Hear more on market conditions that have contributed to strong private equity performance in recent years, and the value that a PE allocation can provide in the decades to come.

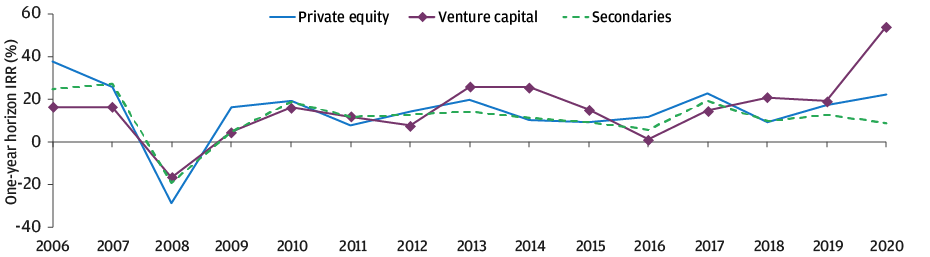

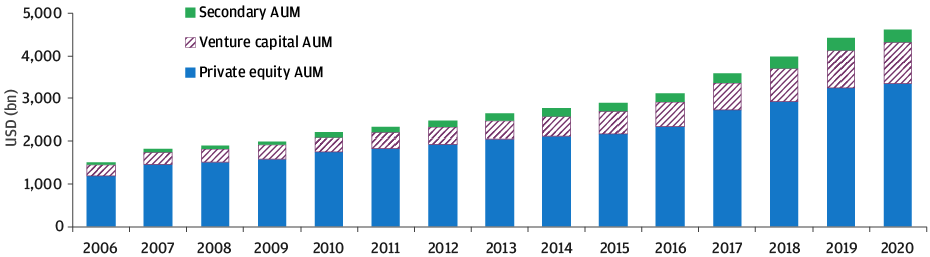

The role of private equity in institutional portfolios is clear: to deliver higher long-term returns than just about any other asset class. On this count, it has succeeded to a remarkable degree, providing investors with strong performance that has been more consistent and less volatile than they might have expected from strategies that make use of leverage and speculative growth assets. Manager skill has surely played an important role, but we should also recognize that multiple positive tailwinds have contributed to both the level and consistency of recent performance across the private equity sector (Exhibits 1A and 1B). A key question for investors today is how they should position their private equity portfolios for the next decade, given that some of these tailwinds may soon turn into headwinds.

Supportive market conditions, including falling interest rates, have contributed to strong fund performance in recent years; assets under management have also climbed

EXHIBIT 1A: Annual pooled internal rates of return (IRRs) for the private equity industry by fund type

Source: Burgiss Private iQ. Private equity consists of buyout and expansion capital, venture capital and secondary funds of funds; data as of December 31, 2020. Data represents pooled annual IRR at the end of each calendar year.

EXHIBIT 1B: AUM growth in the private equity industry by calendar year

Source: PitchBook; data as of June 30, 2020.

Private equity investors will generally point to a few key sources of value creation by managers. First is the application of organizational and operational efficiencies to improve the earnings of the underlying businesses prior to exit. Second is the ability to access cash flow for the paydown of debt or the return of capital to investors in the form of dividends – driven to some extent by the use of leverage. And third is the ability to realize higher multiples upon exit, although this result may be attributable as much to rising public market valuations as to manager skill in negotiating and executing sales.

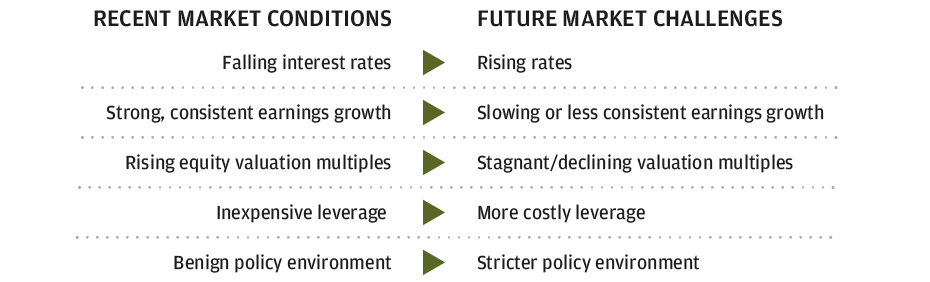

Investors should take care not to confuse genuine skill with performance derived from a favorable market environment. Put differently, how much have external factors – including low and declining interest rates, exceptional levels of market liquidity, easy access to inexpensive leverage and rising public market valuations – given weaker managers undeserved support? The answer to this question matters, because should the markets shift and these external tailwinds become headwinds, we would expect to see both lower average returns across the sector and less consistency of performance across individual managers.

Time horizons and market cycles

Investors in private equity view the extended time horizon and limited liquidity as risks that must be borne in exchange for potentially high returns; managers of private equity view the same features as essential in giving them the flexibility to add value. Both are correct. Perhaps less well appreciated is that the investment horizon for a private equity investor will extend across market cycles, and the returns may be driven not only by decisions made within a fund but also by market forces outside it. Private Equity commitments made today may be invested and harvested in a future market environment that looks very different; managers that prospered in a time of abundant liquidity and rising valuations may face challenges in the years ahead (Exhibit 2).

As the probability of a market inflection point rises, private equity funds may be affected by changes in inflation, interest rates and equity market valuations

EXHIBIT 2: External factors influencing private equity performance

Because private equity investors are effectively locking in exposure to market environments that have not yet emerged, they need to anticipate the impact of changing conditions and the types of strategies that will continue to do well. The shifts described above may challenge funds with larger individual investments dependent on high leverage at inception and public markets upon exit. Conversely, smaller funds that invest in small and mid-size opportunities – with a greater focus on operational improvements and less reliance on leverage – should perform better.

Size, scope and scale in private equity funds

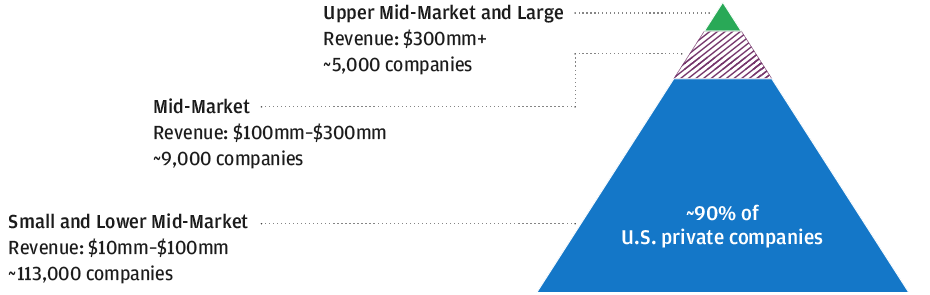

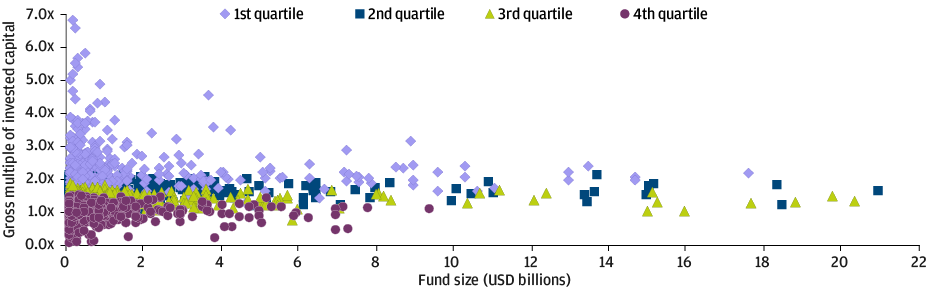

Surveying the population of private companies in the U.S., the vast majority (approximately 90%) fall into the small and lower mid-market space, where revenues range from $10 million to $100 million annually (Exhibit 3A). Mid-market companies represent an additional 5%–7% of the total, and larger firms with revenues greater than $300 million constitute the small remainder. It stands to reason that the opportunity set is deeper and richer for managers investing in smaller companies. The evidence supports this idea, as the population of top-quartile performers is heavily skewed toward smaller-scale opportunities and fund sizes (Exhibit 3B).

The number of companies in the small to lower mid-market range provide a deep pool of opportunities for private equity managers seeking to deliver outsize returns

EXHIBIT 3A: Total U.S. private companies, grouped by market size, revenue range and number

Source: FactSet; data as of May 30, 2021.

EXHIBIT 3B: Private equity industry performance dispersion by fund vintage year and size

Source: PitchBook; data as of May 30, 2021. Fund performance is as of December 31 2020 (or latest available date).

This suggests that a private equity strategy built around managers focused on small and mid-size opportunities can provide superior diversification and better potential performance. These types of investments may rely less on leverage and financial engineering, and more on bottom-up operational value creation, making them far more resilient to a changing external environment. Conversely, larger, more heavily leveraged investments will be more sensitive to public market multiple compression and will offer less attractive opportunities to exit if market sentiment turns negative.

Focusing on smaller managers involves risks, of course. Most notably, as Exhibit 3B shows, the small-fund space comprises a larger percentage of bottom-quartile managers to be avoided. Furthermore, the ability to adequately assess a vast pool of small managers requires internal expertise and resources that few investors possess. The response to these challenges, however, should not be to limit investments to a narrow group of large private equity firms; such an approach would preclude investing in many top-ranked small fund managers – and the returns and asset diversification that they can provide.

The role of external skill

A solution is available: accessing expertise in the form of a dedicated private equity fund manager that has the resources to deliver the advantages of smaller funds at a scalable size, while avoiding the downsides. A well-resourced external fund manager will:

- Apply expertise and experience – as well as valuable internal data – to adequately assess a large opportunity set of smaller funds and make relevant comparisons across managers.

- Deploy reputational leverage to gain access to top managers and to negotiate competitive fees, improving long-term performance.

- Deliver scaled investments far more quickly than an individual investor could prudently achieve with direct allocations.

- Use strong relationships with general partners to generate co-investments while selectively accessing the secondary market to enhance the underlying fund return, reduce blended manager expenses and shorten the “J curve.”

The enormous success of private equity investing should not distract investors from the reality that factors beyond manager skill have been key components of past performance. But markets are shifting, and the coming environment will offer some challenges. Larger and more highly leveraged strategies will likely face the strongest headwinds, while smaller strategies focused on bottom-up operational improvements in earnings and cash flow should continue to flourish. Well-resourced private equity managers are needed – managers capable of navigating the broad opportunity set, maintaining strong relationships with investors and general partners, and filtering out those strategies that have simply benefited from external market forces.