Ultra-short income ETFs: Trading tips and liquidity considerations

While access to underlying market liquidity is essential for all ETFs, we believe there are additional important considerations for investors when choosing and trading liquidity ETFs, including J.P. Morgan’s Ultra-Short Income ETFs.

Trading tips:

- Know when to trade Investors should try to avoid trading at the European market opening and just before the close, when we generally observe wider spreads. Knowing primary market dealing cut-off times is also important as pricing may become marginally wider if the market maker (authorised participant) is unable to create or redeem their position in the primary market.

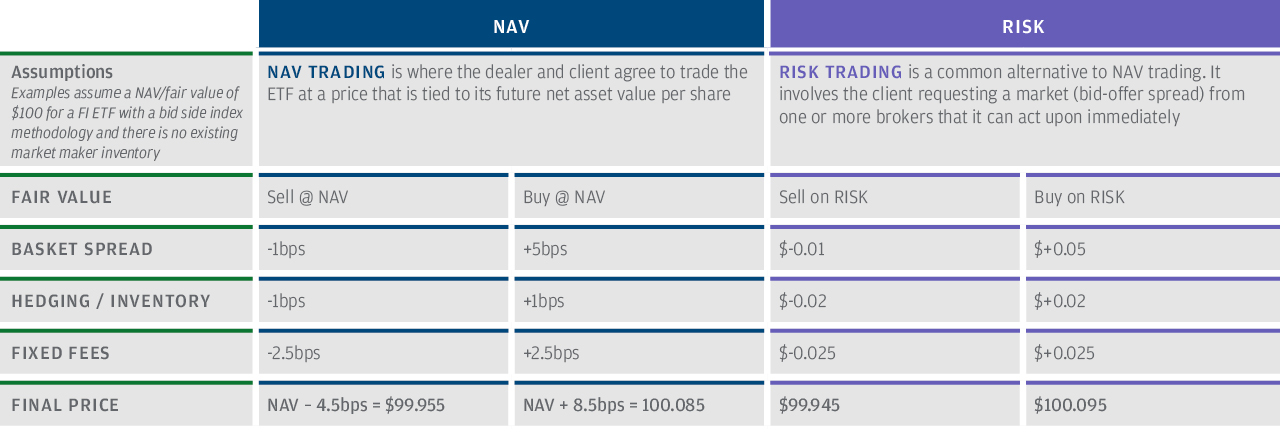

- Consider whether NAV trading or risk trading is more appropriate Investors can trade UCITS ETFs at net asset value (NAV), which is done off-exchange, or on risk, which can be on- or off-exchange. With NAV trading, the dealer and client agree to trade the ETF at a price that is tied to its future NAV per share and is priced as NAV +/- “x” basis points. When trading on risk, the client requests an intraday price from one or more brokers and the trade is priced as a bid-offer spread. Our Ultra-Short Income ETFs can be traded efficiently using both execution strategies.

- Use limit orders for exchange trading A limit order gives investors some control over the price at which the ETF trade is executed by specifying to buy or sell a set number of shares at a stated price or better. A market order is traded immediately at the best available current price—which could be far higher (or lower) than expected.

- Assess where the ETF is trading relative to its fair value For risk pricing, the intraday net asset value (iNAV) can help investors gauge if the bid-ask spread of the ETF is in line with the value of the underlying portfolio. For NAV pricing, the underlying value of the portfolio can be compared to the official end-of-day NAV.

- Get to know the Capital Markets desk J.P. Morgan Asset Management has a dedicated team of trading and liquidity specialists whose role is to work with portfolio managers, authorised participants, market makers and stock exchanges to help assess true ETF liquidity and assist investors with efficient trade execution.

J.P. Morgan Ultra-Short ETFs: Focused on liquidity

As well as trading considerations, it’s also important to ensure you choose a liquidity ETF that can provide ample liquidity at all times. Our actively managed Ultra-Short Income ETFs benefit from access to underlying bond liquidity supported by the strength and depth of our managed reserves business. This active approach allows us to take advantage of strategic and/or tactical positioning to boost liquidity, while we also use inventory seeking technology to help locate secondary supply, matching our axes to live offers, which allows for better execution and further supports liquidity.

Thanks to the liquidity of the underlying market, the strength of our liquidity business, and the efficiency of the ETF creation and redemption mechanism, our Ultra-Short Income ETFs can facilitate trades that far exceed the liquidity displayed on an exchange. Our trading and capital markets resources mean we can absorb large orders while the ETF continues to trade at a price relatively close to the value of its underlying securities.

Focused on preserving capital

Our Ultra-Short Income ETFs also benefit from our global reach, borne from being one of the largest investors of money market securities in the world. J.P. Morgan Asset Management’s Global Liquidity platform currently manages USD 884 billion in assets globally, including money market and ultra-short duration bond funds (as of 31 March 2021).

The size of our platform strengthens our position in the marketplace and our ability to source liquidity, all of which benefit our Ultra-Short Income ETFs and allow our fund managers to access a very deep market, when they choose. Our Ultra-Short Income ETFs are therefore particularly well suited to provide liquidity and preserve capital, even in more challenging markets.

For more information on trading our Ultra-Short Income ETFs please contact our Capital Markets desk on jpmam.etf@jpmorgan.com.