If inflation remains persistent and job growth remains robust, the Fed's first rate cut might be pushed back to the end of 2024.

In brief

- Despite robust U.S. economic and inflation data in recent months, we still see core inflation falling, and the Federal Reserve’s (Fed's) next move to be a cut, not a hike. The overall rate cut cycle may be delayed, but not canceled.

- Fixed income assets may underperform in the near term, but its long-term total returns performance should improve once the rate cut cycle is underway. Government bonds also provide protection against downside risk to growth.

- Recent correction in both stocks and bonds serves as a reminder of the importance of international diversification, as well as the need for alternative assets in portfolio.

Global financial markets have experienced heightened volatility as investors reassess their views on the Fed’s policy outlook. Since the beginning of April, the 10-year U.S. Treasury yield has risen by 40 basis points (bps). The S&P 500 and NASDAQ have declined by 4.6% and 5.7% respectively, while the Nikkei 225 has lost 9% in U.S. dollar terms. Moreover, the U.S. dollar index has surpassed 106 for the first time since October 2023, marking a 2% increase since the March consumer price index (CPI) report.

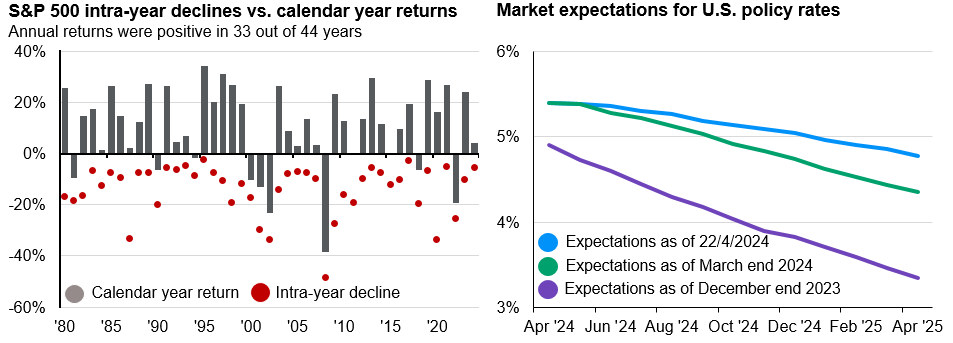

Although this level of market correction is not unusual (left chart of Exhibit 1), it is understandable that investors are feeling nervous. In this regard, we address several questions that have been raised over the past two weeks.

The rate cut cycle is delayed, not canceled

Our perspective on both policy and market outlook is built on the basis that core inflation, excluding food and energy, is still on the decline, but taking longer than expected. The recent surge in energy prices is likely to raise headline inflation in the coming months. However, the Fed could argue that more expensive oil not only affects inflation, but also poses a risk to household spending and corporate profit margins, as consumers and businesses need to spend more on fuel.

We maintain the view that the recent military exchanges between Iran and Israel are unlikely to have a significant immediate impact on the energy market, despite the growing complexity of the geopolitical situation in the Middle East. The crucial point is that it is in nobody's interest to see disruptions in the global energy market that would bring higher energy prices, especially considering the upcoming key elections worldwide. Furthermore, the latest U.S. sanctions and export controls imposed on Iran do not include oil. Moreover, any potential disruptions in Iran's oil exports could be offset by other producers, particularly the Organization of the Petroleum Exporting Countries’ members, who implemented production cuts last year to prop up oil prices. The biggest risk to supply remains the Strait of Hormuz, where approximately 20% of global oil consumption and related products pass through daily. However, we believe the likelihood of Iran causing disruptions in this area is low.

Meanwhile, CPI excluding food and energy, has been steadily falling from its peak of 6.6% in September 2022, to 3.8% in March 2024. The Fed's preferred measure of core personal consumption expenditure, also excluding food and energy, has followed a similar trajectory. We anticipate that several factors contributing to inflation, such as shelter, auto, and home insurance, should gradually ease over time, helping to sustain a downward trend in inflation.

Exhibit 1:

Source: Bloomberg, FactSet, Standard & Poor’s, J.P. Morgan Asset Management. Data as of April 22, 2024.

In this scenario, it is still expected that the Fed's next move should be a rate cut, not a hike. Further increase in policy rates at this point could raise the risk of a sharper slow down in the medium term. However, the timing of the first cut has been delayed due to robust job numbers and other economic data. Currently, the Overnight Index Swap market reflects an 80% probability of a 25bps cut during the September meeting, and a 74% chance of two cuts by the end of the year. Investors are pricing the policy rate to reach 4.1% by the end of 2025, higher than the Fed's own projection of 3.875% published in the March Summary of Economic Projections.

Given the Fed's reliance on incoming data, this is like driving in the dark without street lights. The central bank and the market can form a view based on the current data for the next one to two meetings. Uncertainty in the outcome rises significantly beyond that, and this is the key in market anxiety now.

This implies that the current data would likely prompt the Fed to maintain its stance in the June and July meetings, with the earliest opportunity for a rate cut in September. However, if inflation remains persistent and job growth remains robust, the first rate cut might be pushed back to the end of 2024. Still, long-term investors should be focusing on the fact that the policy rate is expected to be lower in the next 12 months.

A reminder of the importance of diversification

The delay in rate cuts by the Fed has resulted in higher government bond yields. In the short term, the total return on government bonds and high-quality fixed income may underperform cash. Nevertheless, long-term investors have two reasons to stay invested in fixed income.

First, as mentioned earlier, the rate cut cycle is delayed but not canceled, implying that bond yields should eventually decline and boost total returns. Cash, on the other hand, would be ill-prepared for the eventual reinvestment risk.

Second, investors are currently focusing on a scenario of a soft landing or even no landing, accompanied by sticky inflation. However, while macroeconomic data remains robust, investors cannot ignore the possibility of a sharp deterioration in economic activity, even if this is unlikely. Government bonds and high-quality fixed income can help mitigate this risk.

In terms of equities, higher risk-free rates are prompting a correction, particularly in growth and technology sectors due to valuation adjustments. Nonetheless, some inflation can support businesses in maintaining profit margins, which could contribute to earnings growth. In the short term, investors may opt to rotate away from growth-oriented sectors and towards sectors with more cyclical characteristics, such as consumption, materials, and industrials. The strengthening of the U.S. dollar also poses challenges for Asian equities. However, we remain optimistic about Asian tech exporters and Japan, given the recent momentum in Asian export recovery.

The recent correction in both stocks and bonds serves as a reminder of the challenging times experienced in 2022, when high inflation prompted rapid rise in policy rates around the world. It also underscores the importance of diversification for investors. Since the beginning of April, certain markets have exhibited greater resilience, including China, Hong Kong, India, and ASEAN markets. Additionally, commodities such as gold and energy have outperformed stocks and bonds. Some of these assets, like Chinese equities, have cheap valuations that improve resilience against market volatility. Improvement in macroeconomic data and the Chinese government's efforts to enhance corporate governance could act as supportive factors. Higher energy prices have contributed to the current risk-averse sentiment, reminiscent of 2022. Alternative assets such as real estate, infrastructure and transportation can provide diversification benefits and generate income for investment portfolios.

In conclusion, we anticipate that the current wave of volatility from evolving rate cut expectations will eventually subside, and investors should look ahead to position their portfolios accordingly. A well-diversified portfolio comprising of both stocks and fixed income assets remains key to generating returns that align with long-term investment objectives, even though cash may appear attractive during times of volatility.