Today I’m sharing just a short note to highlight one fascinating chart that in my view encapsulates the macro narrative thematically all by itself. Credit to my colleague David Tan for featuring it amongst the hundred or so charts we studied during last week’s GFICC Investment Quarterly (IQ) meeting.

Broadly speaking, we know the so-called “soft” data is looking up – that is, surveys of sentiment, business conditions, outlook, and measures of intent are all showing very encouraging positive readings. And we also know the “hard” data – that is, live measures of output, spending, and investment, have yet to definitely turn higher. If anything, Q1 2017 GDP in the U.S. is likely to read optically quite low (sub-2%) for a variety of arcane reasons. And yet, equities are at all-time highs, credit spreads are close to multi-year tights, and the interest rate market is signaling green shoots of “normalization” for the first time since the old normal. It feels like all of this is built on a big stack of optimism, and as long as we’re waiting for policy changes to arrive, there is no more to the foundation than hope. Notwithstanding our view that real policy changes are coming on taxes, regulation, and fiscal stimulus, it is also our view that the optimism itself is significant enough to materially improve the near-term prospects for growth.

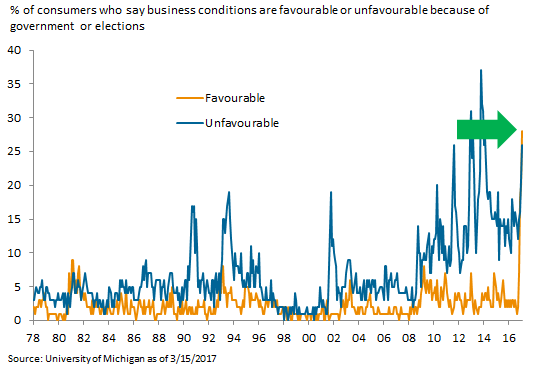

The illustrated chart depicts a subset of the University of Michigan Consumer survey, where respondents cite “government” or “elections” as justification for their opinions on business conditions. This is the essence of soft data; it’s a survey, and it’s qualitative. But to say it’s turning up is an understatement. There has been a once-in-a-generation shift in the perceived relationship between government and business. Perhaps it’s obvious, but this is the sentiment shift which is driving all other sentiment shifts.

It’s well understood that small businesses and startups are a potentially significant driver of job creation and incremental growth in the U.S.[1] , and that entrepreneurship cratered during the financial crisis. It has not bounced back. And yet, this chart depicts something extraordinary. For the first time in the 40-year history of the time series, a meaningful percentage of consumers feel that business conditions are favorable because of the government. Sure, there has been a spike in those viewing conditions unfavorably, but that statistic is no worse than it was during the Obama administration, and some level of pessimism seems rather typical. What’s atypical is government-derived optimism. The magnitude of the consumer optimism exceeds the next closest period by a factor of three. To boot, the participants in this survey are typical U.S. consumers, the same pool of people the economy draws upon for small business and startup entrepreneurship.

This extraordinary shift in the outlook encapsulates the significance of the 2016 election for the U.S. economy. The economy, after all, is made up of individuals, and the risk tolerance of a large constituency is almost certainly improving with this shift view of the government. By extension, so too is the likelihood they will form businesses that create jobs, and add new value to our economy. Growth derived from the grassroots level, as opposed to the corporate behemoth level, is not dependent on closing the yawning manufacturing competitiveness gap nor is it dependent on reversing the trend toward automation. On the contrary, diverse entrepreneurship can exploit these realities as strengths.