The income challenge is changing

With interest rates rising around the world, investors are rethinking their income strategies. But rapid central bank tightening to combat inflation is contributing to volatility, while real yields are still negative in many markets.

Seek attractive, consistent income across sectors with the J.P. Morgan Income Fund

JPMorgan Funds – Income Fund invests dynamically across fixed income sectors, seeking the highest income consistent with a managed level of risk. This risk profile is achieved through genuine diversification, leveraging the sector expertise of our entire global fixed income platform.

Managed volatility

Seeks maximum possible income for a given managed level of risk

Smooth income

Seeks to pay income in consistent dividends

Dynamic portfolio exposure

Diversified global portfolio combined with an income filter

Managed volatility

Seeks maximum possible income for a given prudent level of risk.

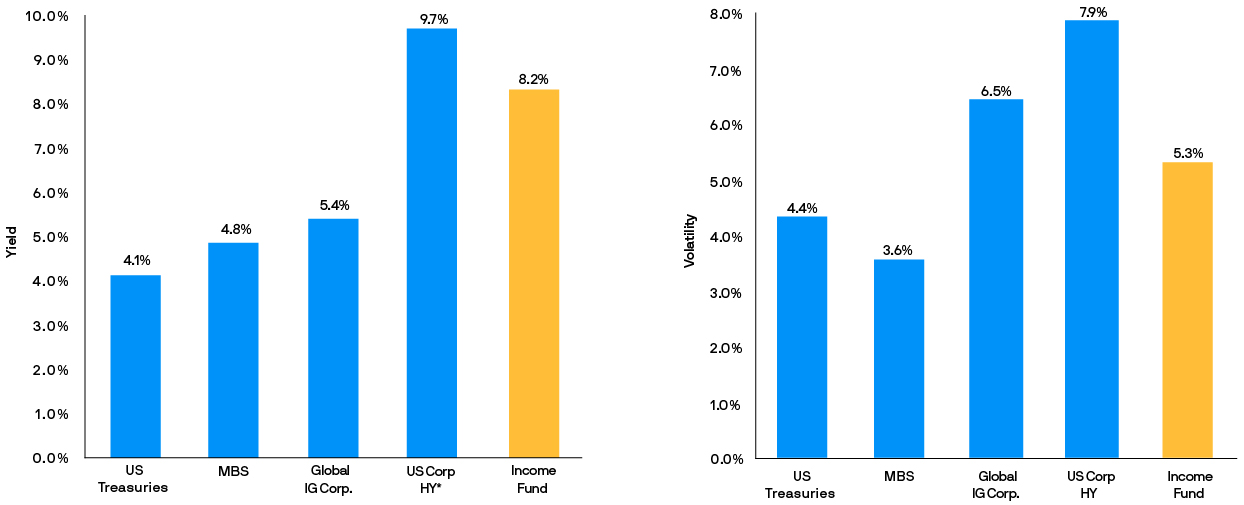

Income Fund taps into expertise across our fixed income platform to target an attractive income while managing portfolio volatility.

Source: Barclays Live, J.P. Morgan Asset Management. Volatility is realized annualized volatility based on monthly data since Income Fund Inception. Indexes used are: Bloomberg ABS Index, Bloomberg Treasury Index, Bloomberg US CMBS Index, Bloomberg Corporate Credit Index, Bloomberg US HY Index, Bloomberg US MBS Index. *US HY Corp is YTW, all else is YTM. As at 30 September 2022.

Yield is not guaranteed and may change over time.

Smooth income

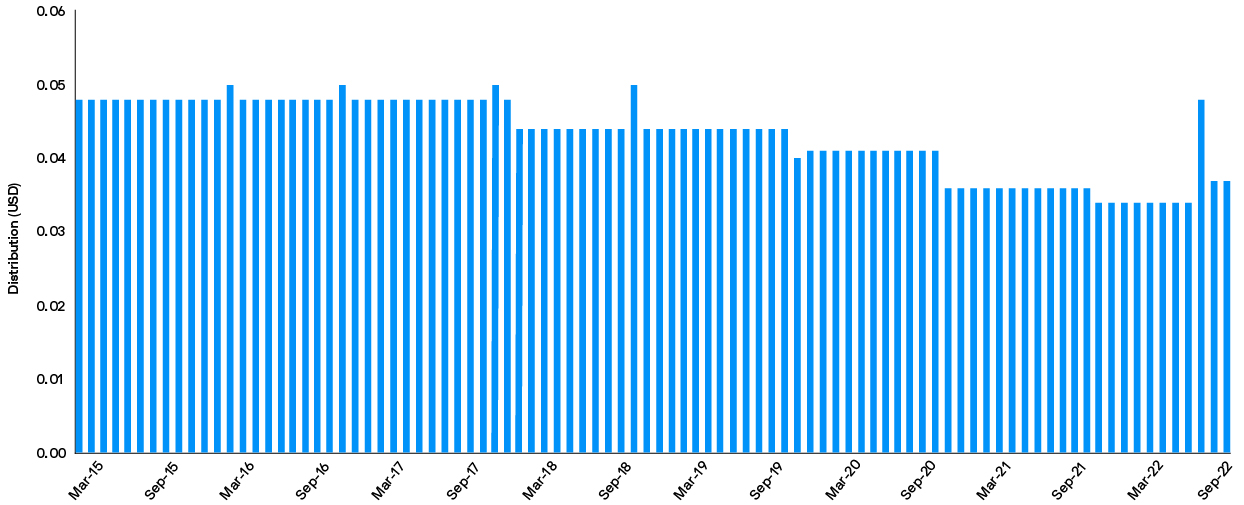

Seeks to pay income in predictable dividends.

Income Fund’s focus on the risk-adjusted yield and its use of an income bank reserve mechanism helps smooth distributions and provide a predictable income over time.

Source: J.P. Morgan Asset Management. As at 30 September 2022.

Yield is not guaranteed and may change over time.

Dynamic portfolio exposure

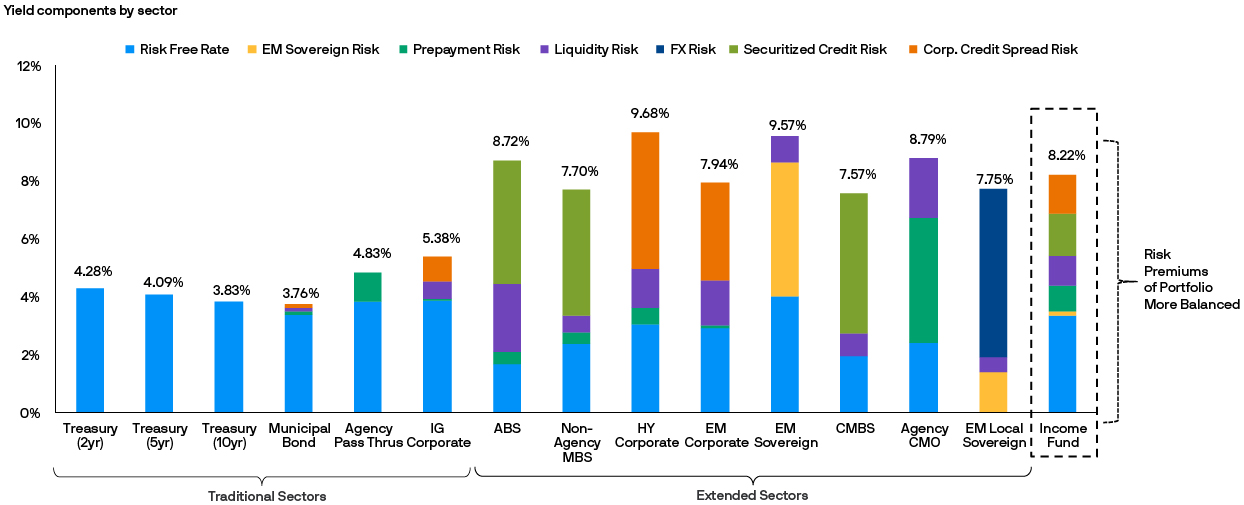

Invests dynamically across fixed income sectors.

Income Fund collects risk premiums from across the full fixed income universe in an effort to achieve risk reduction through diversification.

Source: Bloomberg, J.P. Morgan Asset Management. “EM” = Emerging Market For illustrative purposes only. Based on representative index level data. As of September 2022. Portfolio yield reflects YTM. The manager seeks to achieve the stated objectives. There can be no guarantee the objectives will be met. Diversification does not guarantee investment returns and does not eliminate the risk of loss.

Further reading and information

Why fixed income with J.P. Morgan Asset Management?

Our fixed income funds are founded on active security selection and rigorous risk management—all backed by a powerful combination of deep investment expertise, global resources and time-tested processes.

* In actively managed assets deemed by J.P. Morgan Asset Management to be ESG integrated under our governance process, we systematically assess financially material ESG factors amongst other factors in our investment decisions with the goals of managing risk and improving long-term returns. ESG integration does not change a strategy’s investment objective, exclude specific types of companies or constrain a strategy’s investable universe.

09gf221710095055