2025 has brought profound shifts in global markets, creating new opportunities for active investors such as the Portfolio Managers of JPMorgan Global Growth & Income (JGGI).

The past year has seen some very significant shifts in the investment landscape. Foremost among these were the US administration’s tariff policy pivots, which generated great uncertainty and unusually high market volatility. At the same time, increasing concerns about the rise of an ‘AI bubble’ have stopped the so-called ‘Magnificent Seven’ US mega cap tech stocks in their tracks, to the extent that the valuations of names such as Meta, Amazon and Nvidia, along with several other semiconductor manufacturers, have traded at multi-year lows relative to the global universe¹. The fracturing of the post-war alliance between the US and its European partners has been the driver of another key structural change. The US administration’s ‘America First’ approach to international relations comes at the same time as Europe faces a major threat on its eastern borders. This has compelled European countries, led by Germany, to commit to significant increases in defence and infrastructure spending. After years of lagging returns, this has seen European stocks outperform in 2025, as investors anticipate stronger growth across the region².

JGGI’s response

Such monumental changes in the world view have created many opportunities for astute, proactive investors such as the managers of JGGI. The unconstrained approach of this ‘go anywhere’ investment trust means its managers are free to pursue the best equity ideas from around the world, and to position the portfolio to capitalise on unexpected developments and structural shifts such as we have seen this year.

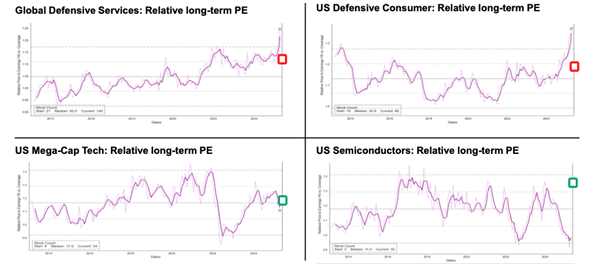

The team’s response to the US government’s on-again, off-again tariff policy announcements is one illustration of the value of this unusual level of flexibility. The uncertainty surrounding the economic impact of US tariffs boosted defensive consumer and services stocks, due to their perceived status as safe havens. Many are trading at extreme long-term multiples relative to the global universe¹. This provided the managers with the chance to take profits by exiting several stocks which they believed were trading at excessive valuations.

Investing in the future: AI

Contrary to the concerns of some investors about an ‘AI bubble’, the managers have a strong conviction that the revolution in artificial intelligence (AI) is one of the most important structural changes in human history, which will deliver rewarding returns on investment over the long term. In their view, we are still in the early stages of a process which will see increasingly intensive integration of AI into business practices, generating huge time and cost savings and substantial productivity increases.

The managers cite the case of a major portfolio holding, Meta (formerly Facebook), as an early and successful adopter and beneficiary of AI. Meta has made a major effort to fully utilise AI across its various social media platforms, with the result that the company now understands its users better, engages them for longer and sends them targeted ads which are most likely to trigger sales. Meta’s earnings have risen accordingly, and although the share price has been volatile this year, the Trust’s managers expect the business to continue to benefit from its investment in AI.

Given their positive view on AI, the managers grasped the opportunity provided by the underperformance of some of the highest profile AI-related stocks to add to existing holdings such as Nvidia and Dutch semiconductor producer, ASML (both top ten portfolio holdings³), and Taiwan Semiconductor Manufacturing Company (TSMC), all of which have since rallied strongly.

Treading carefully in Europe

The year’s European geopolitical developments have also generated portfolio changes. While European regional growth is likely to benefit from increased fiscal stimulus over the medium term, the managers are sceptical that this year’s gains in many European stocks are justified. In their view, the lead times for higher defence and infrastructure spending are often long, and few European nations have the fiscal firepower to follow Germany’s lead. However, some less obvious plays on this theme have been overlooked by the market. For example, Siemens, a world leader in automation and digitalisation, has been trading at long-term lows relative to other European cyclicals. The Trust’s managers opened a position in this stock on the expectation of a cyclical recovery in sales, followed by a potential structural uplift from the rise in European defence spending. Siemens’ share price has climbed steadily since acquisition in Q1 of 2025⁴ .

JGGI: Long-term investor focus

This year’s market volatility has hurt the Trust’s relative performance, due to its bias towards high quality growth stocks. However, returns have remained positive in outright terms, and the Company has delivered competitive performance over longer time periods, with strong outperformance of the benchmark over the five- and 10-year periods to end October 2025⁵.

In addition to impressive long-term capital growth, the Trust pays a quarterly dividend6 totalling at least 4% of net asset value at the end of the preceding year. This combination of an attractive level of income and a diversified approach that seeks to capture opportunities arising from market, policy and structural developments may appeal to investors seeking growth, or income, or both.

1 J.P. Morgan Asset Management. Correlations use 10-year, weekly USD returns. Universe is set to all JPMAM coverage of stocks with correlation >0.7 and sit within the same sector.

2 MSCI Europe Index Factsheet, as at 31 October 2025: https://www.msci.com/documents/10199/db217f4c-cc8c-4e21-9fac-60eb6a47faf0

3 J.P. Morgan Asset Management, as at 30 September 2025

4 Hargreaves Lansdown, as at 12 November 2025: https://www.hl.co.uk/shares/shares-search-results/s/siemens-ag-adr-each-cnv-into-1-ord-npv

5 Source: J.P. Morgan Asset Management. Performance data has been calculated net of fees on the basis of last available quoted offer price with debt valued at par in GBP. ** Formerly JPMorgan Overseas Investment Trust plc. On Friday 8 July 2016 the Board of JPMorgan Overseas Investment Trust plc announced that it was changing its name with immediate effect to JPMorgan Global Growth and Income plc. 1 Excess performance calculated using NAV net of fees geometric excess returns. Returns for periods greater than one year are annualised. 2Since current portfolio management team assumed responsibilities for JGGI. Past performance is not a reliable indicator of future performance.

6 Dividend paid by the product may exceed the gains of the product, resulting in erosion of the capital invested. It may not be possible to maintain dividend payments indefinitely and the value of your investment could ultimately be reduced to zero. Dividend payments are not guaranteed.