Real Assets Outlook: Infrastructure, Transport and Timber

Investments that center sustainability

12-01-2022

Andrian R. Dacy

John Gilleland

Dave Rumker

Gilly Zimmer

INFRASTRUCTURE INVESTMENTS: DIVERSIFICATION WHILE IMPROVING SUSTAINABILITY

Infrastructure investing is becoming foundational in investment portfolios, providing opportunities for lower-volatility returns that historically have low correlation to equities and bonds — an opportunity for downside protection in a crisis, demonstrated most recently during the COVID-19 pandemic. We believe core infrastructure assets, especially in OECD markets, will continue to find investor support.

Recently, governments have pledged their commitments to transitioning to a lower carbon world, making investors even more enthusiastic about long-term investments in infrastructure — renewable energy in particular. When making long-term investments in communities’ essential services, sustainability is top of mind. Investors have an obligation to a broad set of stakeholders to be a positive force in the current energy transition.

We expect core infrastructure assets to continue to serve as a lower-risk, more forecastable source of diversification and steady income (most from cash distributions) through their regulated frameworks, often correlated to inflation; government concessions and long-term contractual revenues with investment grade counterparties.1

Infrastructure also provides an opportunity for steady income through market cycles since the phase of an economic cycle generally doesn’t change water or electricity consumption.

Strong governance, carbon disclosure and improving sustainability

Among the themes underlying our outlook for infrastructure:

Combining renewable energy with natural gas investment: To maintain energy networks’ reliability during the transition from fossil fuels, we anticipate spending on green infrastructure will be complemented by investment in nonintermittent natural gas (which is less carbon intensive than oil and coal) and, to some extent, battery technologies, as natural gas likely phases out over the long term.2

The importance of governance: Strong company governance, including talented, aligned management teams, is key to reducing carbon footprints. Stakeholder engagement is critical for sustainable, risk-adjusted returns, and that requires a diverse board and management team.

Preparing for climate risks to become part of financial statements: An investor best practice will be measuring and auditing portfolio companies’ carbon footprints, in accordance with the most widely used international accounting tool, the Greenhouse Gas Protocol.3

Environmental, social and governance (ESG): Social impact must be a priority across portfolio companies, through initiatives such as promoting health, safety, diversity, equity and inclusion.4 Governance is the foundation of enhanced and transparent ESG reporting, integrating ESG into day-to-day management and engaging with investors, stakeholders and the industry.

Opportunities in infrastructure investing: Bolt-on acquisitions with a conservative approach to debt

We see a large opportunity in acquisitions, to continue building companies while maintaining a long-term investment horizon. Deal flow should be robust. An investment strategy with the potential to lower risk is combining new and “bolt-on” investments.

Bolt-ons are accretive to existing business plans and allow new assets to fall under boards and management teams already in place. We believe owning a controlling stake is another advantage and a differentiator.

Equity infrastructure investments will likely remain a mix of 80% core (regulated, contracted) assets and about 20% core-plus (GDP-sensitive) assets,5 intended to provide a steady, predictable return profile throughout the economic cycle.

Managing potential risks in infrastructure investing

Risks include political and regulatory risk, and higher taxes. Political risks vary, which is why we focus on OECD markets. People are also a key risk and opportunity, which we seek to both mitigate and harness with independent boards of directors and by deploying capital behind existing management teams.

A company’s debt profile can present risks. Although infrastructure has historically been highly geared, we prefer a conservative approach to financial structuring and longer-tenor fixed rate debt. Finally, portfolio construction can be a risk mitigator. The global pandemic has emphasized that to be a portfolio diversifier, your asset mix needs to be diversified, too.

TRANSPORT INVESTING: NAVIGATING THE ENERGY TRANSITION

Limited transportation supply growth at a time of strong demand for moving goods and a growing need for investment to support decarbonization efforts underlie our positive 12- to 18-month outlook for core-plus transportation investment.

In 2022, we expect continued low correlation to equities and a diversified source of transparent, resilient and stable income-oriented returns, including during times of market volatility. Driving this stability: a critical role in the global supply chain and “take-or-pay” leases from high credit quality, often investment grade end users.

Supporting the ongoing energy transition from fossil fuels to renewables is one of the biggest opportunities. With the transition to a less carbon-intensive future, energy-efficient, sustainable transportation assets – many yet to be built, at significant cost – will be even more important to connect industries and economies. Large investors with access to capital should be well positioned.

With tailwinds from the continuing economic recovery, transport is primed for growth and investment

We expect positive market sentiment in the year ahead as backlogs in global supply chains, shipping delays and port congestion continue to lift profits. Ongoing growth in e-commerce and strong consumer demand in major economies should continue to support investor sentiment. Even after pandemic-related supply chain constraints ease, a tight supply of transportation assets may endure. Uncertainty around the future asset designs that will be necessary for decarbonization, has further slowed new orders.

Trends: High lease rates, strong end users, disrupted supply chain

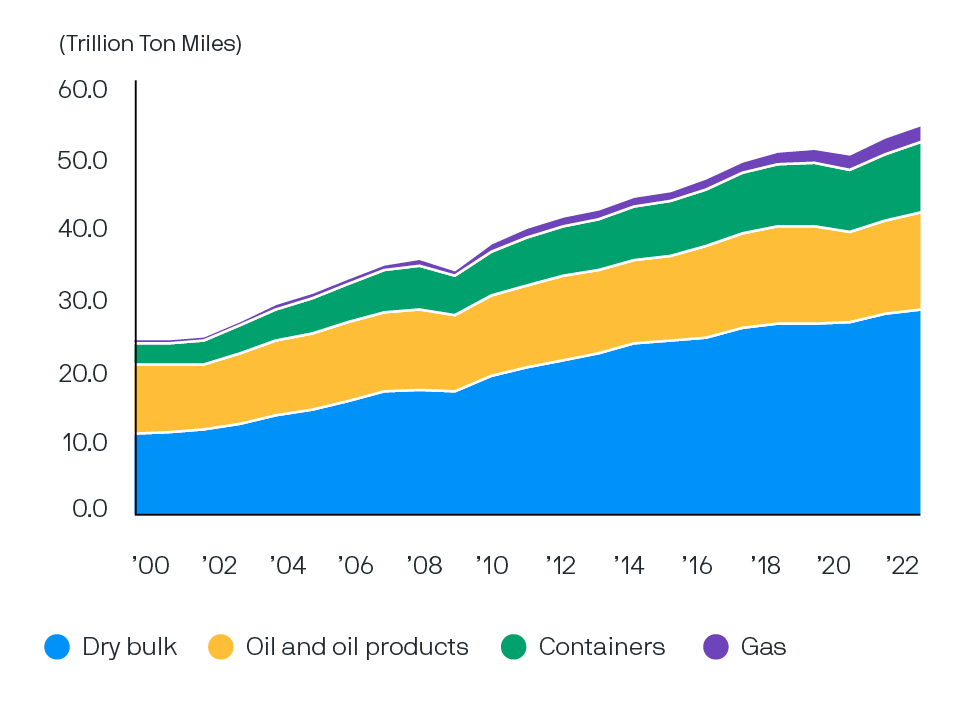

Maritime and energy logistics: Ships, which carry 90% of global trade, have benefited dramatically from the disrupted global supply chain. Current shortages of ships5 and container capacity, which have driven lease rates and asset values to historic highs, are likely to continue. Seaborne trade volumes have returned to pre-pandemic levels (Exhibit 1). The credit strength of large industrial and shipping end users dramatically improved in 2021.

Seaborne trade volumes are back to pre-pandemic levels, and expansion is forecast to be at trend, with 4.4% growth projected for 2021

Exhibit 1: Seaborne trade growth

Source: Clarksons Research; data as of December 2021.

Aviation: We expect domestic passenger volumes to continue improving (although questions remain about long-term trends in international and business travel). Amid concerns created by new variants of the coronavirus and dynamic border control requirements, international aviation’s recovery timeline remains uncertain. The market share vacated by 70-plus airline bankruptcies is being filled by fewer, larger, more stable and well-capitalized companies. Sovereign-backed carriers should remain attractive counterparties if governments continue their historical support of such carriers.

Land-based transport (auto and rail): The pandemic has created infrastructure and intermodal challenges at ports, particularly a need for ground transportation assets and truck drivers to service higher cargo throughput.6 More truck, train and warehouse capacity is needed to support the growing volume of cargo entering ports on ships. More than 70,000 truck drivers have left the profession during the pandemic.

A growing focus on ESG and decarbonization is shaping technology development, end-user demand and financing

Lowering carbon emissions to reduce the sector’s impact on global climate change is a key stakeholder focus: End users, regulatory bodies, investors, banks and customers are all demanding greener transportation.7 Investment will be needed for R&D and new technologies, modification of existing assets, design and construction of new assets, and investment in a new global infrastructure to support new types of fuel.

Attracting financing is increasingly linked to environmental performance as environmental, social and governance (ESG) standards rise.8 Those market participants with ample access to capital will be better positioned to make the necessary investments in green technology solutions and to meet end-user demand for environmentally friendly assets.

Investment opportunities: Leveraging scale, global growth and the energy transition

Against a strong macro backdrop, we expect consistent returns through several preferred strategies:

A diversified portfolio: A diversified approach to core-plus transportation allows for allocation to those subsectors with the best relative value. When the pandemic hit, for example, the aviation sector was significantly impacted and capital deployment was redirected to the maritime sector, where industry fundamentals remained strong.

Energy transition: On average, coal-to-gas power plant switching reduces emissions by 50%.9 We like investments in assets that directly support the energy transition. These include next-generation liquefied natural gas (LNG) carriers and offshore wind farm maintenance and installation vessels.

Partnering with leading operators: Partnering enables the asset owner (investor) and operator to develop solutions that reduce the carbon footprint along the operator’s supply chain. As global industry standards change, such cooperative strategies will enable technology transfer and capital risk-sharing.

Container leasing: Contracted revenue from fixed rate long-term leases, supported by the counterparty’s balance sheet, should offer stable, transparent, highly resilient returns. Cash flow should be supported by increasingly profitable liner company counterparties whose balance sheets have been strengthened by robust pandemic-related earnings.

Meanwhile, lingering supply chain disruption is expected in 2022, with lower container turnover and thousands of “stranded” containers out of position due to lockdowns imposed earlier in the pandemic, creating further supply tightness and likely resilient profitability for asset owners.10

Risks include the uncertain future of clean fuel options, how these fuels will be supplied and distributed (over the long term) and a changing regulatory environment regarding future standards and practices. Other risks: the threat of technological obsolescence for older assets and a contraction in economic growth.

INVESTING IN TIMBER: LUMBER DEMAND AND CARBON AWARENESS ARE ON THE RISE

Demand is rising for timber, a more sustainable and renewable building material than cement or steel. Meanwhile, recognition is growing that working forests can sequester carbon – a natural solution for generating carbon offsets. These will be essential for meeting global and corporate greenhouse gas (GHG) emission targets.

While these are early days for carbon markets, rising demand for carbon offsets is likely to exceed supply in the near and medium terms, potentially supporting carbon prices in the coming years.11 Working forests also provide investors with other, tangible environmental, social and governance (ESG)-related opportunities, from biodiversity to rural jobs, enhanced through sustainability-focused management and verified by meeting third-party forest certification standards.

These highlights underpin our expectation of reliable income returns and capital appreciation in an asset class with inflation-hedging attributes. We anticipate improving cash yields for timberland assets in 2022, and rising prices.

Key themes in timber investing: Tight supply, elevated prices and an early-stage carbon opportunity

Pent-up U.S. housing demand: New home construction, as well as repair and remodeling (together composing about 70% of lumber demand) are surging, driving greater log demand across the U.S. and Canada. Pent-up U.S. housing demand among younger homebuyers and low interest rates are spurring demand that could continue for three to five years (or more).11

A rising proportion of single-family homes (rather than multi-family units) being built is further boosting lumber demand per unit,12 as COVID-19 has stimulated movement to lower density suburban and rural housing. Engineered wood products’ acceptance in medium-rise construction globally has also increased lumber demand.13

Even as the supply chain disruptions that elevated lumber prices to extraordinary levels likely normalize in 2022, lumber prices should stay high as U.S. lumber companies build production capacity (modernizing, expanding and constructing new mills), tightening log supply.

Increasing global recognition that sustainably managed timberlands are a climate solution imperative: Forestland is a natural carbon-capture solution. The carbon sequestered by trees can be quantified and used to offset greenhouse gas emissions by companies paying asset owners for verified carbon units or by asset owners offsetting their own emissions.

Although the carbon credit market is in its early days, this could be a meaningful entry point while interest is accelerating. Regional and global standardization of carbon protocols in the coming years should provide investors greater assurance regarding carbon credits’ legitimacy and corresponding carbon credit pricing.

Timberland’s inflation-hedging characteristics, particularly longer term: A forest’s value isn’t very volatile because biological growth continues during periods of weak pricing. Harvest can be delayed while trees continue to grow in size and value is stored on the stump.

Timber’s alignment with global and corporate ESG goals: Working forests offer an array of ecosystem co-benefits, such as habitat for endangered species and shelter for much of the world’s biodiversity. Forests provide sources of clean water. And importantly, wood-based construction is superior to steel or concrete from a greenhouse gas emissions perspective.

Working forests align with social goals, such as opportunities for public recreation. Forests can also provide living-wage jobs, reduce urban migration and improve the quality of life in rural communities.

Technological advancements: Remotely sensed imagery and geographic information system innovations are making forest carbon and inventory measurement more cost-effective, efficient and scalable, and making carbon markets more widely accessible to landowners. Drones are lowering costs and improving both the safety of forest activities and fire detection. Other innovations are affecting surveying, reforestation, harvesting and wood products.

Opportunities in timber for diversification, climate action, inflation hedging and ESG

A well-diversified timberland portfolio should continue to be attractive as a portfolio diversifier, a natural climate solution and an investment with natural ESG attributes, generating income through the sale of wood products while serving as an inflation hedge.

Along with expected rising demand and improving prices lifting income, returns could benefit further from tight log supply in the U.S. Pacific Northwest, Australia and Chile. Higher log values should help accelerate capital appreciation and compress discount rates somewhat, particularly in tight log market areas. Carbon monetization could provide an additional overlay of revenue potential.

Risks include an economic slowdown that dampens housing demand and government policy measures that slow economic growth. Housing affordability is a risk, but home price appreciation appears to be moderating. Rising interest rates that impact home affordability are another risk, but rates are expected to remain at historically low levels for some time.

Continued expansion of new home construction depends on construction labor availability at costs that do not hurt affordability. (Labor availability constraints are more likely to defer new home construction than reduce new home demand.) And supply chain disruptions that lead to greater reliance on local or regional log and lumber sources benefit some markets but not others.

1 Along with energy, infrastructure assets include pipelines, water distribution and waste collection, broadcast and wireless towers, cable and satellite networks and social assets such as healthcare facilities, schools and public and military housing. Infrastructure companies are often long-lived, with monopolistic characteristics, high barriers to entry and sustainable competitive advantages.

2 We believe natural gas companies could remain critical for as long as 50 years, with a possible inclusion of other fuels in the medium term such as biofuels and/or hydrogen.

3 Future reporting is intended to incorporate updates on companies’ progress in their energy transition, portfolio stress tests, and disclosure of relevant carbon intensity metrics. Our goal is to audit portfolio companies’ scope 1 and scope 2 emissions. Scope 1 are direct emissions from sources you own; Scope 2 are indirect emissions from purchases, such as from electricity consumed; Scope 3 are all other emissions throughout the value chain—as a result of goods and services purchased, business travel, waste disposal, transportation. “Briefing: What are scope 3 emissions?” Carbon Trust.

4 These are necessary if infrastructure businesses are to fulfill and maintain their social license to operate: when a project and its operating procedures (waste management, human resources, etc.) have the ongoing approval of, or broad acceptance by, the local community and other stakeholders such as employees and the wider public.

5 Shipping supply growth remains below trend: The order book stands at just 9% of fleet capacity vs. more than 60% in 2008, and shipyard capacity is reduced after having been consolidated. More ships are needed, but shipyards will not deliver new vessels until 2025. (The world today has only 111 active large shipyards, down from 320 at peak in 2008).

6 Today’s largest containerships are double or triple the size of those in the early 2000s and can hold more than 20,000 containers.

7 Global transportation is addressing global emissions, with U.N. organizations pointing the way: The International Maritime Organization’s Energy Efficiency Existing Ship Index and Energy Efficiency Design Index require a minimum energy efficiency level per capacity mile by ship type and size segments. The International Civil Aviation Organization’s CO2 Emissions Standard for Aircraft will be enforced for new aircraft starting in 2028, targeting emissions reduction by encouraging aircraft design and development to integrate fuel-efficient technologies.

8 For example, among traditional bank lenders. See, for example, the Poseidon Principles.

9 “The Role of Gas in Today’s Energy Transitions,” International Energy Agency, July 2019.

10 Many containers that arrived in regions such as Africa and South America early in the pandemic remain empty and uncollected because shipping carriers have concentrated their vessels on their most profitable Asia-North America/Europe routes.

11 Pent-up demand is approaching four million units due to a decade of underbuilding plus annual housing demand of about 1.5 million housing units; the industry is also seeing the long-anticipated emergence of homebuyers aged 25 to 40 purchasing their first homes.

12 David B. Keever and Joe Elling, “Wood products and other building materials used in new residential construction in the United States, with comparison to previous studies,” APA - The Engineered Wood Association, 2015 and “Analysis and Forecast of the Main

End-use Sectors for Wood Products in North America,” Forest Economic Advisors, 2021.

13 Such as cross-laminated timber (CLT).