Emerging Market Debt Quarterly Strategy Q3 2022

Jedes Quartal treffen sich unsere Spezialisten für Schwellenländeranleihen zu einem Strategiegipfel und diskutieren die aktuellen Marktthemen und deren Implikationen. Erfahren Sie mehr in unserer englischsprachigen vierteljährlichen Publikation „Emerging Markets Debt Strategy“.

Pierre-Yves Bareau

In brief

- Risks continue to proliferate in China, the US and elsewhere. The ongoing war in Ukraine continues to have ripple effects across the global economy and makes the path forward for emerging market debt less clear.

- We see a 50% probability to our base case soft-landing scenario, which may offer a smoother return outlook in the medium term. This view is predicated on current inflation peaking, before gradually declining in the second half of the year.

- We now assign a 35% probability to our bearish scenario of slower global growth. In this environment we would seek to add longer duration, become more selective on risks and generally rotate from credit to duration risk.

- While valuations across emerging market debt have entered more compelling territory, fundamental headwinds, including China’s Covid response, slower US growth and global inflation, continue to pose challenges.

- We are looking for relative value across rates and currencies in emerging market local debt. Fundamentals at emerging market corporate issuers remain strong, though we are expecting some deterioration in credit quality over the next 12 months. The situation across emerging market sovereign debt is the least certain, although much of the risk appears priced in, especially in high yield.

At a crossroads

At our most recent quarterly meeting, as our team wrestled with the present predicament facing investors in emerging market debt, the situation reminded us of the opening lines of Robert Frost’s most famous poem: “Two roads diverged in a yellow wood, And sorry I could not travel both”. Like Frost’s traveller, investors in emerging market debt today also face an unavoidable and uncertain decision.

How did we get here? Two quarters ago, our quarterly meeting produced a more decisive outcome. We placed a high probability on a soft landing, arguing that the Federal Reserve (the Fed) would conduct policy in such a way that markets could navigate the exit from quantitative easing, and that the extra return promised by risk asset classes, such as emerging market debt, would protect investor downside through this process. By March, our optimism had fallen in the shadow of Russia’s invasion of Ukraine, and in our most recent meeting, we debated the varied impacts of the war, including the weakest year of performance in emerging market debt since the 2008 global financial crisis.

On the positive side, however, we noted that valuations across the emerging market debt universe have entered much more compelling territory. Hence, where to turn now is a complex question. To ty to gain clarity, we first look at the three main macro risks for emerging market debt as we see them: China’s slowdown; a potential US recession; and the rise in global inflation.

China slowdown risk

Russia’s invasion of Ukraine is not the only headwind currently challenging our asset class. China, the USD 13 trillion economic engine at the heart of the emerging market debt universe – is currently locked down as the country’s health authorities battle Covid 19 and its derivatives. The result is a pronounced economic slowdown, producing a host of negative outcomes, including rising youth unemployment and softening real estate sales. In response, we have cut our growth expectation for the Chinese economy to 4% in 2022.

Chinese markets have endured a difficult year, marked by foreign net outflows from onshore markets. While Chinese equity prices may reflect some investor cynicism, bond investors may have more reason for optimism. Not least because China’s government is preparing a substantial fiscal expansion to propel the economy away from recession. If China was to ease its lockdown, the impact on emerging market debt would likely be immediate, telegraphed through investor expectations and trade volumes alike. The Chinese currency looks expensive at present, but so does the US dollar; we think Chinese policymakers might seek to track any weakness in the dollar as the US economy normalises away from exceptionalism.

US recession risk

The risk of a US recession is another concern. Looking at financial conditions, we see evidence that the market is ahead of the Fed. In our view, the risk of recession is not imminent, although it increases into next year. The greater immediate concern is the potential for a US slowdown. As US growth trends lower in response to tightening financial conditions, the economy is vulnerable to being tipped into recession by external shocks.

Pushing back against this risk is the US consumer, who enters this period in robust health. In previous recessions, the private sector financial balance – a measure of private sector financial health – has been negative. In contrast, the private sector financial balance is currently positive, thus providing an additional cushion to the US economy that we think should slow the economy’s downward glidepath as it enters a period of sub-trend growth in the fourth quarter.

Inflation risk

Global inflation also continues to challenge the countries in our coverage. Worth repeating is an observation from one of our analysts, who noted that emerging market countries had been encouraged to borrow when times were good; with the Fed now raising rates to attack rising US core inflation, these countries face a global growth slowdown that might challenge previously solid fundamentals. To be clear, we do not see a default crisis ahead; if anything, fundamentals in emerging markets have proven their worth in the current testing times. However, worsening economic conditions may yet prove a challenge.

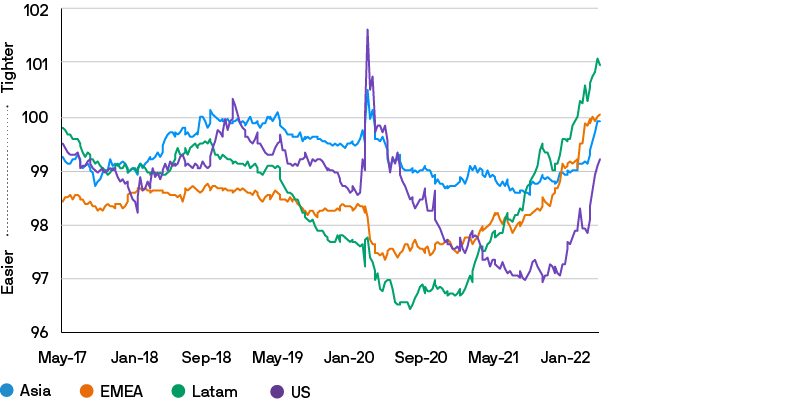

Financial conditions are tightening across all regions, led by Latin America

Exhibit 1: Emerging Markets Financial Conditions Index

Source: Bloomberg, J.P. Morgan Asset Management; data as of 26 May 2022.

When and where inflation peaks are critical questions for us. Many emerging market central banks appear to be nearing the end of their tightening cycles just as the Fed begins its own. In our view, the optimal time to engage with many of these countries is just before that final, cycle-topping hike. In time we may come to see that peak US inflation has passed, though confirmation of this trend would elevate interest in emerging market risk. A cooling of US inflation would encourage investors to step into less-crowded, longer-duration hard currency bonds with their higher yields. While many investors are keen to exit crowded positions in double- and single-B names, moving too early may prove too expensive.

Where to turn?

Taken collectively, these risks lead back to our central dilemma, with much of the debate in our meeting focused on understanding how a more bearish scenario might unfold. We think a more bearish outcome might transpire should inflation persist, perhaps fuelled by supply disruption, which in turn might cause further tightening of financial conditions. Policymakers would find themselves on a constrained pathway; as demand shrinks, commodity prices might fall, though we think commodity prices would remain volatile. These factors would result in a period of slower global growth, an outcome that we assigned a 35% probability. In this scenario, we’d look to add longer duration exposure and become more selective on risks, while rotating from credit to duration risk as a whole.

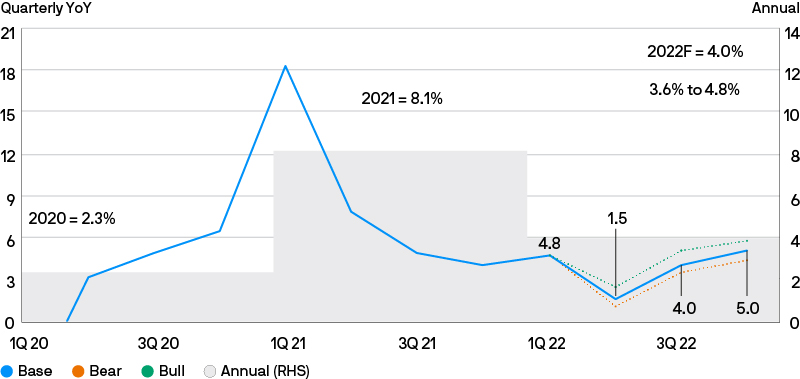

Our base case expectation is for 4.0% GDP growth in 2022 for emerging markets

Exhibit 2: Emerging market economic outlook scenarios

Source: Bloomberg, J.P. Morgan Asset Management; data as of 31 May 2022.

The other pathway is a soft-landing, which may offer a smoother return outlook. At our meeting, we assigned a 50% probability to this scenario, which is our base case view. We think emerging market growth is likely to show sequential improvement and power ahead of developed market growth. This view is predicated on current inflation peaking, before gradually declining in the second half of the year. If inflation cools, we expect financial conditions to moderate, as the pace of tightening would slow. In this scenario, differentiation in fiscal and monetary policy would continue to provide ample opportunity for asset allocators, with supportive commodity prices probably playing a role in guiding those allocations. We temper these comments with a reminder that elevated volatility could continue, both in commodities and elsewhere in the emerging markets complex.

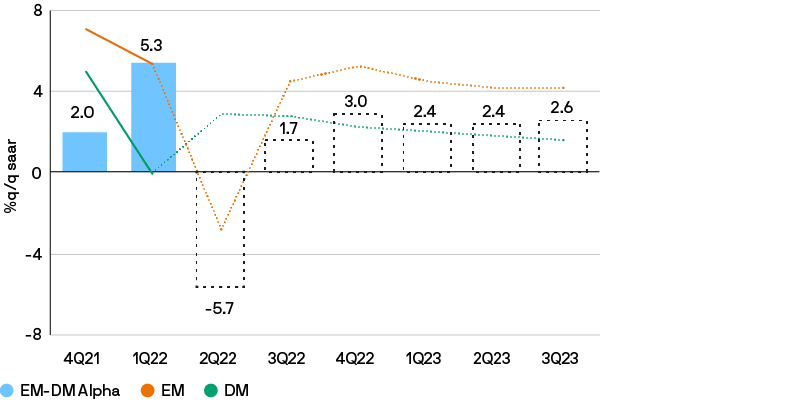

Emerging market growth is set to power ahead of developed markets through the rest of 2022

Exhibit 3: Emerging market/developed market growth alpha

Source: Goldman Sachs, J.P. Morgan; data as of 31 May 2022.

Emerging market local currency: Stepping into relative value

Relative value remains the name of the game in emerging market local currency debt, across both rates and currencies. With inflation having peaked or peaking, we believe the market will look for confirmation before engaging, which in turn gives us time to reflect views. We think the most compelling trades in emerging market local debt are those that offer carry or commodity exposure with less US dollar bias. We are comfortable adding duration where we see a buffer to inflation or where we are closer to the end of the cycle; hence we may gradually add duration over the course of the current quarter. In our view, one key allocation challenge is our perception of a higher fat-tail risk than in previous quarters, which influences our decision to maintain a somewhat conservative footing. In constructing our portfolios, we will be mindful of recession risks and inflationary upside.

Within the local currency space, we have downgraded our conviction on fundamentals by a notch, noting that the increasing mix of weaker growth and higher inflation presents a real challenge for emerging market local debt returns. However, this is offset somewhat by the emerging market rate cycle, with several central banks getting closer to the end of their hiking cycles. In some ways, the market has moved ahead of the real economies in emerging market local debt, with the case for local rates supported by high nominal yields, while fundamental anchors in emerging market currencies – such as the US dollar and Chinese yuan – look better priced. Hence, we prefer carry and commodity-linked currencies in the current quarter.

Above all, we think positioning has been reduced to levels that are consistent with positive entry points, in both emerging market currencies and rates. Geopolitical risk remains a concern, but any clarity on geopolitical outcomes could help unlock the opportunity the space offers.

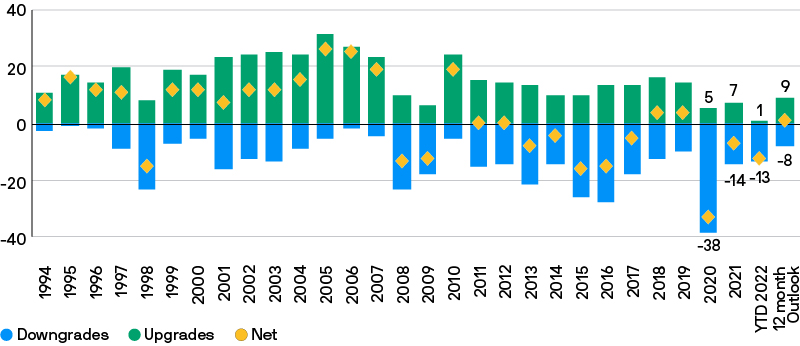

Emerging market corporates: At a tipping point

Balance sheets for emerging market corporate issuers remain strong, though not as strong as 12 months ago, when emerging market corporate debt offered the best fundamentals we have seen. This may change as we approach a tipping point in the business cycle, as we look for more issuers to experience credit quality degradation over the next 12 months. So far, that degradation has been mild, though we expect more differentiation as some sectors face lower growth and potential margin pressure. We think commodities and banks will emerge as winners, while property, consumer, and technology, media and telecom names may lag.

Despite the quality on offer, emerging market corporate spreads have widened over the period; however, the asset class offers little relative value versus peers. From current levels, it is difficult to find a driver for tighter spreads except strong growth and falling inflation, which seem unlikely. We think spreads are likely remain stable in the period ahead, unless growth slows and margins compress. We are encouraged by high cash buffers at companies, which means refinancing risk will be concentrated into particular sectors, such as Chinese real estate. On the technical side, outflows have been balanced by negative net supply, which has helped stabilise pricing. We think technicals will remain weak, especially if conditions continue to deteriorate, even mildly, over the next 12 months.

Our default rate forecast has ticked up, though the bulk of this exposure is in China, where we are focused on the real estate sector. Other risks are more geopolitical in nature, such as escalating tensions around Russia’s invasion of Ukraine or increasing political rivalry between China and the US that further disrupts supply chains. At present, very few names in the Russia complex have defaulted.

A longer-term risk is that globalisation, as a concept, is coming under pressure in subtle ways. We expect this pressure to influence and challenge issuers gradually over the long term. Globalisation enabled China to become key to the global value chain, though that process has started to evolve as China’s advantaged position becomes more clear. The evolution of globalisation is likely to be a slow and complex process that will produce both winners and losers in the emerging market corporate debt space.

Over the long term, we think oil and gas companies may see margins benefit, with the consumer suffering weaker margins as a result. Our calculus could be changed by geopolitics, or a shift in Chinese activity levels – for example, a Shanghai reopening could easily support commodity prices and trigger a shift in returns.

Upgrades to downgrades are expected to be balanced over the next 12 months in the emerging market sovereign debt space.

Exhibit 4: Emerging market sovereign rating upgrades to downgrades

Source: J.P. Morgan Asset Management, International Monetary Fund, Bloomberg. Rating outlook does not include changes between CC/C/D as often temporary/technical.

Emerging market sovereign debt: Uncertainty clouds the outlook

Nowhere is the path ahead less clear than in emerging market hard currency debt, where we see a strong technical story in conflict with uncertainty around future macro developments. Concerns are numerous: as the likely pathway for inflation combines with growth concerns, especially in the developed world. In our view, China’s zero-Covid approach continues to slow the Chinese, Asian and wider emerging market economies. In turn, that slowing creates fundamental pressures on credit quality in emerging market debt. Yet the situation could change quickly: Beijing could unlock with a single policy change while developments in Ukraine could greatly influence investor appetite for emerging market risk.

One positive aspect of the current emerging market sovereign debt environment is that much of the risk is already priced in, especially in high yield. For example, investment grade bond prices have generally remained better anchored than their higher-yielding peers, which have seen spreads over investment grade widen steadily over the last 20 years.

At present, it is easier to like investment grade fundamentals than to become positive on valuations. In part, this valuation anchoring reflects the more diverse sponsorship the space has attracted as it has grown. while it can also be explained by diverging fundamentals. We continue to see select BB names offering value through idiosyncratic stories, though many are crowded.

A similar problem exists in the single B space, where the market appears focused on individual delta. With overall yields high, we think the trigger for a potential rally probably lies in spreads and that emerging market hard currency debt becomes more compelling when valuations can more fully offset risks.

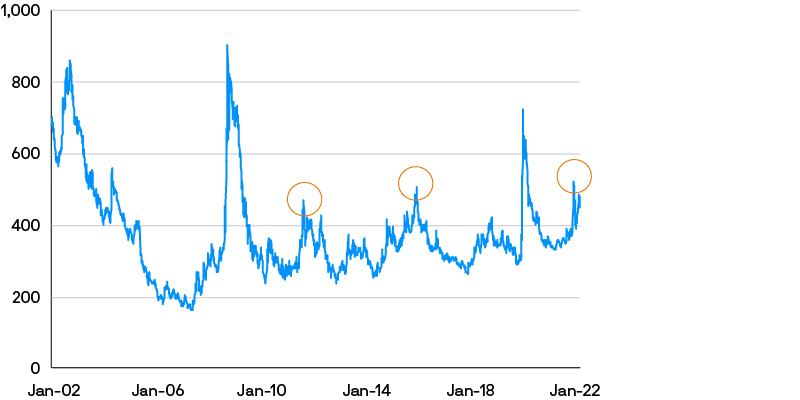

Periods when sovereign spreads are above 500 basis points have typically been buying opportunities.

Exhibit 5: Emerging Market Bond Index Global Diversified Spread

Source: Bloomberg; data as of 6 June 2022.

Conclusion: Looking for direction

As we approach the halfway point in the calendar year, it is fair to ask whether the second half will prove as challenging at the first. Running our finger down our table of annual performances, we find emerging market debt performance in the first half of this year as bad as in any full year since 2008, a period that saw the collapse of Lehman Brothers and the subsequent global financial crisis. In making that comparison, we are mindful that 2009 presented one of the strongest buying opportunities ever, as hard currency sovereigns rallied 84% between 2009 and 2013.

Currently, our own models expect a 10% return for the Emerging Market Bond Index over the next 12 months; we expect 2022 returns will be down 7.1%. We are more optimistic about local currency debt, where we see a 12.9% return over the next 12 months, with a flattish performance expected for the rest of this year. Given these expectations, we are reminded that, in emerging market debt, it is often necessary to invest before one knows which road to take.

09l9220906081149