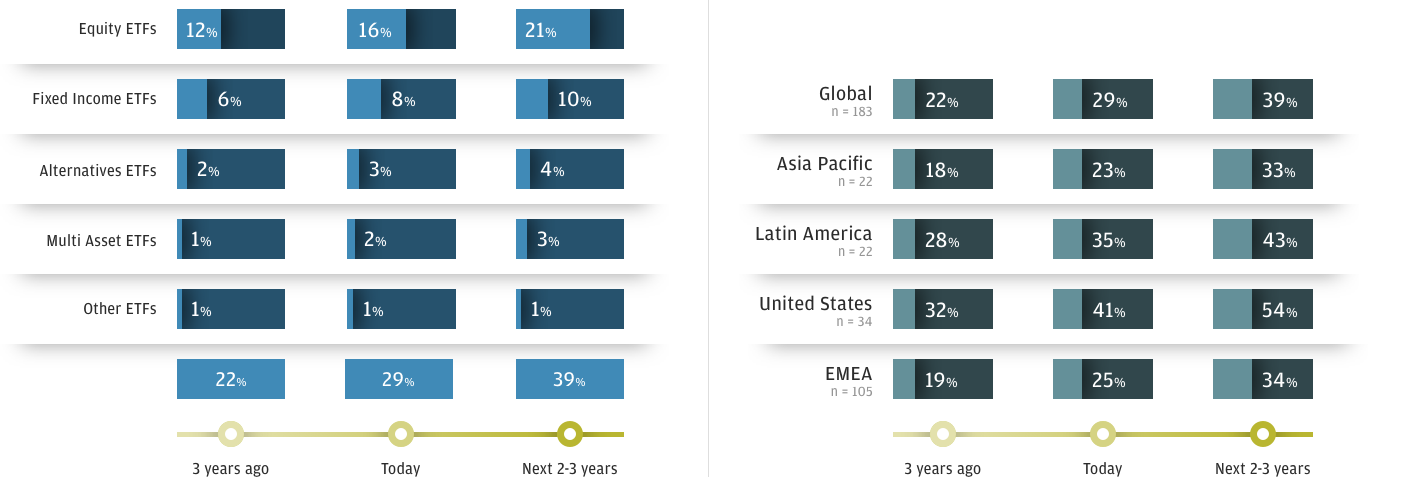

ETF allocations over time

Q1. Approximately what percentage of your clients’ portfolios is allocated to equity ETFs, fixed income ETFs, alternative ETFs, multi-asset ETFs or other types of ETF? Has this allocation changed over the last three years and how will it change over the next two to three years?

Key Take Outs

Allocations to ETFs are set to increase, with respondents expecting to allocate 39% of their portfolios to ETFs over the next two to three years, compared to 22% three years ago.

Equity ETFs will remain the largest allocation in portfolios, with exposure to equity ETFs set to grow faster than other ETF asset classes over the next two to three years.

US respondents have the highest allocations to ETFs, while the strongest increase in allocations over the last three years has been in EMEA.

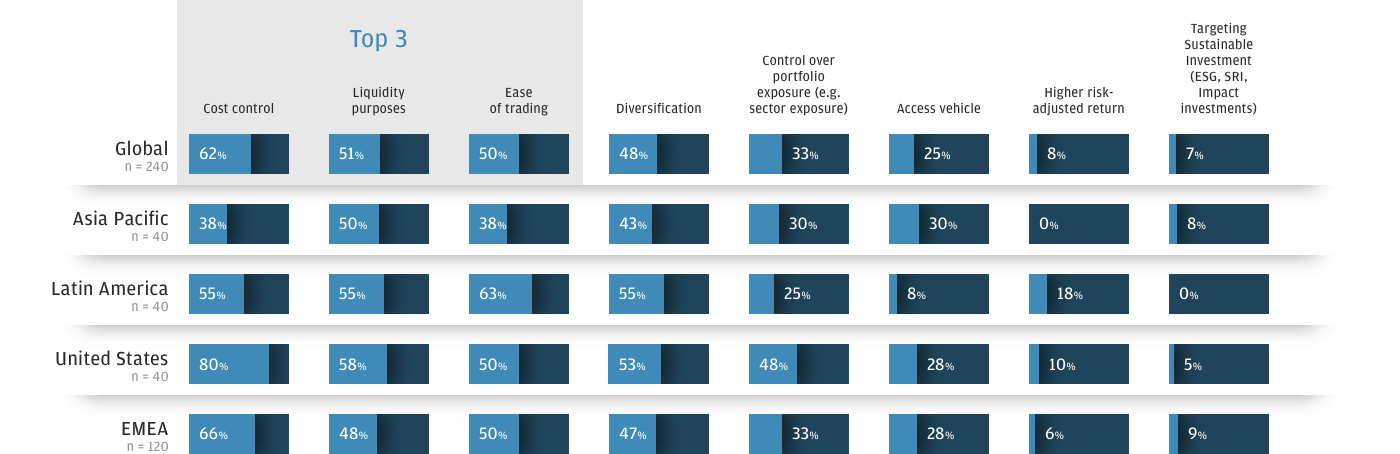

ETF investment objectives

Q2. What are the key investment objectives when using ETFs? (Multiple answers were allowed)

Key Take Outs

Cost control, liquidity and ease of trading are the top three reasons why respondents to the survey use ETFs.

Cost control is the main investment objective for US and EMEA investors, while liquidity is most important for Asia Pacific respondents, and ease of trading is the main objective for Latin American respondents.

Diversification is also a key consideration, particularly in the US and Latin America, while few investors currently use ETFs to meet sustainable investing targets.

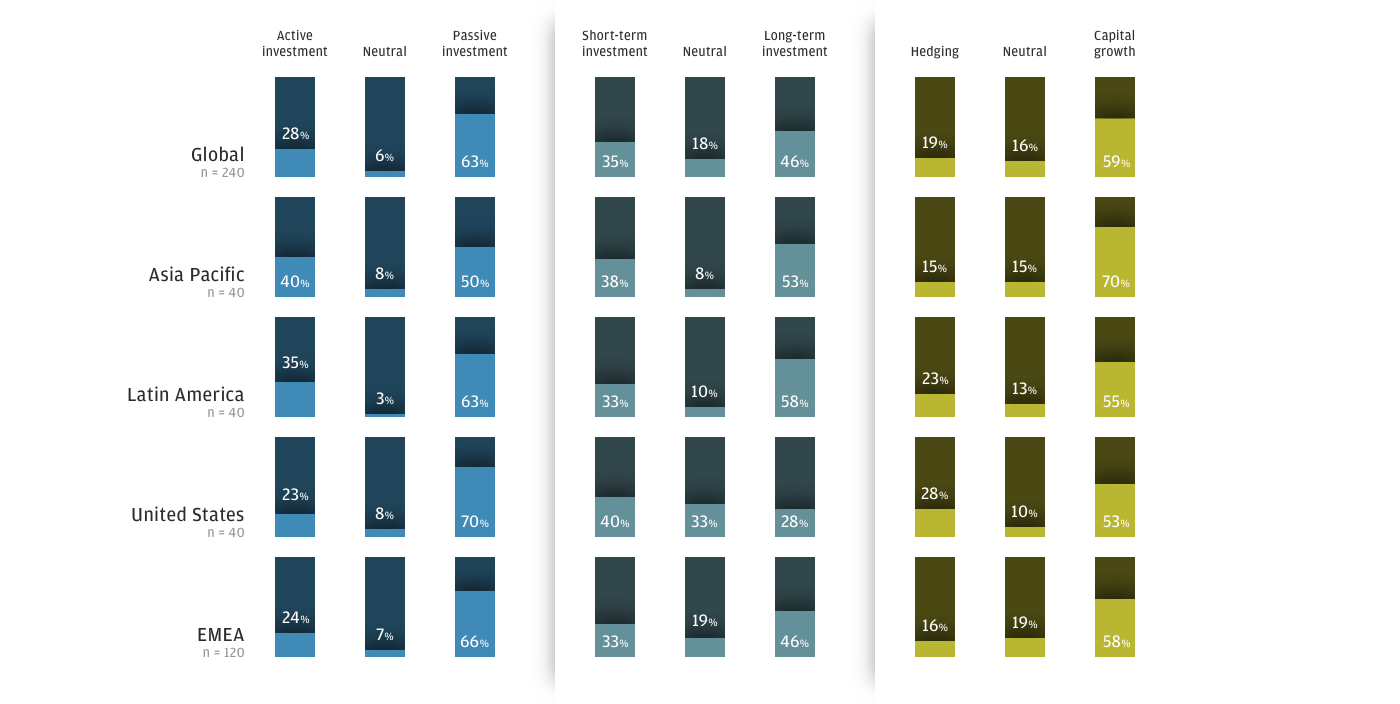

Preferred ETF investment strategies

Q3. What do you consider to be your preferred investment strategy/approach when using ETFs? (Scale 1-5, “don’t know” option not shown)

Key Take Outs

Passive ETF strategies are most popular with the survey’s respondents, who also overwhelmingly use ETFs to provide capital growth.

Active ETF strategies are most popular in the Asia Pacific region, while US respondents are most likely to use ETFs for hedging.

In contrast to Asia Pacific, Latin America and EMEA, where ETFs are mainly used as long-term investment strategies, US investors prefer to take a short-term approach.

0903c02a826bf3c9