Patient investors have had plenty of opportunity to perfect their art in the UK equity market over the past 20 months or so to October 2023, as domestically oriented stocks in particular have remained stubbornly out of fashion.

Guy Anderson, manager of the mid- and smaller-cap focused Mercantile Investment Trust (MRC), is one of the leaders playing the waiting game. Yet he emphasises that the situation is much more complex than the market’s persistent deeply negative sentiment would suggest.

Inflation, of course, is at the heart of the issue. Its dramatic rise through last year and much of this one, accompanied by a string of painful base rate rises from the Bank of England, has been acutely felt by British consumers.

Unsurprisingly, 2022 saw a sharp decline in consumer confidence, with the GfK consumer1 confidence index plummeting to a record low of -49 points in September 2022. Yet wage growth has been robust and employment has stayed resilient despite the UK government’s rapidly tightening monetary policy.

Indeed, as inflation has haltingly declined in 2023, the UK has started to see real growth in wages for the first time in a year and a half. As Anderson explains, that trend has been really important in stimulating consumption. “It’s one of the key reasons why consumer confidence picked up from its nadir at the back end of last year,” he adds.

The UK economy: Surprises on the upside

In fact, the domestic economy has consistently surprised on the upside over the last 12 months. “The UK has a bit of a PR problem, in that the economic narrative is extremely negative - and that’s been reflected in investors’ very low expectations for the future. But so far they have turned out to be more negative than the reality.”

Thus, consensus forecasts for 2024 GDP growth have consistently improved since this time last year, when they hit rock bottom. “The UK has been through a GDP expectations upgrade cycle, which is clearly a positive,” Anderson observes.

The UK economy has consistently been more resilient than anticipated, and at the same time assets are still very lowly rated

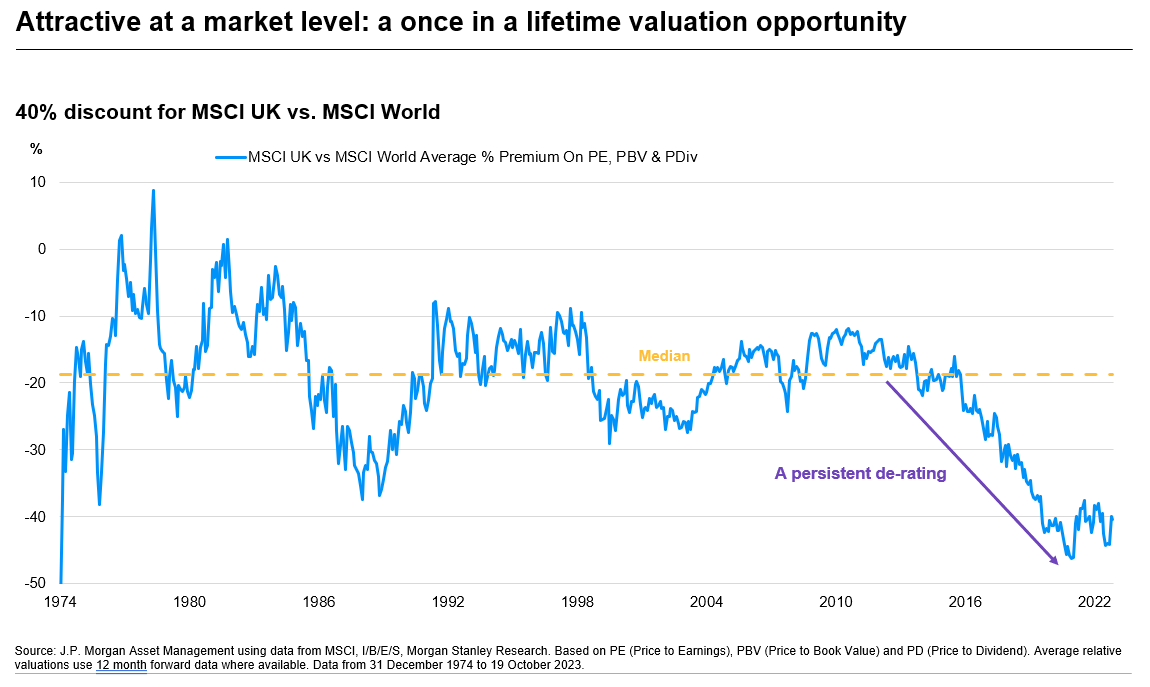

Nonetheless, in spite of the improving outlook valuations remain extremely depressed. The UK market now sits at around a 40% discount to other developed markets – roughly double the average discount of the past 50 years.

In effect, the situation is full of potential for significant turnaround. “Yes, we’re in a pretty tough environment – but the UK economy has consistently been more resilient than anticipated, and at the same time assets are still very lowly rated,” says Anderson.

Against that backdrop, The Mercantile’s bottom-up, stock picking approach ensures that the portfolio remains clearly weighted towards companies with certain characteristics.

Thus it targets high-quality businesses (for instance, the average return on invested capital sits at around 15% compared with 10% for the benchmark as at November 2023), where the longer-term outlook is better than the benchmark (as measured, for example, by expected earnings per share), and valuations are attractive.

Strongly placed for recovery

In aggregate, says Anderson, the portfolio is strongly placed for recovery in due course. “These businesses are still generating high-quality earnings, we’re not downgrading expectations for future earnings, and yet they’re attractively valued,” he comments.

The strength of that positioning also means the team is comfortable with its current level of gearing, towards the higher end of its average range over the past decade at around 12%.

“Hopefully, our action in holding this level of gearing is the best indicator of what we really think about the current situation.”

As far as positioning is concerned, there have been few significant changes this year. Unsurprisingly, given the focus on stockpicking, the portfolio sector weightings continue to deviate significantly from those of the benchmark.

“However, it’s not about our top-down view of the outlook for specific sectors,” Anderson stresses. That’s very evident in an examination of The Mercantile’s top 10 overweight holdings, which span a broad range of industries.

The table is topped by investment group 3i, but also features software business Softcat, engineering company IMI, automotive firm Inchcape, retailers WHSmith and Dunelm and housebuilder Bellway.

It’s a diverse mix, but there are some common themes that run through the selection. “Of course, it’s good to focus on areas where there are great prospects for structural growth, but what we really like are those businesses that have more drivers within their control and specific levers that they’re pulling to drive their own growth,” Anderson explains.

Growth of market share is one such driver. It’s exemplified by Softcat, a corporate IT services provider that has benefited not only from companies’ increasing demand for technology but also from its focus on ‘softer’ factors such as employee satisfaction.

“There is a very high correlation in the business between salespeople’s tenure and their gross profit contribution,” says Anderson. In effect, the business’s focus on happy, long-serving staff is instrumental in its ability to increase market share.

He points to IMI plc as another example of the proactive approach to growth that MRC seeks out.

“IMI has been commercialising its business by concentrating on providing solutions that customers actually want, rather than those that engineers think might be useful,” he says. “If you create things that customers want, they tend to pay more for them and growth is stimulated, so that is another theme through the portfolio.”

Catalyst for change

Of course, the UK has been cheap for years; for as long as the UK market remains unloved, MRC’s attractively positioned portfolio capacity to deliver is restricted. So – the million-dollar question – what could trigger a rerating?

For Anderson, one step in the right direction would be an improvement in the UK’s “horrendously negative PR”. That would be helped by a break from the steady stream of “inflation and other exogenous factors that seem to hit us harder than other countries”.

But the real catalyst for change, he believes, will occur when company outcomes are better than the market’s negative expectations for them. Once that happens, expectations should improve, stimulating wider interest in investing in the UK market and setting up a virtuous circle of rising performance and demand. At which point, patient investors should finally see their rewards.

1 Gfk consumer confidence index - ttps://www.gfk.com/about-gfk

More Insights

Summary Risk Indicator

The risk indicator assumes you keep the product for 5 year(s).

The risk of the product may be significantly higher if held for less than the recommended holding period.

Investment objective:

Aims to achieve capital growth through investing in a diversified portfolio of UK medium and smaller companies. It pays quarterly dividends and aims to grow its dividend at least in line with inflation. The Company’s gearing policy is to operate within a range of 10% net cash to 20% geared

Key Risks:

External factors may cause an entire asset class to decline in value. Prices and values of all shares or all bonds and income could decline at the same time, or fluctuate in response to the performance of individual companies and general market conditions. This Company may utilise gearing (borrowing) which will exaggerate market movements both up and down. This Company may also invest in smaller companies which may increase its risk profile. The share price may trade at a discount to the Net Asset Value of the Company. The single market in which the Company primarily invests, in this case the UK, may be subject to particular political and economic risks and, as a result, the Company may be more volatile than more broadly diversified companies. Companies listed on AIM tend to be smaller and early stage companies and may carry greater risks than an investment in a Company with a full listing on the London Stock Exchange.

This is a marketing communication and as such the views contained herein do not form part of an offer, nor are they to be taken as advice or a recommendation, to buy or sell any investment or interest thereto. Reliance upon information in this material is at the sole discretion of the reader. Any research in this document has been obtained and may have been acted upon by J.P. Morgan Asset Management for its own purpose. The results of such research are being made available as additional information and do not necessarily reflect the views of J.P. Morgan Asset Management. Any forecasts, figures, opinions, statements of financial market trends or investment techniques and strategies expressed are unless otherwise stated, J.P. Morgan Asset Management’s own at the date of this document. They are considered to be reliable at the time of writing, may not necessarily be all inclusive and are not guaranteed as to accuracy. They may be subject to change without reference or notification to you. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Changes in exchange rates may have an adverse effect on the value, price or income of the products or underlying overseas investments. Past performance and yield are not reliable indicators of current and future results. There is no guarantee that any forecast made will come to pass. Furthermore, whilst it is the intention to achieve the investment objective of the investment products, there can be no assurance that those objectives will be met. J.P. Morgan Asset Management is the brand name for the asset management business of JPMorgan Chase & Co. and its affiliates worldwide. To the extent permitted by applicable law, we may record telephone calls and monitor electronic communications to comply with our legal and regulatory obligations and internal policies. Personal data will be collected, stored and processed by J.P. Morgan Asset Management in accordance with our EMEA Privacy Policy www.jpmorgan.com/emea-privacy-policy. Investment is subject to documentation. The Annual Reports and Financial Statements, AIFMD art. 23 Investor Disclosure Document and PRIIPs Key Information Document can be obtained free of charge in English from JPMorgan Funds Limited or at www.jpmam.co.uk/investmenttrust. This communication is issued by JPMorgan Asset Management (UK) Limited, which is authorised and regulated in the UK by the Financial Conduct Authority. Registered in England No: 01161446. Registered address: 25 Bank Street, Canary Wharf, London E14 5JP.

09ug232411120126