Red Med Redemption: Politics, vaccination resistance and the Delta variant; US economic recovery update; big tech reliance on acquisitions to fuel growth; Investor Odds & Ends (NYC hotels, personal/corp/int’l taxes)

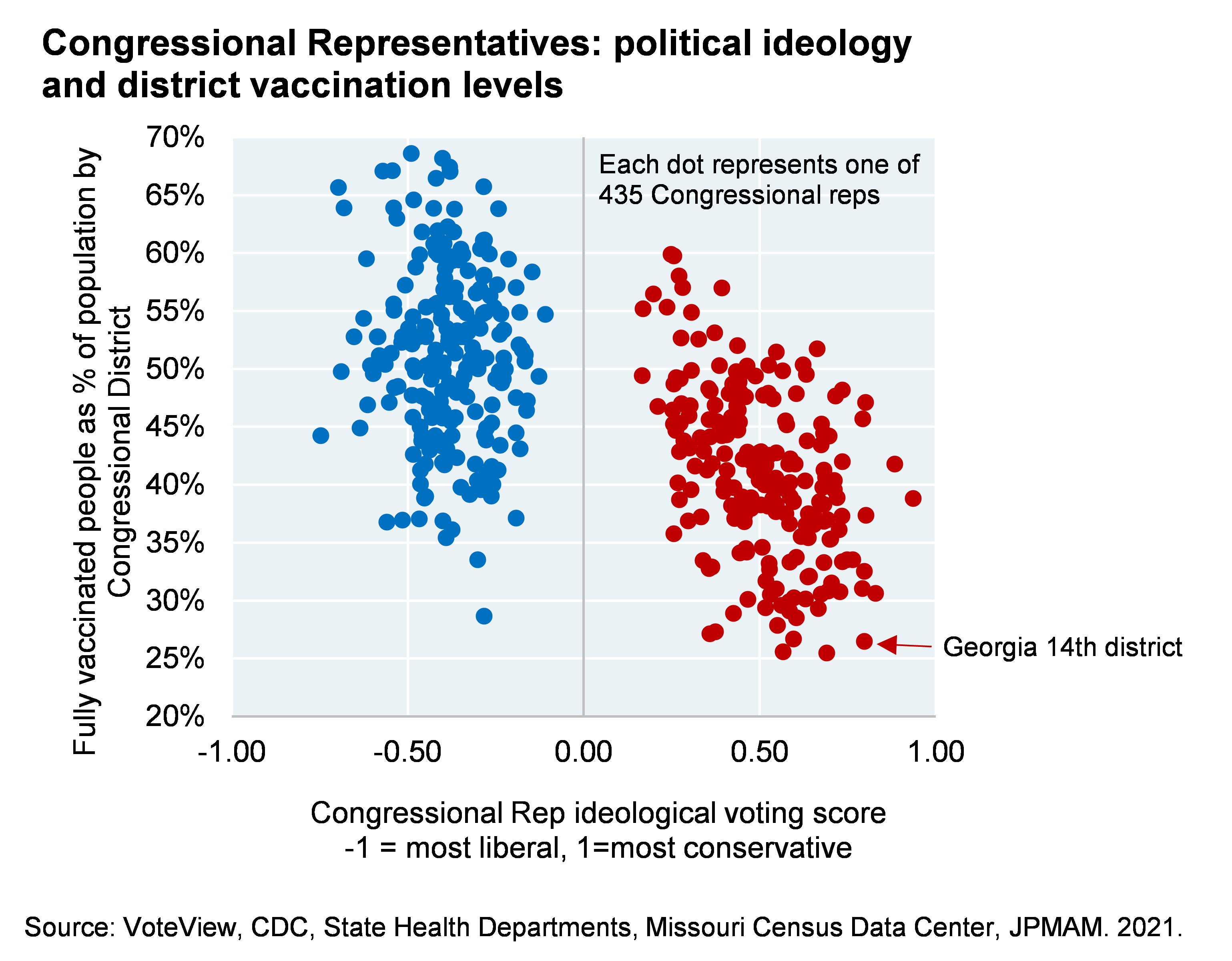

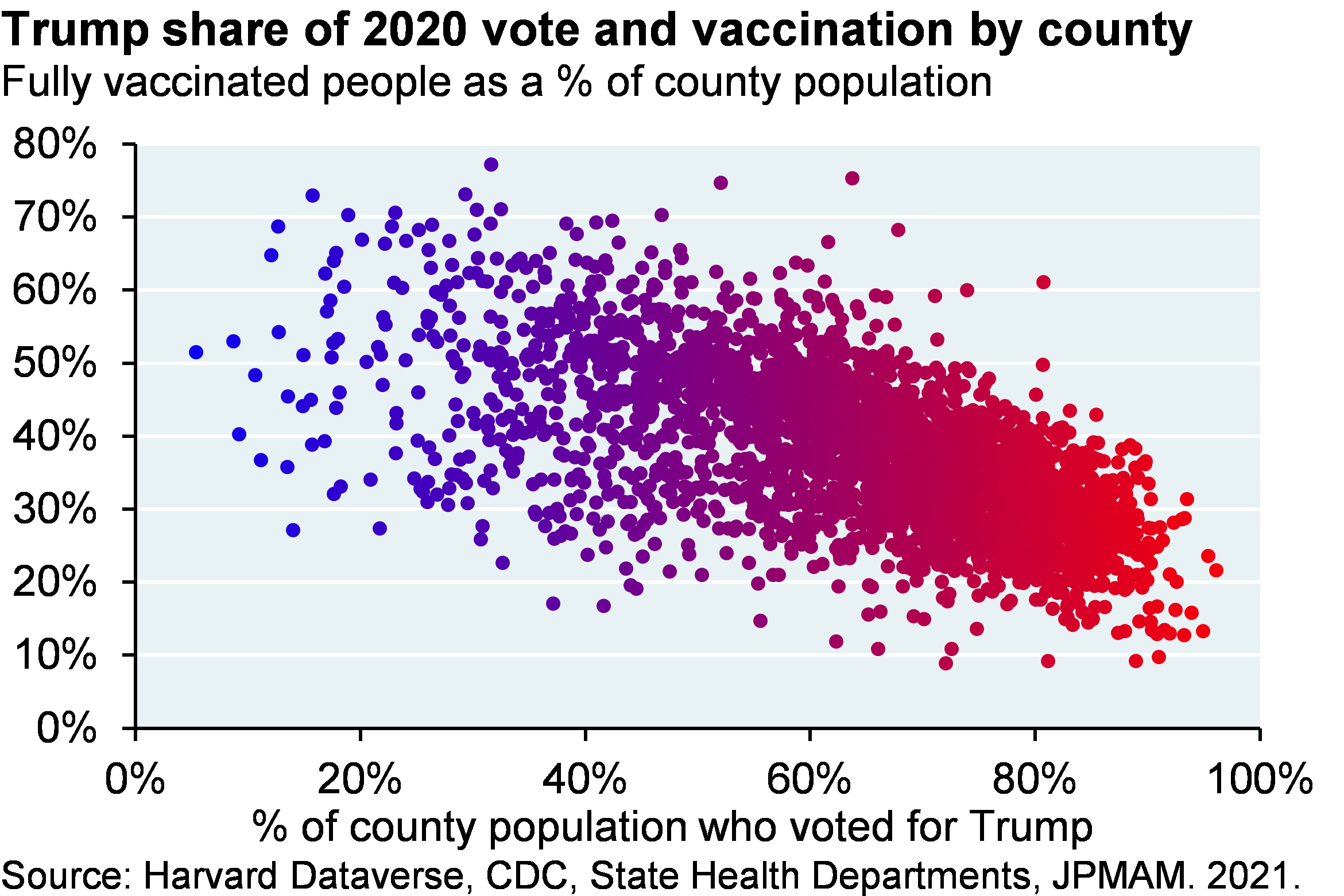

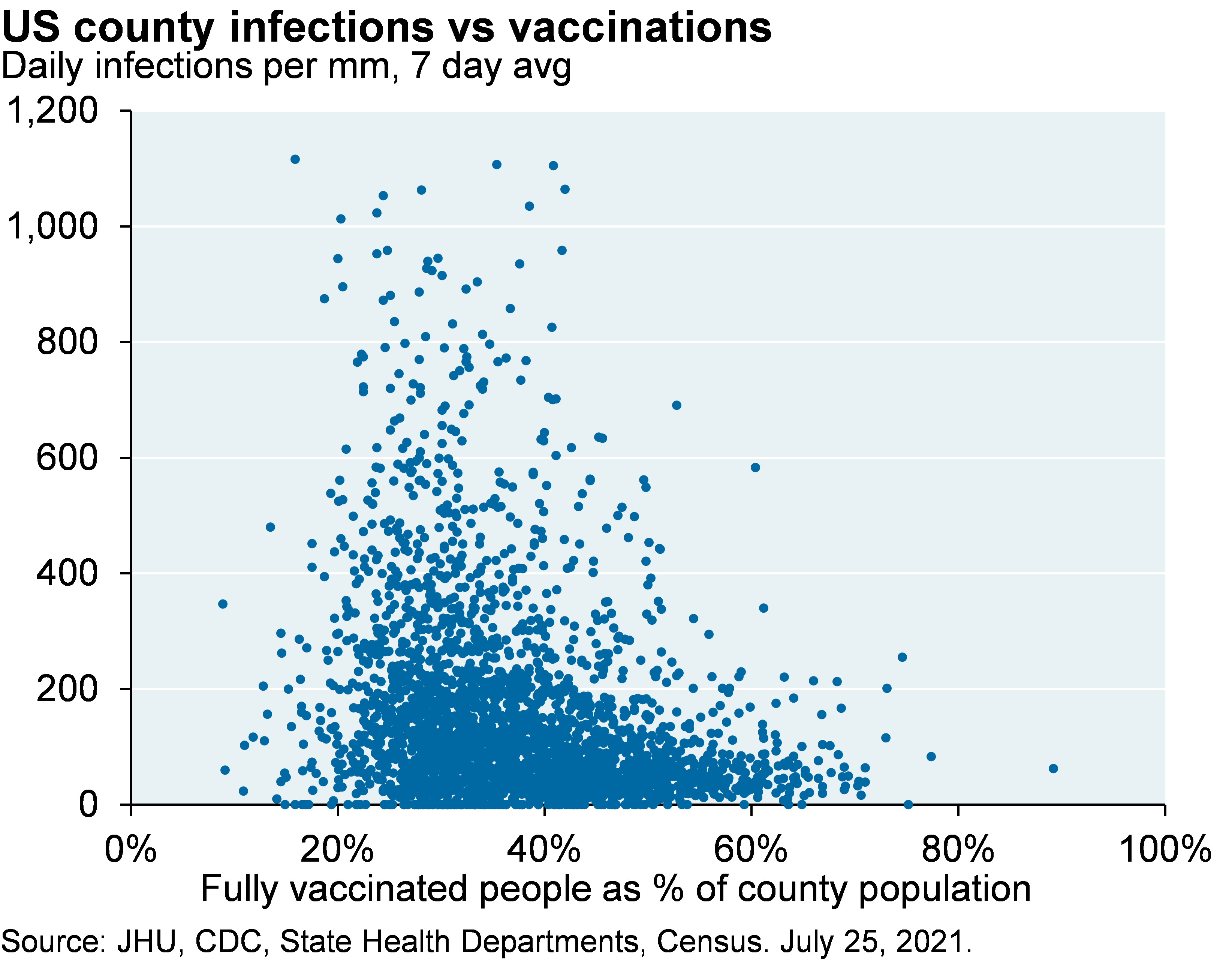

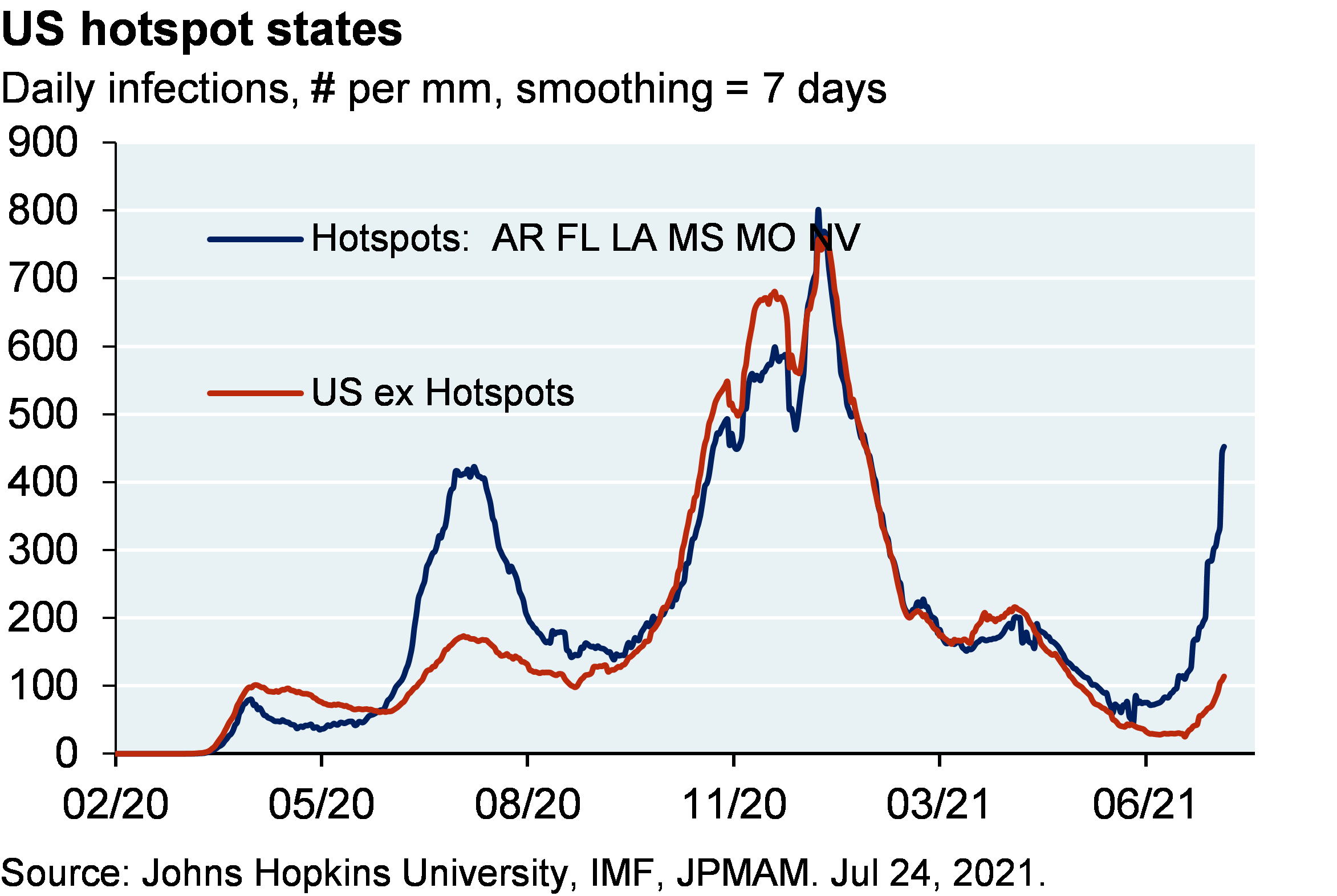

While US vaccine resistance is not the sole province of one political party, there are some clear ideological factors at work as illustrated below. Now that the more contagious Delta variant has become dominant in the US, some unvaccinated members of the GOP may reconsider resistance/reluctance to receive medically proven vaccines. Or maybe not: even though 95%-99% of recent hospitalizations involve unvaccinated people, an Associated Press poll found that 80% of unvaccinated Americans “definitely” or “probably” won’t get vaccinated. To round out the week, a conservative talk show host wondered if Florida’s Governor was being bribed or threatened after he encouraged Floridians to be vaccinated.

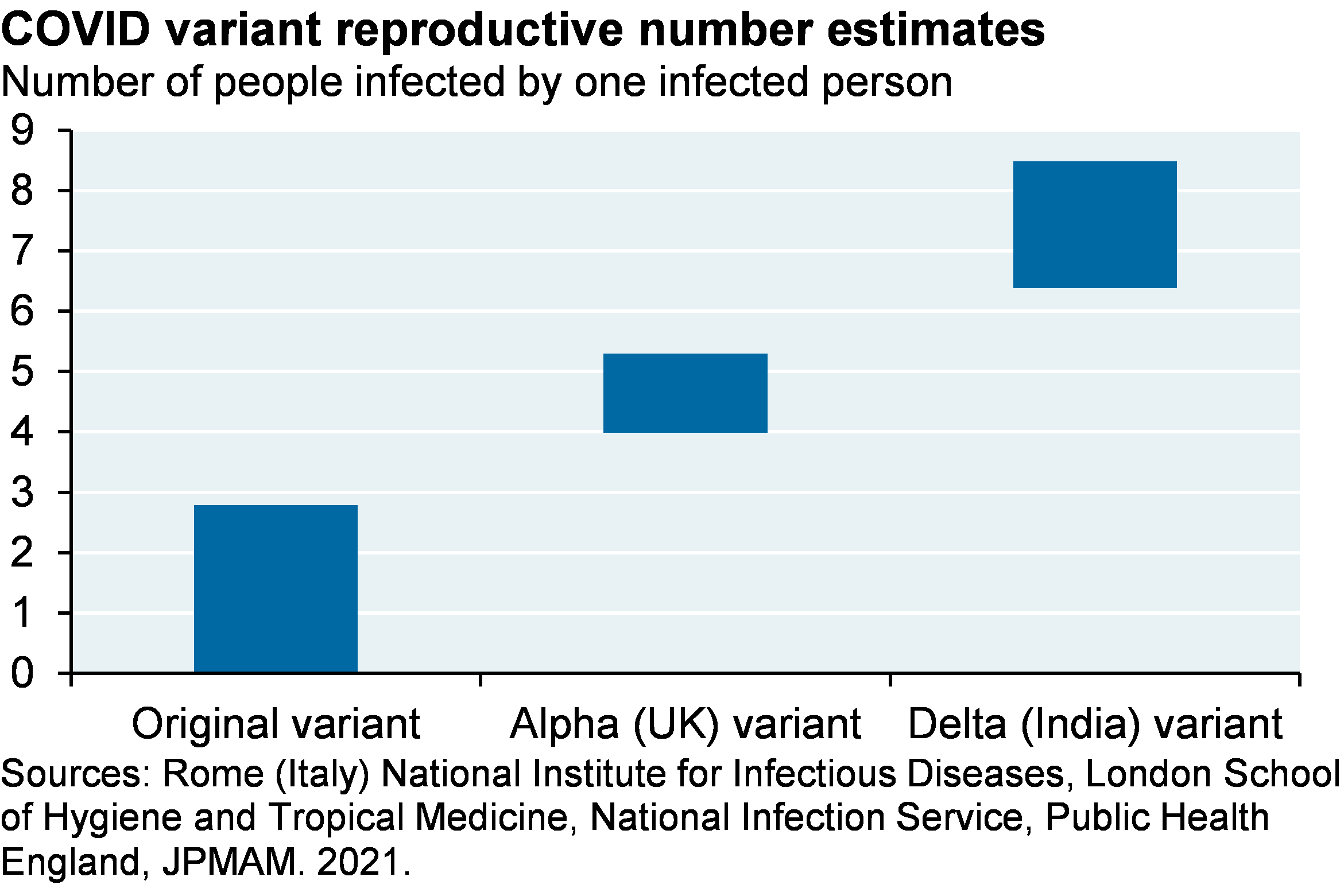

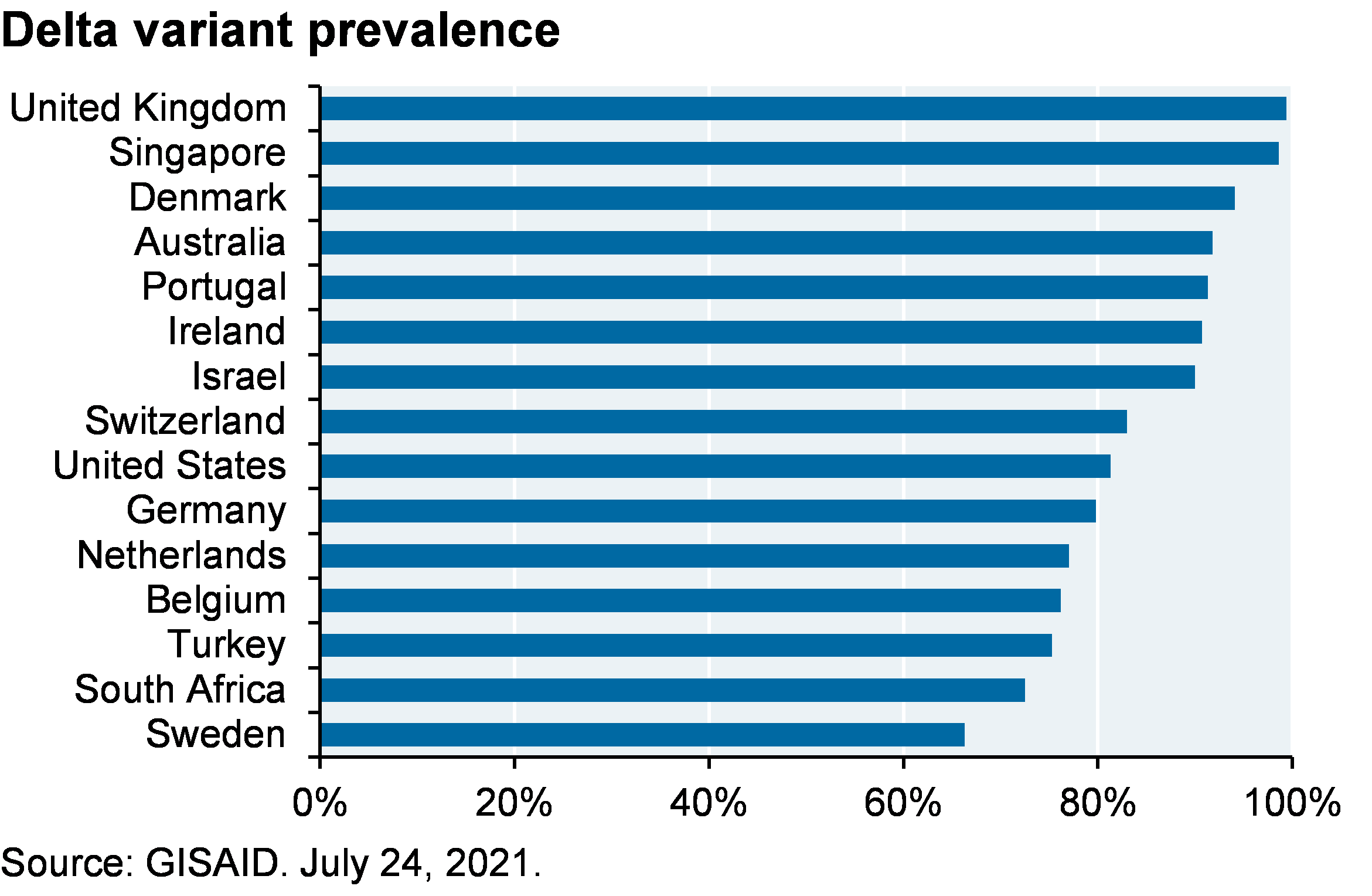

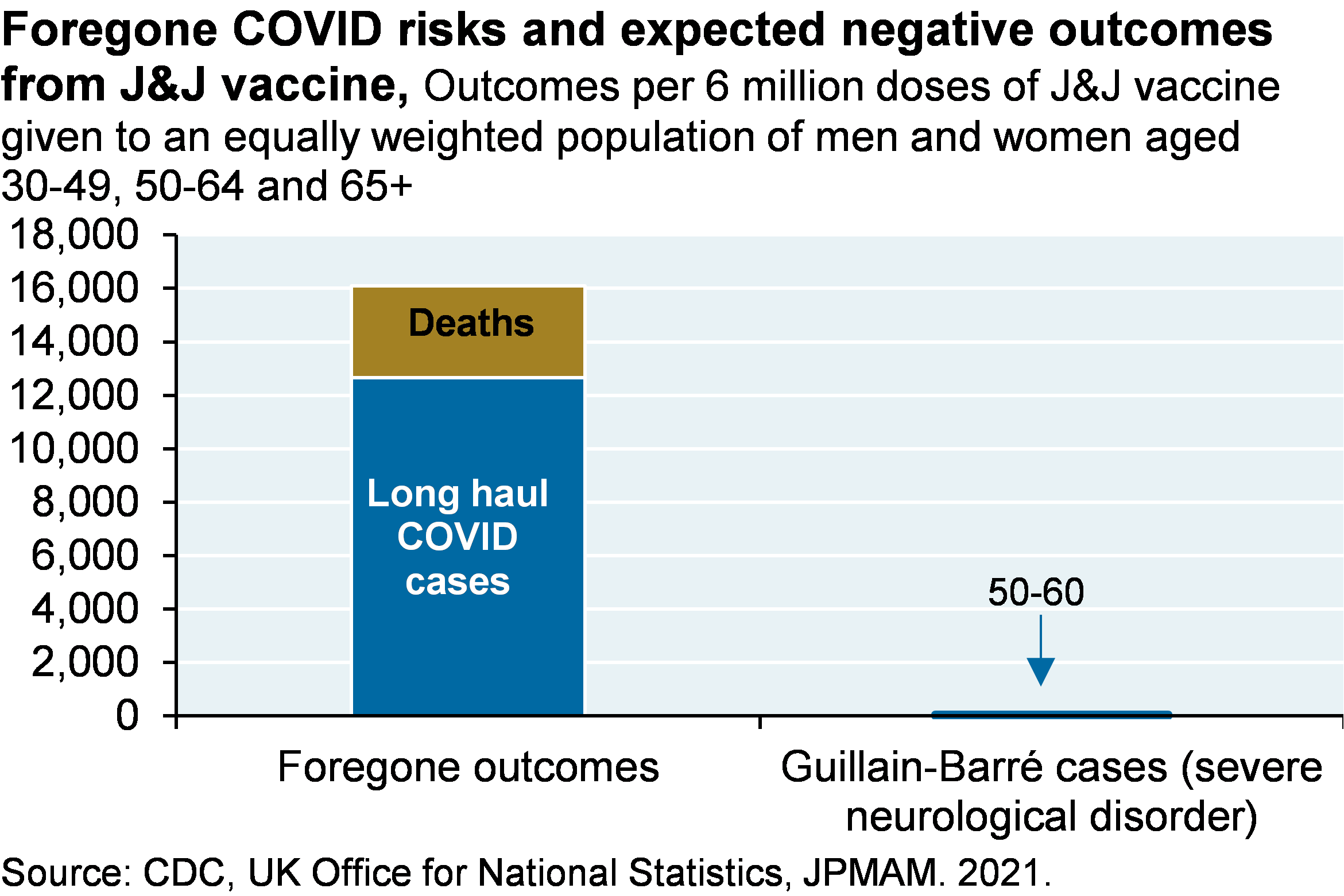

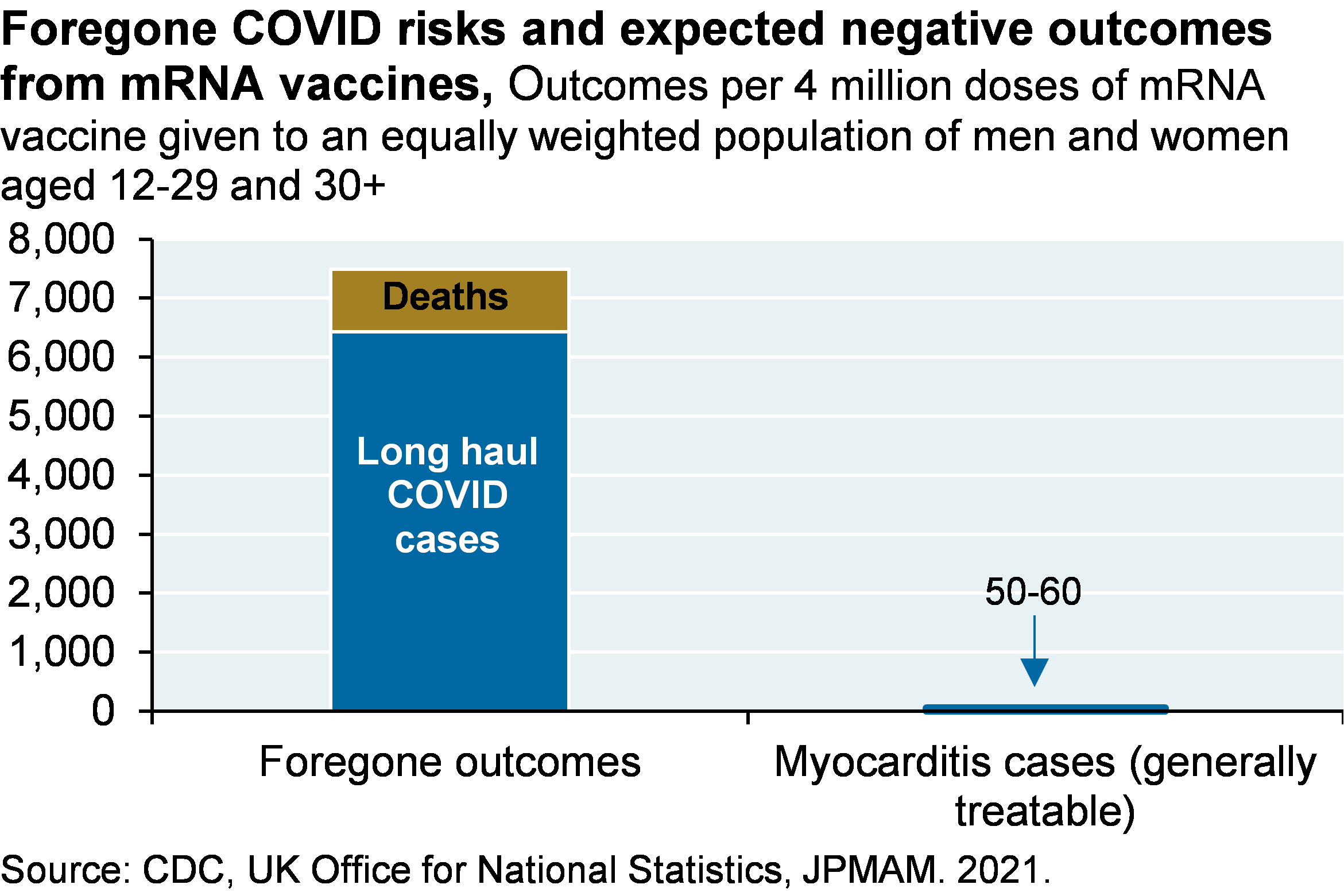

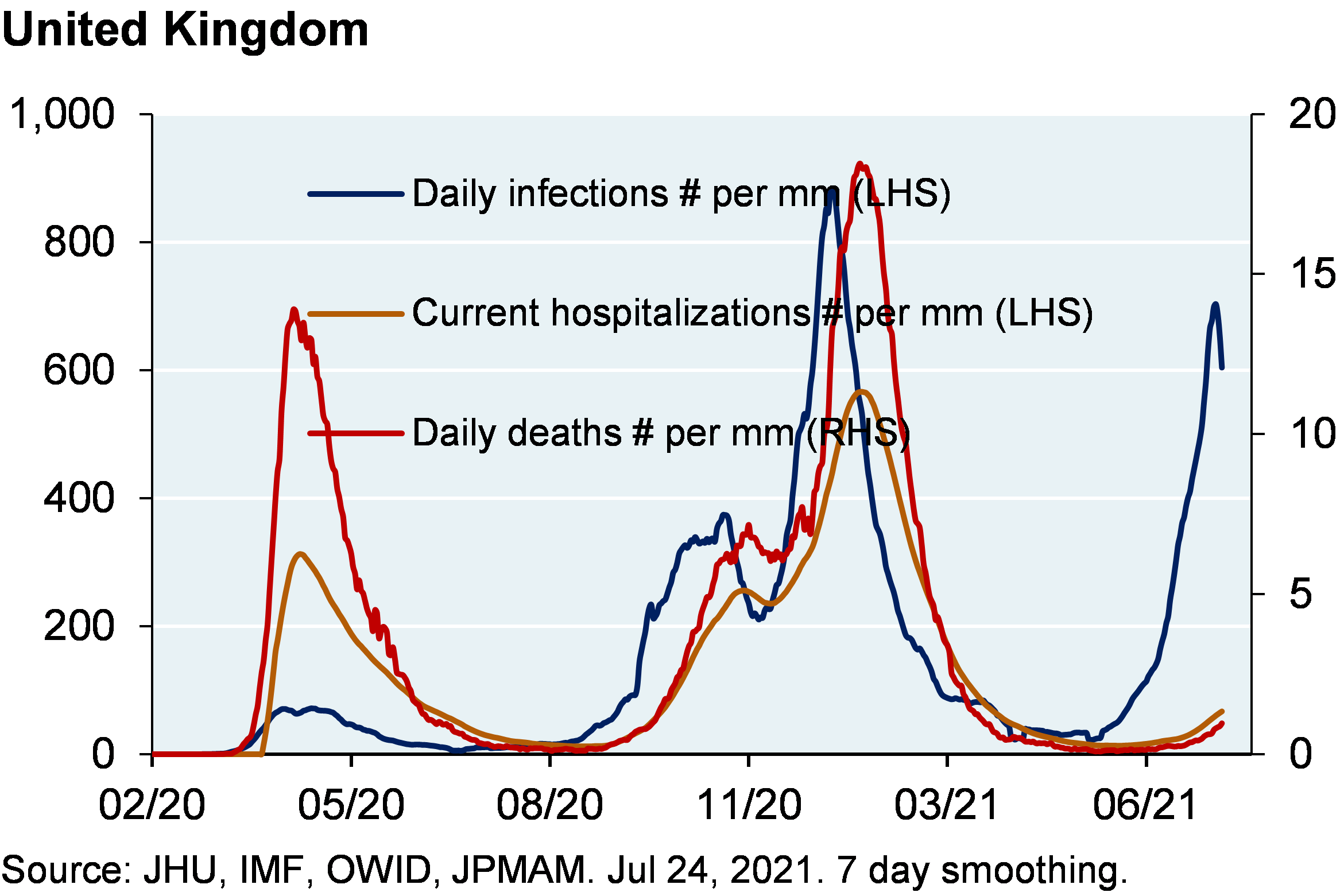

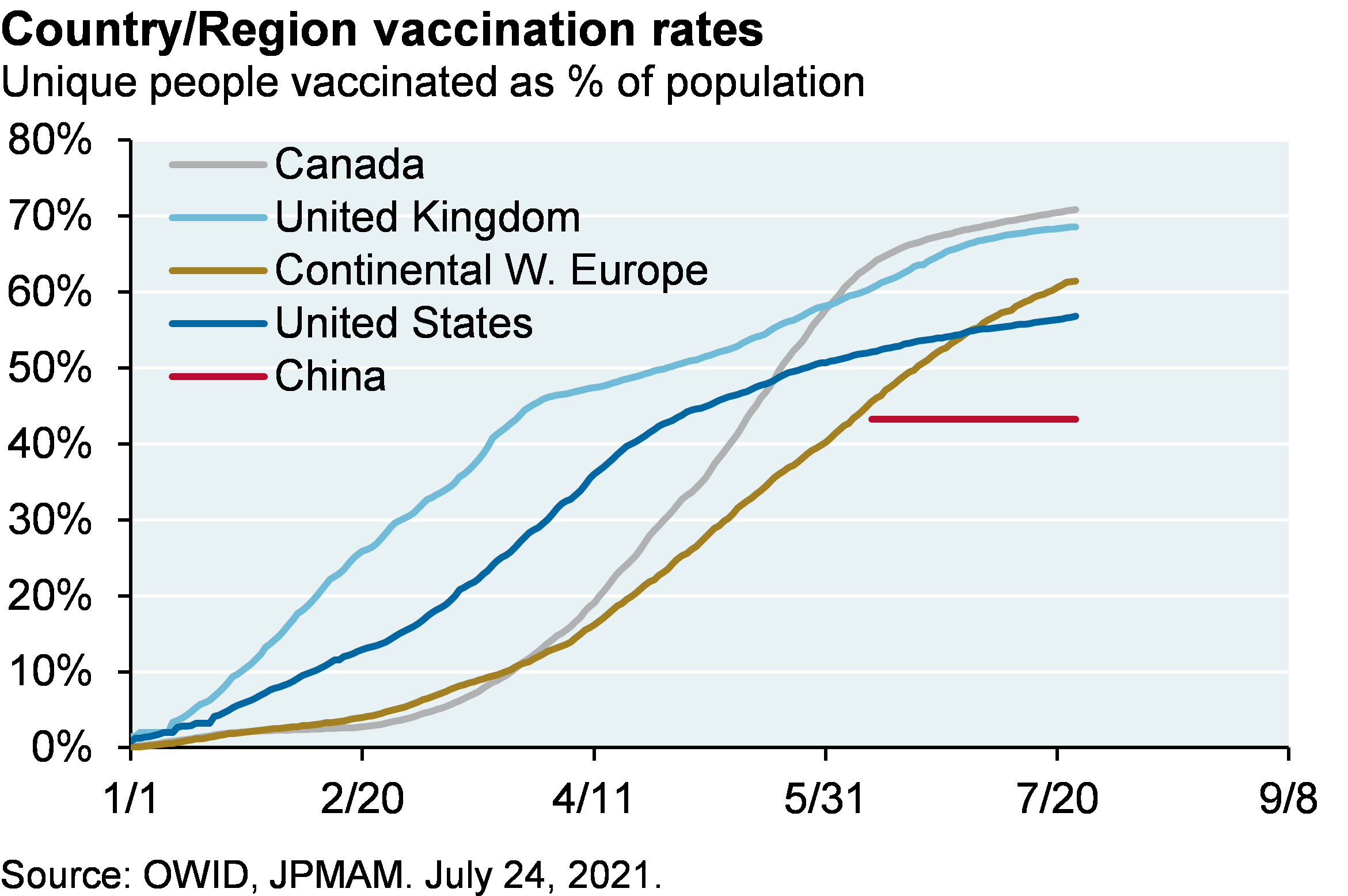

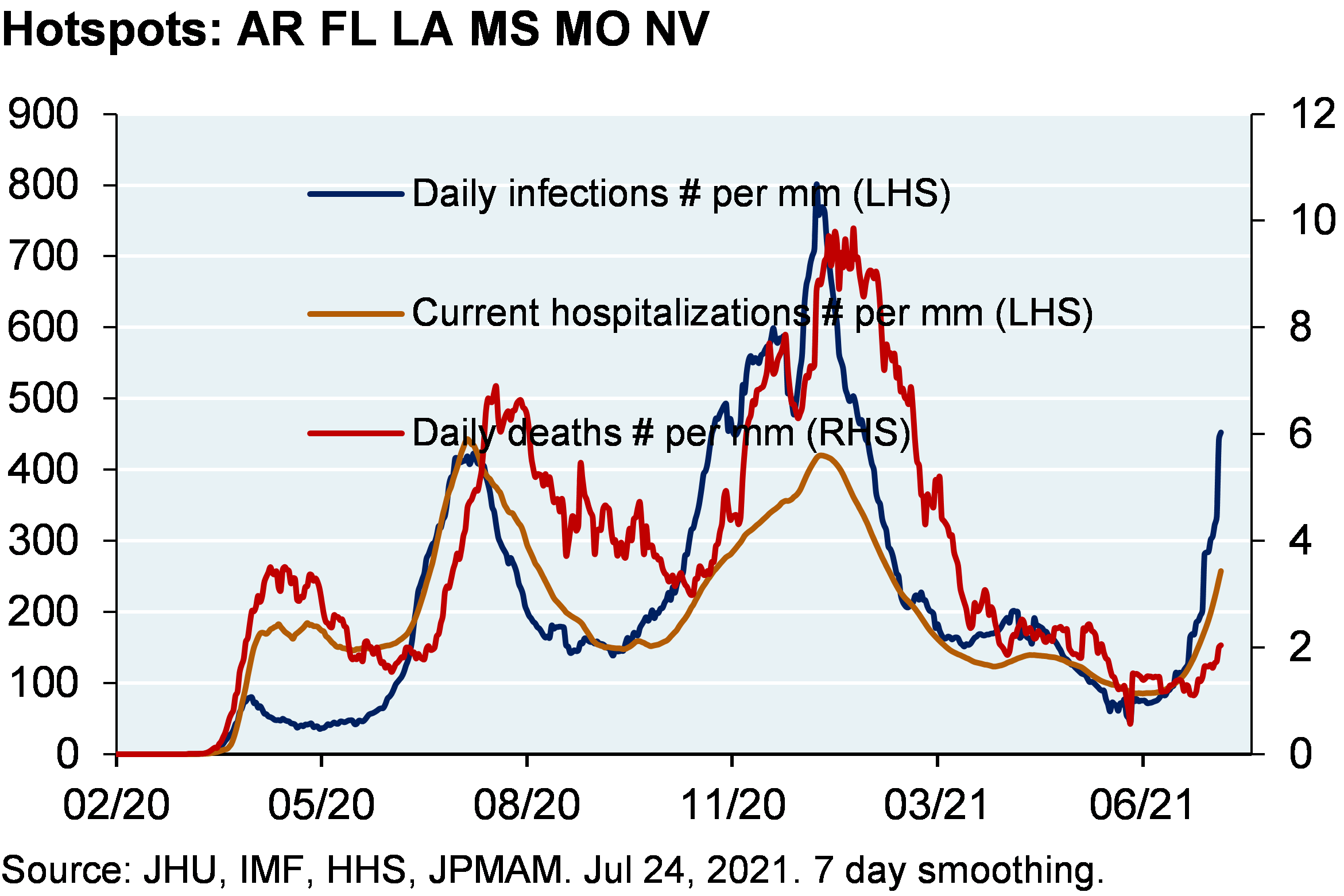

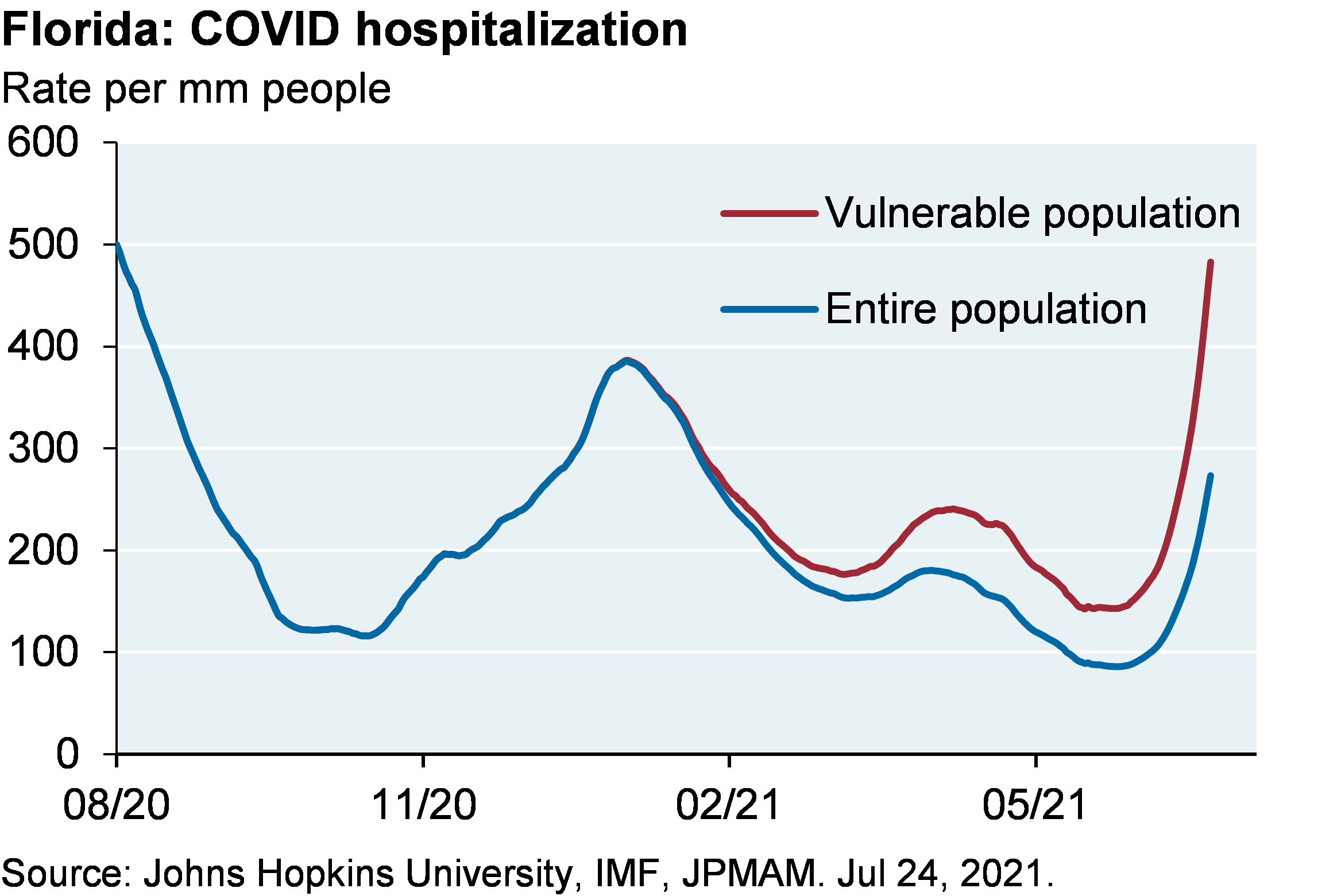

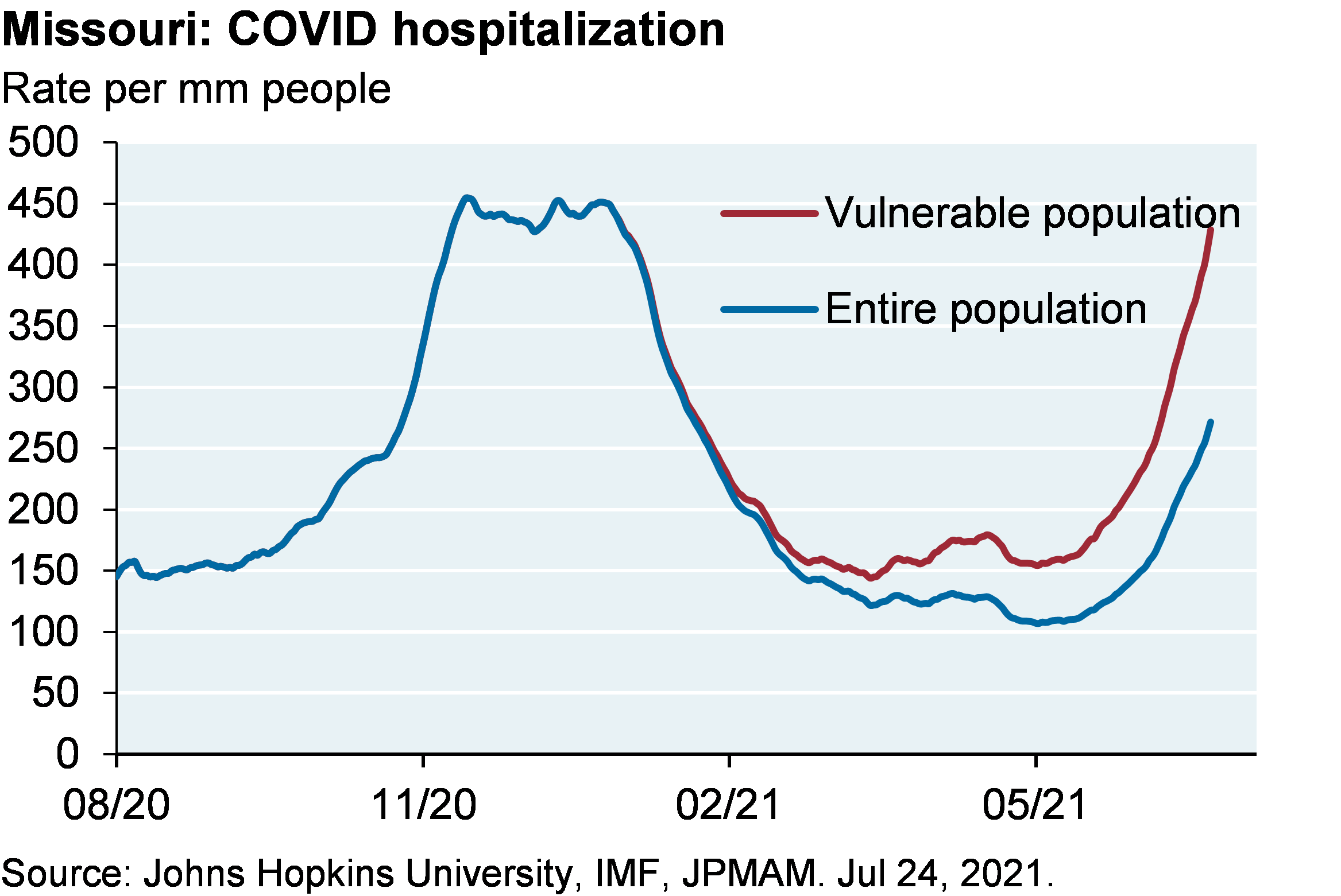

Higher reproductive number estimates for the Delta variant have prompted some to wonder whether the US or other countries will reimpose lockdowns. My sense is that it’s probably too late for that given the prevalence of the Delta variant already. The risk-reward of mRNA and vector vaccines seems pretty clear to me (see charts below), but to each his own. In any case, the bottom chart shows that vaccines are “working”.

For detailed CDC reports on foregone COVID cases, hospitalizations, ICU admissions and deaths vs adverse vaccine outcomes, for mRNA vaccines see here:

https://www.cdc.gov/mmwr/volumes/70/wr/mm7027e2.htm#T2_down

and for the J&J vaccine, see here:

https://www.cdc.gov/vaccines/acip/meetings/downloads/slides-2021-07/05-COVID-Rosenblum-508.pdf

Note the low pass-through from infection to hospitalization and mortality in the UK. I’m optimistic about this, but some of my colleagues believe it’s too early to draw conclusions. More importantly, the UK has vaccinated 95%+ of its age 65+ population. In the US, the same figures are 10%-15% lower depending on the state you’re looking at, and even lower in certain counties. In Missouri and Florida, COVID hospitalizations among the vulnerable (almost all unvaccinated people) are almost as high as they were last winter.

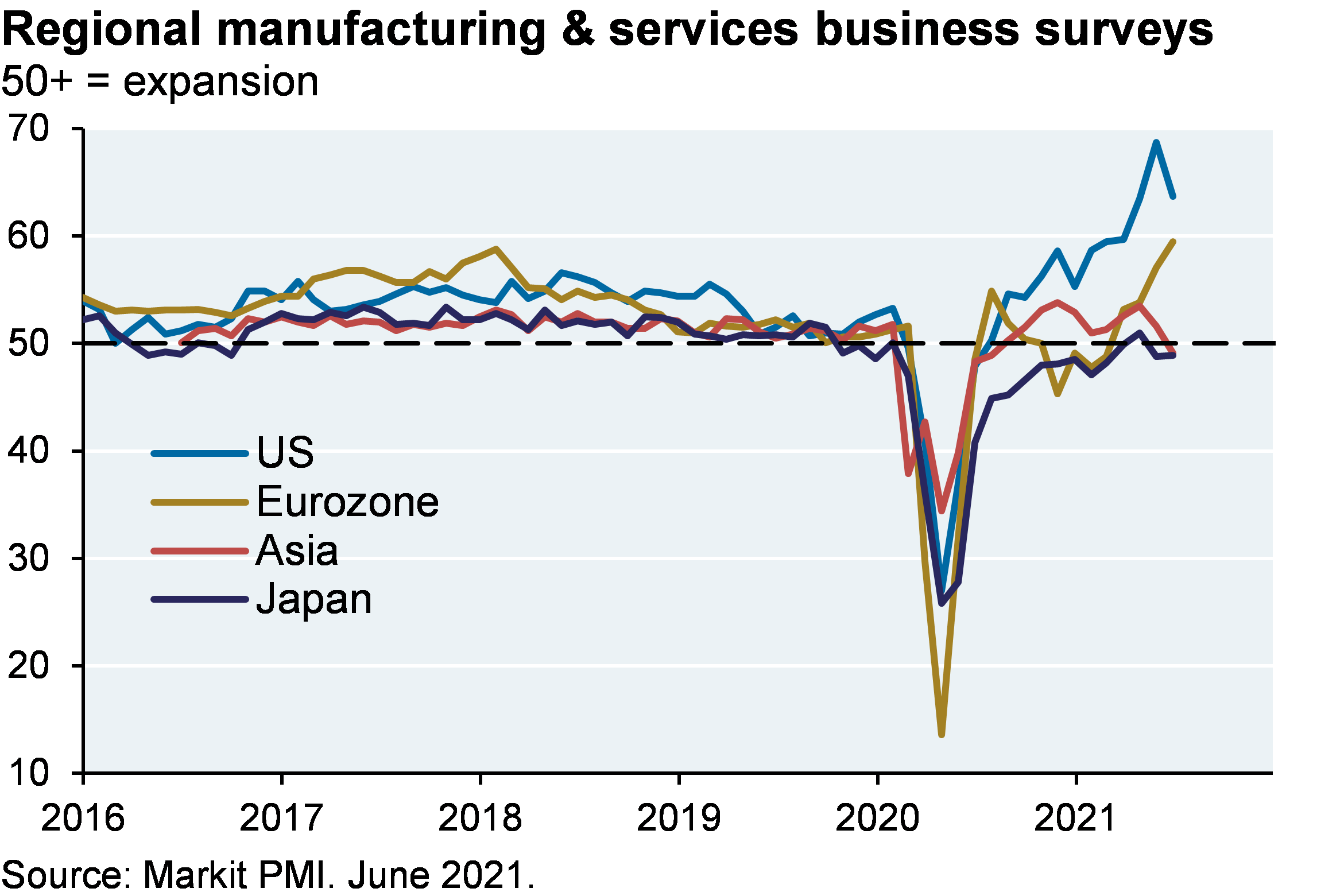

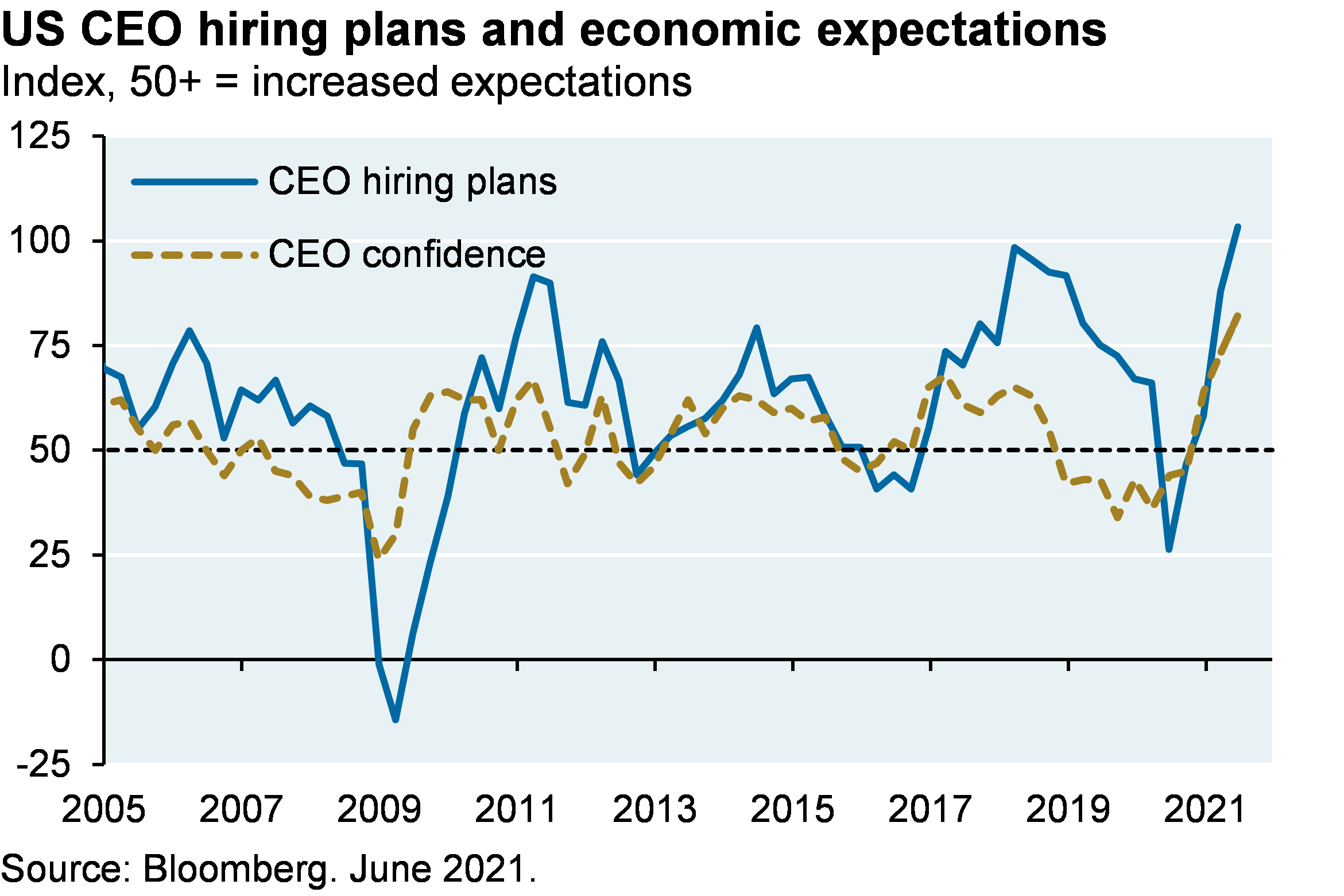

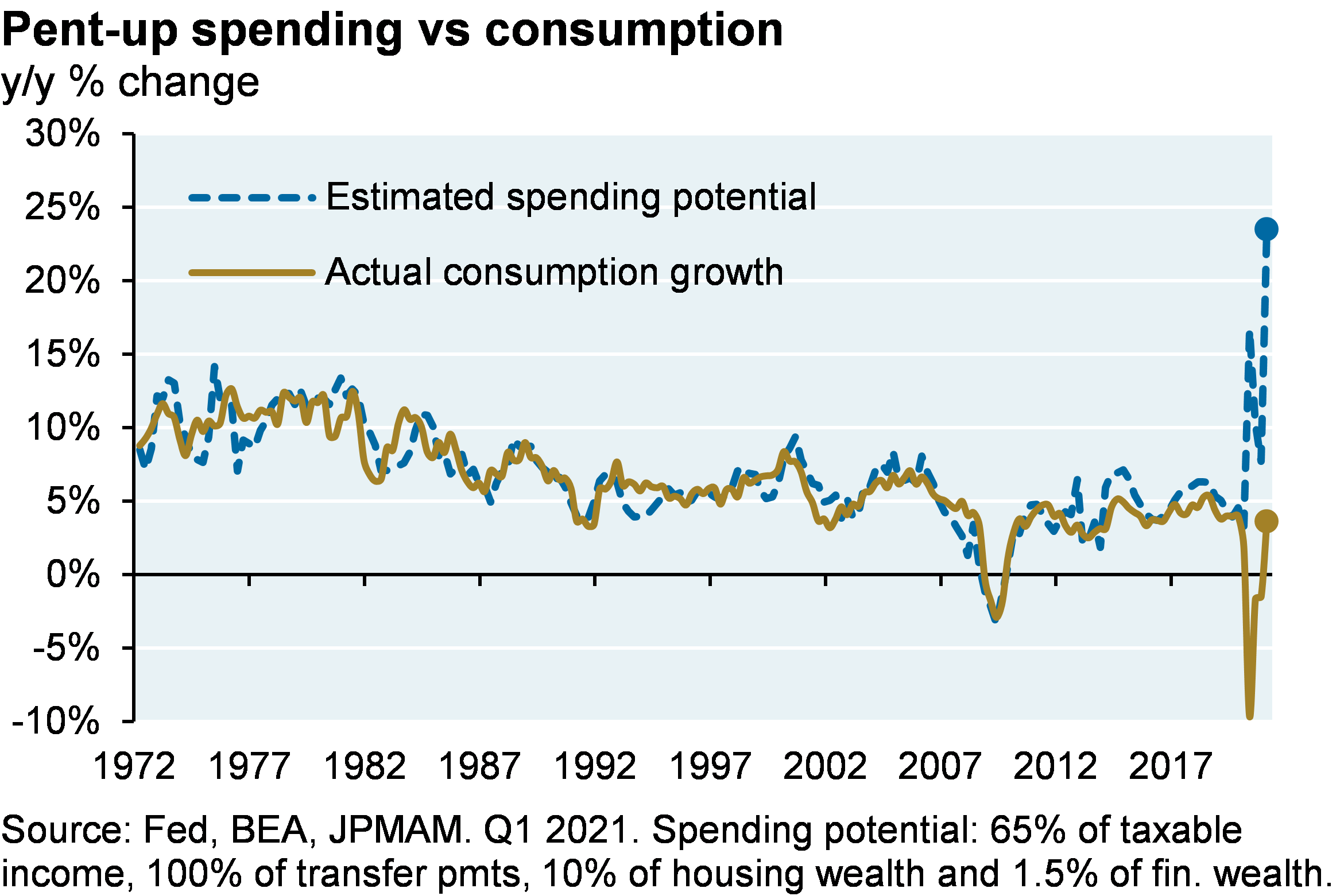

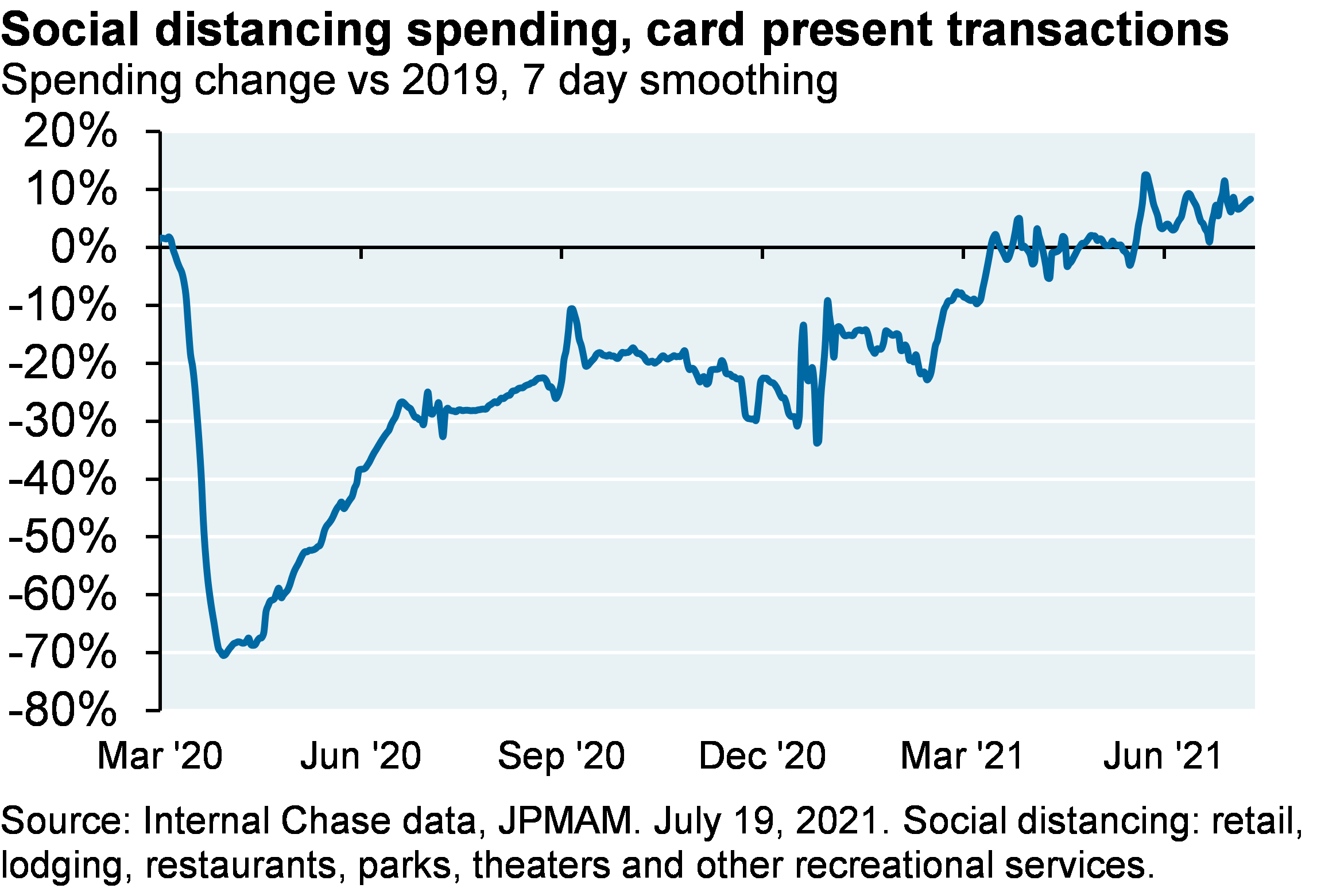

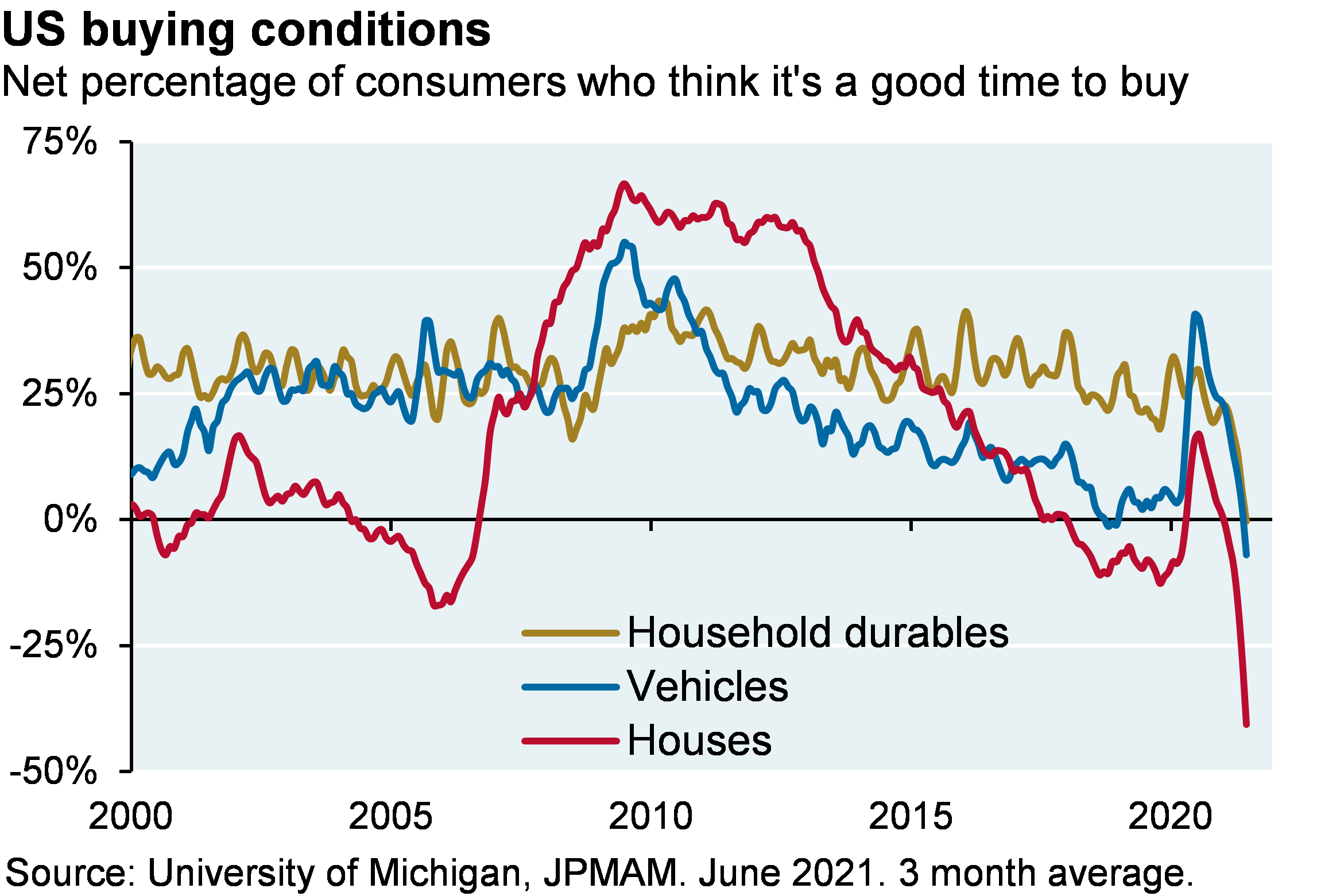

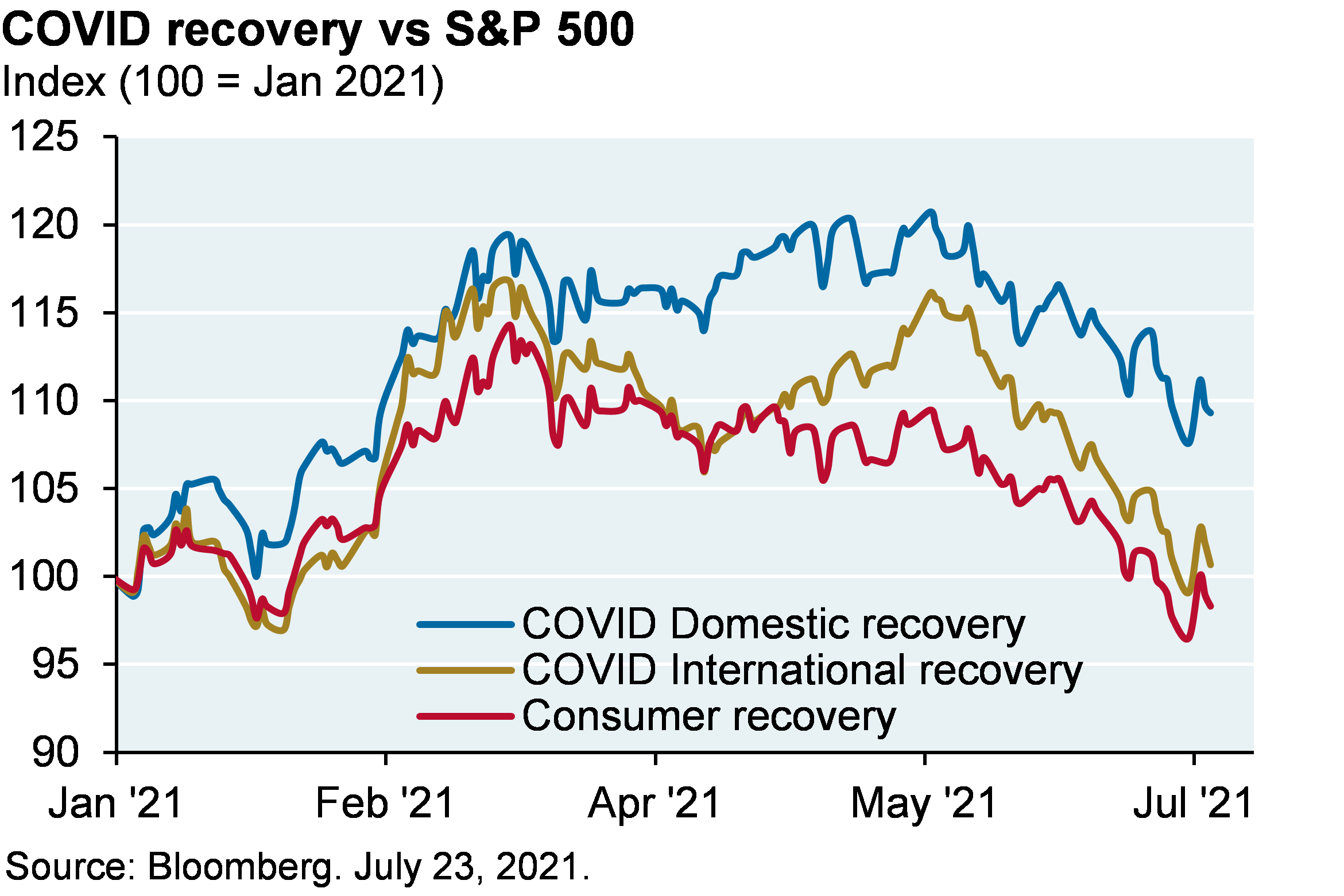

In the prior note, I wrote that I did not expect lockdowns in the US irrespective of how bad the Delta variant gets. I still expect that to be the case; if most unvaccinated people still refuse to be vaccinated, how could a governor justify locking everyone down to protect them? In any case, here’s an update to US recovery metrics we follow. US manufacturing and services are still firmly in expansion mode, CEOs are very confident and plan to do a lot of hiring, retail inventories are at their lowest levels in 25 years relative to sales, and there’s still a lot of pent-up spending potential relative to actual consumption. The negatives: prices for homes and consumer goods have risen so much that consumers may now slow down their purchases, which when combined with the Delta variant, has prompted a rollover in “COVID recovery” stocks.

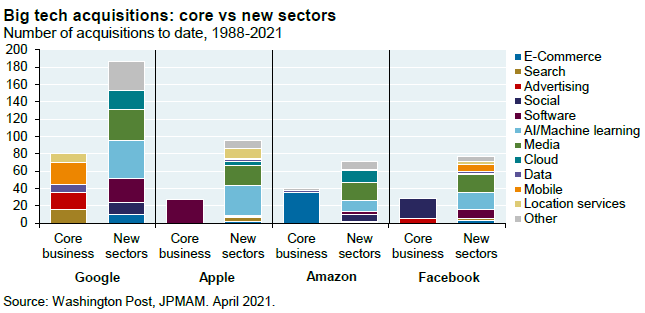

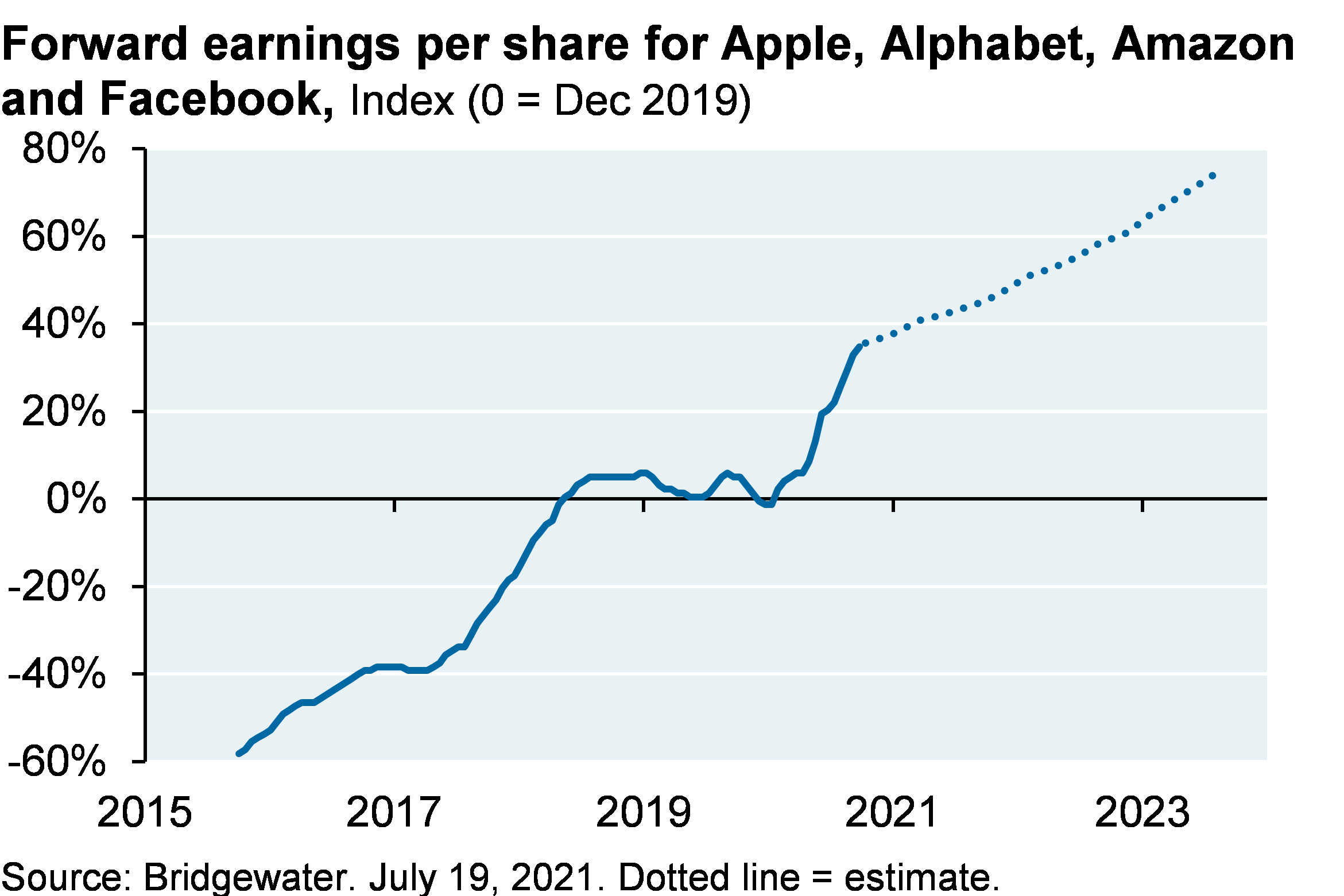

Reliance of the big 4 tech/social media stocks on acquisitions to fuel growth

We will discuss this in more detail after Labor Day, but given the impact of these stocks on the broad market, an anti-trust revival might curtail these kind of acquisitions. It’s too soon to tell since we have no idea which (if any) proposals from the House Judiciary Committee will be enacted as legislation or implemented as an Executive Order. But this is one of the more important political questions to consider as we head into the fall, since as shown below, the market expects little to no impact of anti-trust regulations on the big 4’s earnings.

Investor Odds & Ends: S&P earnings, NYC hotels, and the latest on personal, corporate and int’l taxation

- With a quarter of S&P 500 companies reporting, 88% have beaten consensus EPS expectations and 86% have beaten consensus revenue expectations

- The US CBD office utilization measure we track on our virus portal is at 50% for Texas cities but only 20%-30% elsewhere, among the lowest of all recovery indicators. In NYC, direct+shadow+sublet space has increased by 40 mm sq ft to 80 mm sq ft, compared to 25-35 mm sq ft increases after prior recessions

- A distressed hotel fund just bought the 725-room Lexington Hotel at $255k per key, which is a little more than half of what the seller paid for it in 2011. Permanent closures of nearby hotels (Omni Berkshire Place, Roosevelt) and new rules designed to slow NYC hotel development appear to be part of the fund’s investment thesis. NYC’s hotel industry is still in an “economic depression” according to the American Hotel & Lodging Association, with revenues down 67% vs 2019. Other cities in the AHLA hotel market depression list: Seattle, Boston, Minneapolis, DC, Chicago and San Francisco

- We don’t know how the tax landscape will change since the negotiations over the infrastructure and “human capital” bills are ongoing. But as a placeholder, consider the following: Biden’s original proposal included a 28% corporate rate on domestic income, no deferrals, and a 26.25% GILTI minimum tax after eliminating the exemption for normal returns and eliminating the commingling of foreign tax credits across countries (effectively moving back to a worldwide tax system); new higher taxes on oil & gas; a new SHIELD tax on foreign entities operating in the US; no commingling of foreign tax credits across countries; a cap on like-kind exchanges; full unification of capital gains and ordinary income tax rates for HNW individuals; and forced realization of capital gains at death

- We now believe that the negotiations are headed for a 25% corporate tax rate, a GILTI tax of 15%-19%, partial commingling of foreign tax credits, and possibly a minimum book tax of 15%-20% which we estimate would have a negligible impact on S&P 500 earnings; an increase in capital gains to 28% instead of full unification with ordinary rates; and a possible doubling of the SALT deduction from $10k to $20k. There’s a long way to go, but it is notable how different the possible outcomes are from the original proposal

- There’s a lot of talk about an international agreement on a minimum tax rate. However…how would this actually work? It falls apart considerably if countries do not accept a binding and universally applied definition of income, which means countries would have to agree to unify tax treatment for opportunity zones, R&D credits, drilling expenses, bonus depreciation, LIFO vs FIFO for inventory, bad loan write-offs, orphan drug credits, etc. Otherwise, countries would STILL be able to engage in tax competition with each other and have effective tax rates below the minimum level. This could take years to sort out and implement

In case you missed it: 2021 Eye on the Market archives

Red Med Redemption

Politics, vaccination resistance and the Delta variant; US economic recovery update; big tech reliance on acquisitions to fuel growth