust or fund that will deliver reliable total returns, year in, year out.

J.P. Morgan Asset Management has a range of highly rated broad-based investment trusts with a long-term growth focus that could make an ideal choice for a child’s JISA.