Marketing communication

Despite the short-term challenges facing Asian companies, markets have demonstrated great resilience, supported by structural growth drivers, policy support, and a rebound in key sectors like technology and manufacturing.

Asian markets are having to reorient themselves at speed in the face of US tariff headwinds - but judging by investment performance, they are doing remarkably well. What has been supporting the positive momentum?

Certainly, the past few years have not been an easy ride for investors in the region, and even at the start of 2025 there was little reason to feel particularly optimistic.

On the upside, there was clear improvement in Chinese market sentiment after years of persistent economic weakness, as the Chinese government focused its domestic polices firmly on growth and the private sector. But that was more than offset by concerns around several other important markets, including Taiwan, South Korea, Indonesia and India.

The swingeing tariff regime announced by President Trump at the start of April further exacerbated worries. Regional markets plunged on the news, with the MSCI AC Asia Pacific index down by almost 11%1 in the aftermath.

A number of trade negotiations and deals have since been done, leaving the Association of Southeast Asian Nations (ASEAN) countries facing levies of between 10% and 40%2 on exports to the US, but they are higher than before the announcements and the environment remains underpinned by uncertainty3.

Asia’s resilience

However, despite the short-term challenges being faced by Asian companies, markets have staged an impressive recovery.

As Annabel Brodie-Smith, communications director at the Association of Investment Companies, observed in a recent note4: “Many investors and analysts have been surprised by Asia’s strong performance after many of the key economies were slapped with some of the highest tariffs on Liberation Day in April.

“The average Asia Pacific investment trust delivered a return of 16% this year, in comparison to 12% for the average investment trust. The average Asia Pacific Equity Income trust has had an even stronger year, delivering an 19% return and a yield over 5%4.”

Various factors have contributed to the strong performance of Asian markets. Pauline Ng, who co-manages JPMorgan Asia Growth and Income (JAGI), points to “resilient domestic demand, targeted policy support and a rebound in technology and manufacturing exports” as important components of market strength.

Domestic demand within Asia is being supported by long-term structural factors including favourable demographics, rapid urbanisation and rising consumption across much of the region.

In regard to governmental and financial support, Ng highlights the fact that “several Asian central banks have already begun easing policy to support activity”; moreover, the Chinese authorities are stepping up their targeted stimuli amid early signs of emerging recovery.

Additionally, she continues, technology is playing an increasingly important role within Asian economies. She points to the launch of DeepSeek, the Chinese artificial intelligence (AI) app, as “underscoring the pace of innovation in AI across Asia”.

“The broader shift towards digitalisation in the region is also likely to help boost productivity and drive further economic gains in the years ahead,” she adds.

Investing in Asia’s long-term structural themes

JAGI’s conviction-driven portfolio of industry leading companies across the Asian region reflects this longer-term perspective of technology as a key driver; the top 10 holdings include almost 15% allocated to the global number one semiconductor manufacturer and innovator Taiwan Semiconductor (TSMC), plus a further 12% across the internet giants Tencent and NetEase5.

The third largest holding, amounting to more than 5%, is in the online retailer Alibaba, which announced significant investments in its cloud businesses to take full advantage of DeepSeek’s AI offering5.

Across the portfolio as a whole, there is a significant overweight5 to the communication services sector relative to its benchmark, MSCI AC Asia Ex Japan index.

Ng also emphasises the increasing reliability of Asian companies as far as private investors are concerned, and the importance of shareholder reward for long-term corporate strength within the region. “At the corporate level, rising dividends and share buybacks are contributing to stronger returns,” she explains.

Indeed, shareholder reward is a core factor in the way JAGI is run, and the recent decision to increase dividend payments from an annual 4% to 6% of net assets has underscored its importance as far as the Board is concerned; the expectation is that this policy will generate additional demand for its shares.

Opportunities beyond the expected

Of course, Asia is a hugely diverse region, with different countries offering differing market strengths and conditions.

"While markets like India and China often dominate headlines, several other Asian countries offer compelling opportunities that are under-appreciated by investors, with North Asia in particular deserving more attention due to its growing importance in the global AI supply chain,” notes Ng.

She highlights Taiwan and South Korea as key beneficiaries of this trend: “Taiwan’s strengths in semiconductors and precision electronics, as seen in companies such as TSMC and Delta Electronics, position it at the core of AI infrastructure development.”

Similarly, she says, South Korea’s expertise in components, servers and cooling systems makes it integral to the AI hardware ecosystem. “We expect Taiwan and South Korea to see continued demand growth in these sectors, creating compelling opportunities for investors.”

The team has allocated6 a more than 5% overweight to Korea relative to the benchmark, with the two economies accounting for around 36% of the portfolio overall.

Of course, the global environment remains febrile and markets throughout Asia are vulnerable to tariff pressures, geopolitical tensions and global trade uncertainties. However, in Ng’s view, the weakening US dollar offers important support, providing Asian economies with some resilience.

“In this environment, active management becomes especially valuable in helping investors to navigate these dynamics by pinpointing companies with strong growth potential, solid fundamentals and compelling valuations,” she adds.

JAGI’s solid track record7, with the portfolio’s net asset value ahead of the benchmark over one, three, five and 10 years, reflects its consistent approach to identifying and investing in companies aligned with Asia’s long-term growth trends.

1 Investing.com, MSCI AC Asia Pacific Historical Results Price Data, 07.04.2025

2 Sidley.com, Implications of U.S. Tariffs on Southeast Asia: Navigating The Trade Tumult, 19 August 2025

3 Gisreportsonline.com, Southeast Asia’s economic model at risk due to U.S. tariffs, 11 September 2025

4 AIC press release, 30 September 2025, ‘Asian emerging markets set to continue strong year’: https://www.theaic.co.uk/aic/news/press-releases/asian-emerging-markets-set-to-continue-strong-year

5 JPMorgan Asia Growth & Income, Portfolio sector breakdown as of 31.08.2025

6 JPMorgan Asia Growth & Income, Portfolio regional breakdown as of 31.08.2025

7 Net asset value performance vs benchmark to 31.08.2025

Image source: Shutterstock, 2025

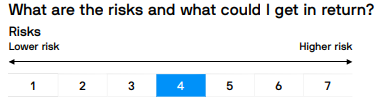

The risk indicator assumes you keep the product for 5 year(s).

Investment objective: The Company aims to provide total return from investing in equities quoted on the stock markets of Asia, excluding Japan. The Company will have a diversified portfolio of Asian stocks comprising around 50 to 80 investments. The Company typically invests directly although it may also take positions in pooled vehicles to gain exposure to such companies. The Company aims to pay, in the absence of unforeseen circumstances regular quarterly dividends each equivalent to 1.5% of the NAV at the end of each quarter. The Company also has the ability to use gearing up to a maximum level of 20% of net assets to increase potential returns to shareholders. Gearing may magnify gains or losses experienced by the Company.

Key risks: Exchange rate changes may cause the value of underlying overseas investments to go down as well as up. Investments in emerging markets may involve a higher element of risk due to political and economic instability and underdeveloped markets and systems. Shares may also be traded less frequently than those on established markets. This means that there may be difficulty in both buying and selling shares and individual share prices may be subject to short-term price fluctuations. External factors may cause an entire asset class to decline in value. Prices and values of all shares or all bonds and income could decline at the same time, or fluctuate in response to the performance of individual companies and general market conditions. This Company may utilise gearing (borrowing) which will exaggerate market movements both up and down. This Company may also invest in smaller companies which may increase its risk profile. The share price may trade at a discount to the Net Asset Value of the Company.