In brief

APAC central banks: Mission accomplished

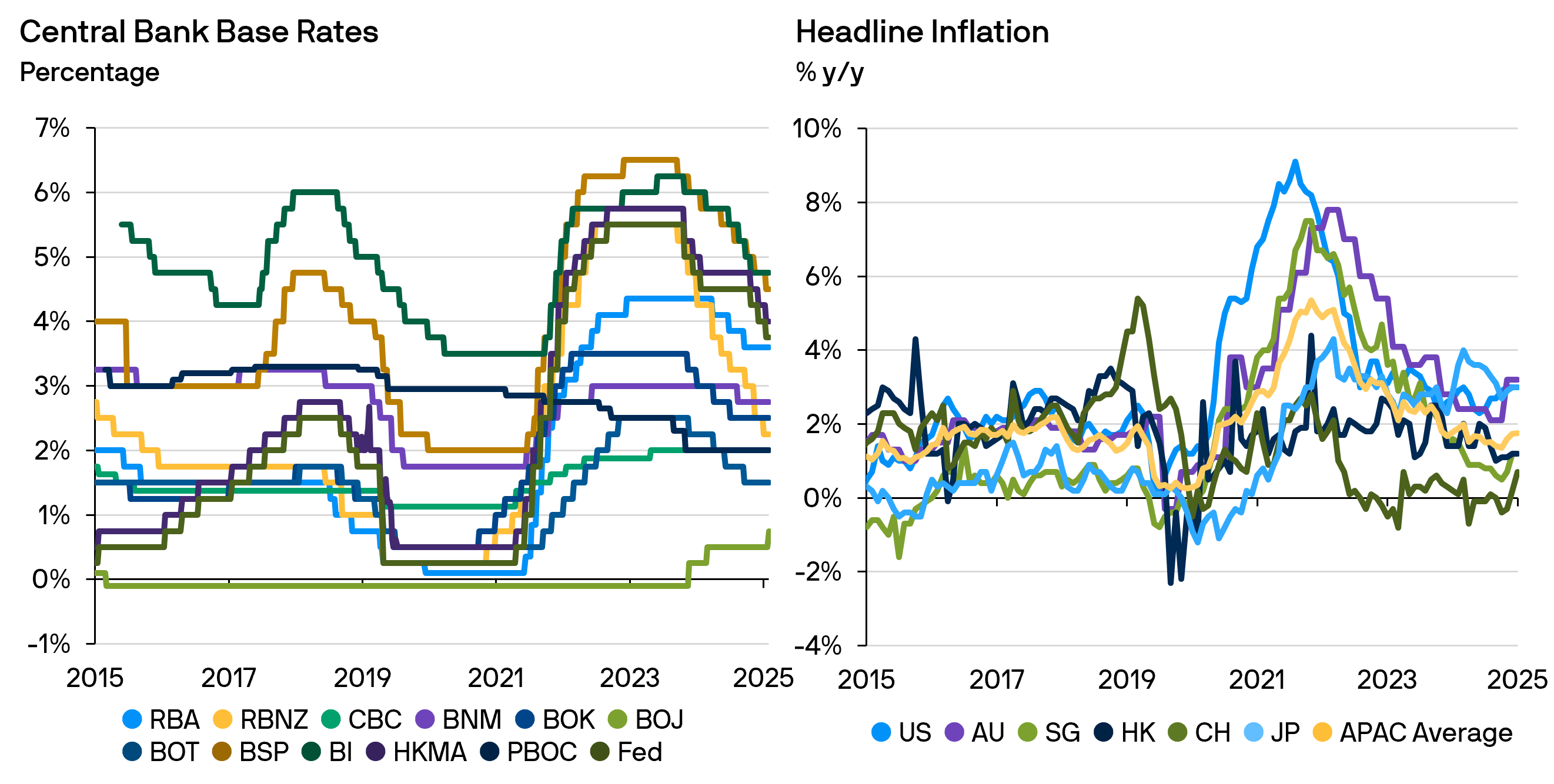

In 2025, the Asia-Pacific (APAC) region was buffeted by trade and geopolitical uncertainty. Despite these challenges, strong exports and robust AI-related investments delivered better-than-expected growth, even as domestic demand remained subdued.

Elevated interest rates, fiscal support, and goods disinflation helped curb inflation without significantly sacrificing growth or employment. This allowed regional central banks to cautiously begin cutting rates aim to reduce policy from restrictive levels and support domestic growth amid concerns about fading as export momentum. Notably, the pace of easing varied by market and was generally slower than expected.

Recent data suggests inflation may be bottoming, raising the risk of more persistent price pressures. With trade and geopolitical risks easing, many APAC central banks are approaching the end of their rate-cutting cycles. Monetary policy is likely to settle at neutral, rather than becoming outright accommodative. China and Japan remain outliers. The PBOC is expected to cut rates further to support growth, while the BOJ is likely to hike rates to address elevated inflation concerns.

Source: Bloomberg, as at 19 December 2025

Federal Reserve (Fed), Bank of Japan (BoJ), Reserve Bank of Australia (RBA), People’s Bank of China (PBOC), Reserve Bank of New Zealand (RBNZ), Central Bank of the Republic of China (CBC), Bank Negara Malaysia (BNM), Bank of Thailand (BOT), Bangko Sentral ng Pilipinas (BSP), Bank of Korea (BOK), United States (US), Australia (AU), Japan (JP), China (CH), New Zealand (NZ), South Korea (SK), Thailand (TH).

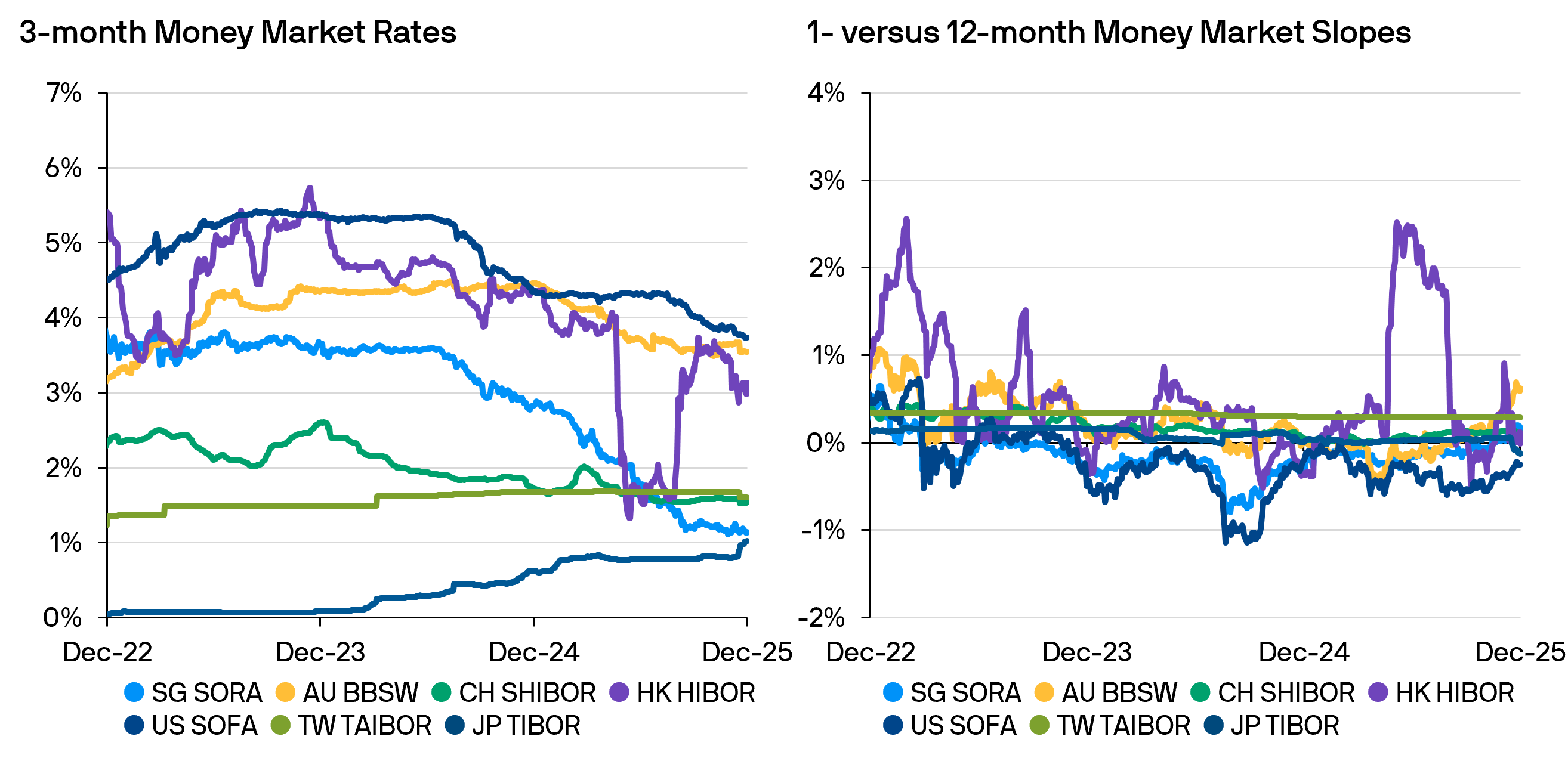

Source: Bloomberg and J.P. Morgan Asset Management, data as at 4 December 2025.

Regional central bank trends

China’s economy outperformed expectations in 2025. GDP is likely to reach the government’s 5% target, despite ongoing geopolitical and trade challenges. Export-orientated sectors benefitted from pre-tariff orders and AI driven tech demand.

This strength allowed the People’s Bank of China (PBOC) to maintain a dovish policy stance, while keeping rates unchanged after a modest cut in May. It also signaled a preference for stability and ample liquidity, while acknowledging the limits of monetary stimulus.

However, resilient external demand has masked on-going domestic weakness. Fixed asset investment has turned negative, and the real estate sector remains a major concern. Declines in home sales, prices and construction likely to persist into 2026. Retail sales growth has also slowed, reflecting subdued consumer confidence and fading fiscal support. Magnifying downside risks, export momentum will likely soften in 2026 as front-loading and seasonal effects fade.

The recent weaker data and lower 2026 growth forecasts have opened the window for additional policy easing. The PBOC is likely to cut the Reserve Requirement Ratio (RRR), 7-day Open Market Operations (OMO) rates and Loan Prime Rate (LPR) further. This suggests short-term interest rates are set to trend lower in the new year.

Australia’s economic growth recovered in 2025, supported by robust exports, improving private demand and a stronger housing market. With inflation declining, the Reserve Bank of Australia (RBA) cut the overnight cash rate three times in 2025, from 4.35% to 3.65%. However, the pace of cuts was slower than expected as the RBA had not previously raised rates as aggressively as other central banks and remained caution about lingering inflation risks.

These concerns have manifested in recent data, with stronger-than-expected growth, a tight labor market, and rising capacity pressures suggesting inflation risks are tilting to the upside. This has raised the possibility of more persistent inflation and suggests monetary policy may be less restrictive than previously thought.

Looking ahead, the RBA forecasts solid growth and low unemployment in 2026, with inflation projected to remain above the central bank’s 2-3% target through the first half of the year before moderating. This outlook has narrowed the RBA’s monetary policy options. With further rate cuts now unlikely, the most probable scenario is an extended pause until inflation returns sustainably to target. As a result, short-term interest rates are expected to remain near current levels, with a steep yield curve into the new year.

Concerns about the impact of tariffs on Singapore’s trade dependent economy, combined with declining inflation, encouraged the Monetary Authority of Singapore (MAS) to begin easing monetary policy in 2025. However, after reducing the slope of the S$NEER twice - in January and April – the central bank paused, keeping policy a moderately restrictive stance.

Despite these initial concerns, strong exports, AI-related investments, and resilient manufacturing offset muted domestic demand, facilitating robust economic growth. The MAS forecasts GDP to moderate towards long-term trends in 2026 as trade-related activity normalizes.

On the inflation front, subsidies, lower import costs, and subdued domestic pressures drove the initial decline. Recently, prices appear to have bottomed, and the MAS forecasts a gradual rise in inflation as labor and import costs increase.

With robust economic growth and reduced uncertainty, the MAS believes that its current policy stance is appropriate to support growth while containing inflation. Further policy easing is unlikely, and the S$NEER parameters are expected to remain unchanged in 2026. This moderately restrictive policy stance suggests short-term interest rates are likely to continue trending lower in 2026, albeit at a slower pace.

In 2025, despite its currency peg, Hong Kong faced significant currency and interest rate volatility, driven by global trade tensions and de-dollarization. Early in the year, the Hong Kong Dollar (HKD) surged, prompting the Hong Kong Monetary Authority (HKMA) to inject liquidity and stabilize the currency. This intervention led to a sharp drop in local interest rates, questioning the robustness of the linked exchange rate system. Subsequently the HKD fell to the weak side of its trading band. This triggered further interventions by the HKMA to drain excess liquidity, which finally normalizing both the currency and interbank rates.

Despite these financial fluctuations, Hong Kong finally achieved a modest economic recovery in 2025. This is supported by strong exports, a rebound in tourism, and a resilient stock market. However, the recovery remains fragile, with ongoing challenges including rising unemployment, fiscal deficits, and commercial real estate concerns.

Looking ahead to 2026, the government has raised its GDP target. This reflects its increased optimism for continued, albeit modest, economic growth. With liquidity conditions returning to normal, investment flows and Federal Reserve monetary policy will be key factors influencing interest rates. Rates are likely to continue trending downward, but at a slower pace.

Japan’s economic trajectory in 2025 shifted course as initially strong domestic demand and solid business investment were undermined by the negative impact of tariffs on key export sectors. Meanwhile, inflation—driven primarily by rising prices for imported goods and food—continued to exceed the Bank of Japan’s (BOJ) 2% target for over three years. This fueled a cost-of-living crisis and weakened consumer sentiment.

In response, the traditionally cautious BOJ ended its negative interest rate and yield curve control policies in 2024. In 2025, it stood out by raising rates to an 18-year high of 0.50% in January, before pausing amid growing political and trade uncertainty.

Recently, a more stable political and trade environment, along with a substantial fiscal stimulus package, has helped restore confidence among investors and consumers. The new stimulus is aimed at easing cost-of-living pressures while supporting growth and defense spending. This allowed the BOJ to resume rate hikes, raising rates again in December to a 30-year high of 0.75%. Looking ahead, the BOJ is expected to remain cautious, but further rate hikes are likely in 2026 to support the yen and contain inflation. As a result, short-term interest rates are set to trend higher in the coming year.

Regional interest rate outlook

Looking ahead to 2026, the path of short-term interest rates will depend on evolving domestic inflation and global growth developments. Trade factors are now better understood and may have less impact than previously as regional governments and exporters adapt.

While Federal Reserve monetary policy will continue to influence central banks in the APAC region, its role is expected to be less significant. The longer-term trend of de-dollarization remains an important consideration.

For APAC cash investors, our central scenario is for rates to remain broadly unchanged, as downside risks from moderating growth are offset by persistent inflation concerns. However, central bank base rates are still significantly higher than in previous cycles. This presents relatively attractive current income and opportunities for tactical duration and credit extensions, as yield curves remain upward sloping.

EMEA and U.S. outlook

This information is generic in nature provided to illustrate macro trends based on current market conditions that are subject to change from time to time. This generic information does not take into account any investor’s specific circumstances or objectives and should not be construed as offer, research or investment advice.