In a recent session at the Global Liquidity Investment Forum, held in Singapore and Hong Kong, portfolio manager Claude Lam and investment specialist Lan Wu explored strategies for balancing risk and return in liquidity management. As the financial landscape continues to be characterized by uncertainty and volatility, understanding how to implement effective liquidity strategies is crucial for investors seeking to find the "sweet spot" for their day-to-day investments.

Adapting to Market Volatility

Global economies are experiencing slower, but still positive economic growth, primarily due to restrictive monetary policies. Fortunately, inflation began to decline in 2024, and this trend is expected to persist into 2025, suggesting central banks should continue their rate cutting cycle. However, US economic and trade policy fluctuations have magnified market volatility – visible in uncertainty regarding the pace and magnitude of future Federal Reserve rate decisions. . This backdrop presents both challenges and opportunities for investors managing cash on a day-to-day basis.

“Managing cash effectively requires a strategic approach that can withstand market cycles and avoid being swayed by short-term market noise” – Claude Lam.

Putting Cash in its Place

The first step in this process is to build a robust investment policy, which serves as a roadmap for decision-making. This policy should clearly define investment goals, such as capital preservation, diversification, income generation, and liquidity needs. Equally important is risk management, which involves assessing key risks including duration risks, credit limits, and currency exposures.

“By establishing a solid foundation through a well-defined investment policy, investors can make informed decisions that align with their objectives and risk tolerance.” – Lan Wu

The second step is to forecast and segment cash to ensure it managed efficiently. This involves assessing cash flows, segmenting balances, and determining liquidity needs and risk tolerance for each segment. Regular reviews and rebalancing are essential to ensure that cash classifications remain aligned with market conditions and investment goals.

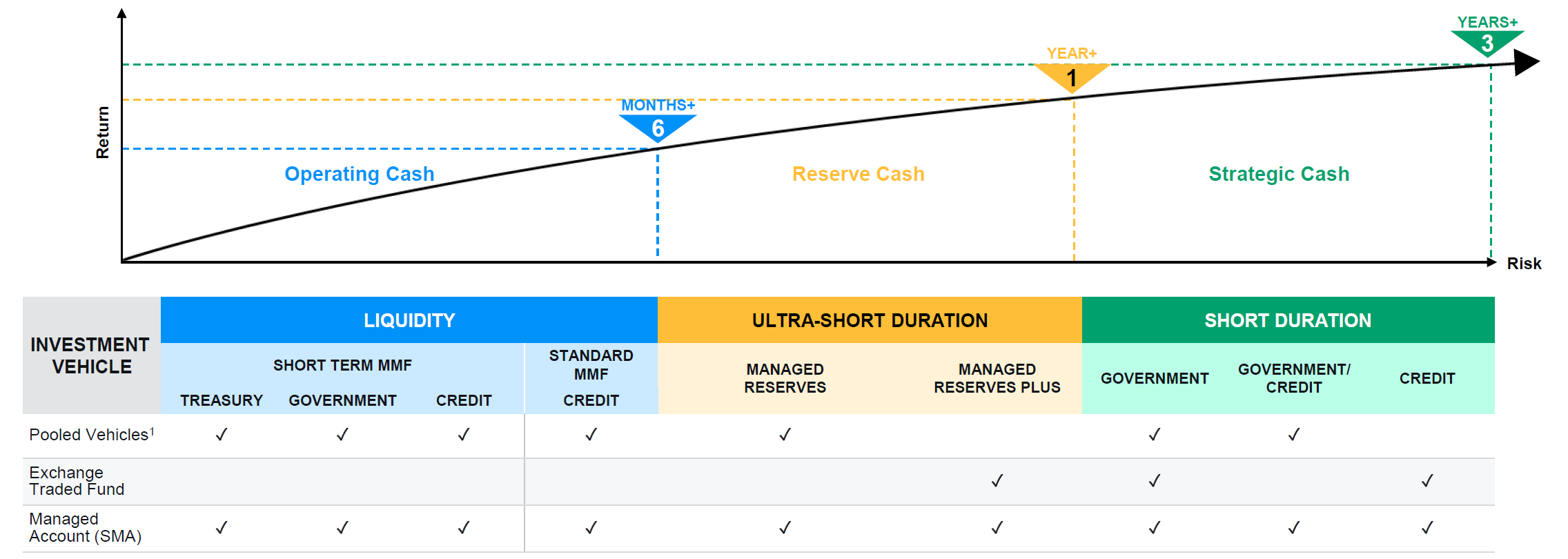

Typically, cash is divided into three segments: operating cash, reserve cash, and strategic cash. Operating cash addresses immediate liquidity needs, while reserve cash is allocated for mid-term needs, such as acquisitions or stock repurchases. Strategic cash, with a longer investment horizon, can be invested in products that generate higher returns.

With a clear understanding of cash segments, the final step is to select the appropriate investment strategy. Investors have a range of options, including direct instruments like bank deposits and reverse repos, and indirect options such as money market funds and ultra-short duration bond funds.

Direct instruments present varying levels of liquidity and diversification, they allow investors to directly control investment decisions, but require substantially more resources to manage effectively. In contrast, indirect options provide high liquidity and diversification benefits but require initial setup and monitoring. Money market funds, for example, invest in high-quality securities and cost-effective investment opportunities. Ultra-short duration bond funds aim to achieve higher returns by leveraging a broader range of duration and credit opportunities.

Indirect investments can be accessed via a range of channels including mutual funds and ETFs. One particular channel, Segregated Managed Accounts (SMAs) present a customizable solution for investors seeking tailored investment strategies. SMAs provide direct ownership of securities, allowing for better control and flexibility. They can be structured to meet specific investment objectives and adjusted as market conditions or investment goals change.

Fig 1: Combining all three steps to “put cash in its place”

1Includes 1940 Act Mutual Funds, SICAVs, and Commingled Funds. Source: J.P. Morgan Asset Management. For illustrative purposes only.

Diversification does not guarantee positive returns or eliminates risks of loss. Risk management does not imply elimination of risks. Provided to illustrate broad cash management landscape without any specific recipient’s objectives or circumstances in mind, not to be construed as offer, research or investment advice. Investors involve risks and are nor similar or comparable to deposits. Not all investments are suitable for all investors.

The return expectations are for illustrative purposes only and serve as an indication of what may occur. Given the inherent uncertainties and risks associated with the expectations, actual events, results or performance may differ materially from those reflected or contemplated.

Finding the Sweet Spot in Volatile Markets

In the current market environment, finding the "sweet spot" for cash investments involves balancing risk and return by adapting strategies to market conditions. Over the past few years, the sweet spot has shifted in response to changes in central bank monetary policy and market dynamics. For instance, during periods of aggressive rate hikes, money market strategies have outperformed due to their very short duration and attractive carry.

As the rate environment normalizes, strategies with high carry and low volatility, such as standard money market strategies and ultra-short duration strategies, are likely to be the sweet spot for 2025. These strategies present a balance between yield and risk, making them relatively appealing options for investors navigating uncertain markets.

Conclusion: Be Strategic with Clear Goals

Effective liquidity management requires a strategic approach that encompasses clear goals, accurate risk management, and effective cash segmentation. By selecting the right investment strategies and leveraging the broad range of direct and indirect investments available, investors can navigate market volatility and capitalize on opportunities.

As we move through 2025, Claude and Lan believe the sweet spot for liquidity management likely lies in strategies that offer high carry and low volatility. By focusing on these strategies and maintaining a flexible approach, investors may achieve their investment objectives while managing risk in a dynamic market environmentdence.