Investors should not underestimate the risks that comes with an untested asset class that may gain more regulatory attention.

In brief

- Higher yields in private credit have enticed investors, leading to rising allocations. The sector is supported by the benign economic backdrop, demand for non-bank lending and, so far, limited credit stress.

- The pace of growth in sector and untested market creates its own risks for investors should there be growth shock or increased regulatory oversight.

- The potentially lagged impact of higher rates on the market leans towards looking at both defensive and opportunistic segments of the private credit market and where assets can be sourced at appropriate discounts to net asset value.

Investor interest in private markets continues to grow as the role of alternatives in enhancing returns, providing income, inflation protection, as well as being a source of diversification becomes increasingly important.

Private credit has increasingly been used by investors to boost portfolio returns and income as corporate bond spreads track near record lows, while government bonds have been buffeted by a repricing of rates and stickier inflation. In contrast to the public markets, the higher interest rate has helped boost private lending returns given the floating rate component, while the relatively benign economic backdrop has minimized credit risk.

Untested market creates risk . . .

The popularity of private credit raises its own risks as the market has increased nine-fold since 2007 to a USD 1.7trillion market. The International Monetary Fund’s April Global Financial Stability Report outlined some of the potential perils associated with a “young”, relatively opaque and lightly regulated asset that has a growing role in the provision of credit within an economy.

Private credit is untested as it is yet to experience a large downturn, adding to the difficultly in estimating the losses, defaults and mark downs, as well as the potential contagion effects in the event of a large shock. Yields on direct lending are around 12%, significantly higher than what is available across other public and private assets. This is an enticing yield, but the ability for companies to continue to pay these yields as the cost of debt increases raises the potential credit risk for lenders. For now, at least, the ability for companies (especially in the U.S.) to maintain earnings in what has been a resilient economy has deferred some of this expected risk.

. . . but the challenge for traditional lenders creates opportunity

Private credit is also likely to become essential to the functioning of an economy. As the regulatory capital requirements on banks has increased, the ability and incentive to lend across all segments of the market has decreased, which creates the opportunity for private lenders to fill the gap.

The private credit market encompasses a wide range of lending that spans direct lending between a lender and borrower, infrastructure and real estate, as well as distressed and special situations.

Each of these segments will perform differently based on the economic cycle, creating opportunities and risks for investors.

The higher yield which attracts lenders also means a higher cost of capital for borrowers. The high-for-longer rate environment may have lagged impact on the market and more credit stress may materialize across pockets of the market. The expectation of falling rates at the start of this year may have led some borrowers to believe they could ride out higher interest rates as refinancing needs were low.

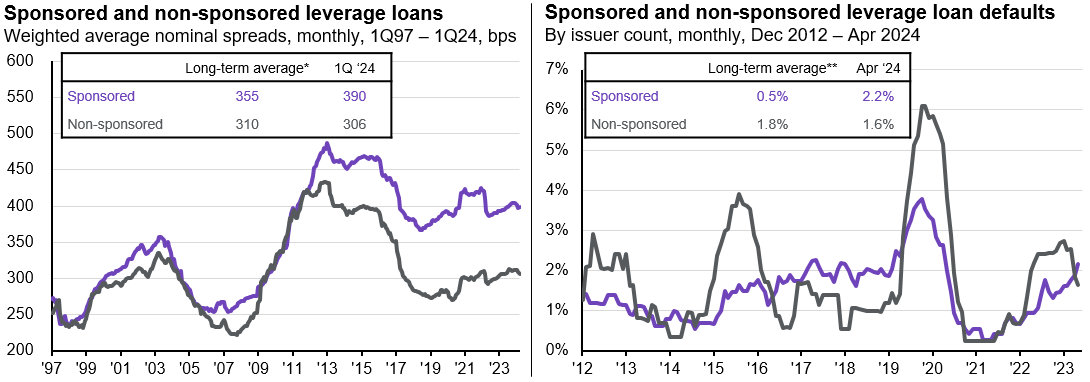

Source: LCD, LSTA U.S. Leverage Loan Index, Morningstar, Pitchbook, J.P. Morgan Asset Management. *Averages are since 1997. **Average default rates are since Dec 2012.

Data are based on availability as of May 31, 2024.

Default rates in private credit remain low in absolute terms, they have risen across both sponsored lending. Recently, the trailing 12-month default rate in non-sponsored lending dropped as some larger issuers rolled out of the calculations, but the trend was higher. Historically, the spike in defaults in non-sponsored lending has been larger in periods of extreme stress. Stresses are likely to build rather than spike given some of the better economic fundamentals.

There is also a divergence in spreads as non-sponsored lending has lower spreads than sponsored lending. This may seem incongruous given an assumption that sponsored lending may be of higher quality. But sponsored lenders often can take on more risk given sponsors can add more equity to a company or be more flexible with the lending terms should challenges arise. Meanwhile, the increase in use of private credit to fund private equity deals may also explain this divergence.

Private lenders have more tools to avoid defaults. The application of this flexibility may explain the still high run rate in the use of amendments and extensions. Especially, as interest rate coverage ratios have declined since the rate hiking cycle began and borrowers may be looking for lenience in lending terms.

Investment implications

A benign economic backdrop and need for alternative sources of lending offers support for the private credit markets. But investors should not underestimate the risks that comes with an untested asset class that may gain more regulatory attention.

The correlations of segments with the private lending market will be an important consideration for investors, especially to public and private equity allocations. Based on these correlations' investors may choose to look both at segments of the private credit market which are defensive as well as those that are more opportunistic.

On opportunistic side of the ledger, distressed credit and special situation investment strategies may benefit from any pick-up in credit stress associated with a lagged impact of higher rates, particularly from borrowers that have depleted other sources of financing. This type of strategy may benefit managers with dry powder, who can pick-up discounted assets.

Activity in the private equity secondary market has increased sharply as managers and investors look to replace liquidity and missed distributions. A similar situation is developing in private credit secondaries, where managers who can provide this liquidity may be able to source deals trading a steep discounts to their net asset value.

As is the case in most private market assets, manager dispersion can be wide, and the skill in underwriting credit risk and executing transactions will be more valuable as the stress from higher rates may start to impact the market.