Assessing the market cap opportunities in the US stock market

Investors in the US stock market enjoyed impressive performance in 2023, led by large cap stocks. However, with potential interest rate cuts on the horizon, and after some stronger relative performance from smaller companies at the back end of last year, investors are now asking where to position themselves along the market cap spectrum.

To assess where the best opportunities may lie, we’ve evaluated each market cap segment by valuation, sector composition, profitability, debt service levels and costs:

- Valuations: Currently valuations are stretched for US large caps, with the price-to-earnings (P/E) ratio 27% above its 20-year average, while small caps are more in line with long-term averages.

- Sector composition: Given index concentration among a narrow set of stocks, US large caps are heavily weighted towards technology stocks. US smaller companies, on the other hand, have the highest relative exposure to financials, consumer discretionary, energy and health care. If the rally broadens out, small caps could benefit, but if the US economy slows those cyclical areas could face headwinds.

- Profitability: While sector exposure is important, so too is the underlying profitability of the companies within sectors. Although we do not expect a recession, the US economy is likely to slow, which could challenge revenues and impact profits, so quality is key. Over 41% of the small cap index is unprofitable, compared to 17.5% in mid cap, and 7.4% in large cap. Profit growth for the large cap S&P 500 is estimated to be 12% in 2024 after tracking slightly down in 2023. Small caps are anticipated to rebound from profit declines of 10% in 2023 to 23% growth in 2024. However, estimates have only been revised down slightly for large caps for 2024, while small cap estimates have already been revised down 9% in the last three months.

- Debt service: Debt interest costs are rising after the interest rate increases from the Federal Reserve last year, but interest coverage ratios, which measure the ability of companies to service their debt, are above their 25-year averages for US large and mid cap stocks, while small caps have dipped below their long-term averages. In addition, higher interest rates may impact smaller companies sooner than larger companies because nearly half of S&P 500 debt outstanding matures after 2030 compared to 14% of the small cap Russell 2000 index. The large cap index also contains just 6% of floating rate debt compared to 38% in the small cap index.

- Costs: Although wages and input costs have recently slowed or receded in the US, they have reset at higher levels than before the pandemic. According to the US National Federation of Independent Business (NFIB) survey of small businesses, inflation and labour quality continue to be the top concerns. These structurally higher costs tend to be absorbed better by larger companies with more robust balance sheets than smaller companies.

Regional banking sector still faces headwinds

Almost a year after the regional banking stress, concerns over the sector is mounting again, following the earnings announcement by New York Community Bancorp (NYCB). NYCB’s earnings came in well below expectations and revealed surprise losses on commercial real estate (CRE) loans, while management slashed dividends, sending shares plummeting. While there are several idiosyncrasies with NYCB’s case, such as its outsized exposure to New York rent-stabilised housing, NYCB’s challenges do show that the regional banking sector is still facing headwinds.

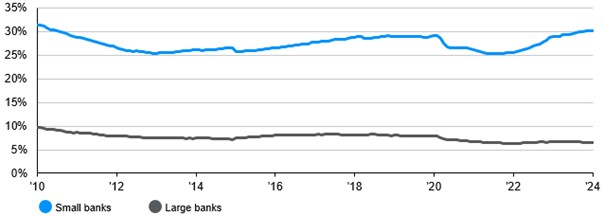

From a balance sheet perspective, post-2008, smaller banks have been piling into commercial real estate loans to gain market share, with these loans now taking up 30.2% of small banks’ total loans and leases (vs. 6.5% for large banks). However, with property prices weak, vacancy rates high and refinancing rates significantly higher than rates on maturing loans, Fitch Ratings has projected that delinquencies (or the number of loans where repayments have been missed by the borrower) on US commercial mortgage-backed securities could more than double from 3.5% in 2023 to 8.1% in 2024.

With the memory of the March 2023 regional banking stress still lingering as a warning to maintain a strong balance sheet in case panic spreads and a deposit run is triggered, more regional banks have announced higher charge-offs and loan loss provisions to help protect against rising loan delinquencies. Other profit headwinds are also weighing on regional banks’ earnings and net interest margins, with higher funding costs and tighter credit standards slowing loan growth and suppressing revenues.

Commercial real estate (cre) loans on small and large us bank* balance sheets

Proportion of total assets, seasonally adjusted

How are small caps positioned?

On the one hand, regional banks take up around 8% of the Russell 2000 small cap index (compared to 1% of the S&P 500), while financials is the second largest sector in the Russell 2000, representing 16% in weight. On the other hand, regional banks are an important funding source to the economy, with small banks providing 32% of all outstanding loans and leases held by domestically chartered commercial banks. They are an especially important funding source for small businesses as well, with the latest NFIB survey reporting 69% of small business owners using a small, regional or local bank as their main funding source, as opposed to 17% using a large bank and 14% using a medium-sized bank.

With the aforementioned concentration in commercial real estate loans and profitability headwinds, in addition to higher regulatory hurdles, regional banks may pullback on lending if stress intensifies. At the moment, we don’t see big contagion risks. Lower rates and loosening credit conditions could provide important relief as well, but this remains an area of risk to closely monitor this year.

Investment Implications

Although a broadening out of the US stock market rally and favourable valuations could benefit small caps, large caps appear to look more appealing, in terms of balance sheet quality and margins. Large caps are also less vulnerable to a possible weakening of the regional banking sector. Investors may therefore look to lean towards quality and defensiveness in the current environment, but once the Federal Reserve starts cutting rates and lower borrowing costs start to feed through to the economy, the environment will be more constructive for the US small cap sector.

This is a marketing communication and as such the views contained herein are not to be taken as advice or a recommendation to buy or sell any investment or interest thereto. Reliance upon information in this material is at the sole discretion of the reader. Any research in this document has been obtained and may have been acted upon by J.P. Morgan Asset Management for its own purpose. The results of such research are being made available as additional information and do not necessarily reflect the views of J.P. Morgan Asset Management. Any forecasts, figures, opinions, statements of financial market trends or investment techniques and strategies expressed are, unless otherwise stated, J.P. Morgan Asset Management’s own at the date of this document. They are considered to be reliable at the time of writing, may not necessarily be all inclusive and are not guaranteed as to accuracy. They may be subject to change without reference or notification to you. The value of investments and the income from them may fluctuate in accordance with market conditions and investors may not get back the full amount invested. Past performance and yield are not a reliable indicator of current and future results. There is no guarantee that any forecast made will come to pass. J.P. Morgan Asset Management is the brand name for the asset management business of JPMorgan Chase & Co. and its affiliates worldwide. To the extent permitted by applicable law, we may record telephone calls and monitor electronic communications to comply with our legal and regulatory obligations and internal policies. Personal data will be collected, stored and processed by J.P. Morgan Asset Management in accordance with our EMEA Privacy Policy www.jpmorgan.com/emea-privacy-policy.

09kw242802094708