Sustainable bond investing without borders

Our clients are increasingly looking for investment solutions that reflect not only their financial goals but also their values. Global Bond Opportunities Sustainable Fund invests flexibly across 15 fixed income sectors and more than 50 countries, building a high-conviction, sustainable portfolio with the potential to deliver enhanced total returns.

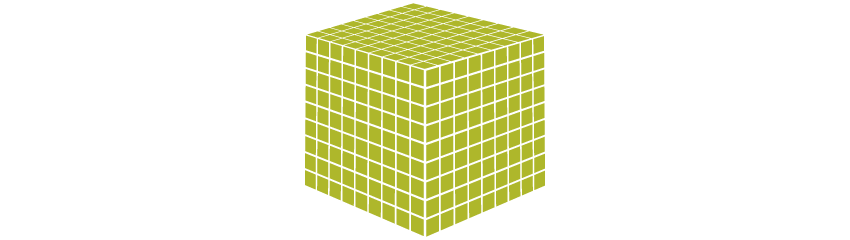

Building a sustainable portfolio

To build a sustainable unconstrained fixed income portfolio, we draw on the depth and breadth of our team of 270+ sector specialists. The shared values of our clients are reflected through a three-step approach that combines ESG integration in the research process with systematic exclusions and positive sustainable positioning.

ESG integration

Environmental, social and governance (ESG) risks are factored into research and decision-making across our entire global fixed income platform.

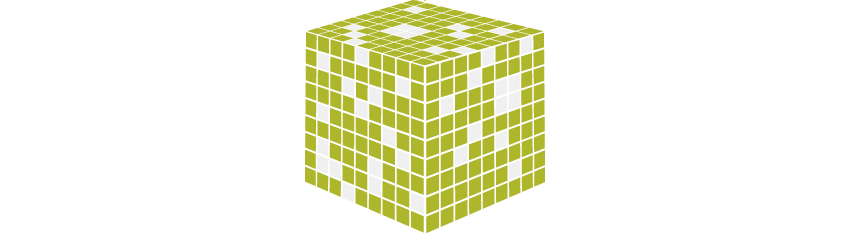

Exclusions

Systematic exclusions are applied to certain industries and sectors.

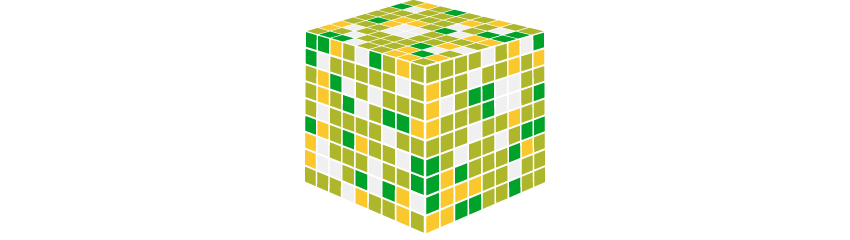

Positive tilt

The portfolio is actively tilted towards securities exhibiting positive ESG factors or momentum.

Jamaica's sustainable advantage in emerging market debt

Bond market sectors with the best ESG credentials – for example, developed market governments – often offer the lowest yields. Extended sectors such as emerging market debt offer more attractive yields, but headline ESG scores are lower and coverage by third-party ESG providers can be limited.

Our in-house research seeks to identify individual countries that offer better sustainability credentials and tilt the portfolio accordingly. Jamaica is one such example.

To develop our proprietary ESG index of emerging market sovereign issuers, we evaluated over 30 ESG indicators to identify those with the strongest long-term valuation impact. Using those indicators, we rank countries from 1 (worst) to 4 (best). We have ranked Jamaica 4, reflecting our view on the ease of doing business in the market and the progress towards addressing poverty and inequality. As a result, we have a positive tilt towards the country's bonds.