In brief

- At the conclusion of their December monetary policy meeting, the European Central Bank (ECB) cut their three key policy rates by 25 basis points (bps) for the third consecutive meeting.

- The accompanying press release contained dovish elements, but the press conference set a more balanced tone, where ECB President Christine Lagarde emphasised the Governing Council’s data dependence, and reiterated that it won’t commit to a specific path for policy rates.

- New staff projections for 2027 were announced.

- The final reinvest of PEPP maturities will occur on 15th December.

Data dependency remains key

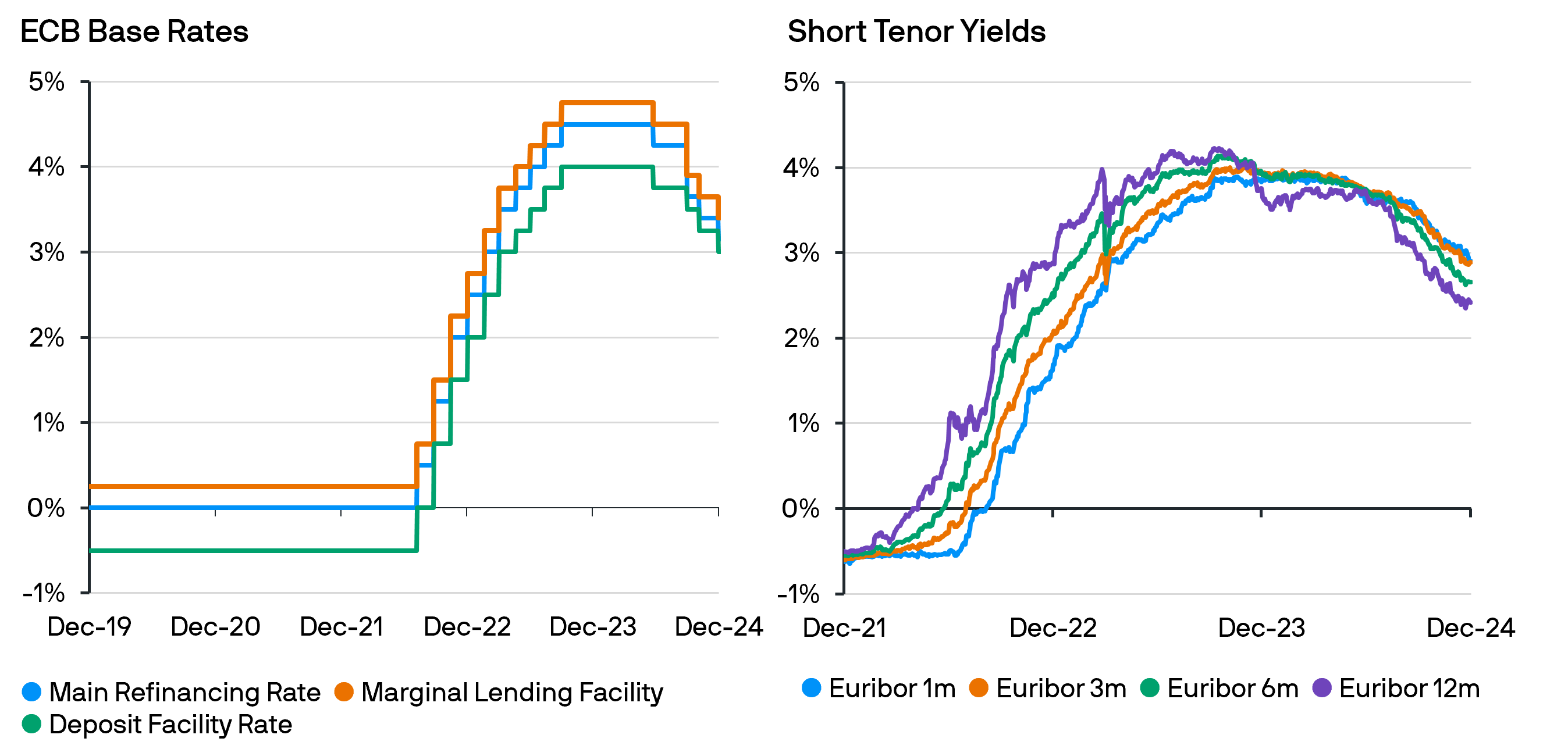

Following its final monetary policy meeting of 2024, the ECB cut all of its policy rates by 25bps. From 18 December, the Marginal Lending Facility will fall to 3.40%, the Main Refinancing Rate will be 3.15%, and the Deposit Facility Rate will be 3.00%.

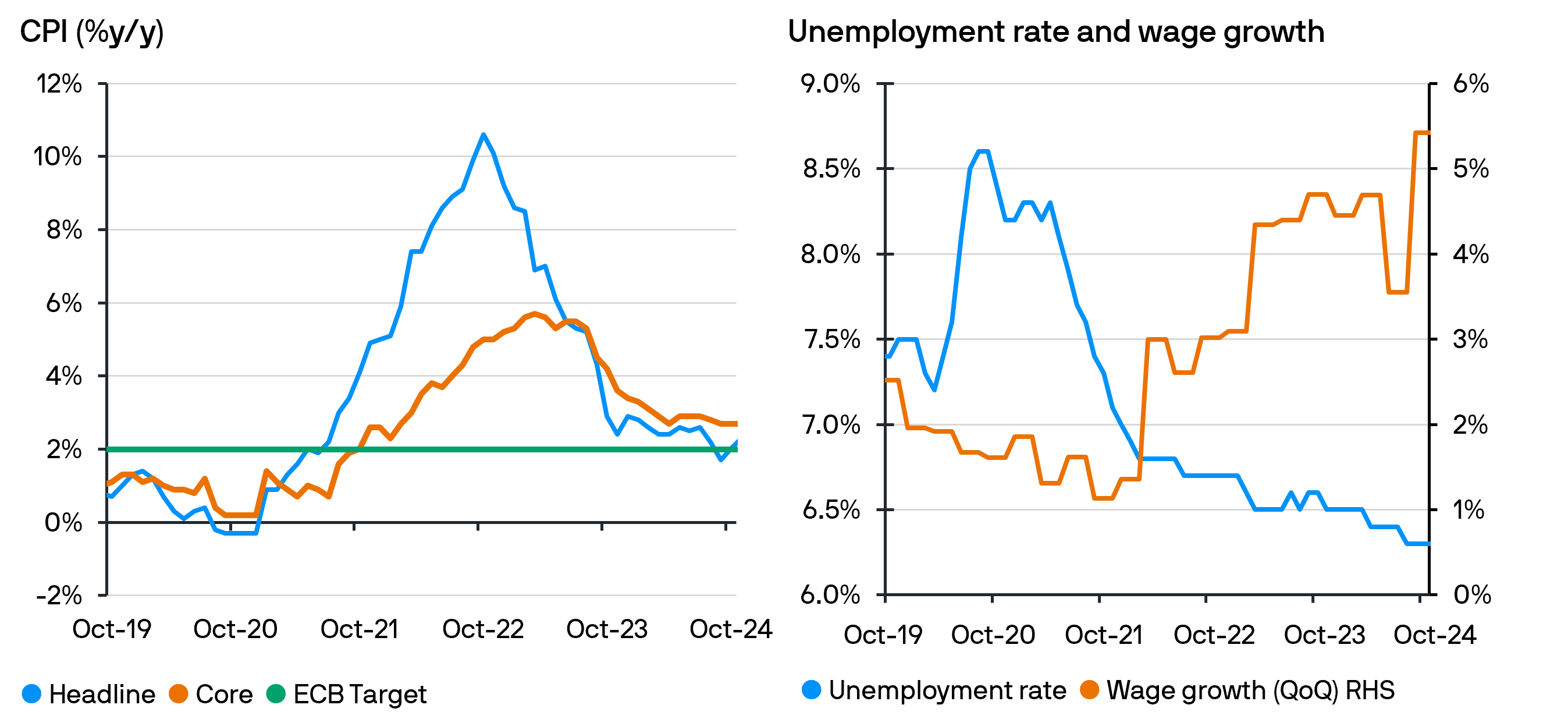

In the lead up to the meeting, the market had fully priced in a 25bp cut to the deposit facility rate. During the press conference, President Lagarde advised that a larger cut of 50bps had been discussed, with 25bps being deemed more appropriate by all Governing Council (GC) members, due to wage data recently printing at 4%, which is considered too high, versus the goal of returning inflation, sustainably to 2%. When asked by a journalist, regarding the potential of a 50bp reduction in January, President Lagarde replied that clarity on this decision would take months and not weeks which would indicate that it is more likely that we will see a 25bp cut in January 2025.

The wording of the accompanying statement, was amended slightly to reflect that the GC expect inflation to “stabilise” at the 2% target level during 2025.

At the subsequent press conference, Lagarde reiterated that the ECB will not commit to a predetermined pathway for rates, but instead will analyse the data. Over the past few weeks, the market has been pricing in a further 25bps rate cut at each of the next four meetings, which would take the eurozone deposit rate to 2% by the end of June 2025. In the aftermath of the meeting, this expected path for interest rates, has not changed. Many economists have predicted that 2% is the neutral rate across the eurozone, which would indicate that the market, by forecasting additional cuts beyond the next five meetings, may be pricing in an overly pessimistic economic outlook.

Source: Bloomberg, J.P. Morgan Asset Management, data as at 13 December 2024.

New staff projections for 2027

New Staff Forecasts were revealed that now extend to 2027. Both growth and inflation data have been revised lower versus the previous forecasts (Sept 2024). Inflation 2024 2.4%(2.5%), 2025 2.1%(2.2%), 1.9%(1.9%) and 2027 2.1%. Growth 2024 0.7%(0.8%), 2025 1.1%(1.3%), 2026 1.4%(1.5%) and 2027 1.3%

Source: Bloomberg, J.P. Morgan Asset Management, data as at 13 December 2024.

Market reaction and fund positioning

Since the Autumn a 25bp rate reduction had been priced in by the market for today’s meeting, so today’s changes came as no surprise. In the intervening period between October’s meeting and today, the pricing did move towards a 50% chance of a larger 50bps cut but steadily rescinded, prior to today’s announcement. The EUR LVNAV strategy is well-positioned to benefit from the rate cut, with a weighted average duration (WAM) in the 40-50 day range and ample holdings of fixed paper in the six- to 12-month part of the curve to lock in longer tenor yields.

For euro cash investors, the rate cut will trigger lower deposit rates at the start of the next Reserve Period (18 December). However, money market fund strategies with longer durations will shield investors from the full impact of lower rates in the medium term.

Conclusion

The ECB has cut its Deposit Facility Rate by another 25bps, adhering to its data-dependent mantra. While the ECB can’t yet declare victory over inflation, policymakers are clearly more confident that Eurozone inflation will stabilise at the target level in 2025. However, the new policies that will come from the US, following the inauguration of Donald Trump and the continuation of the conflicts in Ukraine and the Middle East, will ensure that the ECB will have to remain vigilant, towards achieving its policy targets.