Will debt be a drag?

Dealing with the upward drift in government debt

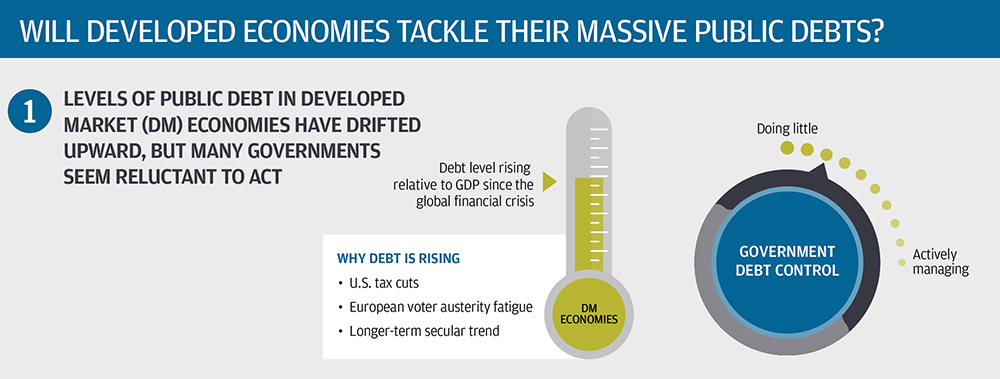

Developed market (DM) governments accumulated massive debts during the global financial crisis—which they appear reluctant, or unwilling, to tackle. The U.S., for example, is deploying a significant, unfunded tax cut, European voters are demonstrating austerity fatigue and Japan is kicking the can down the road.

We ask what a successful DM public debt consolidation would look like, based on successful past consolidations, and consider the obstacles today as well as the long-term investment implications.

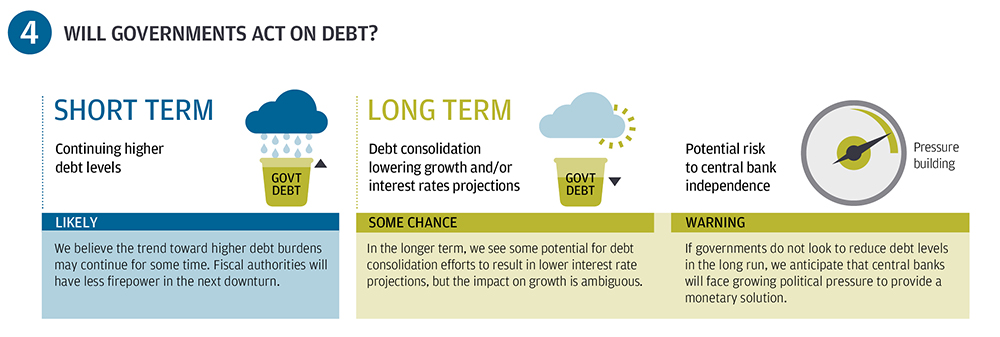

What are potential long-term risks? If they do tackle debt, our interest rate and growth projections may need to be lowered. If debt is not tackled, there is the risk of a political challenge to central bank independence, to lower rates to help ease the debt service burden.

The infographic below uses illustrations to convey the main talking points and areas of interest covered in the article.

1. Levels of public debt in developed market (DM) economies have drifted upward, but many governments seem reluctant to act.

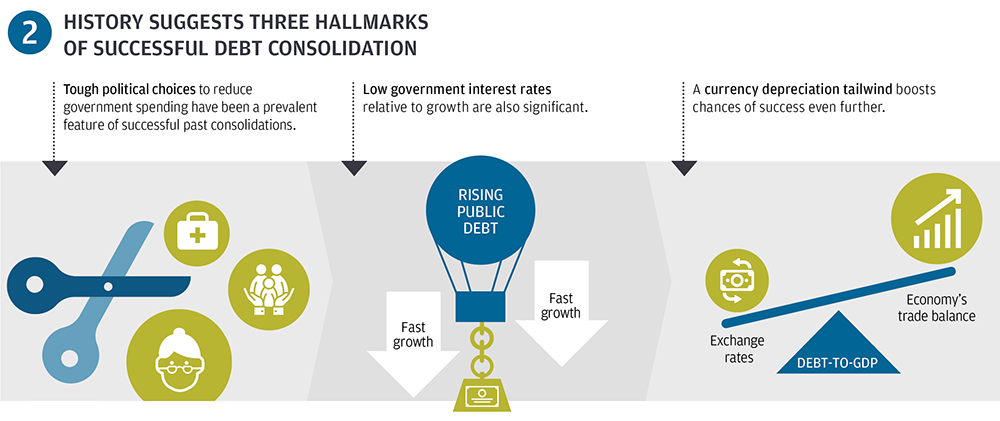

2. History suggests three hallmarks of successful debt consolidation.

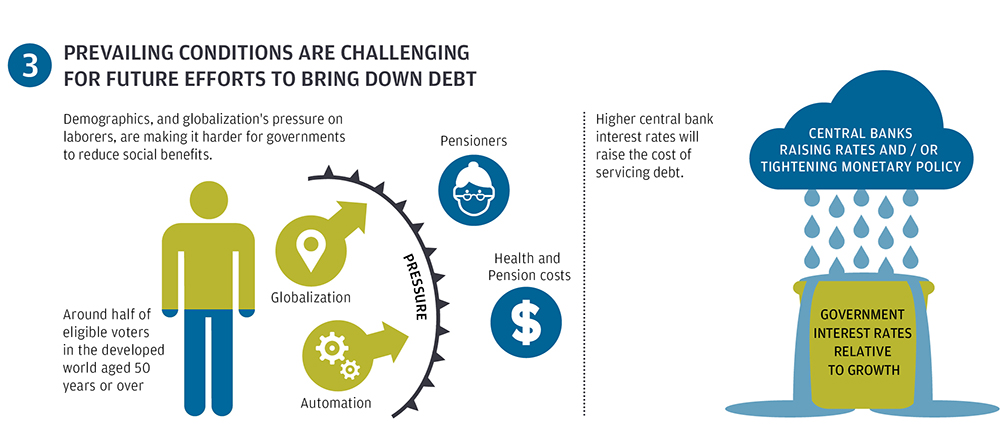

3. Prevailing conditions are challenging for future efforts to bring down debt.

4. Will governments act on debt?

You should also read

Full report and exec summary

Choose between a comprehensive analysis of our forecasts and critical investment themes, or a simpler overview of our macro and asset class assumptions.

Download the latest full report >

Download the latest executive summary >

The evolution of market structure

Over the past 50 years, the roles of public and private capital markets have changed slowly but profoundly – managing illiquidity risk remains critical.

LTCMA

J.P. Morgan Asset Management's Long-Term Capital Market Assumptions draws on the best thinking of our experienced investment professionals worldwide.