In brief

- China’s GDP growth remains on track to meet the government’s “around 5%” target for 2025, suggesting limited need for major fiscal stimulus in Q4 unless external risks escalate.

- Growth remains uneven, supported by robust industrial production but weighed down by weak consumption and investment as the property market downturn continues to drag on domestic demand.

- The People’s Bank of China (PBoC) is likely to maintain an accommodative stance, although further rate cuts are unlikely as stability and liquidity take precedence.

Robust growth – amid imbalances

China’s economy outperformed expectations in 2025, with Q3 GDP up 4.8%y/y despite ongoing geopolitical and trade challenges. However, the underlying picture is more complex as strong exports and industrial production contrast with persistent weakness in consumption, investment, and real estate.

Production has led the way, rising 6.5%y/y in September, fueled by export-driven sectors like autos and semiconductors. However, this momentum may soften as frontloading and seasonal effects fade. On the demand side, fixed asset investment slipped into negative territory for the first time since Covid-induced shutdowns in 2020, driven by declines in manufacturing, infrastructure, and especially property. The real estate sector remains a major concern, with double-digit drops in new home sales and investment, and ongoing price declines. Retail sales growth also slowed to 3%y/y, reflecting subdued consumer confidence and fading fiscal support.

While growth is expected to moderate in Q4-25, the current trajectory should enable China to meet its “around 5%” target, reducing the need for additional fiscal or monetary stimulus. Instead, policy is now focused on executing existing fiscal measures. The recent Fourth Plenum and ongoing US-China trade talks are possible economic pivots, though significant near-term policy changes are unlikely.

Monetary policy – stability over stimulus

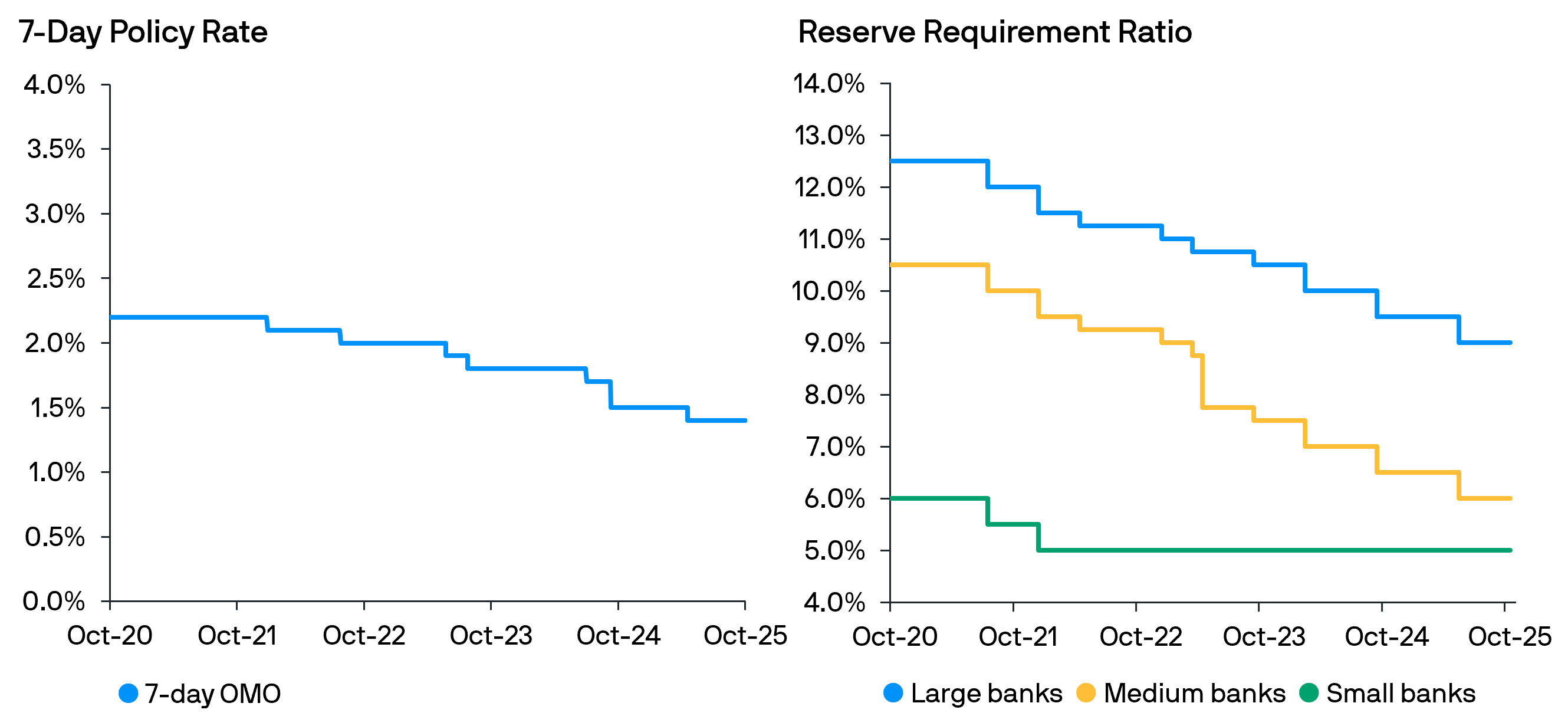

Against this backdrop, the PBoC has maintained an accommodative stance. After cutting the Reserve Requirement Ratio (RRR), 7-day Open Market Operations (OMO), and Loan Prime Rate (LPR) in May, the central bank has kept rates unchanged, signaling a preference for stability and ample liquidity.

Fig 1: Monetary policy has been on hold since May 2025.

Source: PBoC, Bloomberg and J.P. Morgan Asset Management; data as at 21 October 2025.

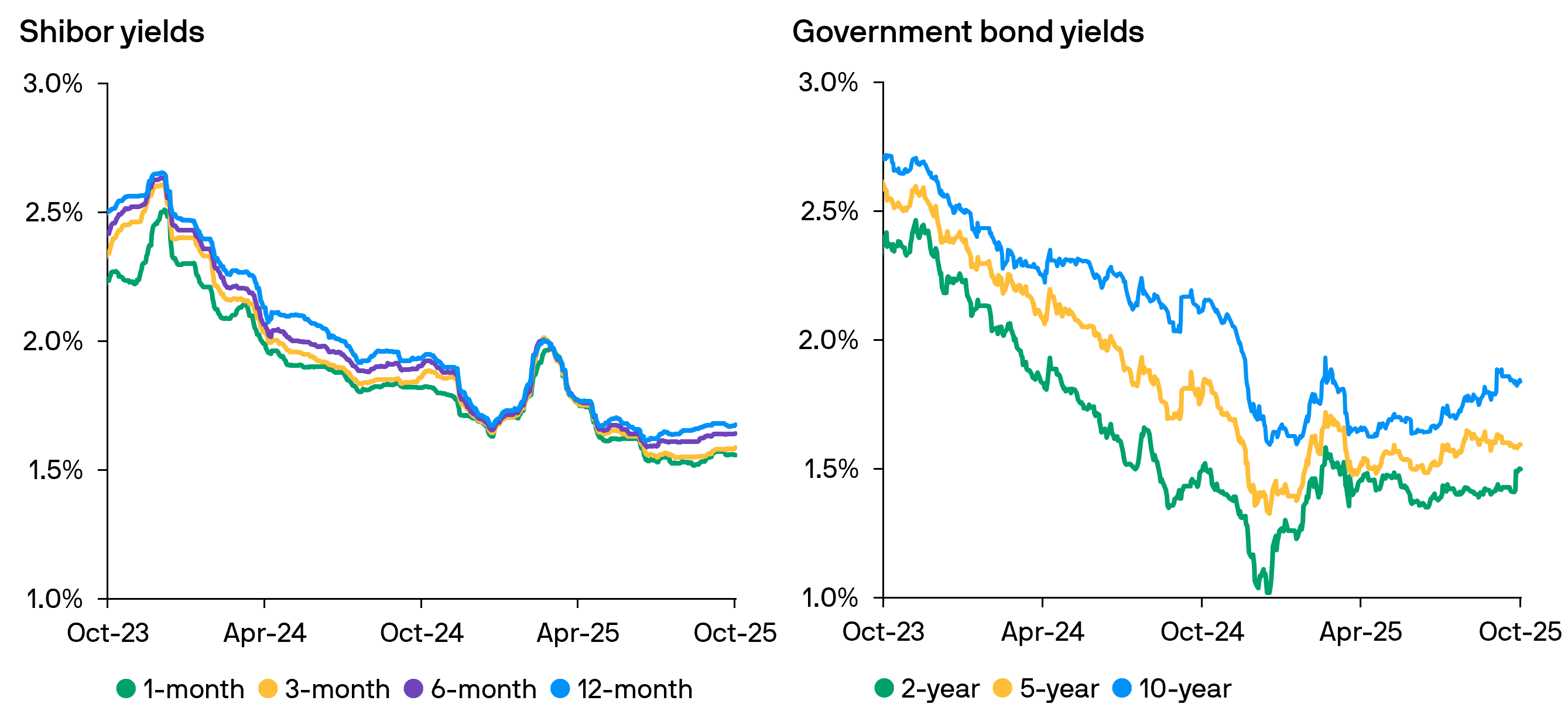

Interest rates, which rose in the first quarter and declined in the second, have since stabilized, albeit at cycle lows. With investors anticipating only incremental and targeted easing rather than broad-based stimulus, short-term rates have edged up and the yield curve has begun to steepen.

Fig 2: Interest rates have declined but recently shown signs of stability.

Source: Bloomberg and J.P. Morgan Asset Management; data as at 21 October 2025.

Interest rate outlook – accommodative but cautious

China’s economy is caught between strong industrial output and persistent weakness in consumption and investment. The PBoC’s cautious monetary policy reflects confidence in achieving growth targets, caution regarding upcoming political and trade developments, and an awareness of the limits of monetary stimulus.

For RMB cash investors, money market fund yields remain near record lows but have stabilized. They continue to present relatively attractive returns compared to declining commercial bank deposit rates. Tactical duration extensions, should the yield curve steepen further, may present opportunities to enhance returns. However, diversification and disciplined investment remain crucial amid ongoing market volatility.