Japan has endured three ‘lost’ decades of low growth, low returns and deflation. However, things seem to be changing. JPMorgan Japanese Investment Trust’s (JFJ’s) portfolio manager, Nicholas Weindling, has spent much of his career investing in Japanese equities and he believes that the outlook for this market has never been brighter. He cites several reasons for his optimism.

The most significant in his view is the revolution in corporate governance. Japanese companies have been reforming their governance practises - increasing disclosure, improving board independence, and returning cash to shareholders, for some time. However, change is gathering pace due to pressure from the Tokyo Stock Exchange, which wants to see all listed companies improve their capital allocation, and from domestic asset managers demanding greater transparency and higher returns.

Japanese companies now more willing to return cash to shareholders

This process is being given further impetus by a generational change in top management – Japanese banks’ longstanding reluctance to lend to growing businesses forced old guard managers to hoard significant amounts of cash. However, the new generation of managers is much more entrepreneurial and willing to return cash to shareholders via higher dividend payments and share buybacks. These actions have the potential to substantially improve valuations and returns across the entire market.

Reforms lead to better investment opportunities for the Trust

JFJ’s manager is also excited by the fact that corporate governance reforms increase the pool of investment opportunities for funds such as JFJ, that are focused on quality businesses. Better governance practices mean that many sound, potentially interesting businesses, which JFJ’s manager has previously avoided due to their substantial cash holdings and other poor governance practices, are now attractive investments. For example, he has recently purchased Secom, Japan’s largest provider of security systems, in anticipation of significantly enhanced shareholder returns, following the company’s decision to implement share buybacks for the first time in 15 years. He cites Samwa, a Japanese manufacturer of doors, as another example of a company set to benefit from its improved governance practices.

Japan’s economy is finally experiencing a post-pandemic rebound. The government only opened its borders late last year, but since then there has been a surge in tourism and related expenditures, which is set to continue as Chinese inbound tourism returns to pre-pandemic levels. Discretionary spending is likely to receive a further boost from higher wages. After 30 years of stagnant incomes, Japan’s tight labour market is forcing many companies to raise salaries to attract and retain workers.

For example, NTT, a telecom company, has lifted starting salaries by 14% and JGC, an engineering and construction company, has increased base salaries by 10%.

Major technological reform to lead to substantial productivity gains

Japan is currently undergoing a major technological transformation across the economy. The country has lagged most other developed economies in its adoption of technology, and businesses and government bodies are only just beginning to digitalise their operations and automate their administrative and payment processes. These efforts are likely to generate very substantial productivity gains and higher growth over the medium term.

The recovery in economic activity and widespread wage growth have raised hopes that Japan may be shaking off the deflationary pressures that have dogged it for so long. Rising energy and commodity prices have also pushed up import inflation, as has the yen’s dramatic depreciation over the past two years. Unlike in other major economies, these developments will be welcomed by the Bank of Japan (BoJ), so there is little risk that it will follow the lead of other central banks and raise interest rates aggressively.

From deflation to (the right level of) inflation?

However, the yen is now significantly undervalued – by more than 40% relative to the US dollar according to the Big Mac Index* - and there is speculation that the BoJ may finally abandon its negative interest rate policy to provide some support for the currency. While any such moves will be cautious, they will nonetheless send a strong signal to currency markets, which will likely trigger some appreciation of the yen. Sterling-denominated investors will benefit accordingly.

Together, these factors – corporate governance reforms, improving economic prospects, concerted efforts to digitalise and automate, and potential currency appreciation - comprise a compelling case for investment in the Japanese market. And although the market has recently reached multi decade highs, valuations are still attractive relative to both history and other markets, according to several metrics. So, it is perhaps unsurprising that after overlooking and underweighting Japanese equities for decades, foreign investors are finally beginning to appreciate the many exciting, attractively priced opportunities available in this market.

JPMorgan Japanese Investment Trust is one of the largest and oldest closed end funds offering access to this market. Its managers target innovative, high quality, high growth Japanese companies from across the market cap spectrum, that are leading the world in growth industries such as e-commerce, gaming, robotics and cloud computing. JFJ has a 25-strong team of Tokyo-based investment professionals providing vital local insights into this under-researched market and seeking out the very best ideas with excellent growth prospects. Such extensive, on-the-ground resources give the Company a significant competitive advantage over its peers.

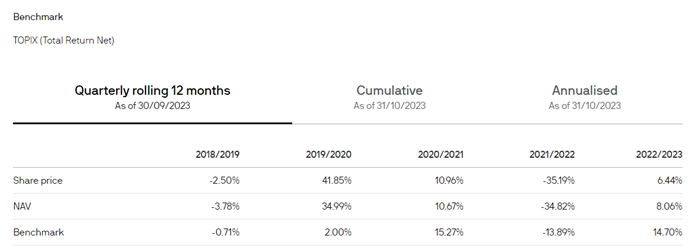

JFJ has a long-term track record of outright gains, slightly above its benchmark, the TOPIX index. In the 10 years ended 30 September 2023, it delivered an average annualised return of 7.6%, versus a benchmark return of 7.5%. While short-term performance may fluctuate due to the Company’s quality and growth focus and its high level of active management relative to the benchmark, its performance over the long term suggests that JFJ could be an attractive vehicle for investors seeking exposure to well-priced, quality, growth companies at the heart of Japan’s rapidly evolving new growth story.

*An informal way of measuring the purchasing power parity (PPP) between two currencies, based on the idea that a Big Mac should cost roughly the same in any country.

Image source: Getty

Past performance is not a reliable indicator of current and future results.

Source: J.P. Morgan Asset Management/Morningstar. Net asset value performance (NAV) data has been calculated on a NAV to NAV basis, including ongoing charges and any applicable fees, with any income reinvested, in GBP.

NAV is the cum income NAV with debt at fair value, diluted for treasury and/or subscription shares if applicable, with any income reinvested. Share price performance figures are calculated on a mid market basis in GBP with income reinvested on the ex-dividend date. The performance of the company's portfolio, or NAV performance, is not the same as share price performance and shareholders may not realise returns which are the same as NAV performance.

Comparison of the Company's performance is made with the benchmark. The benchmark is a recognised index of stocks which should not be taken as wholly representative of the Company's investment universe. The Company's investment strategy does not follow or track this index and therefore there may be a degree of divergence between its performance and that of the Company.

Indices do not include fees or operating expenses and you cannot invest in them.

Summary Risk Indicator

The risk indicator assumes you keep the product for 5 year(s). The risk of the product may be significantly higher if held for less than the recommended holding period.

Investment Objective

Aims to produce capital growth from investment in Japanese companies. The Company has the ability to use gearing to increase potential returns to shareholders. The gearing policy is to operate within the range of 5% net cash to 20% geared, in normal market conditions.

Risk profile

- Exchange rate movements between the pricing currency of the underlying overseas investments held by the Company and sterling (the base currency of the Company) can cause the Company’s NAV (in sterling terms) to go up as well as down. For example, if sterling appreciates relative to Japanese yen, the value of the NAV in sterling terms will be negatively impacted; if sterling depreciates, the value of the NAV in sterling terms will be positively impacted.

- External factors may cause an entire asset class to decline in value. Prices and values of all shares or all bonds and income could decline at the same time, or fluctuate in response to the performance of individual companies and general market conditions.

- This Company may utilise gearing (borrowing) which will exaggerate market movements both up and down.

- This Company may also invest in smaller companies which may increase its risk profile.

- The share price may trade at a discount to the Net Asset Value of the Company.

- The single market in which the Company primarily invests, in this case Japan, may be subject to particular political and economic risks and, as a result, the Company may be more volatile than more broadly diversified companies.

094x230712173709

This is a marketing communication and as such the views contained herein do not form part of an offer, nor are they to be taken as advice or a recommendation, to buy or sell any investment or interest thereto. Reliance upon information in this material is at the sole discretion of the reader. Any research in this document has been obtained and may have been acted upon by J.P. Morgan Asset Management for its own purpose. The results of such research are being made available as additional information and do not necessarily reflect the views of J.P. Morgan Asset Management. Any forecasts, figures, opinions, statements of financial market trends or investment techniques and strategies expressed are unless otherwise stated, J.P. Morgan Asset Management’s own at the date of this document. They are considered to be reliable at the time of writing, may not necessarily be all inclusive and are not guaranteed as to accuracy. They may be subject to change without reference or notification to you. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Changes in exchange rates may have an adverse effect on the value, price or income of the products or underlying overseas investments. Past performance and yield are not reliable indicators of current and future results. There is no guarantee that any forecast made will come to pass. Furthermore, whilst it is the intention to achieve the investment objective of the investment products, there can be no assurance that those objectives will be met.

J.P. Morgan Asset Management is the brand name for the asset management business of JPMorgan Chase & Co. and its affiliates worldwide. To the extent permitted by applicable law, we may record telephone calls and monitor electronic communications to comply with our legal and regulatory obligations and internal policies. Personal data will be collected, stored and processed by J.P. Morgan Asset Management in accordance with our EMEA Privacy Policy www.jpmorgan.com/emea-privacy-policy. Investment is subject to documentation. The Annual Reports and Financial Statements, AIFMD art. 23 Investor Disclosure Document and PRIIPs Key Information Document can be obtained free of charge in English from JPMorgan Funds Limited or at http://www.jpmam.co.uk/investmenttrust

This communication is issued by JPMorgan Asset Management (UK) Limited, which is authorised and regulated in the UK by the Financial Conduct Authority. Registered in England No: 01161446. Registered address: 25 Bank Street, Canary Wharf, London E14 5JP.