Multi-Asset Solutions Monthly Strategy Report

Global markets and multi-asset portfolios

16-08-2021

In Brief

- Bond yields are sending mixed signals. Until the supply-demand mismatch clears, it will be difficult to draw clear conclusions about the economy from bond market price action.

- Stocks have rallied sharply since early 2020. But above-trend economic growth, further earnings upside and policymakers who continue to err to the dovish side create a supportive environment for stocks.

- As the U.S. economy moves into mid cycle we are moving beyond a simple growth vs. value decision to a more nuanced allocation that includes a tilt to quality and a focus on earnings delivery. In equities our exposure is balanced: European stocks provide a cyclical tilt while the U.S. offers a quality exposure — despite rich valuations.

- We continue to be modestly underweight duration. But central banks’ still-significant demand for duration means the near-term upside for yields is probably limited.

Some mixed signals from bonds, many strong signals from earnings

This year, a tussle between investors fearing inflation and those following the “don’t fight the Fed” mantra is playing out in bond markets. In the first quarter the reflationists had the upper hand as U.S. 10-year Treasury rates surged more than 80 basis points (bps). But since March investors betting that ongoing central bank purchases will dominate growth and inflation fundamentals have prevailed.

From a high of 1.74% in March, U.S. 10-year yields sank to an intraday low of 1.12% in early August; and while yields have risen about 20bps in the past two weeks, this reverses less than a third of the previous rally. Overall, the price action this year raises several key questions. What signals, if any, are the bond markets sending? And, more importantly, how long might the distortion of bond markets last and what could it mean for other assets?

Naturally the slide in yields has led to speculation that bond markets see something sinister in the economy that has not yet appeared in other data. While it would be remiss to entirely disregard bond market signals, in our view bond markets are dislocated from other assets and from most other economic data. That is due, quite simply, to outsized demand for duration. Until the supply-demand mismatch clears, it will be difficult to take any clear economic inference from bond market price action. And while investors may be tempted to place large shorts on bonds at current yields, better Sharpe ratio trades may well be on offer.

A refocus on equities

For our part, we are refocusing on equities. This reflects our high conviction in an ongoing earnings recovery and a view that yields are unlikely to rise in a disorderly fashion. While stocks have rallied sharply since the acute crisis of early 2020, we believe earnings could rise a good bit more. Crucially this is still not fully reflected in either forecasts or investor expectations. Above-trend economic growth, earnings upside and policymakers who continue to err to the dovish side create a supportive environment for stocks.

Nevertheless, the rapid rebound in equities together with prevailing valuations cause some to fear that equity markets could be tripped up by a panicked withdrawal of central bank accommodation. Oddly, it is often the same voices that fear bond markets are signalling economic problems who are most concerned that policy tightening could arrest the rally in stock markets.

That mix of fears could suggest that there are a lot of closet stagflationists out there. True, an environment where growth is weak while inflation is strong could be quite damaging to financial asset returns. But we see only a limited threat of a stagflationary end game.

On the inflation front, recent upside pressure from commodities, base effects and supply chain disruption should begin to fade. In addition, secular forces such as technology, coupled with labor market slack, also point to inflation prints moderating over the latter half of 2021. Capex continues to surge, inventories are low and household savings are 15%-20% higher than they were in 2019 across key Western economies. In short, there seems little risk of an abrupt reversal in economic activity.

On the contrary, we see a recipe for powerful nominal GDP growth at the same time that policymakers have indicated that they will not only look through, but plainly welcome a period of moderately above-trend inflation.

In principle, this would be supportive for both higher equity prices and higher rates. But in our view a bet on the strength of the macro environment currently is better expressed in stocks, given the persistent mismatch between price-insensitive demand for bonds and shrinking bond supply. The question, therefore, is which stocks to buy.

Assessing value and quality factors

The U.S. economy has already moved through early cycle — which supports beta and cyclicality above all — into a mid-cycle phase. With its rapid rollout of vaccines Europe is not far behind. Early this year rising rates coincided with a surge in value-style equities. But even as this happened, value spreads1 barely budged. Quality spreads, too, are at appealing levels, and as we move through mid cycle, increasing emphasis on earnings delivery implies that exposure to the quality style should become increasingly attractive.

Although we do not expect bond yields to rise sharply, we would not abandon an allocation toward value-style equity. Our quant team points out that although value performance has recently tracked fairly closely to bond yield moves, in the longer run the extreme level of value spreads is a more reliable driver of forward returns. Therefore, an allocation to sector-neutral value should be thought of as a slower-burn, secular position. We would caution against abandoning value in response to short-term volatility or — worse — treating it simply as a proxy trade for short-term interest rate fluctuations.

While tilts towards value and quality factors represent attractive longer-term allocations, in the shorter term we believe that performance across the equity complex should mostly follow earnings delivery. For the remainder of this year, the cyclical environment should continue to favor earnings momentum in value style equities — mostly due to higher exposure to cyclicality, as well higher operating leverage given the generally lower margin business models.

From growth vs. value to a more nuanced allocation

A renewed period of value outperformance therefore seems plausible. But in the context of less explosive growth and earnings surprises it will probably be less extreme (vs. growth-style equities) than we saw in 4Q20 and 1Q21. Indeed, in the recent reporting season earnings surprise levels were not materially different between the value- and growth-style equities. This implies that we have moved beyond a simple growth vs. value decision to a more nuanced allocation that includes a tilt to quality and a focus on earnings delivery — which may prove supportive for U.S. large cap equities, despite the inherent growth tilt to the index.

Meanwhile, purely defensive areas of the equity market that lack much of a growth angle, such as utilities or old-style telecoms, will likely fail to keep up in either earnings or performance terms, regardless of style exposure. Further, we expect earnings of consumer defensives such as staples producers and retailers will continue to suffer considerable margin pressures, with rising input costs and generally limited ability to pass them through to their customers.

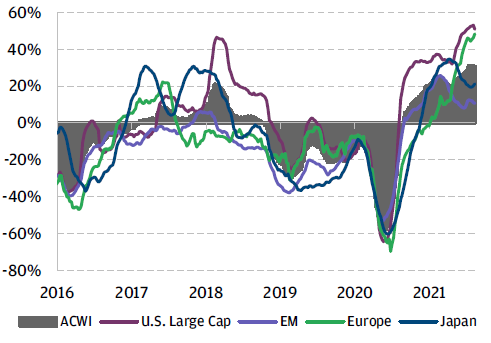

Earnings revisions ratios for major equity markets have been in upgrade territory for an extended period of time as analysts struggle to incorporate the strength of the earnings recovery. After hitting all-time records in the U.S. and Europe they are likely to moderate from here, but should continue to stay at high levels for some time to come among this supportive macro environment.

Exhibit 2: Major equity market 3-month earnings revisions ratios

Source: Datastream, J.P. Morgan Asset Management Multi-Asset Solutions; data as of August 2021.

Regionally, earnings delivery should stay strong across developed markets (DM) even as growth moderates. We expect the greatest potential for further upside surprise in the strongly cyclical and value-heavy Japanese and (especially) European markets. In Europe the longer-run earnings underperformance also suggests that profits could catch up deeper into the cycle. In contrast, projected emerging market (EM) earnings growth rates may look competitive relative to their DM counterparts, but they are unlikely to keep up in terms of upward revisions until the macro picture across EM economies improves.

Asset allocation implications

In our multi-asset portfolios we express our high conviction views on above-trend economic growth and continued earnings deliveries through a moderate overweight to equities. Recent macro data and persistently easy financial conditions reaffirm our view that investors enjoy a favorable environment for risky assets.

While we express our views primarily through equities, our quant signals remain strongly negative on duration. On balance, we continue to be modestly underweight duration in our portfolios as a result. We note, however, that central banks’ still-significant demand for duration means the near-term upside for yields is probably limited. Elsewhere within fixed income, we remain broadly comfortable with the outlook for extended credit, but with spreads tight in a historical context we see more upside in stocks.

In equities we now look to express a more moderate expectation of returns, in keeping with the shift from an early- to mid-cycle phase in the economy. Regionally we favor Europe and have added back exposure to U.S. large caps as the resilience of earnings continues to support the region. This creates a more balanced exposure: European stocks provide a cyclical tilt while the U.S. offers a quality exposure — despite rich valuations. By contrast, recent volatility in EM equities, together with an uptick in virus transmission rates, keeps us from adding risk in emerging markets.

1 Valuation spread is a z-score of the spread between the median P/E ratio of top quartile stocks and bottom quartile stocks as ranked by the respective factor.

Multi-Asset Solutions

J.P. Morgan Multi-Asset Solutions manages over USD 303 billion in assets and draws upon the unparalleled breadth and depth of expertise and investment capabilities of the organization. Our asset allocation research and insights are the foundation of our investment process, which is supported by a global research team of 20-plus dedicated research professionals with decades of combined experience in a diverse range of disciplines.

Multi-Asset Solutions’ asset allocation views are the product of a rigorous and disciplined process that integrates:

- Qualitative insights that encompass macro-thematic insights, business-cycle views and systematic and irregular market opportunities

- Quantitative analysis that considers market inefficiencies, intra- and cross-asset class models, relative value and market directional strategies

- Strategy Summits and ongoing dialogue in which research and investor teams debate, challenge and develop the firm’s asset allocation views

As of June 30, 2021.

0903c02a82a2323f