Invest in the heart of America

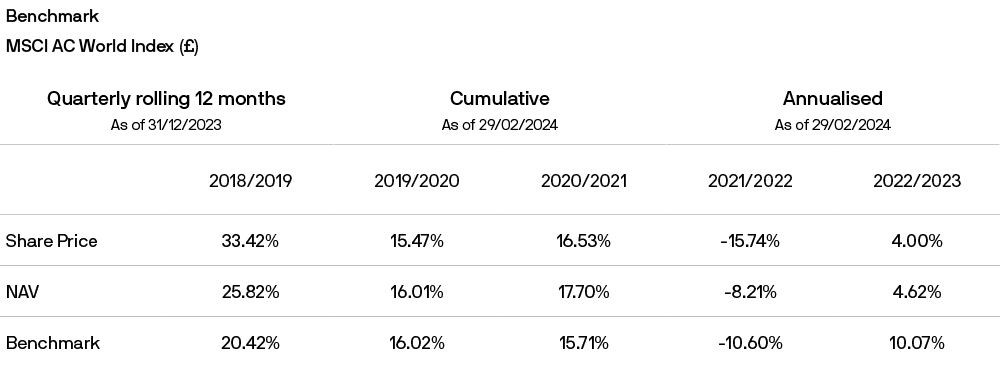

JPMorgan US Smaller Companies Investment Trust (JUSC) has a long track record of excess returns, in a variety of challenging market environments. And risk-adjusted returns are also good — JUSC’s approach has historically shown less volatility than the market and less exposure to downside risk.1

In contrast to its impressive longer-term performance, 2023 was a difficult year for JUSC. Smaller companies tend to underperform when the market focuses on macroeconomic conditions rather than company fundamentals, and during 2023, investors were most concerned about high and rising interest rates and the associated risk of recession. Small companies were also out of favour with investors, whose attention was captured by a handful of mega cap tech stocks, known collectively as the ‘Magnificent Seven’ – Apple, Microsoft, Nvidia, Tesla, Amazon, Meta (formerly Facebook) and Alphabet (formerly Google) – companies perceived to be the main beneficiaries of the artificial intelligence (AI) revolution.

Focus on quality companies, trading at a discount to intrinsic value

The company’s underperformance during 2023 prompted the managers to review the portfolio, and as a result, they opted to ’double down on quality’, by ‘leaning into’ the highest quality, strongest conviction names already held in the portfolio. In all, the managers sold out of 19 holdings and only added nine new, higher quality names — the earnings of these new additions, are, on average, 70 basis points, or 0.7%, higher than the earnings of the stocks sold.2 The portfolio’s high quality is evidenced by the fact that its overall return on equity (RoE) in the 12-months ended December 2023 was 13.1%, 70% better than the RoE of the Russell 2000 Index, which was 7.7% at year-end. 2

Investment opportunities

Examples of the kind of quality stocks the managers favour include MSA Safety, an industrial sector name which sells breathing apparatus and safety equipment, such as that used in firefighting – products that businesses must buy and replace regardless of economic conditions.

Within the technology sector, the managers opened a position in Qualys, a cyber-security company. All businesses are facing increasing cyber risks due to escalating geopolitical tensions, cyber-terrorism and the risks that hybrid working pose to corporate IT systems. Qualys helps businesses guard against such threats. The company is conservatively managed, with strong cashflows and demand for its services is likely to continue rising. 4

Amongst financials, the managers favour high quality franchises with low capital requirements, such as the portfolio’s holdings in AssetMark Financial (which provides wealth management and tech solutions to financial advisers), Kinsales Capital group (a property and casualty insurer), and Moelis (an investment banking advisory firm). In the consumer discretionary sector, the managers look for businesses well-positioned to benefit from shifting consumer trends. For example, a holding in BJ’s Wholesale Club, a discount retailer, gives the company exposure to consumers’ increasing appetite for low priced goods, while Monarch Casino and Resort taps into the rising demand for experiences and travel.

The outlook for smaller companies

JUSC’s managers are positive and excited about the outlook for the quality small companies they own, for many reasons. Firstly, small company valuations in general are very appealing – indeed, small companies have ‘never been cheaper relative to large companies’ in their view – a fact that should spark renewed investor interest at some point soon. The earnings outlook for small companies is also improving. Earnings results for the third quarter of 2023 exceeded expectations, and declining interest rates will provide further earnings support. JUSC’s managers expect small company earnings to increase much faster than large company earnings this year. 3

In addition, the managers believe the end of an extended period of ultra-low interest rates will be supportive for smaller companies. Rates are likely to settle at levels closer to their longer-term average, and history suggests that this is a particularly conducive environment for quality small company stocks. They cite the period following the end of the dot.com boom as an example, when small company stocks outperformed by 1-2% for several years in succession. The fact that 2024 is an election year is further reason for their optimism, as election years tend to be good ones for US equity markets.1

So, with small company valuations enticing, earnings improving, and the rate environment set to normalise, JUSC’s managers are confident 2024 will be a much better year for small company stocks than 2023. The company’s high-quality bias means it is well-positioned to build on its very favourable long-term performance track record, over 2024, and beyond. And with its share price now trading at a discount to net asset value (NAV) of more that 10%, much wider than its historical average, now may be an especially opportune time for investors to acquire exposure.

The JPMorgan US Smaller Companies Investment Trust (JUSC) provides access to potentially fast growing smaller US stocks. The investment approach seeks out well-run companies with record of a potential attractive return.

1JPMorgan US Smaller Companies Investment Trust Investor Presentation, February 2024.

2 Earnings before interest, taxes, depreciation and amortization. Data as of January 2024.

3 JPMorgan US Smaller Companies Investment Trust Annual Report, December 2023.

4 The companies above are shown for illustrative purposes only. Their inclusion should not be interpreted as a recommendation to buy or sell.

More Insights

Past performance is not a reliable indicator of current and future results.

Source: J.P. Morgan Asset Management/Morningstar. Net asset value performance (NAV) data has been calculated on a NAV to NAV basis, including ongoing charges and any applicable fees, with any income reinvested, in GBP.

NAV is the cum income NAV with debt at fair value, diluted for treasury and/or subscription shares if applicable, with any income reinvested. Share price performance figures are calculated on a mid market basis in GBP with income reinvested on the ex-dividend date. The performance of the company's portfolio, or NAV performance, is not the same as share price performance and shareholders may not realise returns which are the same as NAV performance.

Benchmark source: Russell Investment Group is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell© is a trademark of Russell Investment Group.

Comparison of the Company's performance is made with the benchmark. The benchmark is a recognised index of stocks which should not be taken as wholly representative of the Company's investment universe. The Company's investment strategy does not follow or track this index and therefore there may be a degree of divergence between its performance and that of the Company.

Investment objective: The Company aims to achieve capital growth from North American investments by outperformance of the Company's benchmark, the S&P500 Index, with net dividends reinvested, expressed in sterling terms. The Company emphasises capital growth rather than income and when appropriate may have exposure to smaller capitalisation companies. The Company's gearing policy is to operate within a range of 5% net cash to 20% geared in normal market conditions. Gearing may magnify gains or losses experienced by the Company.

Key risks: Exchange rate changes may cause the value of underlying overseas investments to go down as well as up. External factors may cause an entire asset class to decline in value. Prices and values of all shares or all bonds and income could decline at the same time, or fluctuate in response to the performance of individual companies and general market conditions. This Company may utilise gearing (borrowing) which will exaggerate market movements both up and down. This Company may also invest in smaller companies which may increase its risk profile. The share price may trade at a discount to the Net Asset Value of the Company. The single market in which the Company primarily invests, in this case the US, may be subject to particular political and economic risks and, as a result, the Company may be more volatile than more broadly diversified companies.

This is a marketing communication and as such the views contained herein do not form part of an offer, nor are they to be taken as advice or a recommendation, to buy or sell any investment or interest thereto. Reliance upon information in this material is at the sole discretion of the reader. Any research in this document has been obtained and may have been acted upon by J.P. Morgan Asset Management for its own purpose. The results of such research are being made available as additional information and do not necessarily reflect the views of J.P. Morgan Asset Management. Any forecasts, figures, opinions, statements of financial market trends or investment techniques and strategies expressed are unless otherwise stated, J.P. Morgan Asset Management’s own at the date of this document. They are considered to be reliable at the time of writing, may not necessarily be all inclusive and are not guaranteed as to accuracy. They may be subject to change without reference or notification to you. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Changes in exchange rates may have an adverse effect on the value, price or income of the products or underlying overseas investments. Past performance and yield are not reliable indicators of current and future results. There is no guarantee that any forecast made will come to pass. Furthermore, whilst it is the intention to achieve the investment objective of the investment products, there can be no assurance that those objectives will be met. J.P. Morgan Asset Management is the brand name for the asset management business of JPMorgan Chase & Co. and its affiliates worldwide. To the extent permitted by applicable law, we may record telephone calls and monitor electronic communications to comply with our legal and regulatory obligations and internal policies. Personal data will be collected, stored and processed by J.P. Morgan Asset Management in accordance with our EMEA Privacy Policy www.jpmorgan.com/emea-privacy-policy. Investment is subject to documentation. The Annual Reports and Financial Statements, AIFMD art. 23 Investor Disclosure Document and PRIIPs Key Information Document can be obtained free of charge in English from JPMorgan Funds Limited or at www.jpmam.co.uk/investmenttrust. This communication is issued by JPMorgan Asset Management (UK) Limited, which is authorised and regulated in the UK by the Financial Conduct Authority. Registered in England No: 01161446. Registered address: 25 Bank Street, Canary Wharf, London E14 5JP.

09mx241103170643