JPMorgan American Investment Trust plc | JAM

US equities, hand-picked by experts

This is a marketing communication

Wider valuation and performance dispersion, elevated market concentration and potentially higher-for-longer interest rates underscore the importance of an active approach to engage opportunities and manage risks in the US stock market.

Looking beyond valuations

A common refrain about investing in US stocks is valuations. The valuation of the S&P 500 index appears relatively extended compared to its own history and other regional markets, trading at around 21x forward price-to-earnings (P/E) at the end of March, which was meaningfully above its past 15-year average. This valuation compares unfavourably to equity markets in Europe, Asia and Japan, and across emerging markets, where P/E valuations are closer to their respective past 15-year averages.

Yet the headline US valuation figure belies the fact that there is wide dispersion in valuations within the S&P 500 index itself. There is a particularly wide divergence between the valuations of the top 10 largest constituents of the index and its remaining members1.

Higher US equity valuations driven by a handful of stock names.

Source: FactSet, MSCI, Standard & Poor’s, J.P. Morgan Asset Management. Data as of 31.03.2024. Price-to-earnings (P/E) ratios are in local currency terms. Indices do not include fees or operating expenses and are not available for actual investment. Past performance is not a reliable indicator of current and future results.

The higher valuation of the overall index can be explained by the rising concentration of the market in its 10 largest stocks by market capitalisation. Accounting for over a third of the overall index,2 the ebb and flow of these 10 stock names could affect headline numbers, potentially masking interesting opportunities below the surface.

The top 10 stock names have steadily increased their share of the S&P 500 index over the past few years.

Source: FactSet, Standard & Poor’s, J.P. Morgan Asset Management. Data as of 31.03.2024. Provided for information only to illustrate macro trends, not to be construed as offer, research or investment advice.

The collective influence of the 10 largest stocks is not insignificant. While the S&P 500 index climbed 24% in 2023, it was a narrow-breadth rally with the top 10 stocks accounting for about 86% of the annual price return.3

Staying active to differentiate opportunities

Yet in the first quarter of 2024, we’ve observed a dispersion in the performance of the 10 largest US stocks, with some names scaling new heights while others started to struggle.4 Coupled with the wide dispersion of valuations within sectors, an active investment approach could be useful to seek out mispriced opportunities in the US market.

Moreover, a changing macroeconomic environment marked by higher-for-longer interest rates, a higher cost of capital and elevated geopolitical risks could present challenges for various sectors and companies – some more so than others – and invariably create potential winners and losers. This backdrop, characterised by index concentration, valuation and performance dispersion, and fast changing economic conditions underscores the importance of a robust and active investment process to help manage risks and differentiate opportunities from the bottom up. An active approach supported by a robust bottom-up fundamental research process, can be useful to uncover lesser known, higher quality names that could present opportunities for long-term returns.

JPMorgan American Investment Trust (JAM) uses a systematic, disciplined and rigorous fundamental research process to seek out high conviction ideas, across both the growth and value investment universes.5 On the growth side of the portfolio, JAM seeks out durable franchises with large and/or growing addressable markets, sustainable competitive advantages and robust management teams. On the value side, JAM seeks out durable businesses with solid cash flows and attractive valuations.

With its focus on identifying high quality, durable franchises across sectors, backed by the expertise of dedicated US growth and US value investment teams, JAM’s 40-stock portfolio offers attractive opportunities for investors looking to gain access to the long-term growth potential of the US stock market.

1. Source: FactSet, MSCI, Standard & Poor’s, J.P. Morgan Asset Management. Data as of 31.03.2024. Price-to-earnings (P/E) ratios are in local currency terms. Indices do not include fees or operating expenses and are not available for actual investment. Past performance is not a reliable indicator of current and future results.

2. Source: FactSet, Standard & Poor’s, J.P. Morgan Asset Management. “Guide to the markets (US): 1Q 2024.” Data as of 31.03.2024.

3. Source: FactSet, Standard & Poor’s, J.P. Morgan Asset Management. “Guide to the markets (US): 1Q 2024.” Data as of 31.12.2023.

4. Source: Bloomberg, J.P. Morgan Asset Management. Data as of 31.03.2024.

5. Please refer to the fund’s offering documents for further details on its objectives. The manager seeks to achieve its stated objectives and there is no guarantee they will be met. Actual account allocations and characteristics may differ. Holdings, duration, allocations or exposure in actively portfolio managed portfolios are subject to change from time to time. Investments involve risks. Not all investments, strategies or ideas are suitable for all investors. Investors should make their own evaluation or seek independent advice and review offering documents carefully prior to making any investment.

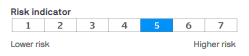

Summary Risk Indicator

The risk indicator assumes you keep the product for 5 year(s). The risk of the product may be significantly higher if held for less than the recommended holding period.

Investment objective

The Company aims to achieve capital growth from North American investments by outperformance of the Company's benchmark, the S&P500 Index, with net dividends reinvested, expressed in sterling terms. The Company emphasises capital growth rather than income and when appropriate may have exposure to smaller capitalisation companies. The Company's gearing policy is to operate within a range of 5% net cash to 20% geared in normal market conditions. Gearing may magnify gains or losses experienced by the Company.

This is a marketing communication and as such the views contained herein do not form part of an offer, nor are they to be taken as advice or a recommendation, to buy or sell any investment or interest thereto. Reliance upon information in this material is at the sole discretion of the reader. Any research in this document has been obtained and may have been acted upon by J.P. Morgan Asset Management for its own purpose. The results of such research are being made available as additional information and do not necessarily reflect the views of J.P. Morgan Asset Management. Any forecasts, figures, opinions, statements of financial market trends or investment techniques and strategies expressed are unless otherwise stated, J.P. Morgan Asset Management’s own at the date of this document. They are considered to be reliable at the time of writing, may not necessarily be all inclusive and are not guaranteed as to accuracy. They may be subject to change without reference or notification to you. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Changes in exchange rates may have an adverse effect on the value, price or income of the products or underlying overseas investments. Past performance and yield are not reliable indicators of current and future results. There is no guarantee that any forecast made will come to pass. Furthermore, whilst it is the intention to achieve the investment objective of the investment products, there can be no assurance that those objectives will be met. J.P. Morgan Asset Management is the brand name for the asset management business of JPMorgan Chase & Co. and its affiliates worldwide. To the extent permitted by applicable law, we may record telephone calls and monitor electronic communications to comply with our legal and regulatory obligations and internal policies. Personal data will be collected, stored and processed by J.P. Morgan Asset Management in accordance with our EMEA Privacy Policy www.jpmorgan.com/emea-privacy-policy. Investment is subject to documentation. The Annual Reports and Financial Statements, AIFMD art. 23 Investor Disclosure Document and PRIIPs Key Information Document can be obtained in English from JPMorgan Funds Limited or at www.jpmam.co.uk/investmenttrust. This communication is issued by JPMorgan Asset Management (UK) Limited, which is authorised and regulated in the UK by the Financial Conduct Authority. Registered in England No: 01161446. Registered address: 25 Bank Street, Canary Wharf, London E14 5JP.

09ew240805150835