Small cap UK equities are generating shareholder value as companies are acquired at premium valuations and management teams buy back stock

Bids and buybacks

Attractive valuations for UK equities have finally caught investors’ attention, although smaller cap UK stocks have so far lagged the FTSE 100 rally. However, the portfolio managers of the JPMorgan UK Small Cap Growth & Income plc (JUGI) see evidence that corporate managements recognise the value of high-quality smaller cap UK stocks, which is boosting long-term shareholder value.

Mergers and acquisitions (M&A) involving smaller UK companies are announced almost weekly and include several companies held by JUGI. One of the top contributors to JUGI’s performance over the 12 months ending 30 September 2025 was Alpha Group*, a financial services company that specialises in managing foreign exchange risk for corporations, and was recently bought at a significant premium to its valuation.

The portfolio managers are not surprised by takeover bids, given the combination of the high average free cash flow generation of many small cap UK companies and their low valuations. This high free cashflow yield is particularly noteworthy because the companies JUGI holds have, on average, higher returns on capital and stronger earnings momentum than the benchmark average.

The low valuations are also contributing to a significant increase in share buybacks and JUGI’s portfolio managers believe that this is currently the best way many small cap UK companies can create value for shareholders.

Consumer confidence could boost spending and returns

In addition to corporate activity, the UK small cap market has several other potential return drivers, especially as the current premium to large cap UK companies remains below the historical average.

UK consumers drive a large portion of the UK economy, and consumer confidence has rebounded from low levels and stabilised. The savings rate is still high—suggesting that consumers may need continued evidence of economic stability before they start spending—but the potential for increasing consumption would be a tailwind for many companies and several holdings in the portfolio.

JUGI recently added a position in Currys*, the technology and electronics and retailer, which has high exposure to the UK consumer and is taking market share. A strong management team has turned around the business and deleveraged the company, enabling it to pay a dividend and buy back shares. The portfolio managers also added to another consumer company, Applied Nutrition*, which formulates and creates nutrition products. Morgan Sindall*, the housing and construction company, remains a key position in the portfolio that will benefit from an improving macroeconomic environment and was a strong contributor to returns over the past year.

UK small caps have global exposure

About half of UK small and mid-cap company revenues are domestic, meaning that many companies are more diversified than investors realise. JUGI’s holdings are well diversified and have exposure to a variety of businesses with operations in other regions. Lion Finance* is a top holding in the portfolio and was a big contributor to returns over the course of the year. This UK-based company provides banking and financial services in Georgia and Armenia. Exposure to these fast-growing markets is producing strong returns on capital and the company is returning capital to shareholders. JUGI added a position in Intercede, a cybersecurity company with contracts at the highest levels of US government, which has strong order momentum and a solid balance sheet.

Some companies in the portfolio with global operations experienced setbacks during the past year. Ashtead*, an equipment rental company that the portfolio has held since it went public, was negatively impacted by uncertainty in the renewables area, especially with changes in US policies. However, the company managed to maintain earnings in line with consensus estimates and has been able to adjust its business, while also maintaining a strong balance sheet with good returns on capital. JUGI is maintaining its position in this high-quality company.

4Imprint*, which markets branded goods shipped from China to corporate customers, was negatively impacted by sentiment around US tariffs. JUGI is maintaining its position as the company has not downgraded any numbers, offers a high return on capital and has paid a special dividend. However, the portfolio managers decided to exit the trust’s position in Warpaint, a cosmetics company, following growth challenges in the US market.

Strong performance track record

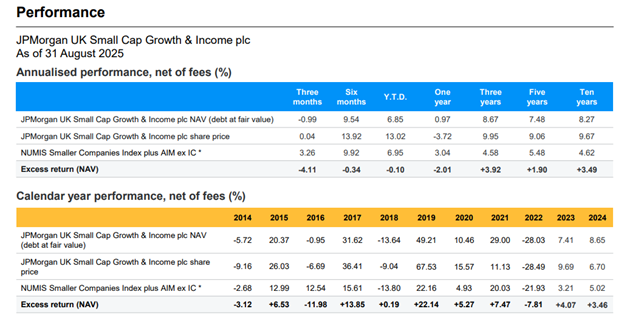

As of 30 September 2025, JUGI has outperformed its benchmark1, the NUMIS Smaller Companies plus AIM ex IT Index, over the past year and over three, five2 and ten2 years, annualised2, and ranks3 in the first quartile vs. its peers in all of these periods. Taking an even longer-term view, over 25 years, JUGI has produced cumulative returns that are significantly above the S&P 500 index, as well as the FTSE 250 ex IT index.

Despite some of the most volatile markets the portfolio managers can remember, they continue to see potential for upside in UK small caps as valuations create opportunities for investors and corporate buyers2.

* The portfolio is actively managed. Holdings, sector weights, allocations and leverage, as applicable, are subject to change at the discretion of the investment manager without notice.

1 Please note these benchmarks are for comparative purposes only

2 Source: J.P. Morgan Asset Management/Morningstar. Net asset value performance data has been calculated on a NAV to NAV basis, including ongoing charges and any applicable fees, with any income reinvested, in GBP. NAV is the cum income NAV with debt at fair value, diluted for treasury and/or subscription shares if applicable, with any income reinvested. Share price performance figures are calculated on a mid-market basis in GBP with income reinvested on the ex-dividend date. The performance of the company's portfolio, or NAV performance, is not the same as share price performance and shareholders may not realise returns which are the same as NAV performance. Indices do not include fees or operating expenses and you cannot invest in them. Geometric excess returns. Periods over one year are annualised. *Benchmark changed from the FTSE Smaller Companies Index ex IT to the NUMIS Smaller Companies Index plus AIM ex IC on 1st January 2019.

3 Morningstar Data , published on 31 October, 2025 -https://www.morningstar.com/cefs/xlon/jugi/quote