Thanksgiving Eye on the Market: the three things I’m thankful for this year

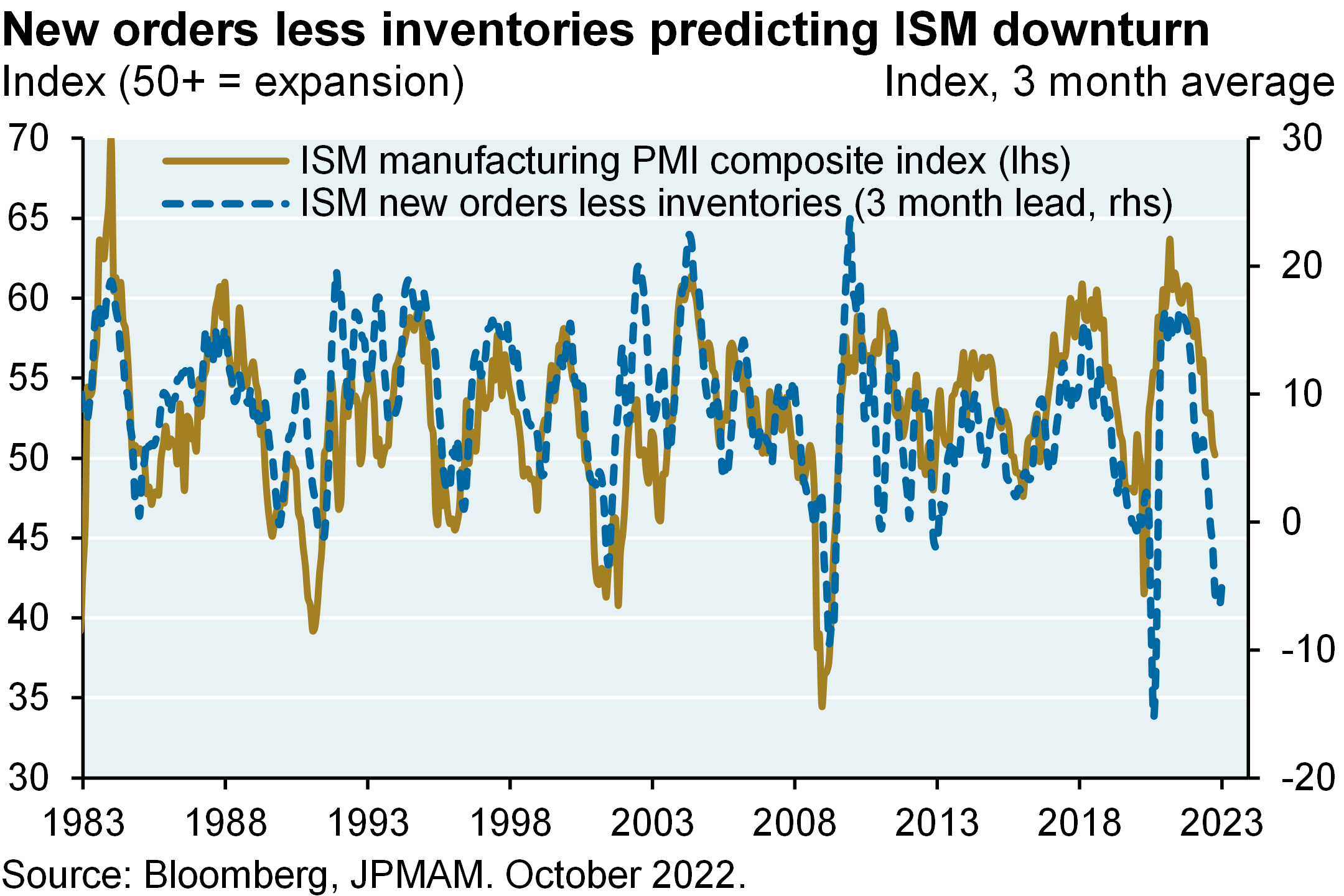

In the October Eye on the Market I wrote about how in 6 of 7 post-war recessions, equity markets preceded the decline in profits, employment and GDP by several months at least. I also mentioned that the best indicator to follow was the ISM survey, which tends to coincide with the equity market bottom +/- 2 months. So, in the interest of thinking about when equities could bottom, the first chart below projects the ISM survey by looking at new orders and inventories. Using this crude approach, the ISM would bottom in the mid-40’s in December. If so, 3570 on the S&P 500 Index reached in mid-October could actually mark the low for the cycle; such a scenario should not be discounted entirely, and would be consistent with market history.

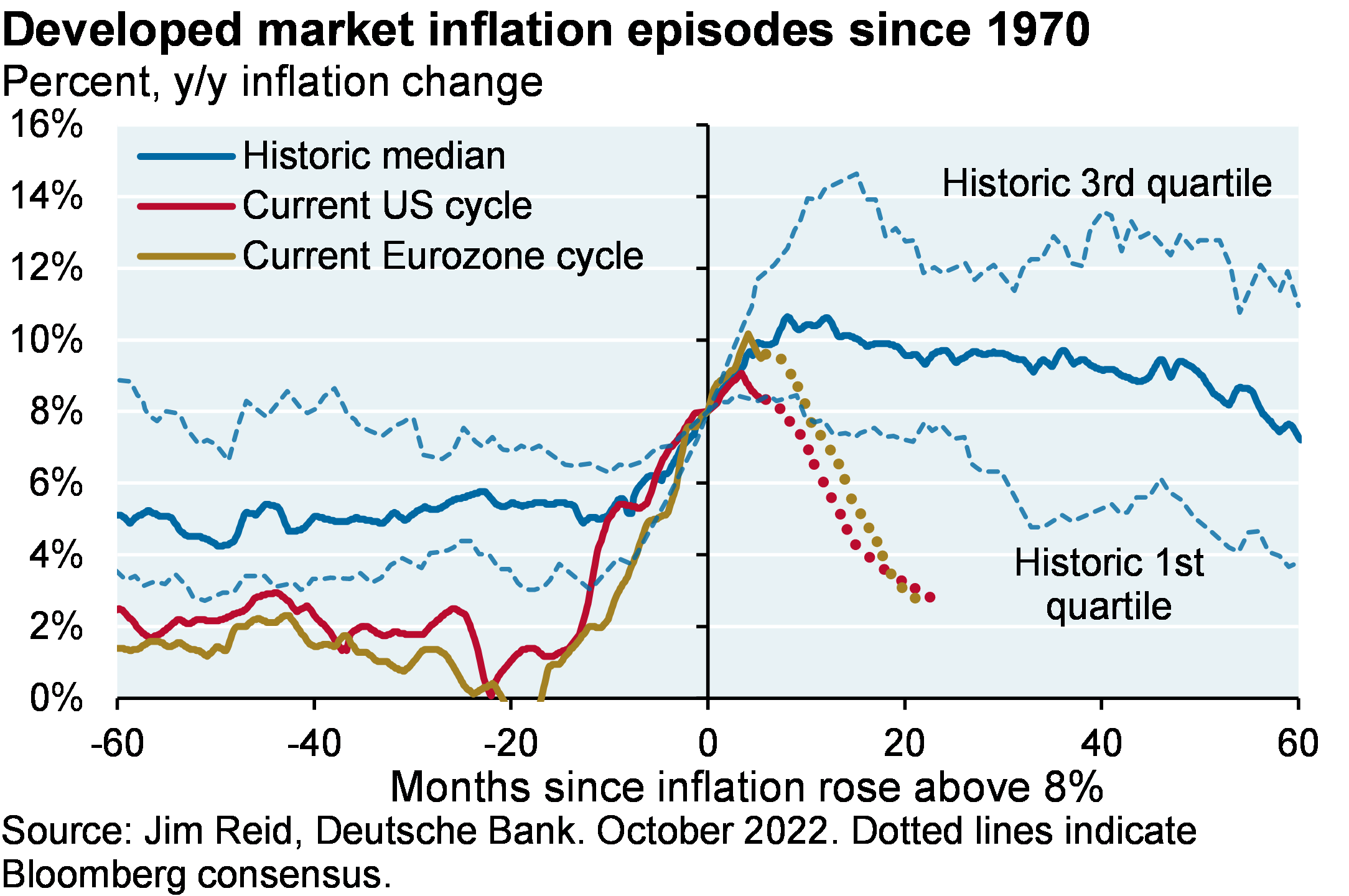

Even so, I still think that there will be more corrections ahead, and that 3200-3300 would offer very good value for long term investors if we got there. The big question now is not how high inflation is going; it’s how long it will remain there. As shown in the second chart, the markets are pricing in a rapid descent in inflation, possibly due to expectations on China reopening or an end to the Russia-Ukraine war. But in the history of inflation spikes in developed countries, once inflation rises, it tends to stick around for a while. This would limit the opportunity for the Fed to rapidly reverse course and cut rates. More on all of this in our 2023 Outlook.

Sometimes I write a November Eye on the Market on things I am thankful for. My list this year: CH4, HR4346 and mRNA-1273. This particular intersection of preferences is unlikely to be popular at dinner parties, which is why I don’t go to them. In any case, Happy Thanksgiving.

Michael Cembalest, JP Morgan Asset Management

Thanksgiving Eye on the Market: the three things I’m thankful for this year

#1: The national security and economic benefits of US natural gas (CH41 ) supplies

As of September 2022, this is what was happening in Europe due to soaring energy costs and reliance on Russia:

70% of fertilizer capacity shuttered (BASF shuttered or slowed production at 180 of its plants worldwide)

30% decline in aluminum smelting capacity

ArcelorMittal to close two German electric arc furnace steel plants and others in Spain, Poland and France; Acerinox (Spain) furloughed 85% of its steel production workforce; other steel closures in Italy

Largest German cement company (Heidelberg) warned of plant closures if energy prices remain high

Since September 2021, 30 UK energy suppliers filed for bankruptcy; nationalization of French EDF

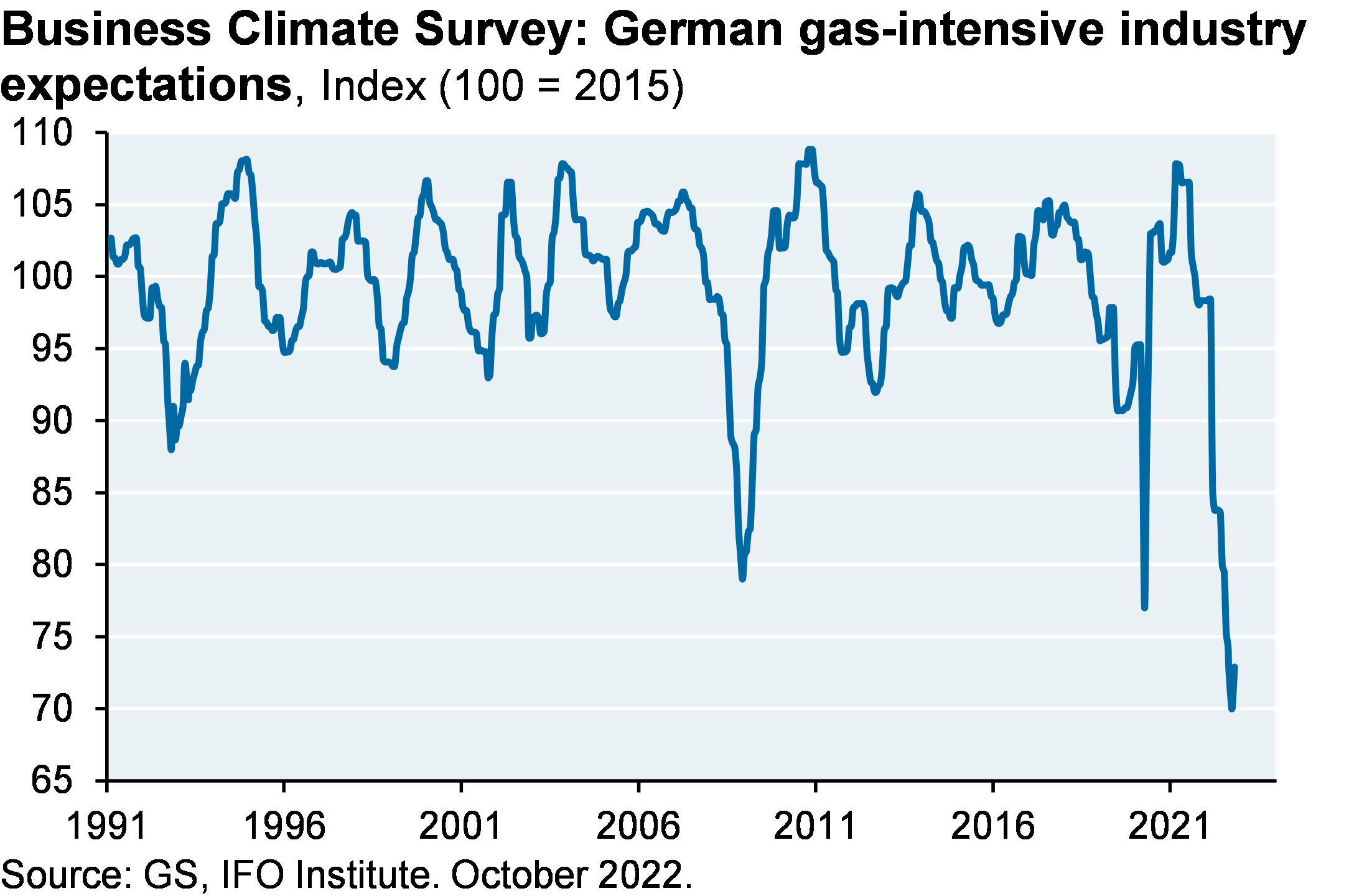

Lowest level of business expectations for energy intensive German industry since reunification in 1990

Germany sees highest inflation rate in 32 years (and in Italy, in 40 years)

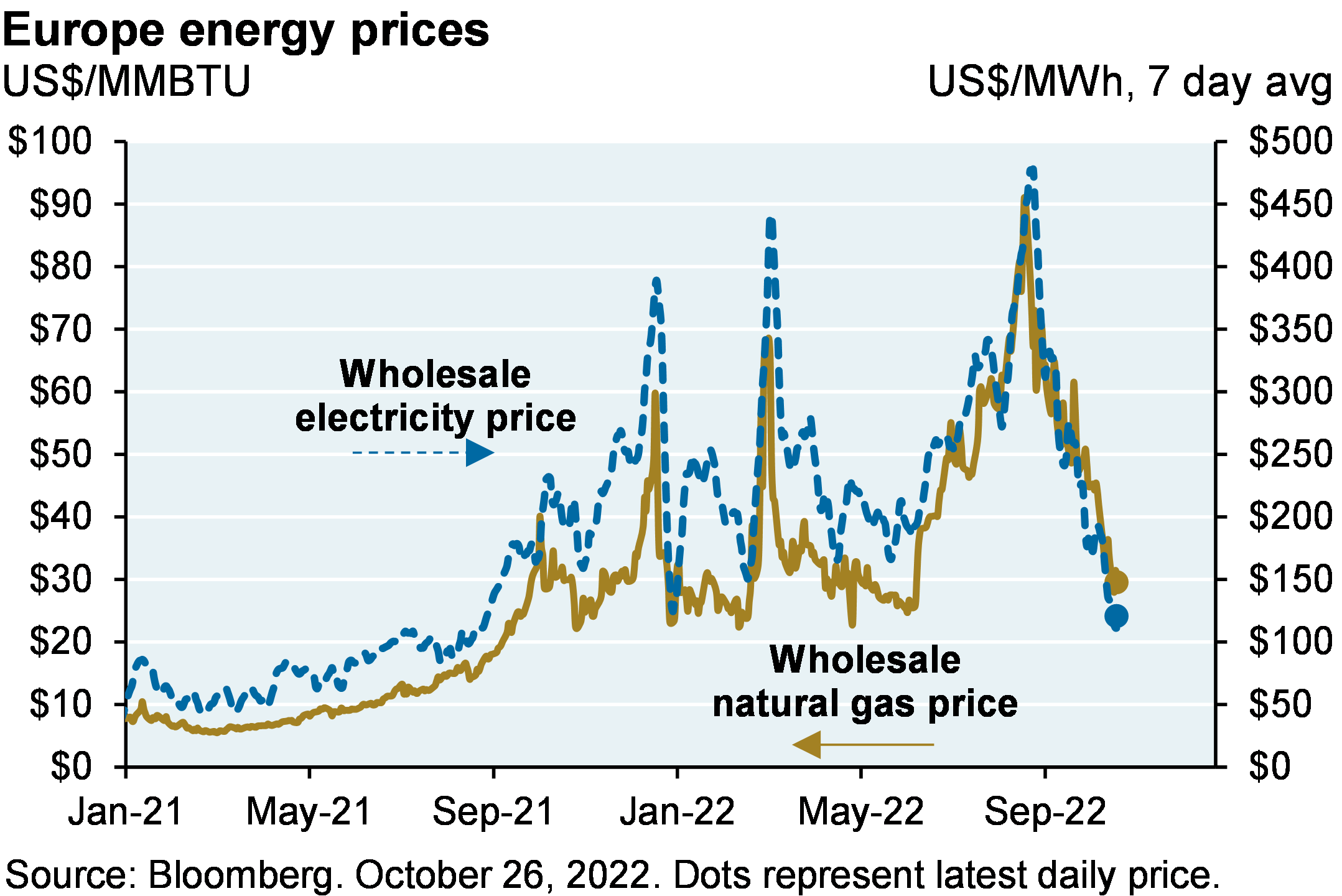

European gas and electricity prices have declined sharply since the summer peak, and there are also a wide range of initiatives underway to cap energy prices, reduce energy taxes and provide support to businesses. As a result, some of this industrial production may come back online. However, European gas and electricity prices are still 2x-3x times higher than at the beginning of 2021, European gas prices are still 6x US levels, and few European countries will be able to immunize industry from the entire shock. While Europe is set for this winter with gas storage at 90%+ of capacity, one factor offsetting the loss of Russian pipeline gas (in addition to increased LNG imports) is lower European consumption due to higher energy prices. In other words, self-imposed austerity with all of its negative economic repercussions.

If I’ve learned anything from the 12 years working on our annual energy paper with Vaclav, it’s that the renewable transition will take time for all the technological, political, judicial, behavioral and economic reasons we discuss each year. In the meantime, I’m thankful the US has ample supplies of its own natural gas. In the latest World Energy Outlook from the International Energy Agency, global natural gas demand rises by 2030 and 2050 in the Stated Policies scenario, and only declines by ~15% by 2050 assuming much more aggressive decarbonization policies.

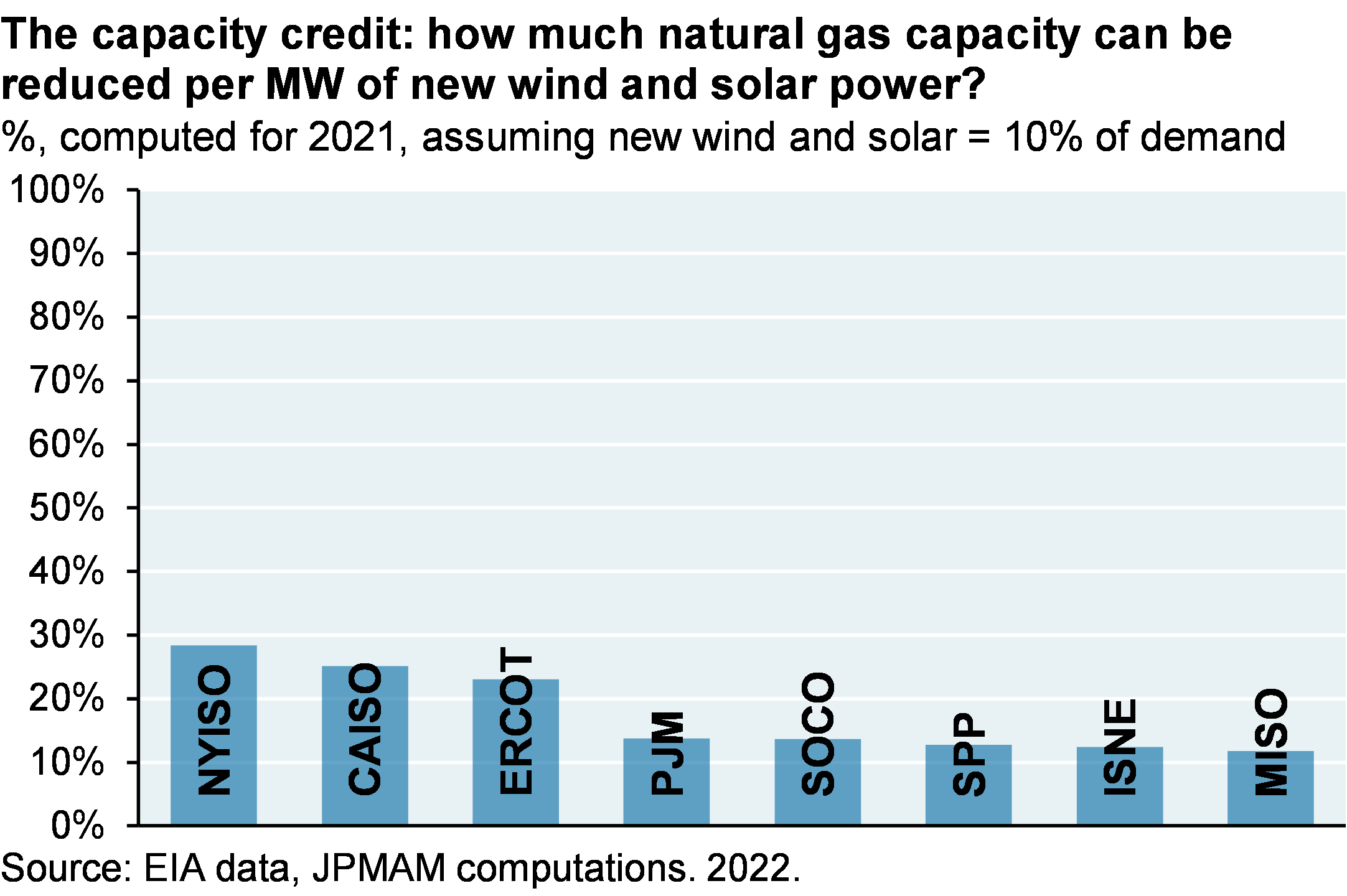

The US will need plenty of natural gas capacity even as more wind and solar power is built in response to energy bill incentives. Wind and solar intermittency creates periods during the year when there’s not enough renewable generation to meet electricity demand. As a result, you typically cannot disconnect 1 MW of natural gas every time you add 1 MW of wind and solar power. The amount of natural gas that can be disconnected is referred to as a “capacity credit”; these credits are a function of specific hourly generation patterns in each region, and range from just 10% to 30% of added wind and solar power. More details in next year’s energy paper in a section on the irrelevance of “levelized costs”, which do not include backup power requirements.

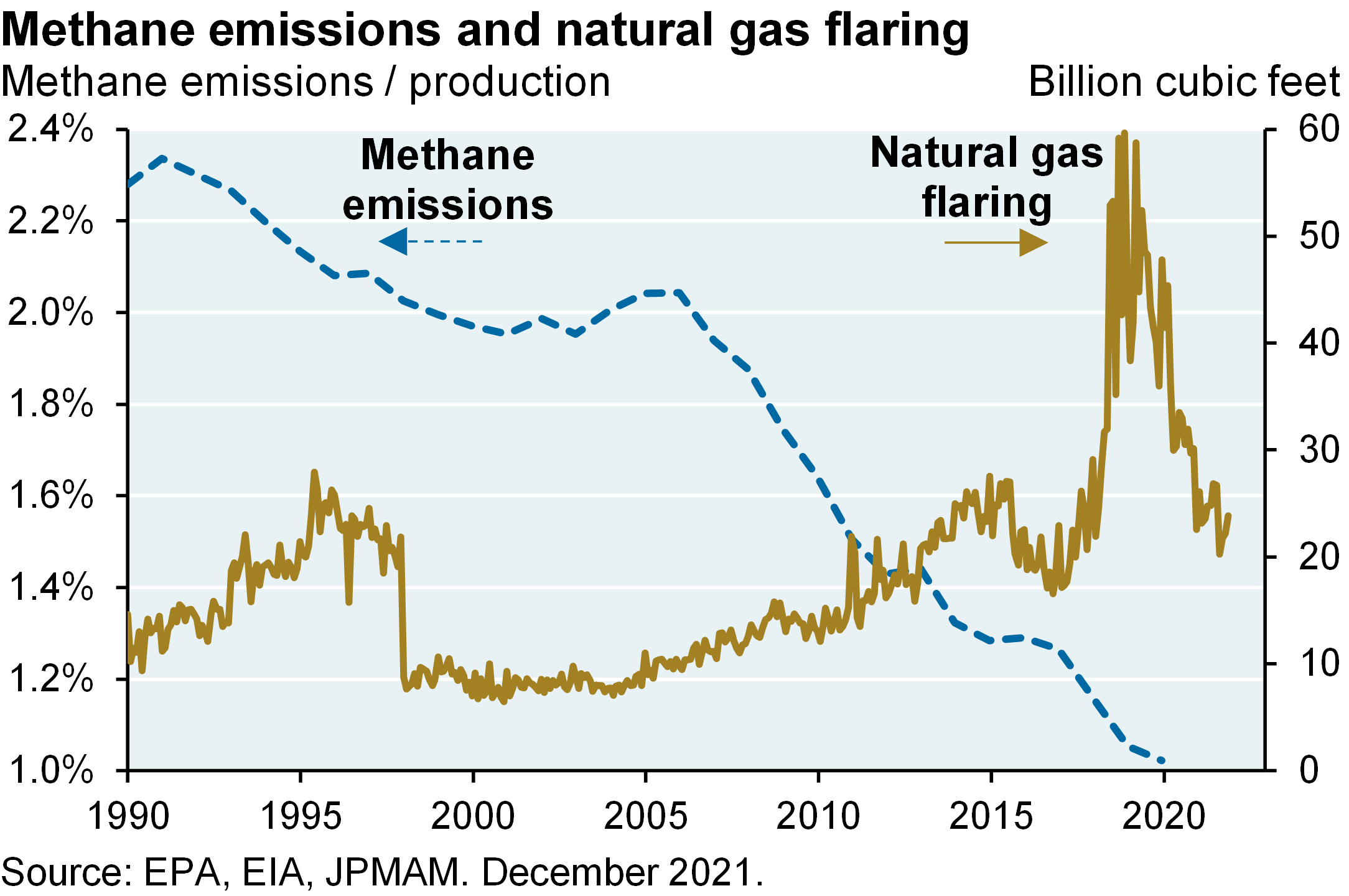

What about methane emissions and natural gas flaring? If you accept EPA data at face value, methane “leakage” rates from natural gas have fallen to ~1%, down from 2.3% in 1990. These rates include leakage from exploration, production, gathering, processing, transmission, storage and distribution. However, EPA emissions data is usually provided by the oil & gas industry and may not reflect variations in utilization or operating performance. As a result, climate scientists conduct their own measurements. Based on aerial, satellite and other surveillance methods, some believe that the EPA data underestimates methane leakage rates by 60%.

In a December 2021 Dallas Fed survey, while 68% and 58% of large firms had plans to reduce methane emissions and flaring, only 24% and 26% of smaller firms had similar plans. The IEA believes that emission reductions of another 75% are feasible with proven technology. I asked my colleague Ben Ratner in J.P. Morgan’s Sustainability group for his thoughts on this issue, since he has done a lot of work on it. Ben’s comments:

Industry leaders have begun the important shift from desktop estimation to more accurate emission measurement (including the use of sensors on planes), committed to eliminate gas flaring by 2025 and engaged constructively with regulators

The federal government has directly regulated methane as a pollutant under the Clean Air Act for newer facilities, while also legislating a methane fee that is designed to give way to expanded regulations

States like Colorado, New Mexico, and Pennsylvania have instituted tight requirements for leak detection and repair, flaring minimization and other best practices

The Oil and Gas Methane Partnership (OGMP) is a collaboration of US and European industry leaders working with civil representatives. Under OGMP’s recently defined “2.0” protocols, companies agree to set a methane target, increase methane measurement and report progress annually

Eliminating natural gas flaring is a common-sense move for companies that want to support energy security and sensibly reduce their carbon footprint. Note: in a 2019 Dallas Fed survey, 70% of respondents cited lack of pipeline capacity as the reason for Permian Basin flaring. Industry leaders do not put wells into production until pipeline capacity is available

#2: The bipartisan realism of the semiconductor “CHIPs” bill, H.R. 4346

Let’s continue the energy thread from the prior section. For the renewable transition to accelerate, EV adoption will have to move into overdrive. Transportation accounted for one third of US fossil fuel consumption in 2021, around half of which was passenger cars and light trucks. There are critical mineral issues to be resolved regarding EVs; we will discuss those another time and talk about semiconductors today.

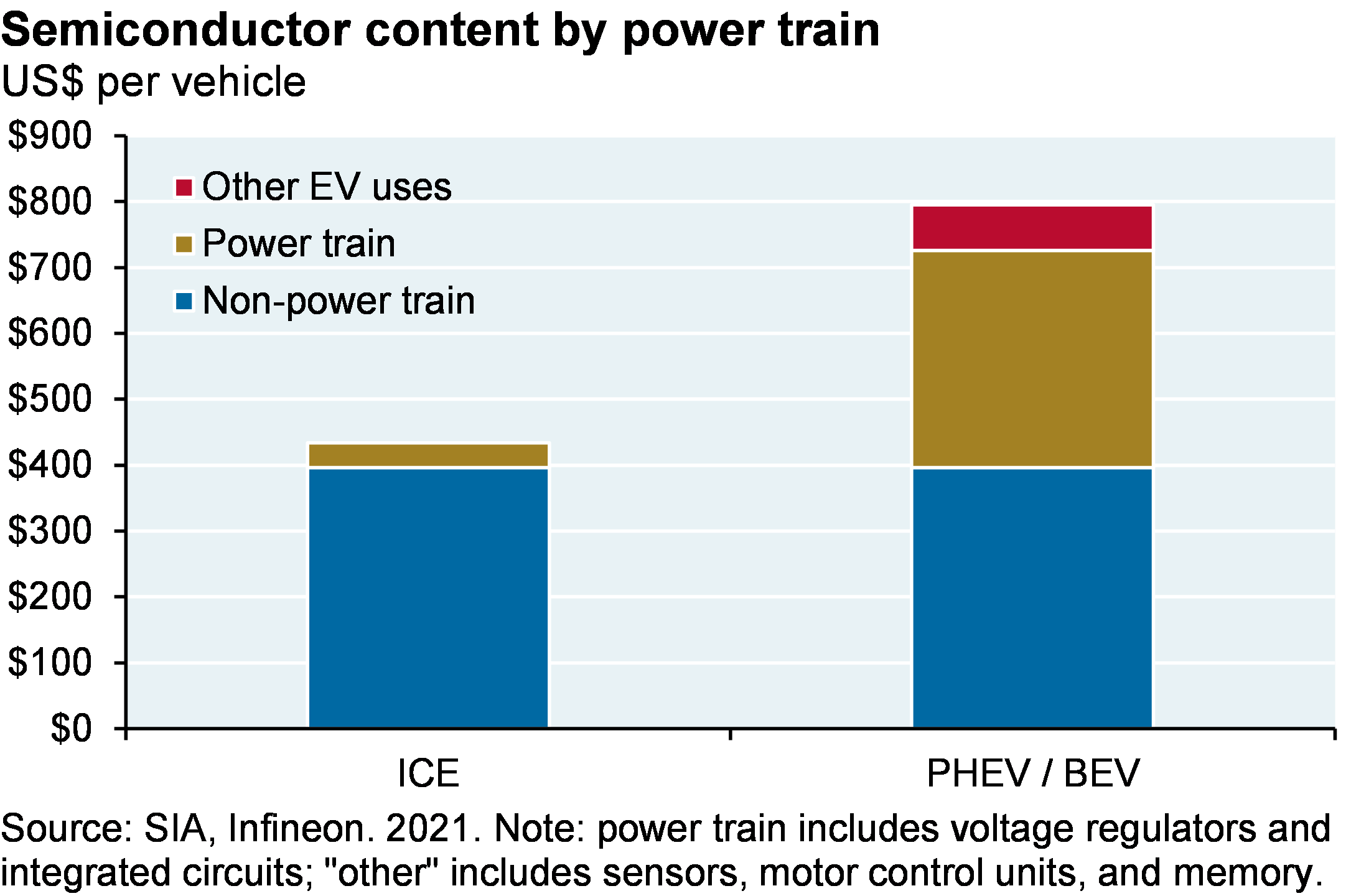

As shown below, EVs have more semiconductors than internal combustion engine cars. The US will need a reliable supply of semiconductors if EVs come anywhere close to the forecasts released by the Senate in the aftermath of the energy bill. One of the sources the Senate cited estimates that 100% of US passenger car and light truck sales in 2030 will be EVs, and that 92% of Class 8 semi truck sales will be EVs as well in 2030.

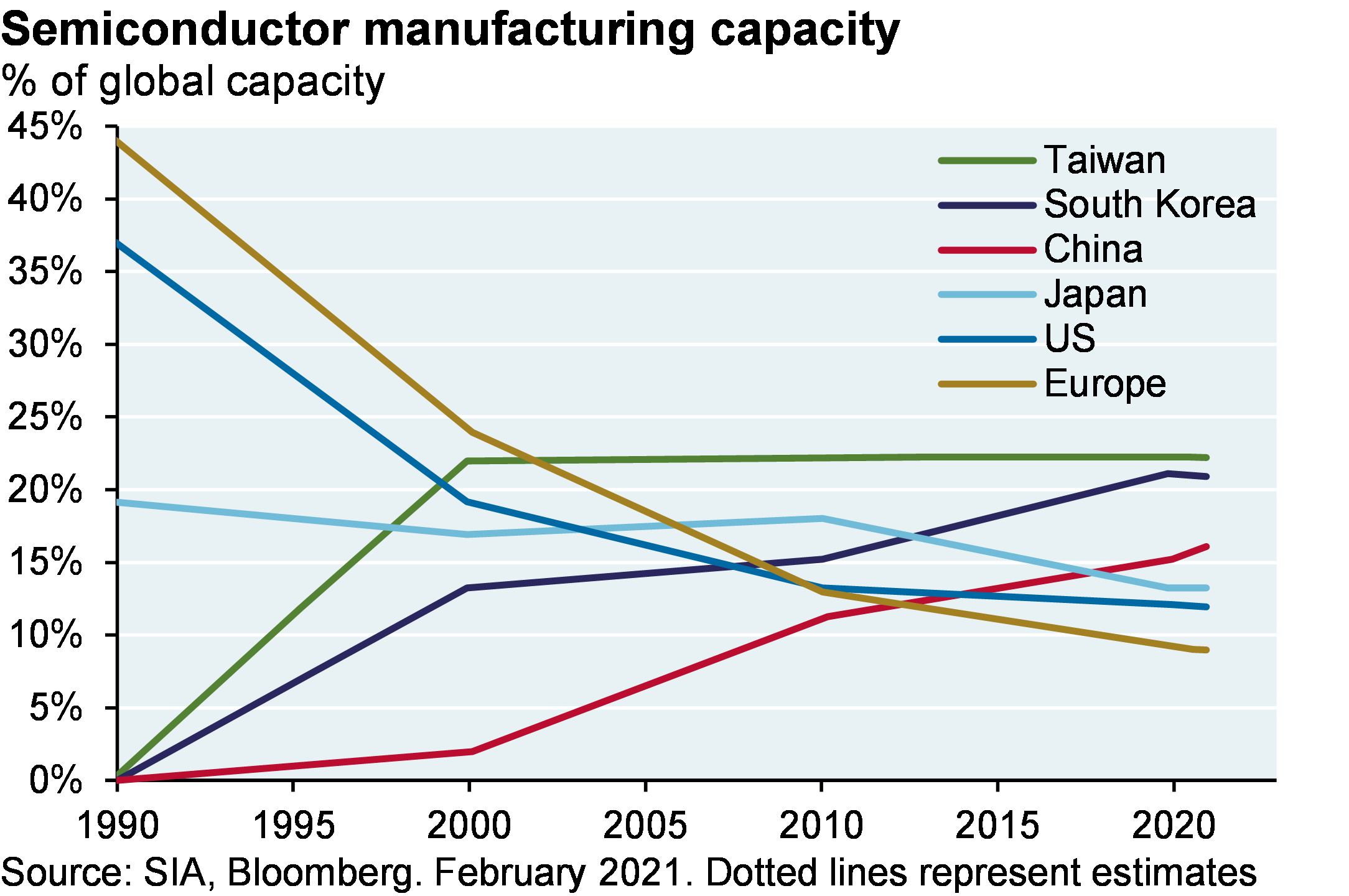

Where would all the semiconductors come from? Starting in 1990, semiconductor capacity started migrating out of the US. While the US still has 47% market share of global semiconductor revenues, only ~40% of US semiconductor capacity is located in the US; the rest is in Singapore, Taiwan, China, Japan and Europe. Taiwan has the largest share of global semiconductor capacity (20%), a 50% share of higher value added logic chip capacity and 60% of the semiconductor foundry market, which refers to outsourced semiconductor production for companies like AMD, Apple, Qualcomm and Nvidia. Do I need to spell out why this might be a geopolitical and economic risk for the US? Probably not.

So, that’s why I’m thankful for H.R. 4346, otherwise known as the semiconductor “CHIPs” bill. It creates meaningful support for US semiconductor production at a time when many US semiconductor companies are negatively affected by White House policies limiting high-end US semiconductor exports to China (Nvidia, which sell 95% of high end AI chips in China, is one example). Some critics view the CHIPs bill as “corporate welfare”; perhaps, but if your goal is improved US semiconductor supply chains, some government support will be needed to offset the impact of US national security priorities limiting their profitable exports to China.

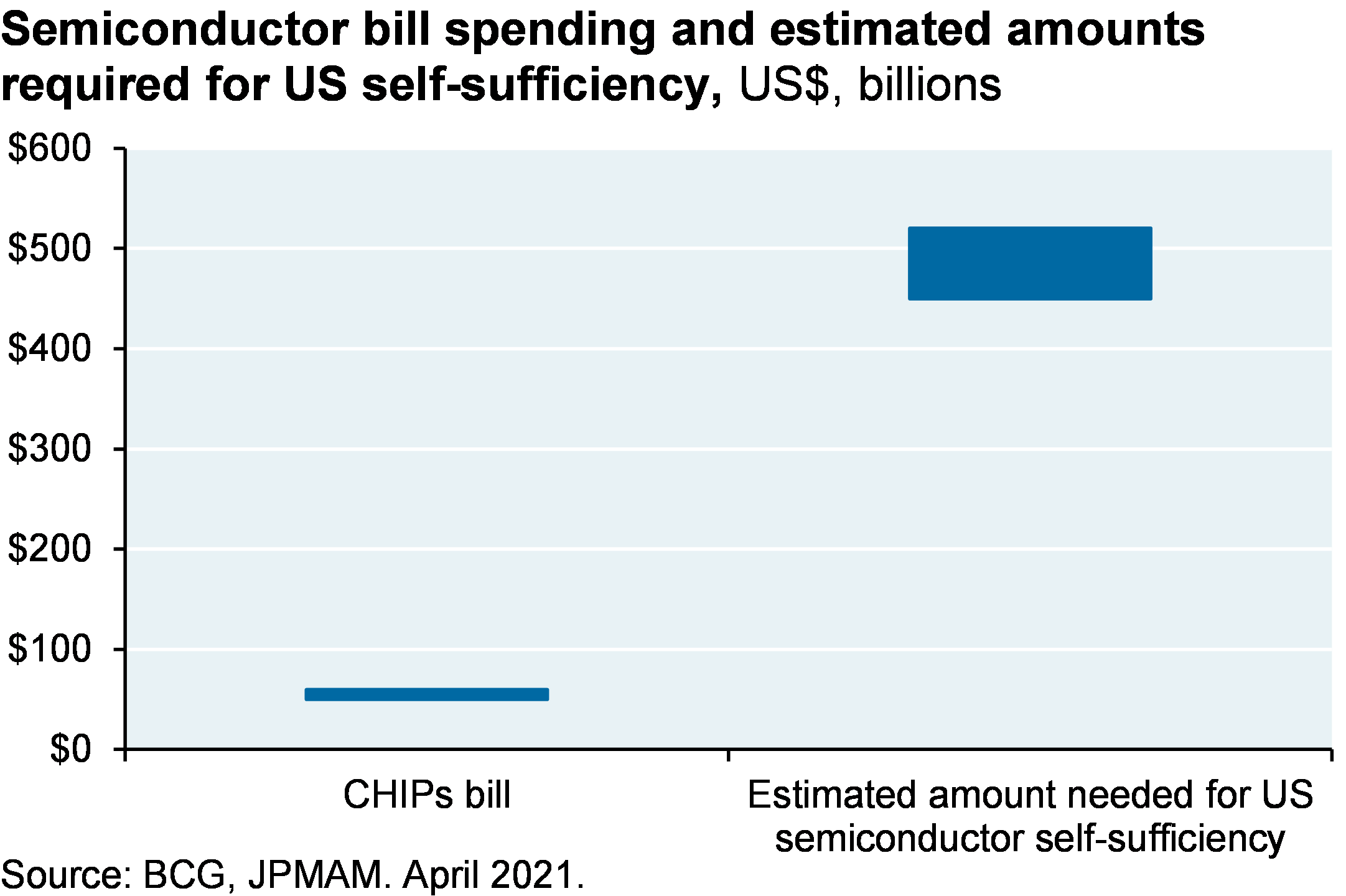

To be clear, the semiconductor bill is just a start. See the next chart below; BCG estimates that the $52 billion in the CHIPs bill dedicated to semiconductor production capacity is only 10% of what would be needed for complete US semiconductor self-sufficiency. But something is better than nothing, and at least it will begin to move the needle in the other direction and reverse some of the outsourcing trends.

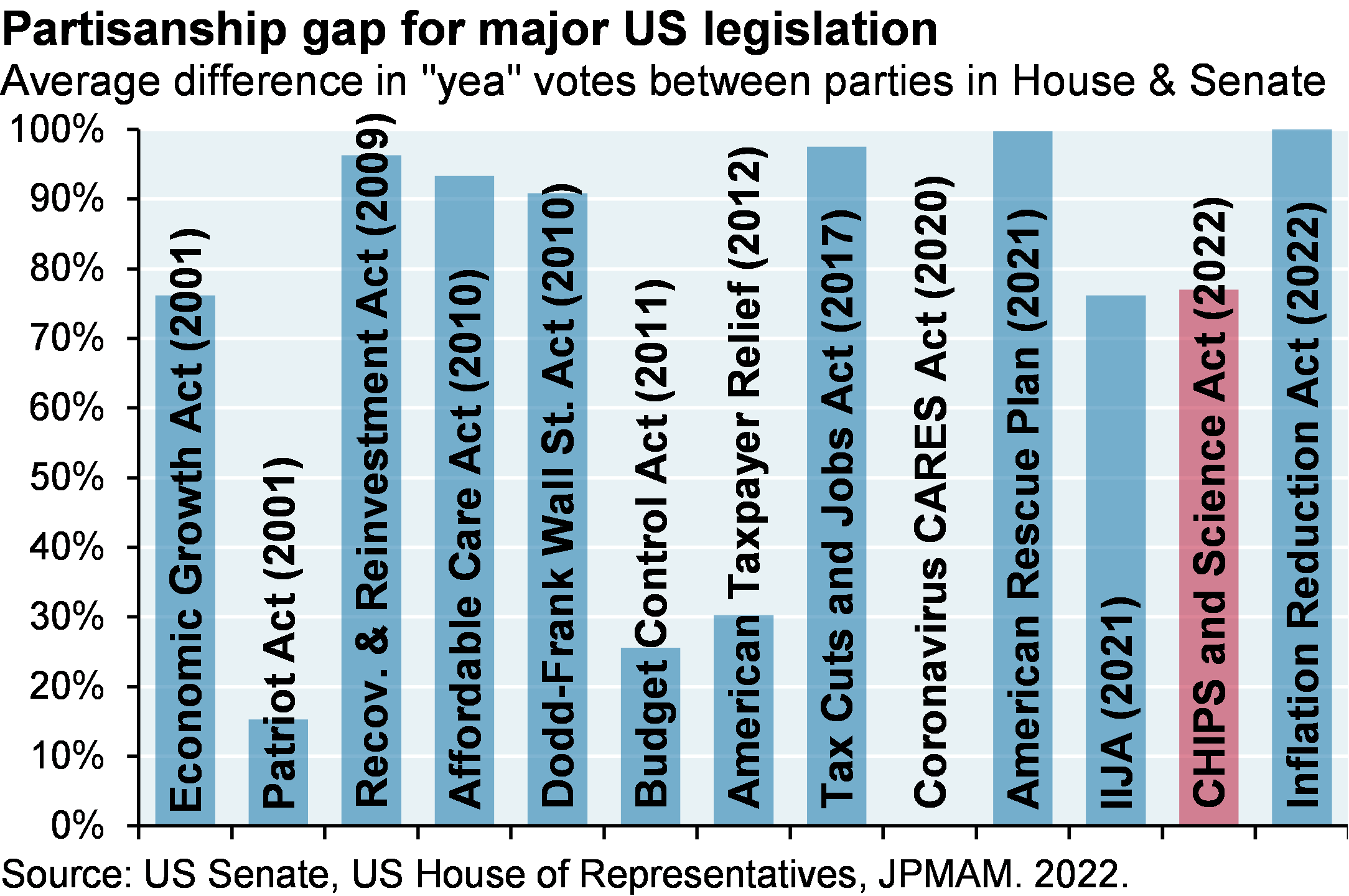

Is the CHIPs bill really bipartisan? Yes. We track the partisanship of major bills since 1913 when legislation was passed creating the Federal Reserve and the first Federal income tax. The partisanship of major bills began to soar in the late 1990’s, and since the year 2000 many bills have essentially been single-party legislation passed by the party controlling the White House and both chambers. The Trump Tax Cut Act was the most partisan bill in US history, surpassing the prior partisanship peak (2009 Recovery and Reinvestment Act) until it was surpassed by the partisanship of the 2021 American Rescue Plan and the 2022 Inflation Reduction Act, both of which were passed without a single GOP “yes” vote in the House or Senate. So with that context, the CHIPs bill’s support from 17 GOP Senators, 24 GOP House members and Trump’s former Secretary of State Mike Pompeo can be seen as an outpouring of giddy bipartisanship.

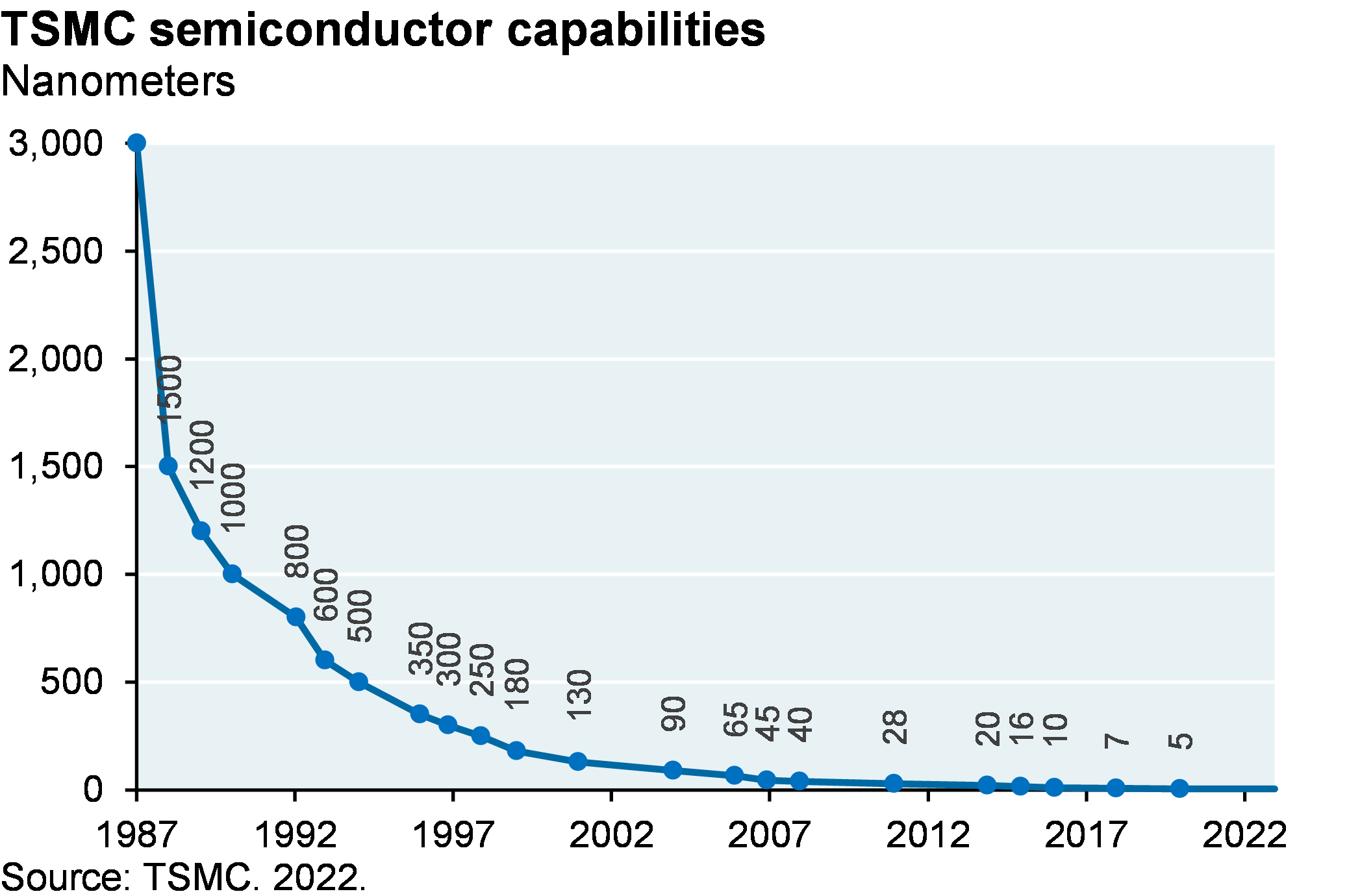

What about Chinese reliance on Taiwan? China accounts for 60% of global semiconductor demand, but only 10% of that demand is met via Chinese production. The other 90% is met through imports and foreign firms producing chips in China. As of 2021, Taiwan accounted for a 70% share of Chinese chip consumption: TSMC produces 10% of China’s chips in its factories in Nanjing and Shanghai, and exports the remaining 60% from Taiwan. There may be no example anywhere in the world of one country so reliant on another for a specific high-value import. That 70% reliance figure dwarfs Europe’s prewar reliance on Russian energy (around 25% of total European energy consumption in 2021). Most Chinese foundries are working on 14-28 nanometer chips while the global leaders like TSMC are already producing at 5-7 nanometers.

More background2: the most advanced and most profitable chips of 10, 7, 5, and 3 nm are difficult and costly to fabricate and can only be made by machines designed and built by ASML (Netherlands) using a process called extreme ultraviolet photolithography (EUV). Because of their complexity, ASML only produces 45-55 such machines per year. Advanced chip foundries require a clean room that is 10,000x cleaner than a hospital surgical room. The chip etching process, parts of which are done in a pure nitrogen environment, can take weeks operating 24 hours a day and involve 700 separate steps, many of them repeated. Completing all necessary steps in the value chain may involve multiple air flights back and forth over thousands of miles to sites with specialized capabilities. These foundries require exotic chemicals, gasses, rare metals, materials and components from thousands of companies and dozens of countries.

#3: The remarkable success of mRNA vaccines in reducing mortality risk for people interested in taking them

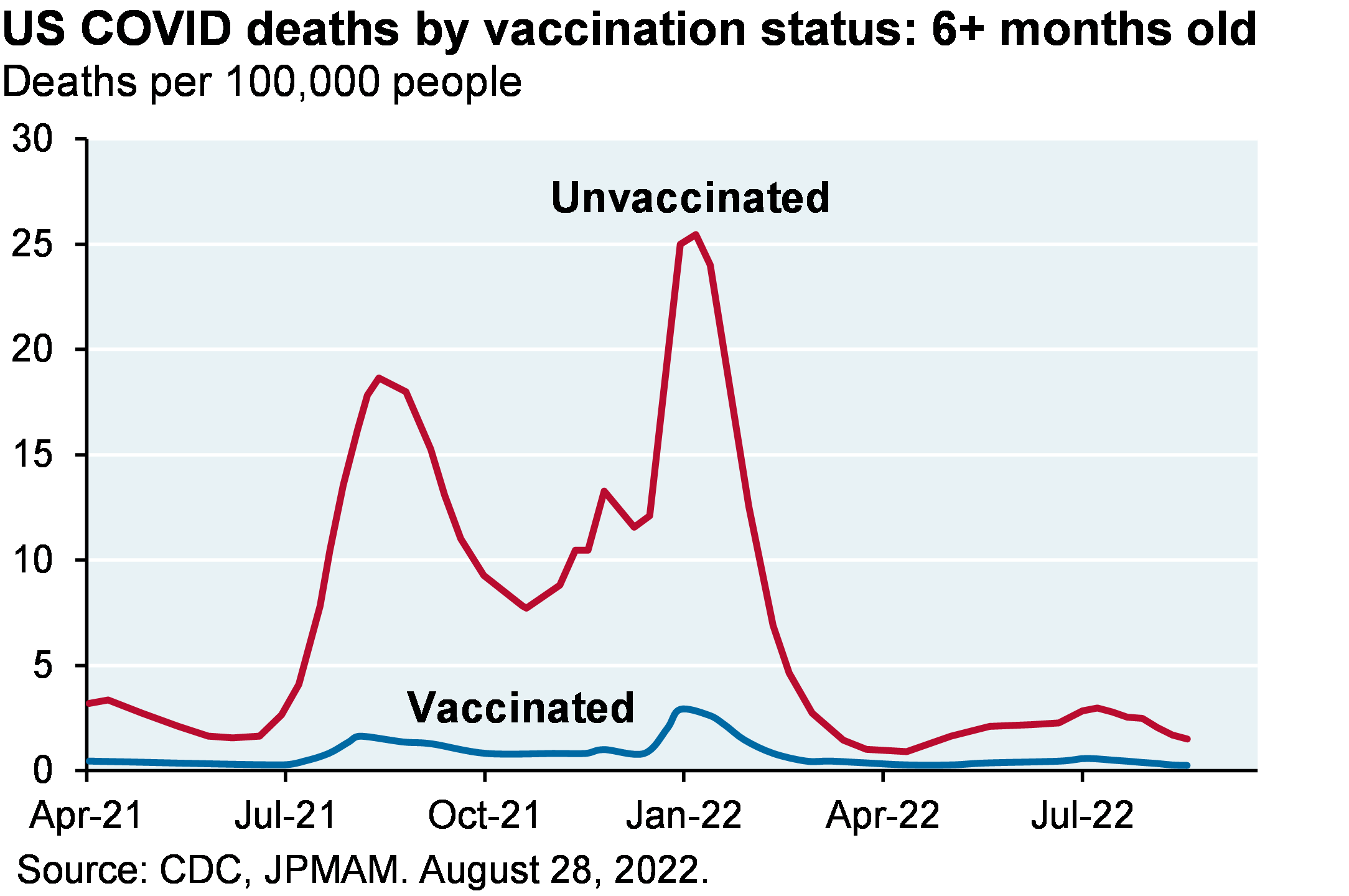

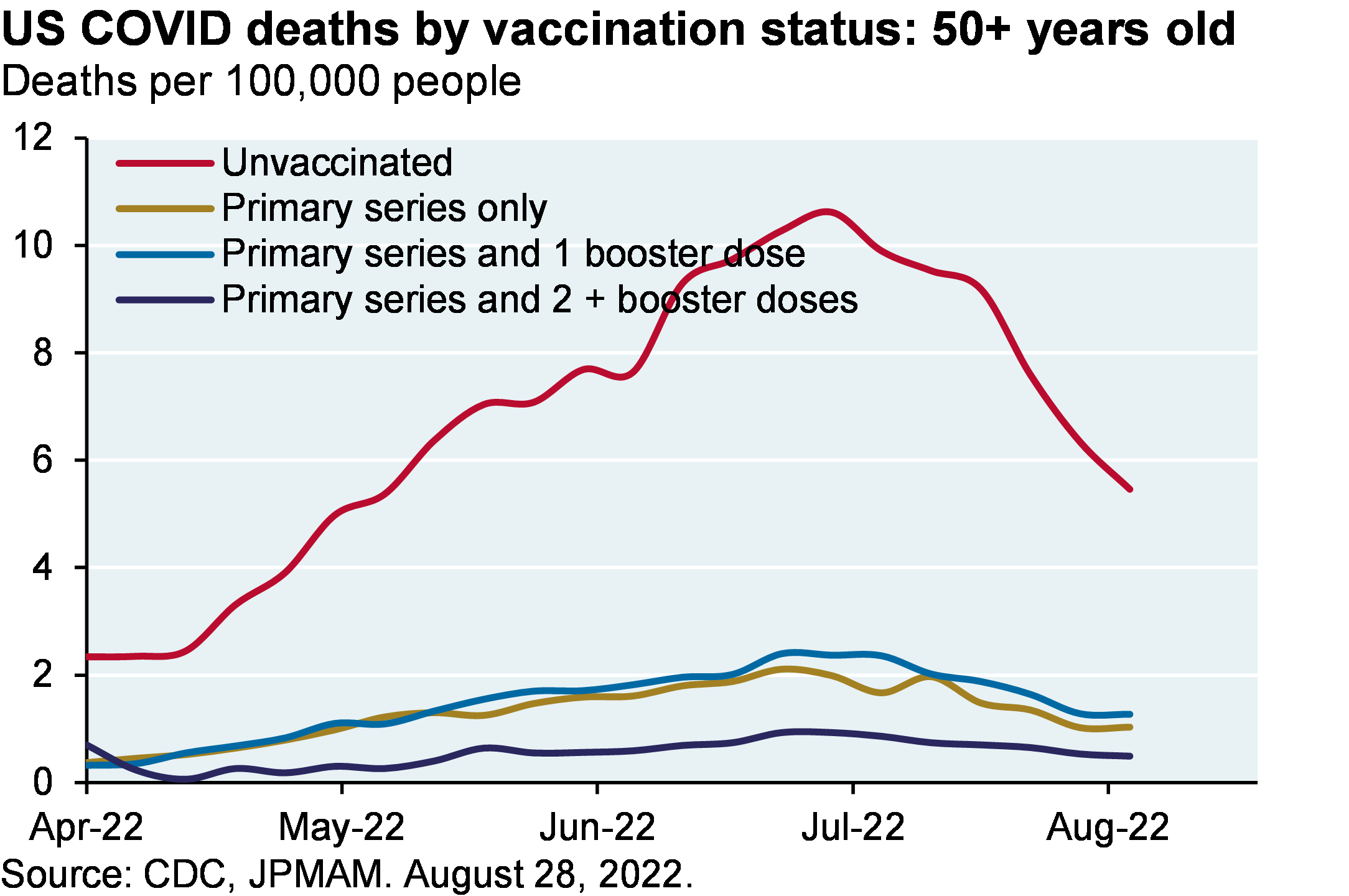

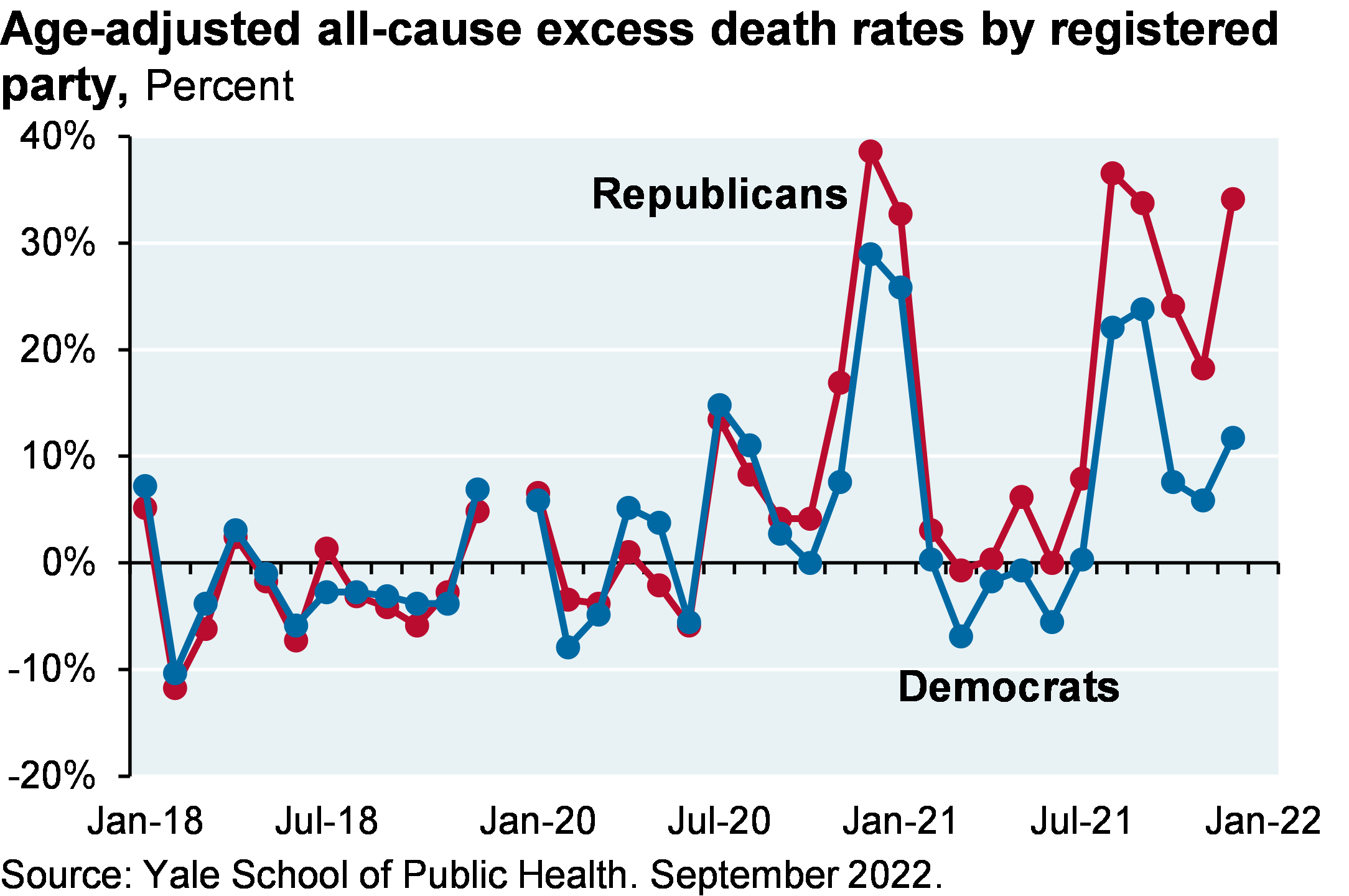

The latest COVID variants are showing signs of increased resistance to existing treatments3, the bivalent booster derived from the original variant and BA.5 only has 12%-15% uptake (the US ranks 73rd in the world on boosters per 100 residents), and vaccine-induced and infection-induced immunity is waning. And as we all know by now, current mRNA vaccines are not highly effective at preventing infection and transmission, only at preventing hospitalization and mortality. What the world needs: nasal vaccine delivery which might do a better job preventing transmission and infection, and pan-coronavirus vaccines that are not variant-specific.

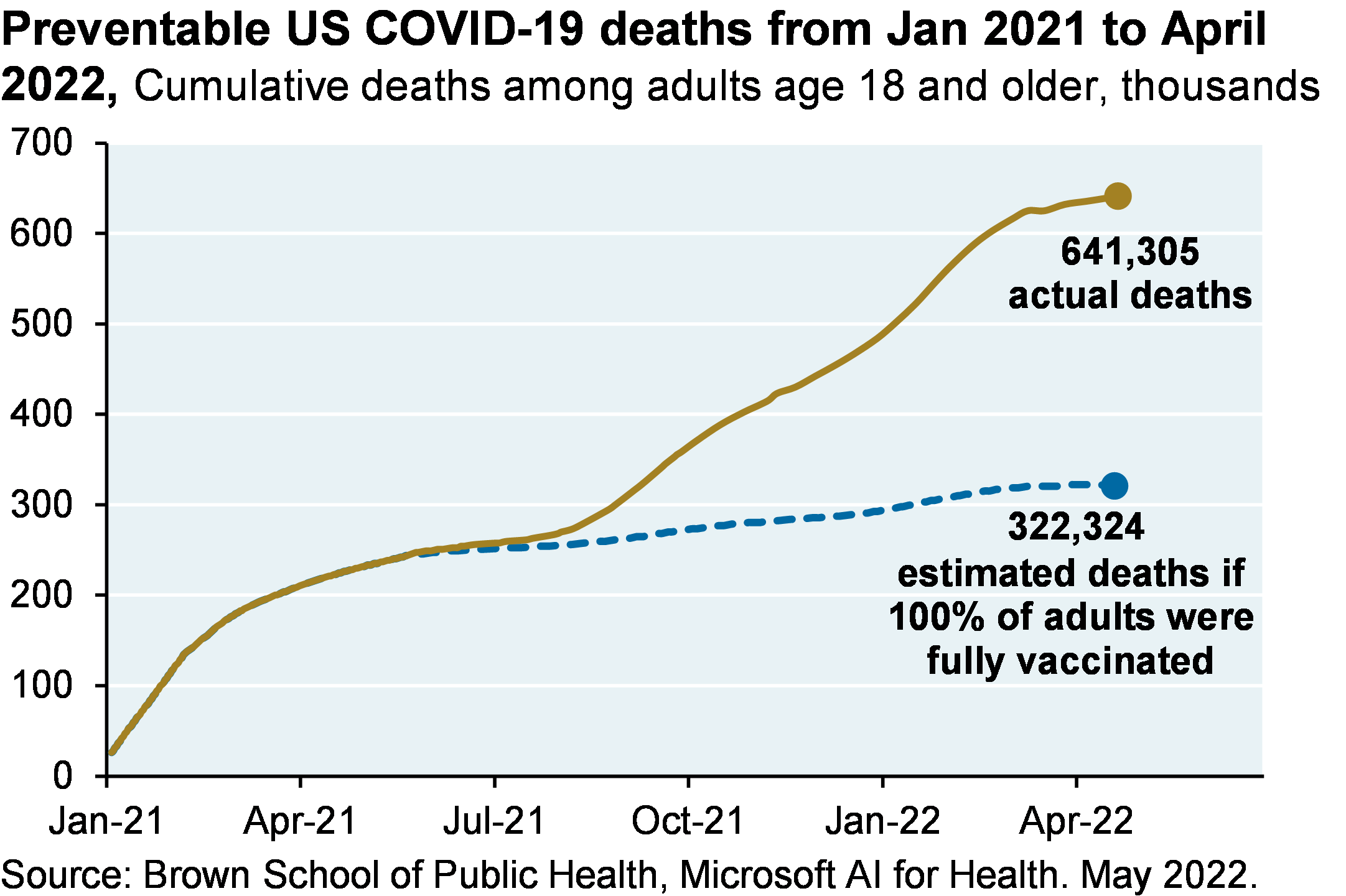

That said, I’m still very thankful for US mRNA vaccines, including the mRNA-1273 versions I have been receiving. They have saved a lot of lives in the US and elsewhere, and according to the Brown School of Public Health, they could have saved more lives if vaccination uptake were higher4. That is all. Happy Thanksgiving.

This report uses rigorous security protocols for selected data sourced from Chase credit and debit card transactions to ensure all information is kept confidential and secure. All selected data is highly aggregated and all unique identifiable information, including names, account numbers, addresses, dates of birth, and Social Security Numbers, is removed from the data before the report’s author receives it. The data in this report is not representative of Chase’s overall credit and debit cardholder population.

The views, opinions and estimates expressed herein constitute Michael Cembalest’s judgment based on current market conditions and are subject to change without notice. Information herein may differ from those expressed by other areas of J.P. Morgan. This information in no way constitutes J.P. Morgan Research and should not be treated as such.

The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment in any jurisdiction, nor is it a commitment from J.P. Morgan or any of its subsidiaries to participate in any of the transactions mentioned herein. Any forecasts, figures, opinions or investment techniques and strategies set out are for information purposes only, based on certain assumptions and current market conditions and are subject to change without prior notice. All information presented herein is considered to be accurate at the time of production. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any securities or products. In addition, users should make an independent assessment of the legal, regulatory, tax, credit and accounting implications and determine, together with their own professional advisers, if any investment mentioned herein is believed to be suitable to their personal goals. Investors should ensure that they obtain all available relevant information before making any investment. It should be noted that investment involves risks, the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Both past performance and yields are not reliable indicators of current and future results.

Non-affiliated entities mentioned are for informational purposes only and should not be construed as an endorsement or sponsorship of J.P. Morgan Chase & Co. or its affiliates.

For J.P. Morgan Asset Management Clients:

J.P. Morgan Asset Management is the brand for the asset management business of JPMorgan Chase & Co. and its affiliates worldwide.

To the extent permitted by applicable law, we may record telephone calls and monitor electronic communications to comply with our legal and regulatory obligations and internal policies. Personal data will be collected, stored and processed by J.P. Morgan Asset Management in accordance with our privacy policies at https://am.jpmorgan.com/global/privacy.

ACCESSIBILITY

For U.S. only: If you are a person with a disability and need additional support in viewing the material, please call us at 1-800-343-1113 for assistance.

This communication is issued by the following entities:

In the United States, by J.P. Morgan Investment Management Inc. or J.P. Morgan Alternative Asset Management, Inc., both regulated by the Securities and Exchange Commission; in Latin America, for intended recipients’ use only, by local J.P. Morgan entities, as the case may be.; in Canada, for institutional clients’ use only, by JPMorgan Asset Management (Canada) Inc., which is a registered Portfolio Manager and Exempt Market Dealer in all Canadian provinces and territories except the Yukon and is also registered as an Investment Fund Manager in British Columbia, Ontario, Quebec and Newfoundland and Labrador. In the United Kingdom, by JPMorgan Asset Management (UK) Limited, which is authorized and regulated by the Financial Conduct Authority; in other European jurisdictions, by JPMorgan Asset Management (Europe) S.à r.l. In Asia Pacific (“APAC”), by the following issuing entities and in the respective jurisdictions in which they are primarily regulated: JPMorgan Asset Management (Asia Pacific) Limited, or JPMorgan Funds (Asia) Limited, or JPMorgan Asset Management Real Assets (Asia) Limited, each of which is regulated by the Securities and Futures Commission of Hong Kong; JPMorgan Asset Management (Singapore) Limited (Co. Reg. No. 197601586K), which this advertisement or publication has not been reviewed by the Monetary Authority of Singapore; JPMorgan Asset Management (Taiwan) Limited; JPMorgan Asset Management (Japan) Limited, which is a member of the Investment Trusts Association, Japan, the Japan Investment Advisers Association, Type II Financial Instruments Firms Association and the Japan Securities Dealers Association and is regulated by the Financial Services Agency (registration number “Kanto Local Finance Bureau (Financial Instruments Firm) No. 330”); in Australia, to wholesale clients only as defined in section 761A and 761G of the Corporations Act 2001 (Commonwealth), by JPMorgan Asset Management (Australia) Limited (ABN 55143832080) (AFSL 376919). For all other markets in APAC, to intended recipients only.

For J.P. Morgan Private Bank Clients:

ACCESSIBILITY

J.P. Morgan is committed to making our products and services accessible to meet the financial services needs of all our clients. Please direct any accessibility issues to the Private Bank Client Service Center at 1-866-265-1727.

LEGAL ENTITY, BRAND & REGULATORY INFORMATION

In the United States, bank deposit accounts and related services, such as checking, savings and bank lending, are offered by JPMorgan Chase Bank, N.A. Member FDIC.

JPMorgan Chase Bank, N.A. and its affiliates (collectively “JPMCB”) offer investment products, which may include bank-managed investment accounts and custody, as part of its trust and fiduciary services. Other investment products and services, such as brokerage and advisory accounts, are offered through J.P. Morgan Securities LLC (“JPMS”), a member of FINRA and SIPC. Annuities are made available through Chase Insurance Agency, Inc. (CIA), a licensed insurance agency, doing business as Chase Insurance Agency Services, Inc. in Florida. JPMCB, JPMS and CIA are affiliated companies under the common control of JPM. Products not available in all states.

In Germany, this material is issued by J.P. Morgan SE, with its registered office at Taunustor 1 (TaunusTurm), 60310 Frankfurt am Main, Germany, authorized by the Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) and jointly supervised by the BaFin, the German Central Bank (Deutsche Bundesbank) and the European Central Bank (ECB). In Luxembourg, this material is issued by J.P. Morgan SE – Luxembourg Branch, with registered office at European Bank and Business Centre, 6 route de Treves, L-2633, Senningerberg, Luxembourg, authorized by the Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) and jointly supervised by the BaFin, the German Central Bank (Deutsche Bundesbank) and the European Central Bank (ECB); J.P. Morgan SE – Luxembourg Branch is also supervised by the Commission de Surveillance du Secteur Financier (CSSF); registered under R.C.S Luxembourg B255938. In the United Kingdom, this material is issued by J.P. Morgan SE – London Branch, registered office at 25 Bank Street, Canary Wharf, London E14 5JP, authorized by the Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) and jointly supervised by the BaFin, the German Central Bank (Deutsche Bundesbank) and the European Central Bank (ECB); J.P. Morgan SE – London Branch is also supervised by the Financial Conduct Authority and Prudential Regulation Authority. In Spain, this material is distributed by J.P. Morgan SE, Sucursal en España, with registered office at Paseo de la Castellana, 31, 28046 Madrid, Spain, authorized by the Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) and jointly supervised by the BaFin, the German Central Bank (Deutsche Bundesbank) and the European Central Bank (ECB); J.P. Morgan SE, Sucursal en España is also supervised by the Spanish Securities Market Commission (CNMV); registered with Bank of Spain as a branch of J.P. Morgan SE under code 1567. In Italy, this material is distributed by J.P. Morgan SE – Milan Branch, with its registered office at Via Cordusio, n.3, Milan 20123, Italy, authorized by the Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) and jointly supervised by the BaFin, the German Central Bank (Deutsche Bundesbank) and the European Central Bank (ECB); J.P. Morgan SE – Milan Branch is also supervised by Bank of Italy and the Commissione Nazionale per le Società e la Borsa (CONSOB); registered with Bank of Italy as a branch of J.P. Morgan SE under code 8076; Milan Chamber of Commerce Registered Number: REA MI 2536325. In the Netherlands, this material is distributed by J.P. Morgan SE – Amsterdam Branch, with registered office at World Trade Centre, Tower B, Strawinskylaan 1135, 1077 XX, Amsterdam, The Netherlands, authorized by the Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) and jointly supervised by the BaFin, the German Central Bank (Deutsche Bundesbank) and the European Central Bank (ECB); J.P. Morgan SE – Amsterdam Branch is also supervised by De Nederlandsche Bank (DNB) and the Autoriteit Financiële Markten (AFM) in the Netherlands. Registered with the Kamer van Koophandel as a branch of J.P. Morgan SE under registration number 72610220. In Denmark, this material is distributed by J.P. Morgan SE – Copenhagen Branch, filial af J.P. Morgan SE, Tyskland, with registered office at Kalvebod Brygge 39-41, 1560 København V, Denmark, authorized by the Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) and jointly supervised by the BaFin, the German Central Bank (Deutsche Bundesbank) and the European Central Bank (ECB); J.P. Morgan SE – Copenhagen Branch, filial af J.P. Morgan SE, Tyskland is also supervised by Finanstilsynet (Danish FSA) and is registered with Finanstilsynet as a branch of J.P. Morgan SE under code 29010. In Sweden, this material is distributed by J.P. Morgan SE – Stockholm Bankfilial, with registered office at Hamngatan 15, Stockholm, 11147, Sweden, authorized by the Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) and jointly supervised by the BaFin, the German Central Bank (Deutsche Bundesbank) and the European Central Bank (ECB); J.P. Morgan SE – Stockholm Bankfilial is also supervised by Finansinspektionen (Swedish FSA); registered with Finansinspektionen as a branch of J.P. Morgan SE. In France, this material is distributed by JPMCB, Paris branch, which is regulated by the French banking authorities Autorité de Contrôle Prudentiel et de Résolution and Autorité des Marchés Financiers. In Switzerland, this material is distributed by J.P. Morgan (Suisse) SA, with registered address at rue de la Confédération, 8, 1211, Geneva, Switzerland, which is authorised and supervised by the Swiss Financial Market Supervisory Authority (FINMA), as a bank and a securities dealer in Switzerland. Please consult the following link to obtain information regarding J.P. Morgan’s EMEA data protection policy: https://www.jpmorgan.com/privacy.

In Hong Kong, this material is distributed by JPMCB, Hong Kong branch. JPMCB, Hong Kong branch is regulated by the Hong Kong Monetary Authority and the Securities and Futures Commission of Hong Kong. In Hong Kong, we will cease to use your personal data for our marketing purposes without charge if you so request. In Singapore, this material is distributed by JPMCB, Singapore branch. JPMCB, Singapore branch is regulated by the Monetary Authority of Singapore. Dealing and advisory services and discretionary investment management services are provided to you by JPMCB, Hong Kong/Singapore branch (as notified to you). Banking and custody services are provided to you by JPMCB Singapore Branch. The contents of this document have not been reviewed by any regulatory authority in Hong Kong, Singapore or any other jurisdictions. You are advised to exercise caution in relation to this document. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice. For materials which constitute product advertisement under the Securities and Futures Act and the Financial Advisers Act, this advertisement has not been reviewed by the Monetary Authority of Singapore. JPMorgan Chase Bank, N.A. is a national banking association chartered under the laws of the United States, and as a body corporate, its shareholder’s liability is limited.

With respect to countries in Latin America, the distribution of this material may be restricted in certain jurisdictions. We may offer and/or sell to you securities or other financial instruments which may not be registered under, and are not the subject of a public offering under, the securities or other financial regulatory laws of your home country. Such securities or instruments are offered and/or sold to you on a private basis only. Any communication by us to you regarding such securities or instruments, including without limitation the delivery of a prospectus, term sheet or other offering document, is not intended by us as an offer to sell or a solicitation of an offer to buy any securities or instruments in any jurisdiction in which such an offer or a solicitation is unlawful. Furthermore, such securities or instruments may be subject to certain regulatory and/or contractual restrictions on subsequent transfer by you, and you are solely responsible for ascertaining and complying with such restrictions. To the extent this content makes reference to a fund, the Fund may not be publicly offered in any Latin American country, without previous registration of such fund’s securities in compliance with the laws of the corresponding jurisdiction. Public offering of any security, including the shares of the Fund, without previous registration at Brazilian Securities and Exchange Commission— CVM is completely prohibited. Some products or services contained in the materials might not be currently provided by the Brazilian and Mexican platforms.

JPMorgan Chase Bank, N.A. (JPMCBNA) (ABN 43 074 112 011/AFS Licence No: 238367) is regulated by the Australian Securities and Investment Commission and the Australian Prudential Regulation Authority. Material provided by JPMCBNA in Australia is to “wholesale clients” only. For the purposes of this paragraph the term “wholesale client” has the meaning given in section 761G of the Corporations Act 2001 (Cth). Please inform us if you are not a Wholesale Client now or if you cease to be a Wholesale Client at any time in the future.

JPMS is a registered foreign company (overseas) (ARBN 109293610) incorporated in Delaware, U.S.A. Under Australian financial services licensing requirements, carrying on a financial services business in Australia requires a financial service provider, such as J.P. Morgan Securities LLC (JPMS), to hold an Australian Financial Services Licence (AFSL), unless an exemption applies. JPMS is exempt from the requirement to hold an AFSL under the Corporations Act 2001 (Cth) (Act) in respect of financial services it provides to you, and is regulated by the SEC, FINRA and CFTC under U.S. laws, which differ from Australian laws. Material provided by JPMS in Australia is to “wholesale clients” only. The information provided in this material is not intended to be, and must not be, distributed or passed on, directly or indirectly, to any other class of persons in Australia. For the purposes of this paragraph the term “wholesale client” has the meaning given in section 761G of the Act. Please inform us immediately if you are not a Wholesale Client now or if you cease to be a Wholesale Client at any time in the future.

This material has not been prepared specifically for Australian investors. It:

May contain references to dollar amounts which are not Australian dollars;

May contain financial information which is not prepared in accordance with Australian law or practices;

May not address risks associated with investment in foreign currency denominated investments; and

Does not address Australian tax issues.

A CH₄, HR4346 and mRNA-1273 Thanksgiving

A Thanksgiving list of things I am thankful for. My list this year: CH₄, HR4346 and mRNA-1273.

[START RECORDING]

FEMALE VOICE: This podcast has been prepared exclusively for institutional, wholesale, professional clients and qualified investors only, as divined by local laws and regulations. Please read other important information, which can be found on the link at the end of the podcast episode.

[intro music]

MR. MICHAEL CEMBALEST: Good afternoon, and welcome to the Thanksgiving Eye on the Market. In the October note last month, I wrote about how, in almost every post-war recession except for one of them, equity markets preceded the decline in profits and employment and GDP and things like that by several months and said, let’s focus on the ISM survey instead, because when that bottoms, it tends of coincide much more closely to the bottom of the equity markets.

So, in terms of thinking about when that can happen, we have some approaches to try to figure out when the ISM survey is going, and they’re crude, but the fit’s actually not bad, and using this approach, the ISM would bottom in the mid- to low-40s sometime in January, February of next year.

If that were the case, it’s not impossible that the lows we hit in mid-October would be the lows for the cycle, and almost everybody I talk to discounts that scenario entirely, although, you know, it would be consistent with market history. I think that there are more corrections ahead, and that something closer to 3300 would be pretty good value for long-term investors if we got there.

The big question to me, now, obviously is not how high inflation goes. It’s probably cresting. The question is how long will it stick around, and we’ve got a chart in this month’s piece that looks at all the episodes of rising inflation in developed countries, and once inflation spikes, it tends to stick around for a while, which is in stark contrast to the much more rapid decline in inflation that markets are pricing in, in both the U.S. and Europe.

Now, I know we’ve got some exogenous issues now with COVID and China and the Russia-Ukraine War. Even so, what’s priced in about the inflation decline is much more rapid than what we’ve seen historically. Anyway, more on all of this in our outlook for next year.

The purpose of this year’s note is an eye on the market on the three things that I’m thankful for, and my list this year is CH4, HR4346, and mRNA1273. I will of course explain.

So, number one, why am I thankful for CH4? Well, I’m referring, of course, to natural gas. Natural gas composition is mostly CH4 with little bits of ethane and propane and butane mixed in. Let’s look at what was going on in Europe about a month ago. 70 percent of the fertilizer capacity was shut down. 30 percent of its aluminum was shut down. Steel plants were closing in Germany, Spain, Poland and France. One of the biggest companies in Spain furloughed 85 percent of its workforce and steel producers. The cement companies were shutting down. 30 UK energy suppliers filed for bankruptcy. The French utility EDF was nationalized. We saw the lowest level of business expectations for energy intensive German companies since re-unification in 1990, and Germany and Italy were seeing the highest inflation rates in 32 and 40 years, respectively. Now, gas and electricity prices have declined a bunch in, in Europe since the summer peak, and there’s a bunch of initiatives underway to cap energy prices, reduce energy taxes and provide support to businesses. Eventually, obviously, those are all borne my taxpayers. So, some of this industrial production might come back online, but European gas and electricity prices are still two to three times higher than at the beginning of 2021. Gas prices are still six times U.S. levels, et cetera, so while Europe is set for this winter with plenty of gas storage, most countries are either at or above 90 percent of capacity, a lot of what Europe has done to prepare for the winter is also lowering its consumption due to higher energy prices, and that obviously has a lot of negative repercussions.

So, stepping back for a moment, if I’ve learned anything from the 12 years I worked on our energy paper with Vaclav [phonetic], it’s that these renewable transitions are going to take time, for technological reasons, political reasons, judicial reasons, behavioral, economic. We go into detail every year in the energy paper. In the meantime, I’m very thankful the U.S. has ample supplies of its own natural gas, and the latest world energy outlook from the IEA, they show global natural gas demand rising by 2030 and 2050, in the scenario that is attached to policies that countries are currently pursuing, rather than declining. And we’ll go into more detail next year.

But, there’s something that all of your probably understand now about wind and solar power. We’re going to need plenty of natural gas power, gas capacity, even as we build more wind and solar power. Wind and solar are very intermittent and there’s times during the year where there’s not enough renewable generation to meet the load demand. This is all pretty simple. As a result, you can’t disconnect a megawatt of natural gas every time you add a megawatt of wind and solar power. The actual amount you can disconnect is referred to as a capacity credit, and they’re computed, and they’re pretty intensive calculations. We do them. You have to take the hourly generation by type and demand loads in each ISO, which is the independent system operator. Bottom line, every time you add one megawatt of wind and solar power, in the major ISOs in the United States, you can only disconnect around 10 to 30 percent of that in terms of the natural gas that you can unplug because you need that back-up thermal capacity. And the cost of that back-up power is not included in anybody’s estimates, or in most estimates I see of levelized cost of wind and solar, which is why I think that levelized cost concept is kind of irrelevant.

What’s more relevant to me on this natural gas question is methane emissions and flaring, and we have a little bit of a discussion in here, progress is being made slowly. Most largely firms have plans to reduce methane emissions and flaring, but only about a quarter of the smaller firms do, and this is from a Dallas Fed survey from last December and so the, look, the industry leaders have begun a very important shift from quarterly desktop estimations of methane leakage to more accurate measurements using sensors on planes and things like that. Most of them have committed to eliminate flaring by 2025. There are some new Clean Air Act regulations. A lot of the states have adopted new regulations. There’s a European and U.S. partnership called the Oil and Gas Methane partnership, so the industry leaders are generally moving in the right direction here and, and hopefully through, through both the combination of self-preservation and legislation, the smaller companies will follow.

Okay, what’s the second thing that I’m thankful for. I mentioned HR4346. That is the semi-conductor bill. The U.S. is going to need a lot of semi-conductors in the future, particularly if the renewable transition is going to pick up speed through adoption of electric vehicles. The semi-conductor intensity of electric vehicles is roughly double that of traditional, internal combustion engine cars.

So, unfortunately, as we all know, semi-conductor capacity started migrating out of the United States rapidly in 1990, fell in half by 2000, and then fall in half again by 2020, so only around something like 12 percent of U.S., the United States accounts for only around 12 percent of global semi-conductor capacity. The U.S. has a large market share of global semi-conductor revenues, but that’s because it relies heavily on Taiwan for production because Taiwan’s got 50 percent share of high value added chip capacity and 60 percent of the foundry market. I don’t think I need to spell out why this might be a geopolitical risk for the United States.

So, I’m thankful for this semi-conductor bill that was passed. It gives support for U.S. semi-conductor companies. I think it helps offset some of the negative consequences of the latest policies restricting their ability to sell chips and equipment to China. Nvidia, for example, stock has been in freefall. They, 95, they sell 95 percent of the high end chips in China. And this bill has gotten some criticism as corporate welfare, and I understand that, but if your goal is to improve U.S. semi-conductor supply chains, some kind of government support is going to be needed to offset some of the negative impact of some of these new national security rules.

Now, this semi-conductor bill is just a start. It’s probably only 10 to 20 percent of what the U.S. would need to become substantially semi-conductor self-sufficient, so it’s just a drop in the bucket, 50, 60 billion, but it gets the ball rolling, and believe it or not, it was a bipartisan effort. In the last few years, we’ve had a lot of bills that passed with zero support. This is the first time in American history bills passed Congress without a single vote from the opposing party in the House or the Senate. The 2021 American Rescue Plan, the 2022 Inflation Reduction Act are examples of that, and when the Trump Tax Cut Act was passed, it was the most partisan bill in U.S. history at the time.

So, the CHIPS Bill got 17 GOP Senator, 24 GOP House members, and Mike Pompeo also supported it, so in the context of the world we lived in, we currently live in, it is definitely a bipartisan bill.

Just a couple of quick comments, too, the United States relies on Taiwan, and China relies on Taiwan to an entirely different level. 70 percent, China only produced 10 percent of its own chips. The other 90 percent comes from imports or foreign firms producing chips in China. Of that 90 percent, 70 percent share is Taiwan. So, Taiwan produces 10 percent of China’s chips in Nanjing and Shanghai, and then exports the remaining 60 percent from Taiwan. I can’t find anywhere in the world an example of one country that’s so reliant on another one for a high value import. For context, Europe was, before the Ukraine war, 20 percent, or 25 percent reliant on Russian energy. So, think about that, 70 percent reliance on Taiwan for semi-conductors by China. That’s a huge number, and most of the Chinese foundries are working on 14 to 30 nanometer chips. The global leaders like TSMA in Taiwan are already producing at five to seven nanometers, so if the U.S. is reliant on Taiwan from a semi-conductor perspective, China’s reliance on them is much, much, much greater.

The last thing I am thankful for this year are mRNA vaccines. Now, the news is not all good. The latest COVID variants are showing increased signs of resistance to treatments. The new booster, which is derived from both the original variant and BA5 only has a 12 to 15 percent uptake in the U.S. The U.S. ranks somewhere around 73rd in the world on booster shots, and vaccines no longer do a great job against infection and transmission. However, they do a great job at preventing hospitalization and mortality, particularly for people like me, who are, you know, 60 years old. I just turned 60, which I’m still getting used to.

Now, what the world really needs is nasal vaccine delivery mechanisms, which might do a better job at preventing transmission and infection because instead of, I mean, I think the vaccines now do a good job at preventing the infection from getting into your lungs, but it doesn’t prevent you from getting into your respiratory system, and that’s what a nasal delivery might be able to do. We also need pan-coronavirus vaccines that are not so variant specific, right? In other words, not just tuned into the, into the three-dimensional topological shape of one variant or another.

That said, I’m very thankful for these mRNA vaccines, including the Moderna versions that I received. They have saved a lot of lives in the U.S. and elsewhere, and we have a chart in here showing how much more lives they could have saved if the vaccination uptake were higher. There’s some charts in here that support all of that, but I consider all of this to be pretty straightforward stuff.

Now, as you might imagine, my thanksgiving list of natural gas, the CHIPS Bill and vaccines is a Venn diagram that doesn’t overlap with a lot of Americans in the United States, which is why I’m still working alone from my hidden, unnamed bunker. Anyway, Happy Thanksgiving to all of you, and thank you for listening to the podcast. Bye.

FEMALE VOICE: Michael Cembalest’s Eye on the Market offers a unique perspective on the economy, current events, markets, and investment portfolios and is a production of JPMorgan Asset and Wealth Management. Michael Cembalest is the Chairman of Market and Investment Strategy for JPMorgan Asset Management and is one of our most renowned and provocative speakers.

For more information, please subscribe to the Eye on the Market by contacting your JPMorgan representative. If you’d like to hear more, please explore episodes on iTunes or on our website.

This podcast is intended for informational purposes only and is a communication on behalf of JPMorgan Institutional Investments, Inc. Views may not be suitable for all investors and are not intended as personal investment advice, or as solicitation or recommendation. Outlooks and past performance are never guarantees of future results. This is not investment research. Please read other important information, which can be found at www.jpmorgan.com/disclaimer-eotm.

[END RECORDING]