European small caps present high growth potential and a long-term track record of outperformance vs. most other equity indices—but are trading at attractive relative valuations.

Marketing Communication

European Small caps: Poised for the next phase of growth

European small caps present high growth potential and a long-term track record of outperformance vs. most other equity indices—but are trading at attractive relative valuations.

Many investors may be surprised to realise that the cumulative returns of the MSCI Europe Small Cap index over the past 25 years are higher than the S&P 500 index and most major large cap and small cap equity market indices. European small caps could continue to outperform, supported by strong earnings growth prospects, tailwinds from German infrastructure and defense spending and attractive valuations.

Greater potential for high growth

The portfolio managers of JPMorgan European Discovery Trust plc (JEDT) look for small European companies with big growth opportunities. Some companies have market capitalisations as low as EUR 1 billion, which means they are often not covered by sell-side research analysts and that a small amount of growth in absolute terms can still have a big impact on a percentage basis.

Small companies can grow revenues and earnings organically or through mergers and acquisitions (M&A), especially bolt-on acquisitions that may be easier to integrate than large mergers. In many cases, these deals can help a growing company maintain a high return on equity (ROE). One of JEDT’s holdings, Reply, which is an IT consulting company, has completed 15 M&A deals since 2016, increasing sales and driving a strong return on invested capital (ROIC).

Of course, small companies are also sometimes taken out at a premium by large cap companies, which can also generate returns for investors. Whether through organic or M&A growth, European small cap companies have outgrown their large cap peers by around 200-300 basis points per year over the long term, contributing to their outperformance.

Rare valuation discount

The significant growth potential of European small caps is typically reflected in a premium valuation to large caps. However, the asset class is currently trading at a discount, making European small caps attractively valued vs. their own history and other markets. Indeed, the last time European small caps traded at a discount was in 2000 and then they outperformed significantly.

The potential for valuations to drive returns is evidenced by the performance of European bank stocks in recent years. After trading close to distressed valuations when interest rates were near zero, banks’ profits rebounded as interest rates normalised and their stocks appreciated sharply.

Some of this valuation discount in European small cap stocks reflects subdued sentiment on European growth but the JEDT portfolio managers believe that sentiment will rebound. Small caps have a greater domestic focus and are generally less impacted by US tariffs. More importantly, many European small caps will be positively impacted by the one trillion euros the German government is planning to spend over the next few years on infrastructure and defense.

Key investment themes driving portfolio positioning

In the past few years, the JEDT portfolio managers have evolved the investment process to increasingly focus on active stock selection by reducing the amount of active risk at the sector level. The portfolio managers look for structural growth stories within sectors stories to ensure exposure across most sectors.

Digitalisation is one of the key themes across the portfolio. Some examples of how this theme is expressed include the Germany company Bechtle*, which is helping businesses upgrade their IT infrastructure to meet the demands of AI, and the German real estate platform Scout 24*.

Several of the holdings in the portfolio are related to the theme of decarbonisation, including Bilfinger*, an industrial services company that has been one of the top performers in JEDT over the past year. The new management team focused on the industrial services business and helping clients with energy cost issues, boosting the company’s earnings growth.

Another example is Accelleron*, a Swiss maker of turbochargers used in marine transport to reduce fuel consumption. This technology is now being used by datacenters, supporting an innovative decarbonisation strategy. Tecnicas Reundias*, a Spanish engineering and construction company, is a large active position in the portfolio. The company currently has a large power generation pipeline and is expanding in LNG and decarbonisation projects.

Smaller companies are also key drivers of health care innovation, another important theme in the portfolio. Many of these also tend to get acquired by larger pharmaceutical companies. JEDT currently has positions in Irish sport nutrition company Glanbia*, and Cosmo*, a Swiss pharmaceutical company that has a successful product to combat hair loss and is testing a new acne treatment.

Looking ahead

International interest in European small caps has already picked up significantly during 2025 from little demand in recent years. Any improvement in sentiment or the economy that modestly increases flows into the asset class could have a big impact on returns.

The trust’s gearing of about 6% reflects the JEDT portfolio managers’ optimistic view of the prospects for European small caps, given the powerful combination of growth drivers, attractive valuations and potential for a macroeconomic tailwind.

*The companies above are shown for illustrative purposes only. Their inclusion should not be interpreted as a recommendation to buy or sell. The portfolio is actively managed. Holdings, sector weights, allocations and leverage, as applicable, are subject to change at the discretion of the investment manager without notice. Past performance is not a reliable indicator of current and future results.

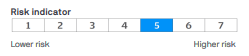

Summary Risk Indicator

The risk indicator assumes you keep the product for 5 year(s). The risk of the product may be significantly higher if held for less than the recommended holding period.

Investment Objective:

The Company aims to provide capital growth from a diversified portfolio of smaller European companies (excluding the United Kingdom). As the emphasis is on capital growth rather than income, shareholders should expect the dividend to vary from year to year. The Company has the ability to use borrowing to gear the portfolio within the range of 20% net cash to 20% geared, in normal market conditions.

Risk Profile:

- Exchange rate changes may cause the value of underlying overseas investments to go down as well as up.

- External factors may cause an entire asset class to decline in value. Prices and values of all shares or all bonds and income could decline at the same time, or fluctuate in response to the performance of individual companies and general market conditions.

- This Company may utilise gearing (borrowing) which will exaggerate market movements both up and down.

- This Company invests in smaller companies which may increase its risk profile.

- The share price may trade at a discount to the Net Asset Value of the Company.