2019 IFRS foundational conference: London

On June 20-21, we attended the 2019 IFRS conference in London to stay informed on important regulatory issues affecting the insurance industry today.

10-07-2019

Wheatley Garner

Key topics (Full details below)

- Amendments to IFRS 17 have been introduced, designed to ease implementation without disrupting implementation processes currently underway: The International Accounting Standards Board (IASB) has issued a number of targeted improvements to address concerns expressed by insurers and to refine some of IFRS 17’s requirements as implementations get underway.

- The European Commission is researching the effects of IFRS 9 on long-term investing activities: Last year, the EC adopted an action plan on financing sustainable growth, which includes efforts to garner more private capital for sustainable projects. Some have raised concerns that IFRS 9’s treatment of equity investments may not be conducive to long-term investing goals.

The IASB releases targeted amendments to IFRS 17 to aid insurers’ implementation efforts

During last month’s IASB board meeting, the IASB agreed to propose targeted amendments to IFRS 17 to respond to concerns and challenges raised by stakeholders as IFRS 17 is being implemented. The IASB has also released a corresponding exposure draft, which seeks public comments on the proposed amendments to gain additional insight from the industry.

There are modifications covering eight areas within the proposed amendments, which are designed to refine and improve a few areas within IFRS 17, without disrupting implementation processes that are already underway. The most widely publicized amendment has been the deferral of IFRS 17’s effective date (which includes deferring the application of IFRS 9 for most insurers) until 2022. The IASB felt that a deferral would allow more time for testing and analysis, while also helping to ease the workloads associated with the insurance industry’s implementation efforts.

Another notable amendment was the decision to include additional scope exclusions that would exempt certain products from IFRS 17 compliance. IFRS 17 carried forward scope exclusions that previously existed in IFRS 4, including manufacturing or dealer warranties (included in IFRS 15) and some financial guarantee contracts. The new proposed scope exclusions will include the option to apply IFRS 9 or IFRS 17 to certain types of loans (e.g. loans with death waivers), along with the requirement to apply other IFRS standards to some credit card products that may meet the definition of an insurance contract (e.g. credit cards that provide insurance coverage for free). The goal of these exclusions is to allow companies to continue their existing accounting practices for some loan and credit card products and to reduce the obligation to comply with IFRS 17 for firms that typically do not have other contracts in scope for IFRS 17.

There is also a proposed amendment that addresses the allocation of insurance acquisition costs to expected contract renewals. The agent commissions insurers pay to agents can at times be higher than the premiums received within an insurance contract term period. And while insurers are generally fine with this because it expects the contract to be renewed in the future, for accounting purposes, this would cause certain contracts to be considered onerous (loss making) at initial recognition. To remedy this dilemma, the IASB has proposed an amendment that would require that entities: 1) allocate to ‘anticipated contract renewals’ part of the insurance acquisition cash flows directly attributable to newly issued contracts; 2) recognize the insurance acquisition cash flows allocated to ‘anticipated contract renewals’ as an asset on the balance sheet until the renewed contracts are recognized. This will lead to fewer onerous contracts being reported at initial recognition, but will require recoverability assessments at each reporting period and additional disclosures on asset changes and impairments.

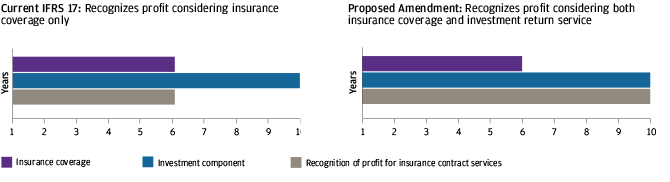

Regarding the recognition of CSM1 in profit or loss, the IASB is also proposing to amend IFRS 17 so that in the general model, the CSM is allocated by considering both insurance coverage and any investment return service for contracts without direct participation features that includes an investment component. The IASB noted that many contracts combine insurance coverage and service relating to investment activities and the timing of provision of service relating to investment activities might differ from the timing of provision of insurance coverage (EXHIBIT 1). The proposed amendment would change the timing of profit recognition for these insurance contracts, but would leave the timing of profit recognition for insurance contracts without investment activities unchanged.

Lastly, there will also be amendments related to risk mitigation options when a company uses reinsurance contracts, accounting mismatches for reinsurance and additional transition relief for liabilities acquired in a business combination. Also amended are the requirements around balance sheet presentation. The presentation of insurance assets and liabilities will be determined using portfolios of contracts instead of groups of contracts. This will reduce the size of insurance contract assets presented on the balance sheet, and may assist in reducing implementation costs, particularly for those who plan to use the simplified approach (or PAA2).

EXHIBIT 1: A 10-YEAR CONTRACT WITH AN INVESTMENT COMPONENT PROVIDING INSURANCE COVERAGE FOR THE FIRST SIX YEARS

The IASB has invited the industry to comment on the proposed amendments, and will decide on whether to proceed with publishing any resulting amendments in mid-2020.

The European Commission (EC) to research alternative accounting approaches pertaining to long-term equity investments

In March of last year, the EC adopted an action plan3 on financing sustainable growth, which lays out a comprehensive vision on how to build a sustainable finance strategy for the EU. Part of the plan addresses the ways the financial system could better support sustainable investments, which includes garnering more private capital for sustainable projects such as transportation, energy and infrastructure.

Several factors can be attributed to the lack of sustainable financing, and in an effort to better understand the effects of accounting requirements on investing activities, the EC has requested the EFRAG4 assess IFRS 9’s impact on long-term investing and potential alternative accounting approaches for equities and equity-type instruments (e.g. units in investment funds).

IFRS 9 has brought along changes to how equity instruments can be treated for measurement purposes. Under IFRS 9, equities are measured at fair value with changes in fair value recognized in profit or loss. But, at initial recognition, entities are also allowed to make an irrevocable election to present changes in the fair value in “Other Comprehensive Income” (OCI) on an instrumentby- instrument basis— the “FVOCI election5.” But if the FVOCI classification is chosen, any gains or losses recognized in OCI cannot be reclassified to P&L upon disposal, also referred to as “recycling.” Equity and fund investors that were heavy users of the Available-for-Sale (AFS) classification under IAS 396 would be most affected by this change.

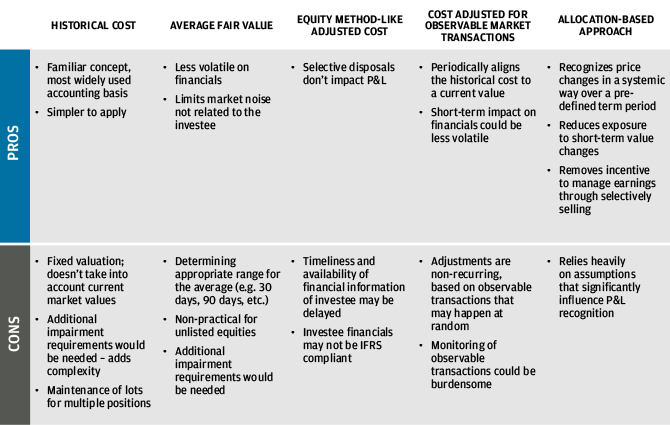

With the new accounting rules being perceived as uncompromising toward funds and equity instruments, other notable accounting approaches have also been mentioned as an alternative to the current rules, all of which have advantages and disadvantages associated with them (EXHIBIT 2). These alternatives include an allocation-based approach, historical cost, average fair value, an “adjustable” cost based on the profits and losses of the investee (equity method-like accounting) or adjustments based on “observable market transaction”, similar to the U.S. GAAP approach used for equities without readily determinable fair values.

Given the business model of some companies as long-term investors, which includes insurers, it has been argued that IFRS 9 accounting treatments (along with other regulatory treatments) for equities are not attractive and create a disincentive to hold such investments. The contrast to that view is that accounting standards aren’t designed to encourage or discourage investment activity. The chief purpose of accounting standards, and broader financial reporting requirements, is to provide transparent, reliable financial information about the reporting entity that is useful to investors, lenders, creditors and other stakeholders.

To that end, the EC remains committed to better understanding the effects of accounting changes on portfolios, while remaining cognizant that accounting rules only make up one of many factors that may affect investment decisions and potentially lead to asset allocation changes. The EFRAG will also be collecting some quantitative information from institutional investors to obtain industry views on the infrastructure industry, sustainable projects, fund investing and alternative accounting approaches that could better help to facilitate investing for long-term purposes. Broader industry views, however, of IFRS 9’s impact may ultimately not be known for some time, with a large segment of the institutional investing community still in the early stages of IFRS 9 preparation and planning due to IFRS 17’s temporary exemption available to most insurance companies from having to apply IFRS 9 until 2022.

EXHIBIT 2: NOTABLE ALTERNATIVE ACCOUNTING APPROACHES

Source: EFRAG Secretariat Background Paper: Equity Instruments – Research on Measurement

1Contractual Service Margin

2Premium Allocation Approach

3https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX:52018DC0097

4The European Financial Reporting Advisory Group is an advisory group tasked with developing and promoting European views on financial reporting, the development of IFRS and how it contributes to the efficiency of capital markets.

5Fund investments do not meet the definition of an equity instrument per IAS 32, and therefore are not eligible for the FVOCI option.

6Under IAS 39, the rules IFRS 9 replaced, equity instruments, other than those held for trading, were classified as Available-for-Sale (AFS). AFS equities were measured at fair value, with changes in fair value presented in OCI. Upon disposal, gains and losses would be recognized in P&L.

GIS-NAIC_0719 | 0903c02a826337c3