A summary of the latest trends in the markets (February 2024)

After markets ended 2023 on a strong note, performance in January was more mixed. Upbeat economic data in the US, combined with pushback from some central bankers on the market’s dovish outlook for rate cuts, proved to be a less positive environment for fixed income. Global bond yields rose 8bps during the month to reach 3.59%. Meanwhile, equity performance was mixed across regions. The S&P 500 reached a new high in January and was up 2% during the month, supported by strong growth and jobs data. Elsewhere, Japanese equities moved up 5%, and China is almost back to the lows it saw in October 2022 (down 11% in Jan.). As a result, the 60/40 global portfolio has fallen 0.2% so far this year.

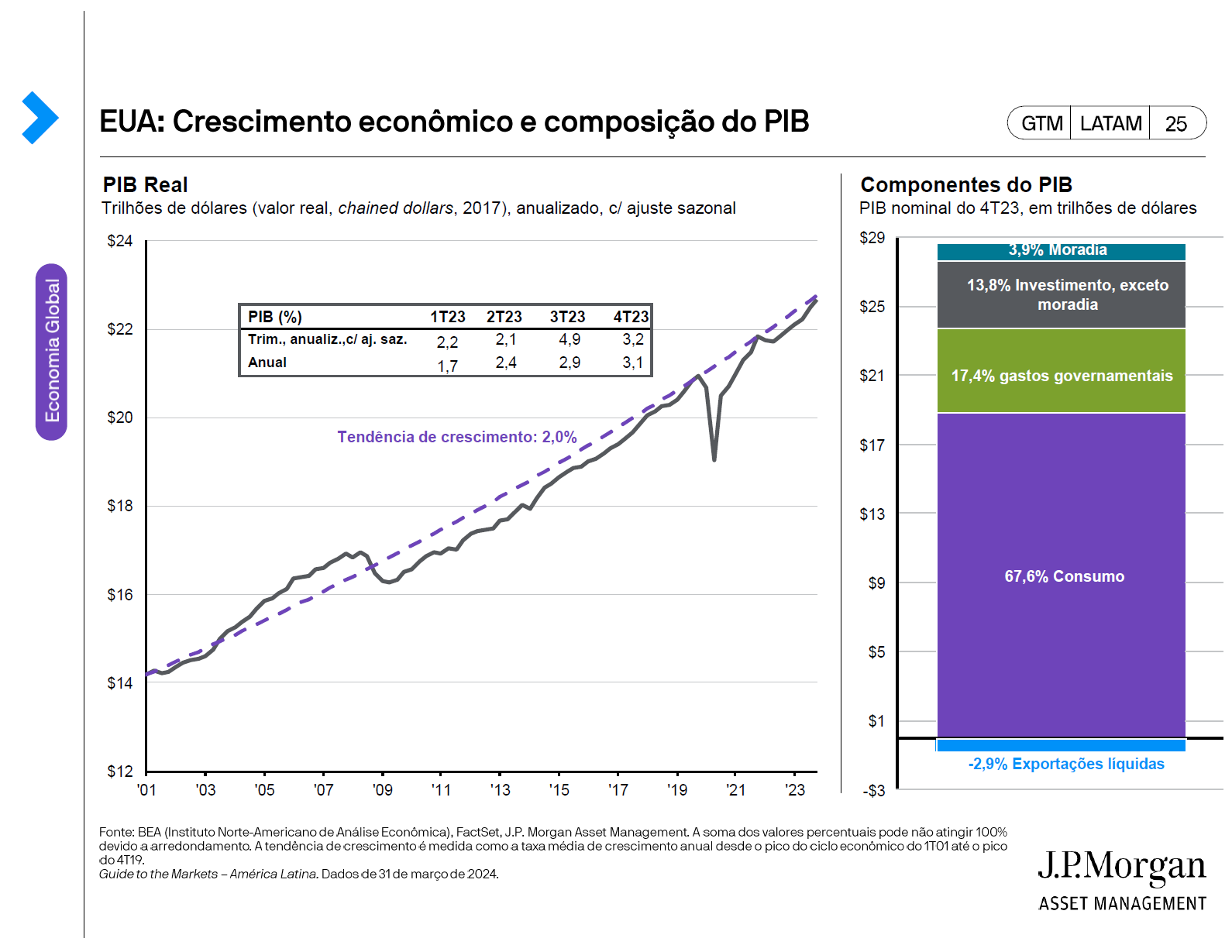

January was full of central bank activity. In the U.S., robust economic data helped propel the “soft landing” narrative with 3.1% GDP growth in 4Q23 and the economy adding 335,000 jobs in January. Given the above-trend data, the Fed will likely remain on pause until it can gain more confidence that inflation is still on track to hit 2%. Meanwhile, inflation in the Eurozone and UK has retraced about a third of its inflation surge, and Japan’s is still hovering at its peak. This means the Fed is likely to cut rates first followed by European central banks while the BoJ is still debating if rate hikes are appropriate.

For fixed income, reinvestment risk should be top of mind for investors in 2024. Investors heavily allocated to money market funds and cash should add exposure to riskier assets that typically outperform cash after peak rates. Assuming rates fall this year, bond investors should embrace intermediate-duration instruments and can still rely on attractive coupons to act as a “cushion” if rate views unexpectedly changes. They should also look for quality within fixed income to account for tighter-than-expected spreads and the chance for default rates to pick up.

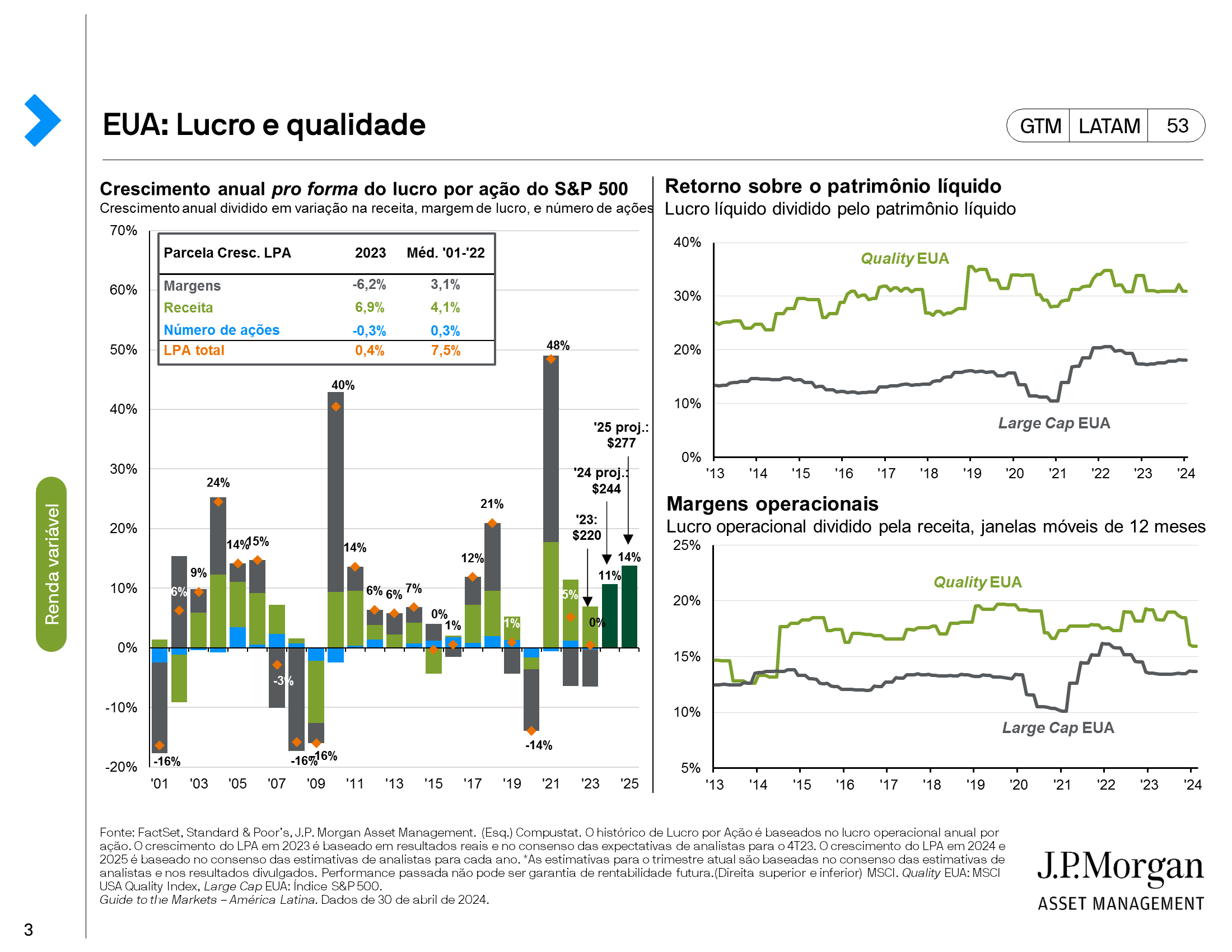

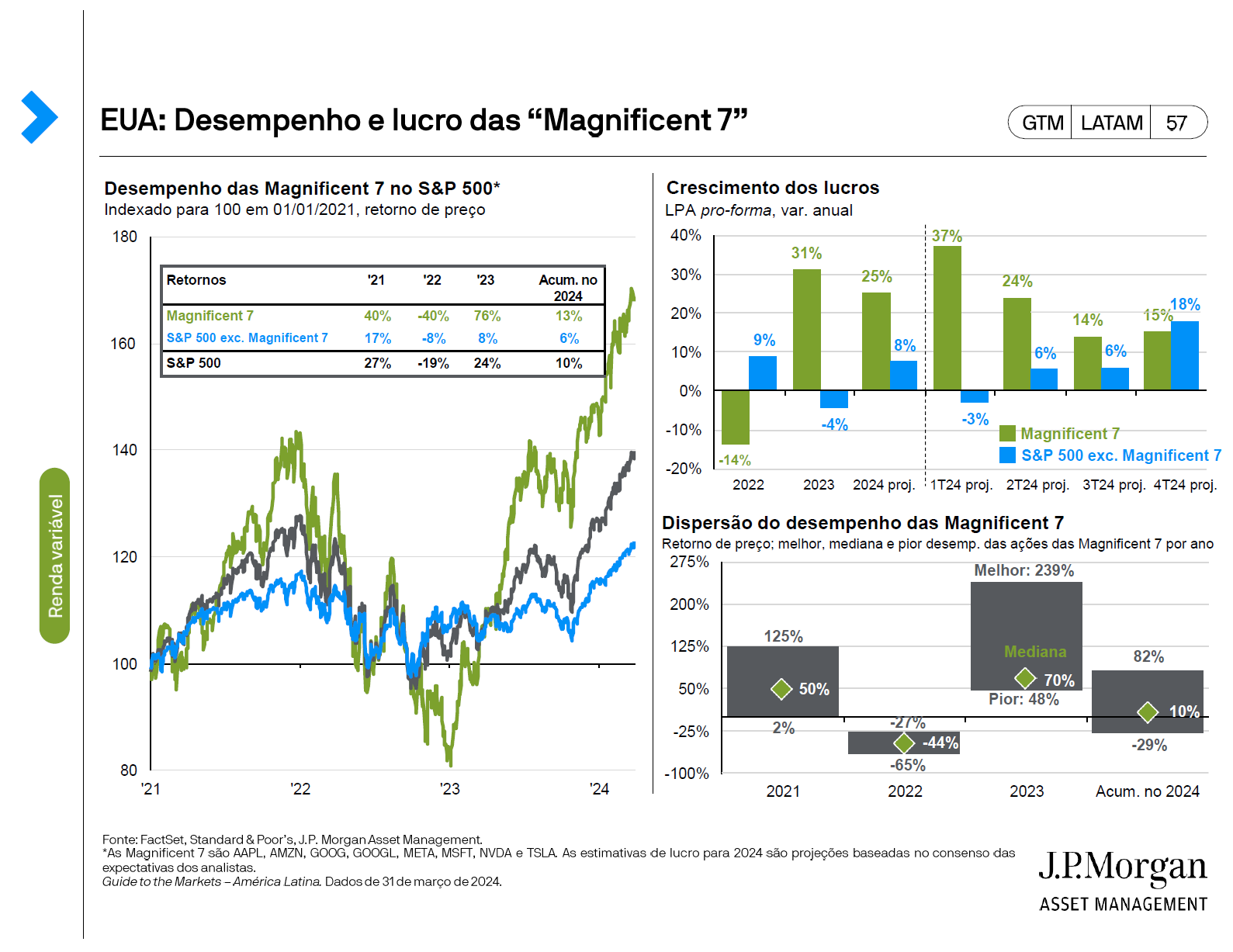

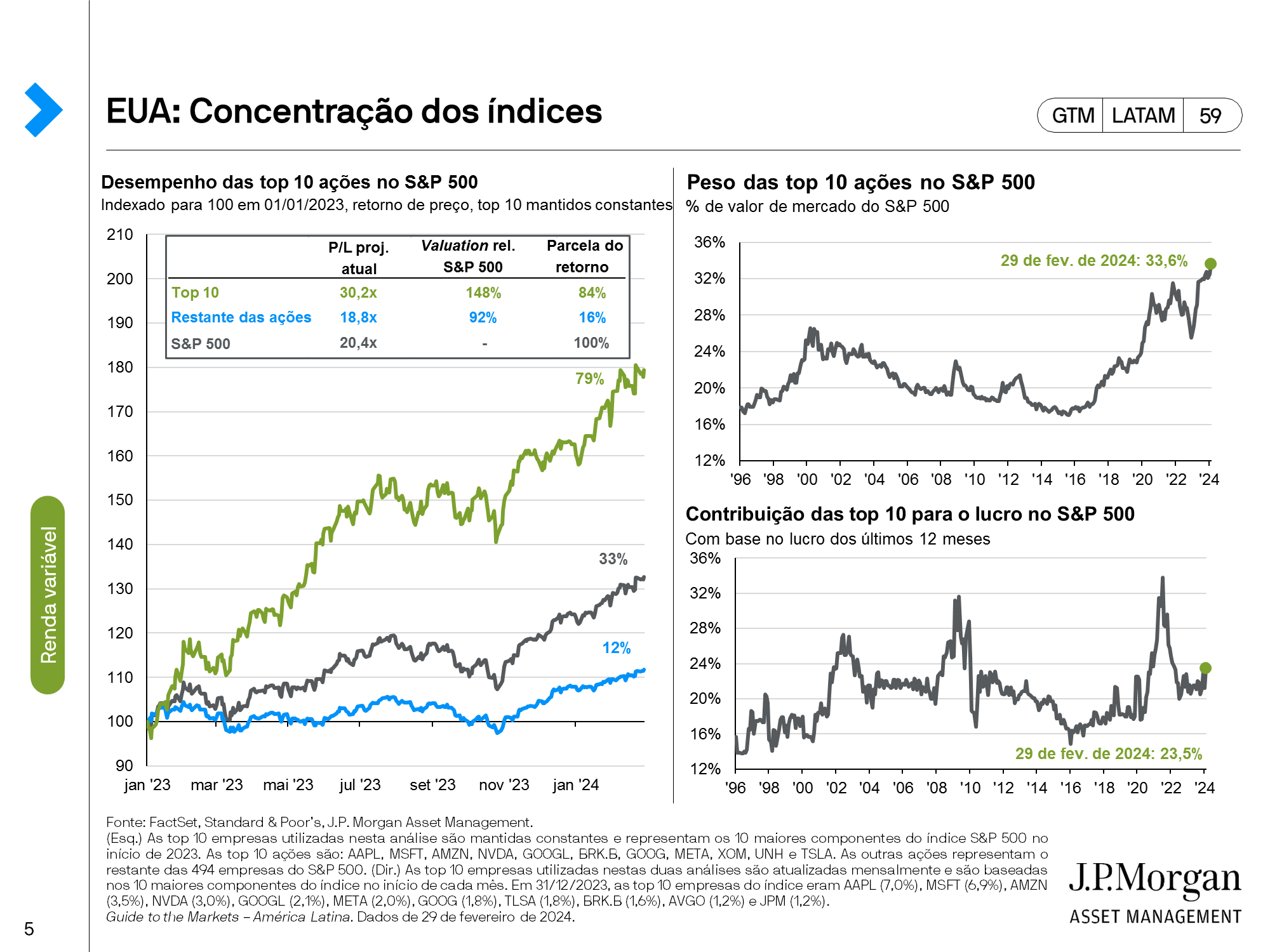

The resetting of rate cut expectations led to a sell-off in US equities in early January, but they ended the month at near all-time highs. Valuations are now 19% above long-term averages. Stretched valuations mean investors should look for profitability and quality across sectors and use active management to identify discounts. Beyond multiples, it will be key to watch how markets react to company earnings. The 4Q23 earnings season kicked off in January with mixed results, especially for big tech. Sky-high expectations for the “magnificent 7” led to some disappointment despite the results being solid. Outside of the top 7, valuations remain in-line with historical averages. A soft landing and falling rates should lift sectors left behind in last year’s narrow rally.

Outside the U.S., international equities are now trading at the biggest discount vs. the U.S. of the past 20 years. Given better cyclical and structural stories in places like Japan and India, some argue that a 35% discount is not justified. Positive rates, a stronger yen, and corporate governance changes are the key themes in Japan while India should continue to see positive tailwinds from “friendshoring” activities and strong domestic consumption. Meanwhile, outflows from China continued in January. Chinese equity valuations sit at very depressed levels as investors question if a floor has been reached and have some hopes for a tactical rebound.

Geopolitical tensions continued to grow during January with the attack on U.S. troops in Jordan and threats on ships in the Red Sea. Investors should tune in to how the Middle East conflict could affect the real economy. Shipping delays could cause a temporary re-acceleration in global goods inflation, but investors should still stick to their plans amid the uncertainty. History shows that the market impacts of geopolitical events are typically short-lived and that more time out of the market can result in long-term underperformance.

The divergence in performance across assets and regions in January help to underline the importance of diversification and risk management. In a year where 50% of the world’s population will be impacted by elections, looking beyond the short-term volatility is key for investors. The opportunities that exist in fixed income (like upcoming rate cuts), U.S. equities (broadening out of performance), and international equities (narrowing growth, interest rate differentials and discounted valuations) all reinforce the importance of stepping out of cash and adding exposure to interesting investment opportunities.

Snapshot of the economic and market update for the first quarter of 2024

For important information, please refer to the homepage.

This content is intended for qualified investors and is part of the educational material available for download through this page. We recommend reading the document for complete access to the information and its respective disclaimers.