Does the resurgence of COVID cases in Europe derail its investment story?

02/09/2020

Listen to On the Minds of Investors

Back in mid-June, we noted five reasons why investing in European equities might finally pay off. One of the reasons was that Europe had crushed its COVID-19 curve and had better success than the U.S. in breaking the link between reactivating economic activity and rising infection rates. Unfortunately, daily new COVID-19 cases have begun to rise again in Europe, especially in Spain and France, to levels not seen since mid-April. This begs the question, does the recent resurgence in new cases derail the European investment story?

Fortunately, like the experience in the U.S., this second increase in cases is not being accompanied by the same rise in fatalities as the first. While the seven day moving average of daily new cases in the Eurozone increased to 17,929 on August 31st, a level not seen since April 21st, the daily fatalities remained quite anchored at 53, much lower than the levels of 2,460 that had prevailed back in April. This is likely due to a combination of better treatments and hospital capacity, as well as a lower average age of infection.

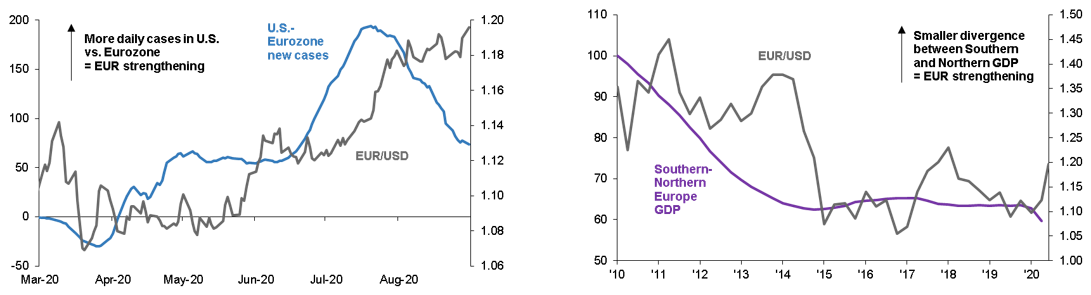

From a purely markets perspective, the good news is that European countries will not have to resort to the economically damaging national shutdowns that prevailed in April. The bad news is that it does leave the economic recovery incomplete, with mobility indicators plateauing in Spain, France, Germany and Italy over the past month, just like they had in the U.S. before. While a double-dip recession in Europe seems unlikely, some of the shine has been taken off with regards to the relative strength of its recovery versus the U.S. This dynamic has caused the strengthening of the Euro versus the dollar to pause over the past month.

However, it is important to remember that another change has taken place in Europe this quarter that has longer lasting implications than COVID developments alone. As we have written about before, the approval by EU-member states of the joint EU recovery fund is a giant leap forward for investing in Europe. This fiscal solidarity might finally allow Southern and Northern Europe to recover at similar speeds, lowering the risk of a break-up of the European project and the currency in the process. For the medium term, this is still the most important development that can provide support to the Euro and to European assets more broadly.

Short-term, EUR/USD has been moving based on differences in infection rates…

Left: U.S.-Eurozone daily new cases per million people, 7-day average; Right: EUR/USD

Medium-term, EUR/USD can move higher based on success of EU Recovery Fund

Left: Southern-Northern Europe GDP, 2010=100; Right: EUR/USD

Source: DESTATIS, INSEE, Instituto Nacional de Estatistica, ISTAT, ECB, Johns Hopkins CSSE, FactSet, J.P. Morgan Asset Management. Southern Europe defined here as Italy and Spain and Northern Europe defined here as France and Germany. Data are as of September 1st, 2020.

0903c02a829d3412